- Michael Burry makes a $1.6B short bet against the market

- David Einhorn also waves a yellow flag on valuations

- S&P 500 is delicately poised here at the 10-week EMA – will it hold?

45 days after the end of every quarter – Wall Street’s top fund managers are required to report their most recent holdings.

These filings are known as 13Fs – and they reveal a lot about where the ‘smart’ money is going.

Personally, I monitor about 50 leading funds. For example, some include (certainly not limited to):

- Berkshire Hathaway

- Blackrock

- Altimeter

- Appaloosa

- Baupost

- Coatue

- D1

- Duquesne

… and a host of others.

Consider for example David Tepper’s Appaloosa. Major positions he added to last quarter were:

- NVDA – Increase of 870,000 shares (8.01% of the portfolio)

- META – Increase of 802,500 shares (8.00% of the portfolio)

- MSFT – Increase of 980,000 shares (7.84% of the portfolio)

- AMZN – Increase of 1,162,500 share (7.65% of the portfolio)

Two observations:

- In Q2, Tepper clearly thought there was more upside in tech (and he was right); and

- Tepper clearly keeps his maximum position size below 10% (which is not a bad rule of thumb)

But to be clear, Tepper may now be completely out of these positions after their recent near vertical run (we will find out 45 days after the end of Q3; i.e. mid November)

Perhaps one of the more interesting report filings was from Berkshire Hathaway.

I say that because Buffett’s firm is less likely to move in and out of large positions quarter to quarter (unlike Tepper who is far more active). Typically when Buffett (or his colleagues) buy something – it’s for the long-term.

For example, whilst Apple remains his single largest holding (51% of the portfolio) – Berkshire took a small position in Capital One (COF) and also home builder D.R. Horten (DHI)

What we don’t know if whether it was Buffett himself making these trades (it could have been his peers).

What’s more, DHI is only 0.21% of Berkshire’s portfolio – however they added some 5,969,714 shares (~$727M)

But there was another filing which caught my eye…

It was the “Big Short” investor Michael Burry.

Burry runs a fund called Scion Asset Management – with about $2B under management.

It turns out he is making another “Big Short” bet… but it’s not housing.

Burry Shorts the S&P 500 and Tech

For those who have not seen the “Big Short” – it’s fabulous.

It’s a movie starring Christian Bale (who plays Burry) about Wall Street insiders who predicted the events of 2008.

Burry discovered that high-risk subprime loans were propping up the U.S. housing market and were about to implode.

The only question for Burry was when (not if).

However, to profit from this doomsday thesis – he created a financial instrument called a credit default swap.

This allowed him to bet against mortgage-backed securities with banks (who firmly believed that housing never goes down).

Turns out it can.

Housing collapsed under the weight of (poor) sub-prime loans and he made $2.6 billion for his efforts.

His name is now stuff of Wall St. legend.

So what does this market ‘genius’ see that others potentially don’t?

This time he thinks the stock market (especially tech) is over-valued.

But to short the market – he doesn’t need to create complex credit default swaps.

It’s much simpler.

He can simply buy put options on market (which allows him to manage his risk)

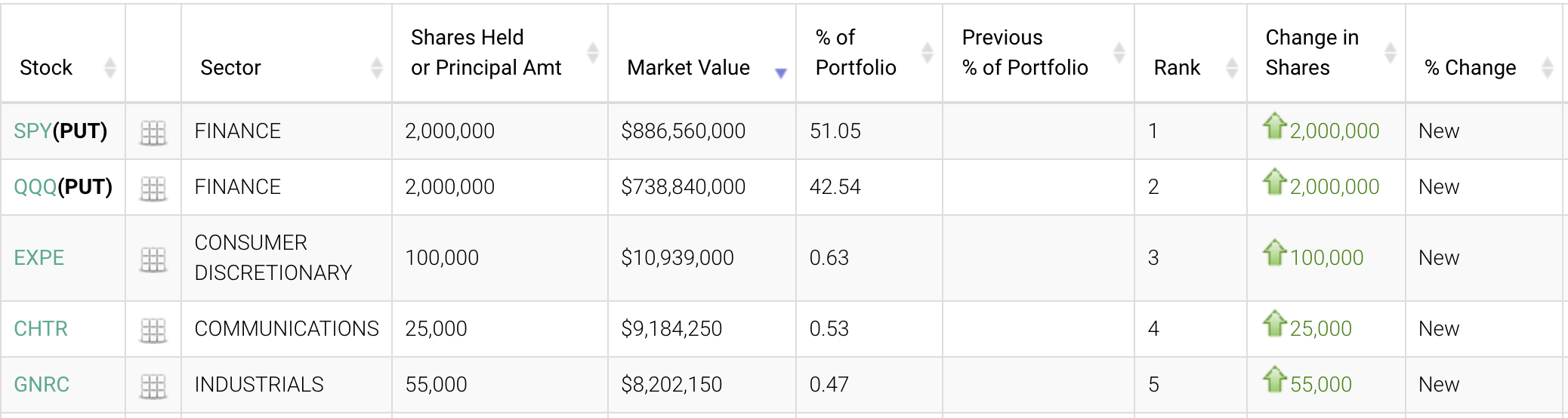

Below is a summary of his latest Q2 13F filing:

The top line shows Burry owning ~$887M put option contracts on the SPDR S&P 500 Trust (SPY).

Not finished with the S&P 500 – he’s making a similar bet with the QQQ ETF (a proxy for tech stocks) – with~$738M of put options.

Combined these two positions equate to a staggering 93% of this portfolio.

You could call that an aggressive bet!

Outside that, he is long stocks like Expedia, Generac and Cigna.

However, these long positions are less than 2% of his total portfolio in aggregate.

