- CPI comes in slightly hotter than expected

- Bond yields continue to rise – aligning with the Fed

- However equities remain optimistic on rate cuts

If there was a headline today… it wasn’t CPI for January… it was this:

“The measures of underlying inflation (also) remain elevated and well above our 2 percent longer-run goal. For example, after declining earlier in 2022, the New York Fed’s Multivariate Core Trend has been hovering around 3-3/4 percent for the past few months. Similarly, both the Dallas Fed’s trimmed-mean PCE inflation rate and core inflation that excludes food and energy prices averaged around 3-3/4 percent over the past six months.

So, our work is not yet done. Inflation is still well above our 2 percent target, and it is critically important that we reach that goal”

Declines in commodity and goods prices will not be enough to bring inflation to 2 percent on a sustained basis. We need all the gears turning at the right pace to restore balance between demand and supply in the entire economy.

We still have some way to go to achieve that goal. And it will likely entail a period of subdued growth and some softening of labor market conditions. As a result, I expect real GDP growth to come in around 1 percent for 2023. And I anticipate the unemployment rate to edge up over the next year to between 4 and 4-1/2 percent.

As tighter policy actions continue to work to restore balance to supply and demand, I expect PCE inflation to fall to 3 percent in 2023, before moving closer to our 2 percent longer-run goal in the next few years

To that end, today’s all-important CPI only reiterates their work is ‘far from done’.

