- Bond yields in the driver’s seat

- Expect some short-term reprieve before a leg higher

- The sugar high of 4600 is probably done

Are equities finally connecting the dots?

Maybe…

Whilst this has been a difficult market to trade – my sense was to approach with caution.

From mine, there were too many open questions.

For example, when the market was trading around 4600 – my sentiment was the downside risk outweighed any upside reward.

We are now 8% lower… closer to the zone of where I felt the S&P 500 could trade.

In short, I felt valuations were stretched.

Put another way, the risk premium for owning stocks wasn’t there.

But markets pushed higher – almost taunting the Fed on their “higher for longer” script.

Month after month – without fail – Powell reminded the market they were not done.

Inflation was still far too high – although we had seen some progress.

“The Fed will cut rates three times before the end of 2023” was the equity narrative a few months ago.

That’s gone.

“Well… the Fed will likely cut four to five times in 2024” they felt.

Will they?

Bond yields have surged higher in recent weeks (more on this below) – forcing stocks to recalibrate.

About time they figured it out.

Let’s start with bonds… as they tell the story.

Bonds Yields Continue to Rise

In a moment I will share what we see with the US 10-year yield.

Today they touched 4.60% and from mine – likely to keep pressing higher.

However, we might see a little reprieve in the short-term.

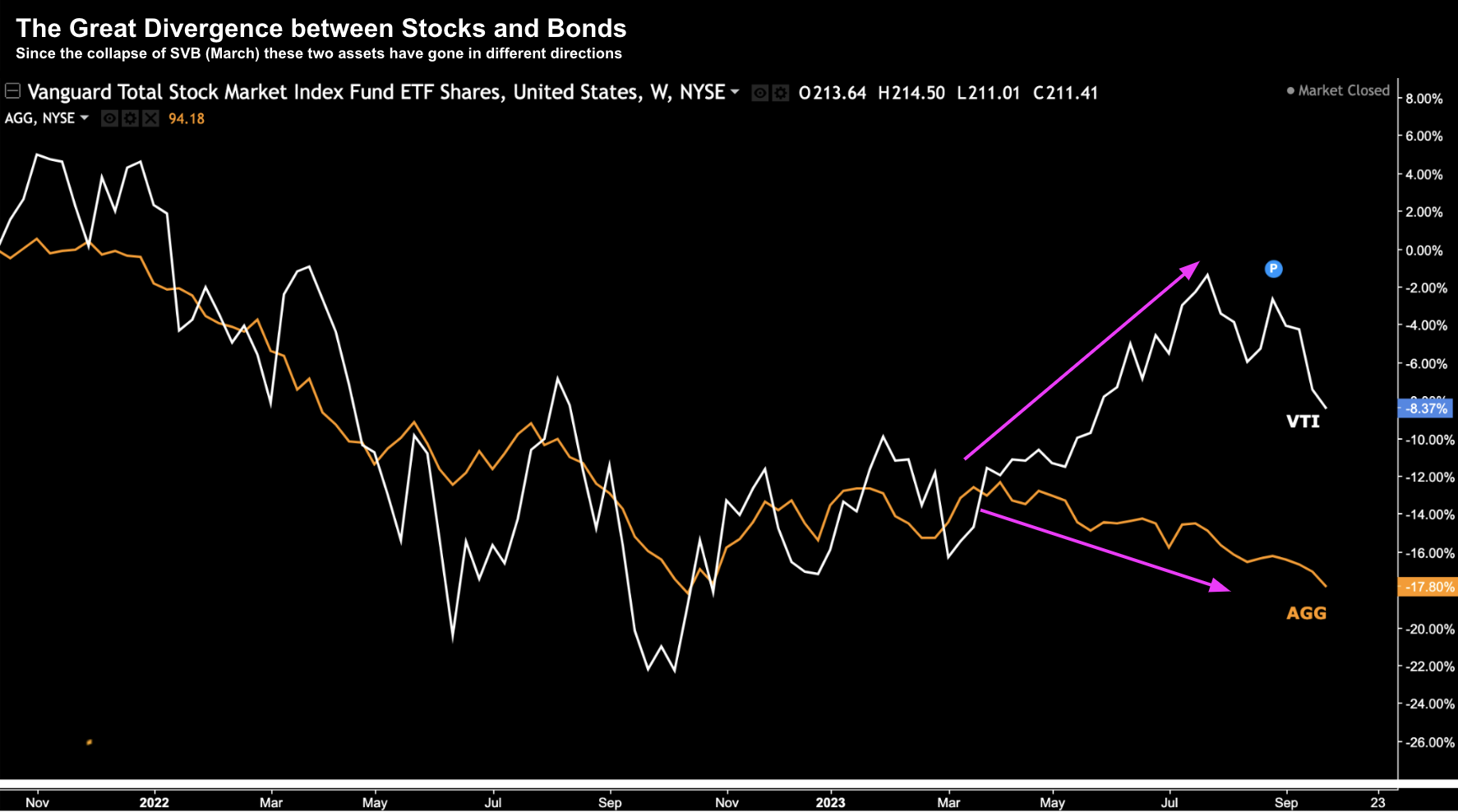

First I wanted to share an notable divergence between corporate bonds and equities.

Two charts are represented below:

- Vanguard Total Stock Market Index Fund – VTI (as a proxy for the S&P 500); and

- iShares Core U.S. Aggregate (Corporate) Bond ETF – AGG

Sept 26 2023

From late 2021 to March 2023 – these two ETFs largely traded in lock-step.

That is, when stocks traded lower – corporate debt followed (meaning yields were going up).

But something curious happened post the collapse of Silicon Valley Bank (SVB) in March.

Stocks turned in the opposite direction however the ETF AGG went the other way.

Why?

Yields were telling us that there might be trouble ahead – however equities looked the other way.

My guess is we will see the white line (stocks) converge towards the orange line.

But we will see…

In any case, yields are now in the driver’s seat.

As an aside, I talked about this here: “Less About the Fed — All About Bond Yields”

The post wasn’t widely read (who wants to read about boring bond yields?) – so let me repeat a small portion:

In short, if bonds fail to ‘calm down’ (for lack of a better term) – equities will face meaningful headwinds.

