- Big-tech drags down the market

- US consumer hedonism is real; and

- Is the market sell-off done?

If you’re long the market – it was another rough week.

My portfolio was no exception.

My largest position (Google) was smoked – losing around 10%.

From my lens, a lot of very good news was already priced in. You could say the same for Meta and other tech stocks.

With respect to Google – it was trading at forward PE multiple of ~26x into the print.

Now when you consider the company is posting top-line growth of ~11% – that’s lofty by any measure.

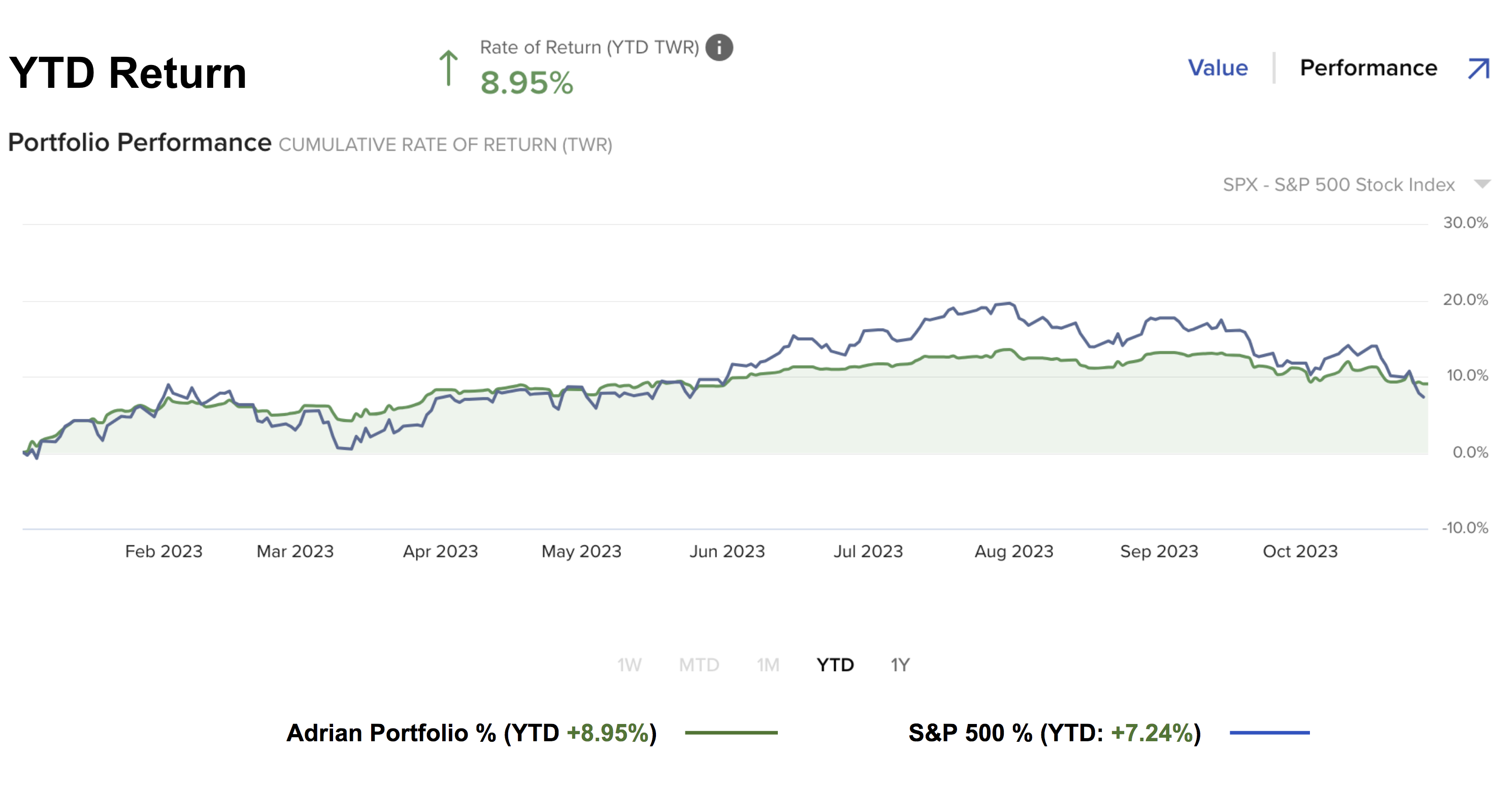

That said, my 65% long portfolio was down 0.3% this week – slightly better than the S&P 500’s loss of 2.5%