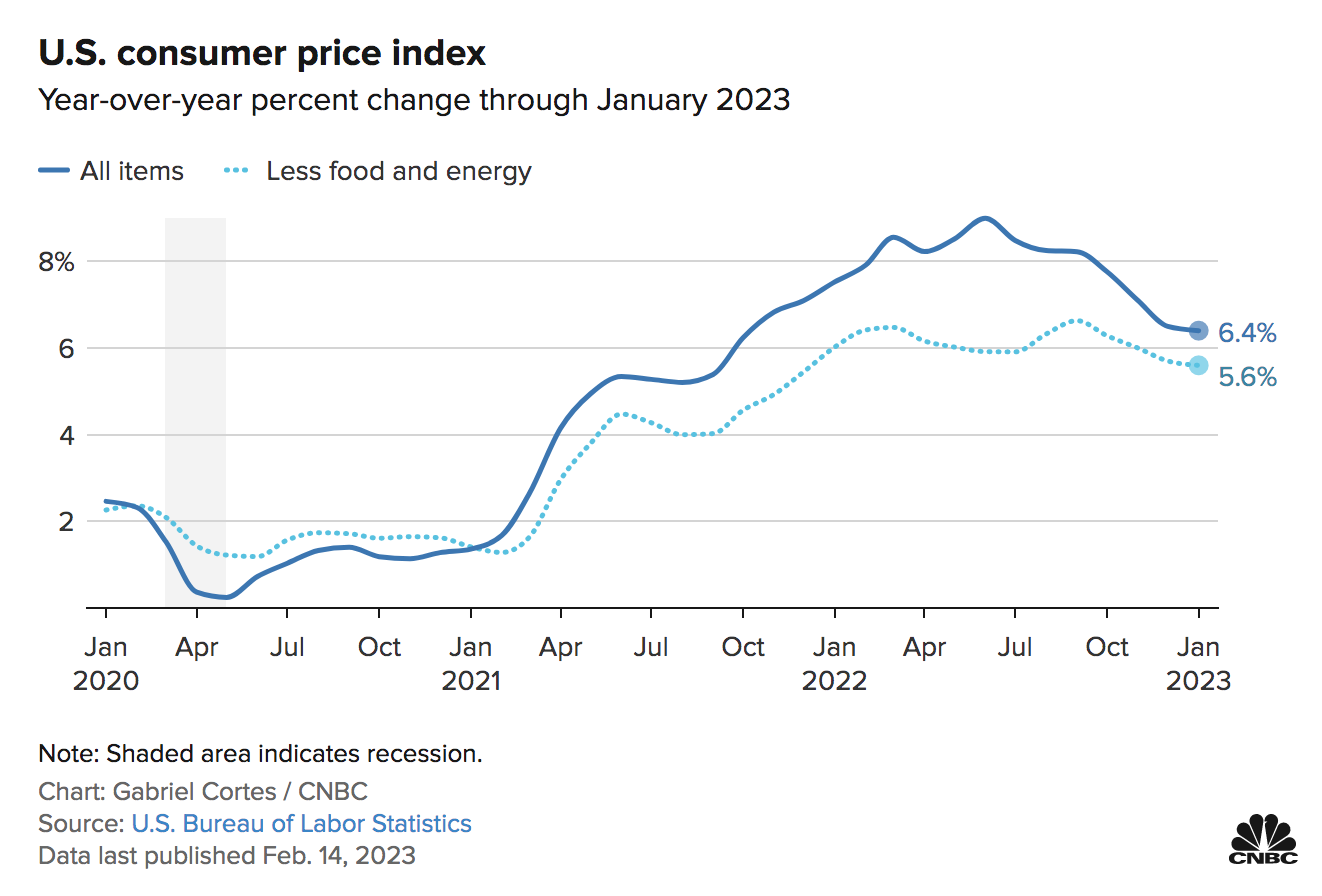

Inflation Up 6.4% from a Year Ago

- Inflation rose in January by 0.5% following a 0.1% increase in December

- The CPI was up 6.4% from the same period in 2022 – higher than expected.

- Across-the-board we saw increases in shelter, food and energy; and

- “Super core” services inflation, which excludes food, energy and shelter, rose 0.2% for the month and was 4% higher than a year ago.

And it’s this last point which is the most important from the Fed’s perspective (echoing Williams’ sentiment)

Here’s my quick takeaway on today’s print:

The easy work is mostly done.

Getting inflation to fall from its peak of ~9.2% last June down to ~6.4% today was the low-hanging fruit (i.e. falling goods and commodities).

And it won’t take too much to get it to ~5%

But the harder work – and what the market potentially underestimates – is the time required to get it from ‘4% down to 2%’

That’s why the Fed is focused on what it calls “super core” inflation (i.e., exclusive of food, energy and shelter)

For example, rising shelter costs accounted for about half the monthly increase.

The component accounts for more than one-third of the index and rose 0.7% on the month and was up 7.9% from a year ago.

Energy also was a significant contributor, up 2% MoM and 8.7% YoY. And finally food rose 0.5% MoM and 10.1% YoY.

From mine, to see headline CPI at above 6% is a little surprising.

My expectation is it would be closer to 5% by this time given the extreme measures the Fed have taken… but it shows you how sticky inflation can be.

Bonds Realign with the Fed

At the start of the month – I made the observation that something was “off” in bond markets.

For example, we had the US 2-year yield trading at ~4.1% and the Fed closer to 4.75%

This was a massive disconnect.

Bonds were essentially telling the Fed they needed to pause (or even cut).

However, Powell was having none of it.

This was the Chairman’s language when challenged on what the bond market was suggesting:

Given our outlook, I don’t see us cutting rates this year, if our outlook comes true.

Powell also said he was “not concerned” about the bond market implying one more cut before a pause, because some market participants are expecting inflation to fall faster than the Fed does. “If we do see inflation coming down much more quickly, that will play into our policy setting, of course,”

Things have changed a lot the past two weeks.

Powell has not said a thing… however bonds have come around to his way of thinking (i.e., expect higher for longer)

Feb 14 2023

From mine, today’s inflation print reinforced why rate cuts are less probable this year.

However, equities don’t yet agree.