But it’s not just Burry who thinks we are headed lower… another billionaire is waving a “yellow flag”.

David Einhorn also Bearish

David Einhorn is another closely followed billionaire investor.

As an aside, I really enjoyed Einhorn’s book “Fooling Some of the People All of the Time – A Long and Short Story”

It’s a great (first hand) story about how he shorted a deeply fraudulent financial firm called “Allied”.

Einhorn claimed Allied was using questionable accounting practices to prop itself up (sound familiar?)

However, he had to “go through hell” to prove it.

No-one believed him – as Allied was a widely held Wall Street stock at the time – and a fixture in most people’s 401Ks.

However, he stuck with it.

Needless to say – Einhorn was proven right.

Maybe there’s a movie in there too?

Einhorn’s fund is called Greenlight Capital.

The name “Greenlight” came from his wife when he was given the “green light” to start his own hedge fund (also a story in the book)

Einhorn is widely followed due to his many successes.

And after returning more to his investors than they could’ve earned investing in the S&P 500 during the second quarter, David said this to investors:

“If we were bearish until March and neutral through June, we would now characterize ourselves as worried. When the authorities bailed out bank depositors in March, we thought the implications were bullish for both stocks and inflation and adjusted the portfolio accordingly.”

Einhorn echoed the sentiment we heard from Bill Gross last week – that inflation will be “stickier” than what most believe.

This was Gross’ comment:

Inflation may prove sticky at around 3%. He pointed out that 10-year yields historically traded about 135 basis points above the Federal Reserve’s policy rate.

So even if the Fed lowers interest rates to about 3%, the current 10-year yield remains too low, given the historical relationship.

In addition, the skyrocketing government deficit will add supply pressure on the bond market, he said, reiterating his view outlined in his recent investment outlook.

And as we watch yields rise – this is largely why the likes of Gross and Einhorn are “worried”.

Maybe (and I’m guessing) this is also why Warren Buffett is adding bonds to his portfolio.

Call it a prudent hedge.

Now why do you think the likes of Bill Gross, Michael Burry, Warren Buffett and David Einhorn have concerns?

These investors are exceptionally savvy… arguably some of the best in the game.

My take is they are of the view that valuations are full and the risks are to the downside.

Will They Be Right?

Ha! If only we knew.

If we did – then we would ‘bet’ with the conviction of Michael Burry.

But if I was to bet one way – I would lean to the downside.

I’ve issued various posts of late expressing my concern about the market’s pricey valuation.

I’ve shared this chart (and forecast) for the S&P 500:

Aug 15 2023

Now, if you have not read this post, it explains why I think there’s room for stocks to correct.

And it comes back to the (very low) equity risk premium.

In short, the amount of premium you get by owning stocks here does not adequately compensate you opposite the risk.

For example, you can get close to 5.50% for 12 months with treasuries today.

That’s a risk free return.

However, if we assume the forward PE for the S&P 500 is ~19x (pending what you assume for earnings) – that’s an earnings yield of ~5.30% (i.e. 1/19 = 5.30%)

What investors expect to see is the earnings yield for stocks should be substantially higher (i.e., the premium) than that of the risk free rate.

But what we find is the opposite!!

We have only seen this phenomenon twice in recent history.

2001 and again in 2008.

My guess is Burry knows this. He’s extremely astute.

Now you should not take that to think there is going to be an imminent market crash.

No.

All this says is we are in “rarified air” when it comes to valuations.

Therefore, you could easily argue that probabilities are in Burry’s favour – but it’s not certain.

Death is certain. Tax is certain.

Forecast near-term movements in stocks (e.g. less than 3 years) is far from certain.

Why It’s Always Difficult Being Short

As regular readers will know – I am not short the market.

In fact, I am 65% long which has seen me wear about 1% of downside the past two weeks.

Almost all of my holdings are lower (especially tech)

What’s more, I don’t have any put options in play.

My “hedge” (if you could call it that) is I remain in 35% cash.

But what I will say is it’s very difficult to sell the market short.

Why?

For the simple reason most of the time the odds are against you.

Over the long term – the market (and economy) has a great track record of increasing in value over time.

Yes there are always bumps along the way.

2001 and 2008 were two solid bumps.

Burry profited from that.

And there will be many more “2001s and 2008s” before I finish playing this game.

That’s part of it.

However, over time, it has proven to be a losing bet if you consistently bet against the market.

Therefore I don’t do it.

What I do is simply lower my exposure.

Putting it All Together

I won’t lie – I will be rooting for Burry to make another “$1B” with his short bet.

Why?

Because I would love to put my 35% cash to work at better long-term valuations.

Will I hurt if tech corrects say 20%?

Absolutely!

Tech is a whopping 20% of my total portfolio (across Apple, Google, Amazon and Microsoft)

These are good stocks to own – but they are horribly overpriced.

I would be happy buying stocks at much lower valuations.

Looking at what we have heard from the likes of Einhorn, Burry and Bill Gross this week – they are waving a yellow flag.

It’s the same flag I’ve been waving all quarter… as we watch yields rise (which I think is a bigger risk than the Fed)

It would remiss to ignore them.

Now if I look at the weekly S&P 500 chart I shared earlier – the market is delicately poised.

It could easily break below the 10-week EMA – and trade quickly down to the 35-week EMA.

And who knows – maybe Burry will cash his trade with a ~10% move lower for a nice gain? It’s entirely plausible.

We will find out 45 days after Q3 ends (i.e., mid November)

But from a fundamental perspective – companies must deliver strong revenue and earnings growth to grow into the “19x” forward multiple.

Will they?

That’s the (big) bet the bulls are making.

Because if they don’t… investors will take to the exits.