- Bond yields move higher… will equities follow?

- Jamie Dimon warns of “higher for longer” rates

- Did we see a massive ‘false break’ on the S&P 500?

- US dollar index; and

- 2-Year bond yields; and

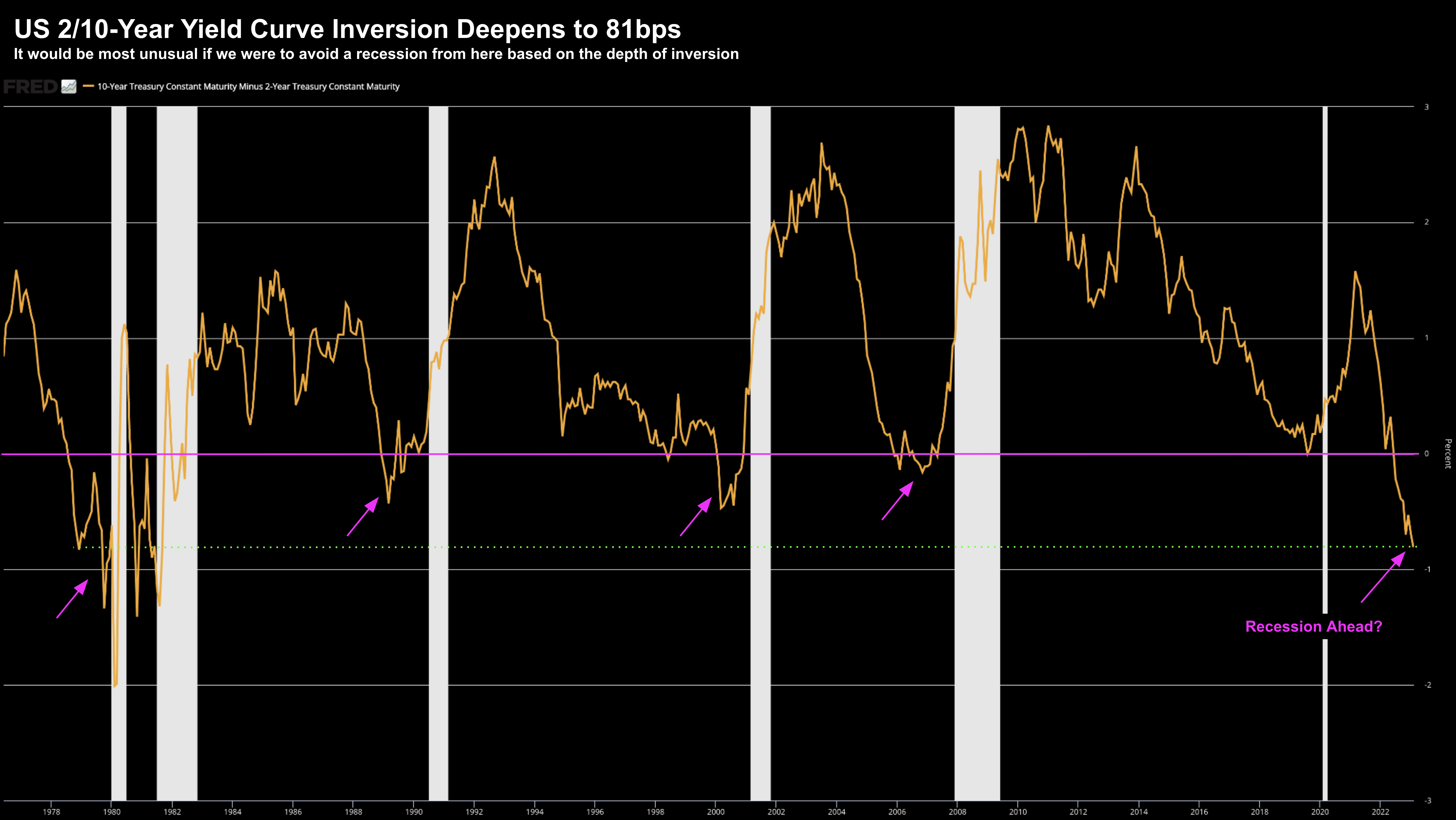

- The 2/10-year yield curve

Both the dollar index and short-term bond yields have reversed course post the Fed’s latest statement on monetary policy.

The question is why?

For example, could bond markets be paying more attention to Jay Powell’s message; i.e. expect further hikes?

I don’t know.

The move in yields has also seen the all-important 2/10 yield curve invert further… not a great sign.

But before I get to what I see with these charts – Jamie Dimon had a few words on what investors should prepare for:

The chief executive of JPMorgan Chase & Co, the biggest U.S. bank, cautioned against declaring victory against inflation too early, warning the Federal Reserve could raise interest rates above the 5% mark if higher prices ended up “sticky.”

He added “people should take a deep breath on this one before they declare victory because a month’s number looked good. It’s perfectly reasonable for the Fed to go to 5% and wait a while”

This will sound familiar to regular readers of the blog.

For example, last November I offered a framework when thinking about Fed policy.

In short, it consisted of three vectors:

- How high?

- How fast?; and

- How long?

How high is now laregly a moot point.

