- MSFT and GOOG Q2 Earnings: ‘good not great’

- Strong FX headwinds expected to get worse in Q3;

- Shopify lays off 10% of staff after misreading the economy post pandemic

- Consumer confidence falls for the third straight month

Earnings season is now in full swing.

Google, Microsoft, Visa, General Motors and McDonalds – some of the bigger names reporting.

In summary, it’s a mixed bag.

Some pockets show optimism… others give reasons to be cautious.

Take Visa…

They said they see no slowdown in consumer spend and remain optimistic looking ahead. Amex said something similar.

Here’s Reuters:

Visa Inc beat estimates for quarterly profit on Tuesday as resilience in consumer spending so far and a summer travel boom across much of the United States translated into higher card spends. After being holed up at their homes, pandemic-weary Americans are splurging on travel and other leisure related activities, helping the economy to stay on track despite an onslaught from inflation.

Good news (in part).

How about General Motors?

GM reported second-quarter earnings Tuesday that missed Wall Street’s estimates after the company was unable to ship nearly 100,000 vehicles by quarter-end due to parts shortages. But the company maintained its previous earnings guidance for the full year, saying it’s confident it will be able to ramp up production in the second half of 2022. It also confirmed it has locked in sufficient supplies of critical battery-related materials to support its mid-decade EV plans.

The stock was ~4% lower.

Which brings us two of the most highly anticipated earnings reports… Google and Microsoft.

In short, both missed estimates on slower than expected growth (more on this in a moment)

However, Microsoft issued positive guidance – as the top-line grew 12% – which has the stock up ~5% after hours.

Its cloud business – Azure – grew 40% YoY – but was shy of the 43% expected.

Google said it saw it’s search advertising grow 13% – citing strong spend in the retail and travel sectors (echoing Visa’s comments)

But the “TL;DR” from both Google and Microsoft’s Q2 earnings was demand isn’t falling off a cliff.

The question to ask is whether this is rear-view mirror?

Maybe….

For example, today we learned the consumer confidence index fell for the third straight month.

So how does that bode for Q3?

Microsoft: Azure Grows 40% YoY

Further to my preface, Microsoft missed expectations for profit and revenue – as deteriorating economic conditions hampered the result.

What’s more, they cited:

- Unfavorable foreign exchange rates – hitting revenue by $595M and EPS by 4 cents

- Covid-related production shutdowns in China and a deteriorating PC market – impacting revenue by $300M

- Reduced advertising spending with LinkedIn by over $100M

The second bullet point deserves focus – as I suspect Apple is likely to report something similar.

However, as part of the company’s conference call, they maintained their guidance soothing investor concerns.

Put together, they reported:

- Quarterly earnings of $16.74 billion, or $2.23 a share, up from $2.17 a share YoY; and

- Revenue up 12% to $51.87 billion from $46.15 billion in the year-ago quarter.