The Index is now only up 7.24% for the year…. a long way from almost 20% higher in June. My own performance 8.95% YTD

But more on this later…

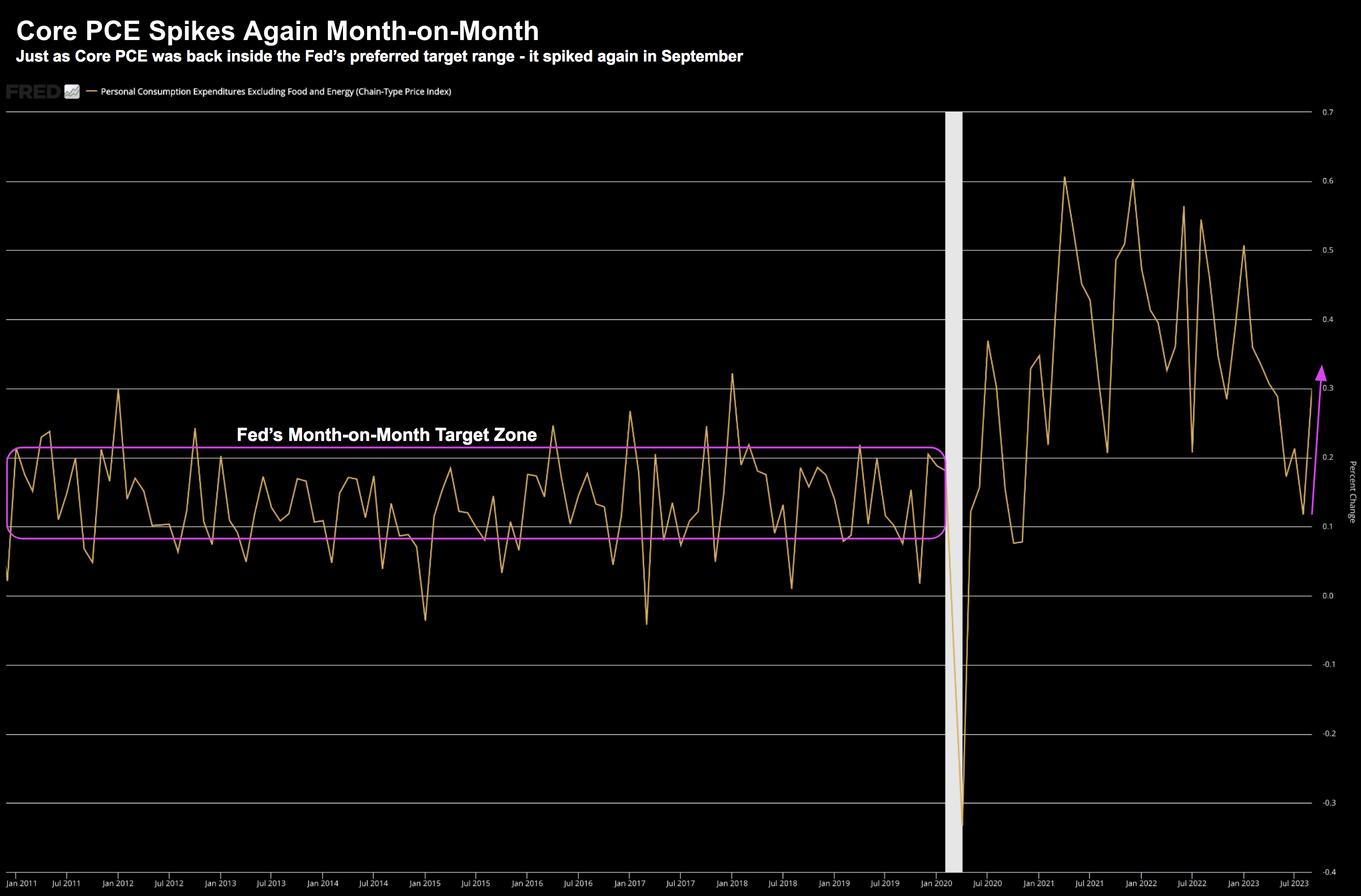

First I want to cover what we saw with Core PCE inflation during the week.

This is the Fed’s preferred measure and an ‘uncomfortably high’ read could mean they are not finished raising rates this year.

US Consumer Hedonism is Real

I have a saying when it comes to the US consumer:

“Never underestimate their desire to want to spend… even if it’s with money they don’t have“

Last month was another example.

The hedonism of the US consumer is real.

I think everyone underestimated just what lengths US consumers will go to spend.

Whether it’s their “Netflix subscription“, their “Coca-Cola” or their “Air Jordans” or whatever – they will spend.

According to this week’s Personal Income and Outlays report from the U.S. Bureau of Economic Analysis – consumers continued to reach for their trusty plastic card.

Who cares if rates are at 26%?

Consumer spending rose a sharp 0.7% MoM – higher than the 0.5% expectation.

However, the ‘good news’ (at least from the Fed’s lens) is income only rose 0.3% MoM (lower than expectations)