As we near the end of the rate tightening cycle – it’s possible we see another “50 basis points” – but it’s unlikely we will get another “400 bps” this year.

How fast is also rear-view mirror.

For example, if we consider the recent trajectory, the Fed have slowed hikes from 75 to 50 to 25 bps. Again, this is the rate cycle maturing.

Finally, we have how long?

This is the point that Dimon is making; i.e. it’s perfectly reasonable for the Fed to go to 5.00% and wait a while”

Here’s what I wrote November 19 last year:

I doubt it will be a case of “hitting 5.0%” and then soon after – pushing for rate cuts.

That’s presumptuous and would assume something very bad has happened (e.g., widespread debt defaults).

At this stage (and it’s a function of both employment and inflation) – we could see rates trade north of 4.75% for most of next year.

But that’s not what the market is pricing.

And equity markets are still not pricing it in.

Now bond markets could be coming around to this view… especially given the strength we see in the labor market.

But equities are yet to concede…

With that, let’s start with bonds and the 2-year yield – it’s moving higher.

US 2-Year Yield Rallies

It’s often said that if you want to know where rates are heading – pay attention to the US 2-year yield

Now recently they were heading lower… at one point threatening to fall below 4.00%

At the time I said something is off…

I said we have a Fed at 4.75% and the 2-year at ~4.10%… a difference of 65 basis points.

I called it a massive disconnect.

Of late the bond market has changed its tune.

It found support around 4.00% and has taken off to the upside… trading closer to 4.50% at the time of writing:

Feb 9 2023

This is worth noting…

It suggests (to me) the bond market is now starting to side a little more (not fully) with the Fed.

Now when I critiqued the latest Fed statement, I commented how Jay Powell “waved away” what he saw in bond markets.

Specifically I cited the following (Fed) language:

Given our outlook, I don’t see us cutting rates this year, if our outlook comes true.

Powell also said he was “not concerned” about the bond market implying one more cut before a pause, because some market participants are expecting inflation to fall faster than the Fed does.

“If we do see inflation coming down much more quickly, that will play into our policy setting, of course,”

Keep an eye on this…

Because if the 2-year continues to move higher – it is a headwind for equities.

2/10-Yr Yield Curve Negative 81bps

Related to the rise in 2-year yields – this is further deepening the inversion of the yield curve.

For example, if we subtract the 2-year yield (4.48%) from the 10-year yield (3.67%) – we are now negative 81 bps

Let’s say the 2-year pushes 4.67% and the 10-year remains at say 3.67% – that inversion will be 100 basis points.

This is not a vote of confidence in the economy.

In short, an economy dependent on credit does not function (long-term) with a negatively sloped curve.

Put it this way:

Banks are typically not in the game of buying money at a higher price than what they can lend it out.

That’s not good business.

Feb 9 2023

But the other common interpretation is this inversions suggests the Fed is far too tight with monetary conditions.

And they might be… sure.

But more importantly – Jay Powell isn’t interested.

That’s what matters.

He is on a mission to kill unwanted (sticky) inflation even if it means exceptionally tight conditions for a lengthy period.

So why do I care about this chart?

Before I can get aggressively bullish on equities, I need to see this chart turn around.

Once the yield curve starts to show a positive slope (even if still below zero) – we can have more confidence that things are getting better.

Until then, there is nothing about this chart that tells me we will avoid a hard landing.

US Dollar Index Strength

The last chart I want to share is the rebound in the US dollar index.

Let’s take a look at the weekly chart for the world’s reserve:

Feb 9 2023

The sell-off in the DXY from overbought levels was expected.

It was too much too fast.

However the sell-off was a large tailwind for equities.

Naturally, the opposite holds true.

The recent bounce from ~100 to ~104 has capped the equity rally.

For example, take a look at the strong (inverted) correlation when overlain with the S&P 500 (white line):

Feb 9 2023

Note how the stock market bottom coincided almost perfectly with the peak in the dollar.

At the time, I called the US dollar the “wrecking ball”.

In summary, keep a close eye on any rally in the USD.

And much of this will be a function of what we see with interest rates.

For example, at the time of writing, traders are pricing in a 52% probability the cash rate will peak between 5.00% and 5.25% by May or June.

And that feels about right.

However, they are also pricing in two cuts before year’s end.

That part, I’m not sold on.

Not yet.

Gene Frieda, global strategist at PIMCO, said the US dollar’s yield advantage versus other developed economies will narrow as the Fed moves toward an expected pause in its hiking cycle in the first quarter of 2023.

Yes, the Fed will eventually pause in 2023.

However, will they cut?

“Don’t bank on it” says Jamie Dimon and Jay Powell.

Putting it All Together

Before I close, a quick word on the S&P 500.

As part of my last post I said I’m watching for a potential “false break” of the 4100 high.

Repeating my language:

False Break: we need to see the market rally above this level and hold it there for a few weeks. In other words, what I don’t want to see is the market briefly trade above the December highs of 4100 and drop back below. If we saw this, I would consider it a “false break” of the previous high… often a reliable reversal signal

Today (Thursday) we closed 4081.

If we close below 4100 this week – it sends a warning of near-term downside.

And whilst I am not overly bearish… the market is ripe for a pullback.

Keep some powder dry folks… there will be an opportunity soon to put it to work.