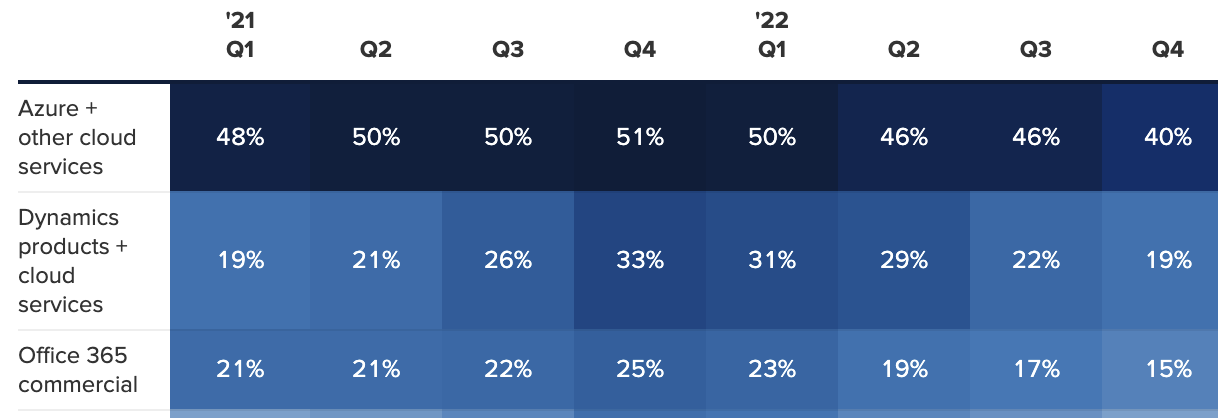

The most closely watched line was their growth in cloud services; i.e. Azure (see top line below).

But as I say – the result was mixed…

For example, the “half glass empty” lens is it’s the slowest growth we’ve seen in seven quarters (where the street expected 43% YoY)

On the other hand, “half glass full” is an impressive 40% YoY growth off a very large customer base.

What’s more, Microsoft doesn’t see demand for enterprise IT spend falling… reiterating their forward guidance.

CEO Satya Nadella boasted about winning bigger Azure deals during a conference call with analysts.

Here is his comments:

“We are seeing larger and longer-term commitments and a record number of $100 million-plus and $1 billion-plus deals this quarter,” Nadella said

The Fundamentals and Chart

Going into the print, Microsoft wasn’t cheap around 25x forward earnings.

But as I’ve maintained for a decade writing this blog – you’re buying a business which is growing which is best in class.

You are always going to pay a premium for a business like Microsoft opposite its consistently strong cash flow.

The only question is what premium do you put on the stock?

From mine, a valuation between 20 and 25x is not unreasonable.

And with the result (and projected growth of 14% full year) – the price is about “inline”.

But let’s check the chart….

With the stock some 28% off its all-time November 2021 high – the news of slower-than-expected growth and significant foreign exchange impact was priced in.

Put another way – the earnings bar was already quite low

Note – last week I said expect tech stocks to likely rally post earnings (in the near-term) – given the setup.

July 26 2022

When I look at the weekly chart – it suggests the price action has more ‘work to do’. For example:

- It remains in a weekly bearish trend (i.e., expect a rally to be sold)

- We find lower highs and lower lows

- Stock could rally back to the 35-week EMA (~$280) where it will likely face selling pressure

- Weekly MACD showing signs of bottoming

If you don’t have a position in Microsoft… I would establish one between $220 and $250 with a 3-year plus lens.

And if you already do own the stock (like myself) – add to it on weakness.

In the near-term, I expect the stock to rally on the positive guide and earnings largely inline.

But I still see overhead resistance around $280… I don’t think it’s smooth sailing ahead.

Google: ‘Solid’ Earnings w/$140B in Cash

After the ‘SNAP train-wreck’ last week – many felt there could be ad-spend ‘capitulation’ for Google.

I felt it was a false assumption to draw parallels between SNAP and the likes of Google or Meta.

They are not in the same league…. and today we saw why.

Let’s review the key metrics:

- Earnings per share $1.21 vs $1.28 expected

- Revenue: $69.69 billion vs $69.9 billion expected (13% YoY)

- YouTube advertising revenue: $7.34 billion vs. $7.52 billion expected (5% YoY)

- Google Cloud revenue: $6.28 billion vs. $6.41 billion expected

- Traffic acquisition costs: $12.21 billion vs $12.41 billion expected

- FX headwinds resulted in 3.7% revenue growth

Google’s search and other revenue was $40.69 billion (58% of total revenue) — up from $35.85 billion the year prior.

Echoing what Visa said earlier – that growth was boosted by travel and retail queries (interesting given the difficulties we see with Target and Walmart)

And whilst Google refused to offer a forecast – analysts expect revenue growth for the full year at 14% to $293.9 billion (from $256B in 2021)

To the weekly chart:

July 26 2022

Not unlike Microsoft – a lot of the bad news was ‘priced in’.