Consumers continued to draw down on savings and added debt. The personal savings rate fell to 3.4% – which is now the lowest level since last December.

Translation:

This only adds to the slowdown argument for next year.

So is this good new or bad news?

Well retailers might celebrate the news. But if you’re the Fed – they may be less enthused.

In short, this gives them less wiggle room.

For example, odds of a 25 bps rate hike for December now sits at 75% – up from ~50% a couple of weeks ago.

The market does not see a rate hike for November.

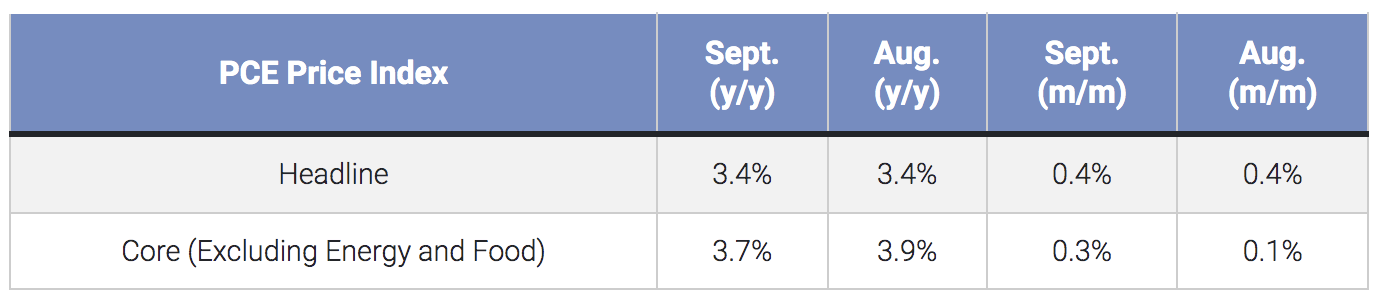

The Core PCE Price Index increased at the fastest pace since April, rising 0.3% MoM – accelerating significantly from August’s 0.1% MoM.

Up until last month, Core PCE was trending in the right direction.

The question is whether September’s spike was an anomaly – or something more threatening?

If you ask me – I lean towards the former.

Why?

Because consumers will likely struggle with higher debt levels, higher rates, elevated costs and reduced credit availability.

For example, we saw durable goods prices fall 0.1% during the period.

These are bigger ticket items….

The overall PCE Price Index, which includes food and energy, rose 0.4% during the period, faster than the 0.3% projection and unchanged from August’s pace.