If these yields continue to rise, they will place increasing pressure on the high multiples being asked of stocks

In other words, the equity risk premium (the earnings yield above the risk-free treasury yield) becomes less.

And the more yields rise – the harder it will be to justify the rally in stocks.

This post was perhaps about 1.5 months early….

But I was worried about what I was seeing in bond markets.

Things were not adding up…

Since then the 10-year yield has rallied from 4.25% to around 4.55%

It may not sound like much – but it’s enough to knock equities off balance.

Sept 26 2023

- Are 10-year yields about to break out (it’s not quite there yet); or

- Are we seeing a false break of the October 2022 high?

If I were to guess – it’s the former. It feels like yields are now breaking to the upside where the path of least resistance is higher.

If that’s right – it’s very bad news for stocks.

That said, these yields are overbought (or bonds are oversold) in the very near-term. Therefore, I would not be surprised to see a tactical move lower.

For example, the 10-year to pull back to around 4.0%

And if that happens – then expect to see equities catch a fresh bid.

However, I also think it will be temporary where yields will continue to move higher.

And right now – stocks are having a tough time calibrating higher for longer.

Bye Bye Sugar High

The S&P 500 is now 7.3% lower than its July high of 4606

That’s not a lot in the broader context – but it’s enough for people to pay attention.

I say that because the market has not seen a pull back of this magnitude since March – when the market panicked over SVB.

Sept 26 2023

But how much substance was in the March to July rally to keep it going?

Not much from my lens…

For example, were earnings and revenue showing strong growth?

Not really.

They were better than feared but they still declined over 4% year on year (the 3rd quarter in a row).

Was Core PCE inflation near the Fed’s target?

Not even close…. still more than double their target.

Were the Fed closer to cutting rates?

Nope. In fact, they could still raise them.

Were the Fed adding to their balance sheet?

They did for a very short time when SVB collapsed – however that has been reversed (QT).

So what’s the catalyst to ‘pin your ears back’ and buy stocks?

I could not see it.

And if we also consider:

- Consumers burning through their $2.1T in excess savings;

- Consumer confidence falling;

- Oil prices are back above $90/b; and

- No more massive fiscal stimulus on the horizon (i.e., “the sugar high”)

It’s been my question all year and I’m yet to come up with a robust answer I can defend.