The bar was set low…

Google traded at $152.10 per share earlier this year – which means the stock was some 31% off its high.

Now the market knew ad revenue was going to be notably softer.

For example, Sundar Pichai – Google’s CEO – advised they will slow hiring (not cut) – after a year where headcount grew some 21%

Like Microsoft, the stock will catch a bid tomorrow simply on the fact that revenue did not fall off a cliff.

However, technically the chart still has to do a lot of work.

Google faces critical support around $100 (i.e. $2,000 before its 20-1 split earlier this month)

If that breaks, then it’s a quick trip lower.

That said – and despite the bearish looking chart – Google is cheap relative to the sector and the broader market.

For example, it boasts:

- Forward PE 19x (just 17x adjusted for $10 p/share in cash)

- PEG Ratio of around 1.3x (assuming full year growth of 14%)

- Price to Sales of 5.4x

Note: the PEG ratio is what you are paying for growth.

- 1x is generally good value; anything 2x plus is high.

- For example, a company “growing at 20%” trading at “20x forward PE” is a PEG ratio of 1x

Much like Microsoft, Google commands a premium to the market given its exceptionally high quality.

And with the stock trading at ~17x forward (adjusted for $140B in cash) – it’s inline with the broader market (and cheap for tech)

Now could we see Google fall to a PE of 15x?

Yes… especially if we fall into a sharp pro-longed recession.

Google (not unlike Microsoft) are vulnerable to economic headwinds.

But if we are lucky enough to see 15x forward – it warrants a place in your long-term portfolio.

*** Full disclosure – I work for Google and it’s my largest position ***

Putting it All Together

Google and Microsoft’s earnings this afternoon was an important hurdle for the market to clear.

I think the market ‘exhaled’ post the earnings calls.

Yes – earnings missed for both companies – but it was far from “we are falling off a cliff”.

For example, both companies posted top-line double digit growth in a very challenging environment (and not from a small base)

That said, Google and Microsoft’s fortunes are tied very much to the ‘engine room‘ economy.

What do I mean?

They need businesses (small and large) to be doing well.

And for business to be doing well – they need to see a healthy consumer.

Yesterday I talked to how the consumer is starting to feel the pressure of inflation, especially the lower-end (e.g., Walmart’s warning).

Lower-end consumers feel it most… as they don’t enjoy high levels of discretionary income.

Now if sophisticated retailers like Walmart are being forced to manage their costs (to defend shrinking margins) – it’s going to ripple through the entire economy.

For example, Walmart will probably look to reduce both cloud and advertising spend (as their profit margins get crushed)

Advertising is always one of the first budgets to be cut… but how about cloud?

It’s not immune.

Cloud spend is demand driven.

For example, companies like Walmart will “spin up” cloud services (storage and compute) based on demand levels.

If demand increases – they will use more cloud services.

The opposite holds true.

Now if consumer demand (and confidence) wanes – it follows that enterprise levels of spend will likely fall too.

Put another way, cloud spend (opex) is designed to be elastic.

That’s one of the reasons its so attractive… you use it when needed (vs the sunk cost of fixed (physical) infrastructure).

Before I close (and part of the “mixed bag” today) was from online (eCommerce) services company Shopify.

They said they will cut 10% of its global workforce.

CEO Tobi Lutke said the business has seen a pullback in online spending and that he misjudged how long the pandemic-fueled e-Commerce boom would last.

You can’t help but see the overlap here with Walmart, Target and others.

My read on this was the artificial ‘surge’ in spend we saw in 2020/21 was simply demand pulled forward.

These companies are ‘right-sizing’ as the higher cost of capital weighs.

Ruth Porat – Google’s CFO – was right not to offer a forecast.

Looking through a complex windshield of higher interest rates, continued inflation, a weaker consumer and slowing growth remains challenging (at best)