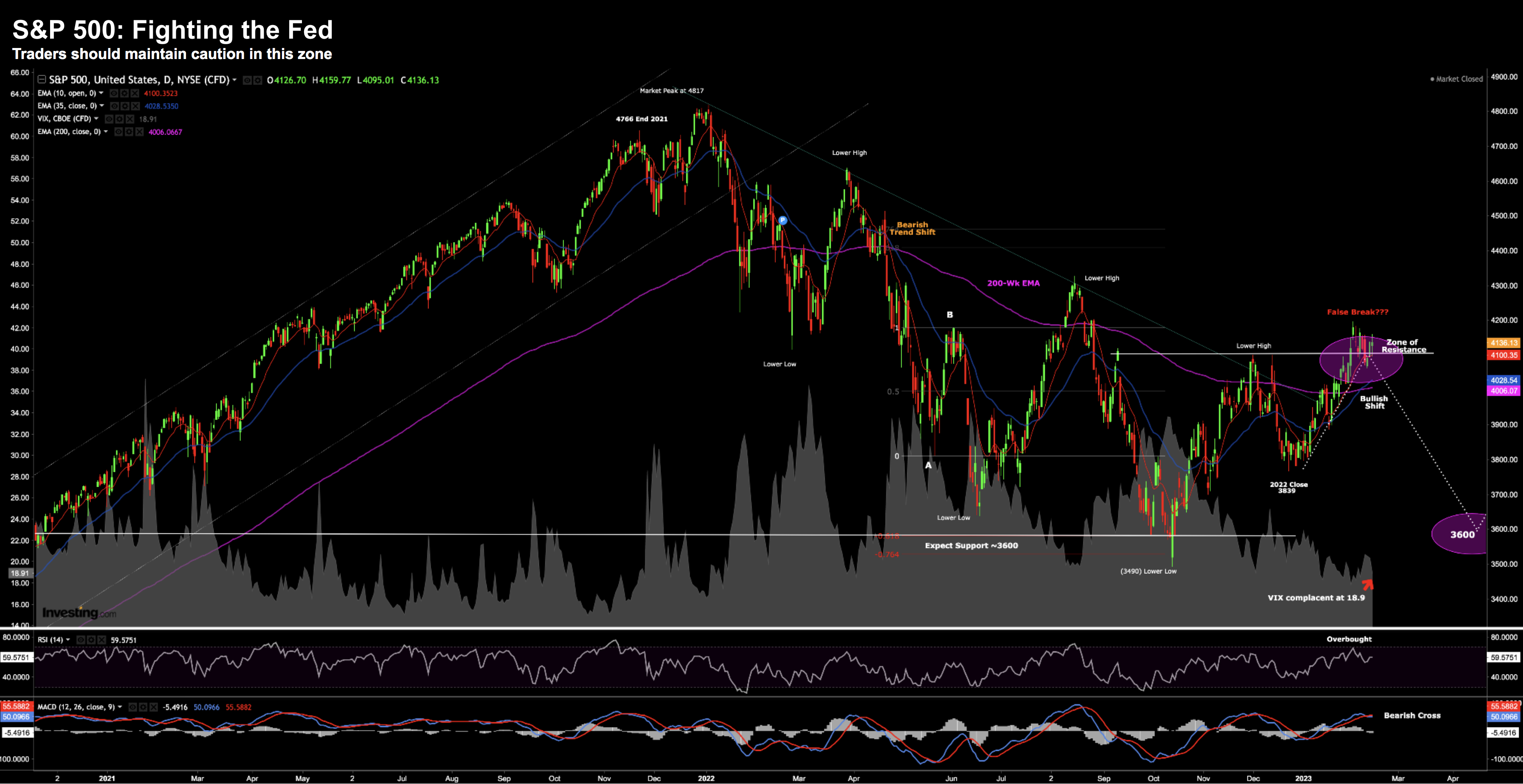

S&P 500: Bulls Refuse to Believe the Fed

For now, equity bulls continue to defy the Fed (and bond markets)

As an aside, if you told me this morning that 2-year yields would trade above 4.6% and the 10-year above 3.70% — I would say equities would be lower.

Wrong.

Whilst yields rallied (i.e., suggesting higher for long rates) – equities shrugged it off.

Below is the tape which I will update at week’s end.

Feb 14 2023

In short we are still trading in what I feel is a zone of resistance.

And whilst stocks could push higher… I think the upside gains are minimal (e.g. less than 5%)

However, I see near-term downside risks exceeding 10%

Putting it All Together

We were gently reminded today that inflation won’t fall in a linear fashion. It will be bumpy.

What’s more, the path from ‘9% to 5%’ is lower-hanging fruit.

Goods and commodities account from most of that.

However, the push to the Fed’s target of 2% will be a much harder fight.

Here we are still early.

Two things summarise the hard road ahead:

- A labor market which is resilient (~3.5% unemployment w/4%+ wage growth); and

- Stickier forms of inflation which may prove to be stubborn.

Put those together and it suggests that rates will be “higher for longer” (where higher means a Fed funds rate 4.75%+)

That has been my thesis for 6+ months.

In closing, NY Fed President Williams reminded us today their job is unfinished.

Equities paid no attention.

Instead, they chose what they wanted to hear; i.e. Fed President Harker saying “we are closer to the end”

Of course they are closer to the end!

The Fed probably won’t add much more than 75 bps this year (e.g. 3 installments of 25 bps).

They may not even need to do that much.

But that says nothing about how long rates will remain in a restrictive zone.

That’s the piece that equities may not be pricing in.