Putting it All Together

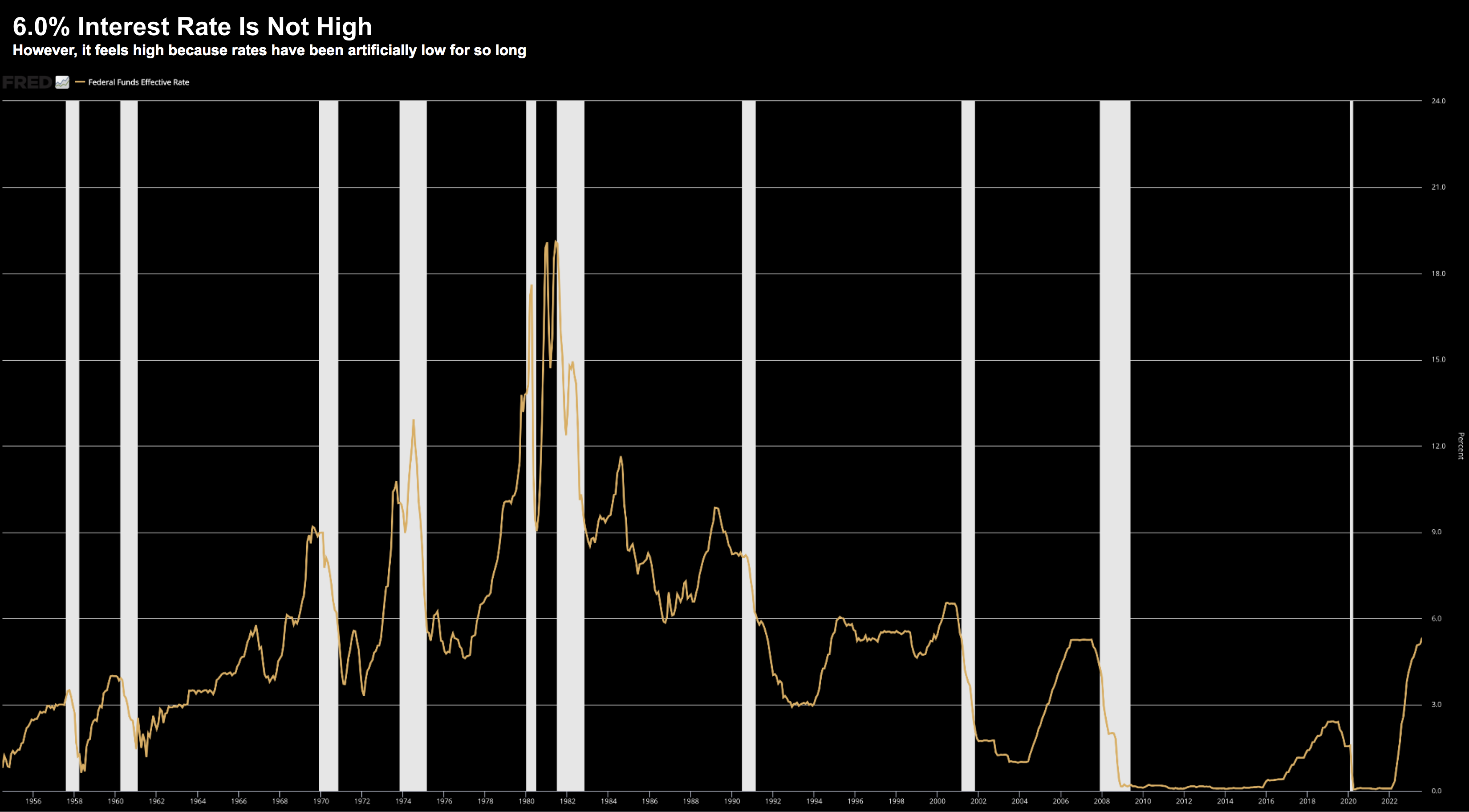

Whilst some will argue that rates are very high – they aren’t.

Not even close.

For example, if the Fed were to raise rates to 6.0% – it’s not a historically high level.

The chart above shows the effective Fed funds rate from 1956.

From 1963 to 2002 (~39 years or 58% of the time) – they were consistently above 3.0%

And from 1969 to 1991 they were mostly above 5.0% (excluding a brief period in the 1970s)

What is abnormal is for rates to stay anchored at zero for so long.

This is perhaps why investors feel rates are excessively high.

My thinking is investors should get used to rates staying above 3.0 to 3.5% going forward.

And if the Fed needs to raise the cash rate to 6.0% or higher to kill unwanted sticky inflation – so be it.

The challenge of course is the tsunami of debt now in the system.

That’s what’s changed from 40 years ago.

Today a rate of “6.0%” probably feels like “18% in 1980” – because of the amount of leverage.

I said to someone recently that rates won’t need to get to “10%” again… it will be lights out well before then.

In closing, I expect the market to catch a bid in the 4000 to 4200 zone.

Keep your eye on quality stocks for good long term buys…. as there are few coming into range.