And on a YoY basis Headline PCE prices rose 3.4% (no change from last month); while the Core rose at 3.7% YoY, compared to 3.9% in August.

Again, these numbers would still be considered uncomfortably high for the Fed.

A rate rise for 25 bps in December is not off the table (not yet)

Let’s move to the equity market…

As stocks were not impressed with the either PCE inflation and/or various company earnings.

Is the Sell-Off Done?

From my lens, things continue to trade per the script.

We remain largely range bound with no catalyst to take us meaningfully higher.

Sure, there are any number of things which could take us sharply lower (some of which I outlined above).

But the forces to take us back to say “4800” are just not there… not in the near-term

Oct 28 2023

To recap – in August I highlighted a warning sign I saw with the weekly-MACD (lower window)

It had tuned negative with the Index around 4400… and I said “watch this”

And the week of July 24 – I said “things feel overbought” with the weekly RSI topping 70.

Since then, stocks have drifted lower.

We’ve seen 10 down weeks (red candles) vs 4 up weeks (green candles).

However, the down weeks have been bruising.

From mine, I still think there is more to go (and I apologize for sounding like a broken record the past few weeks).

For weeks (possibly months?) my sense was we could easily re-test the zone of 3800 to 4000.

However, that’s a zone to start adding to quality names.

The risk/reward starts to look more attractive there.

What’s more, we’re coming into a very seasonally strong time of year… so don’t be surprised to see markets catch a bid.

For example, if we’re to receive weaker-than-expected payrolls numbers next week – that could auger well for stock prices.

This might help the Fed consider pausing in December…

But let me offer some logic on why we are likely (not certain) to face more pressure.

And it’s explained in one simple chart….

The Great Bifurcation

Further to my preface, stocks like Google and Meta were sold aggressively given how much “good news” was already priced in.

Whenever I see a stock run hard into earnings (as these stocks had run extremely hard) – I get nervous.

Put simply – it sets the bar that much higher.

And whilst both posted “solid” numbers by any account – their valuations had simply run too far.

We saw similar things with Apple and Microsoft. Valuations were just too stretched.

Now that’s not the company’s fault.

As regular readers will know, these businesses are outstanding free cash flow generating machines.

In addition, they have fortress-like balance sheets, strong margins and wide operating moats.

You want to own them.

But you can always pay too much for quality.

This brings to me the bifurcation story of 2023…

I’ve been using this chart at various times to explain what is happening in the market.

In short, it shows the S&P 500 in blue vs the Equal Weighted Index in orange.

Oct 28 2023

Post the collapse of Silicon Valley Bank in March – these charts have gone in opposite directions.

In short, investors rushed to the perceived safety of big-cap tech (for the qualities I outlined above)

Other sectors were not considered as safe; and investors could not hide in bonds (with yields ripping higher)

Big-cap tech was considered a safety trade.

The problem (as I saw it) was the trade was significantly overdone.

As a result, I started to trim my positions.

For example, if someone wants to pay me over 30x fwd PE to own Apple or Microsoft – well have at it folks.

It’s all yours!

Hope it works out… turns out they are licking their wounds.

I will happily take it back from you at a multiple somewhere between 20x and 25x (at the very most).

But let’s get back to the lesson of market bifurcations…

The problem the market faced was should big-tech stumble (or run too far) – then it was going to take the market down with it.

That’s what happened.

However, here’s something else:

Whenever a bifurcated market starts to crack – it’s not just the leaders that go down.

The weaker stocks go down too.

You could say the weaker continue to get weaker.

Put another way – just because they are considered “value” – they do not automatically attract money.

That’s how bifurcated markets usually end.

The “market generals” fall – and they will take the rest of the market down with it.

I’ve seen that script play out again and again. This is no exception.

Now I’ve also heard many say “yes Adrian – but this is still a bull market”

My answer to what is “well… that depends on where you are looking?”

For example, if you look at the equal weighted index – it’s ~20% lower than where it was in February.

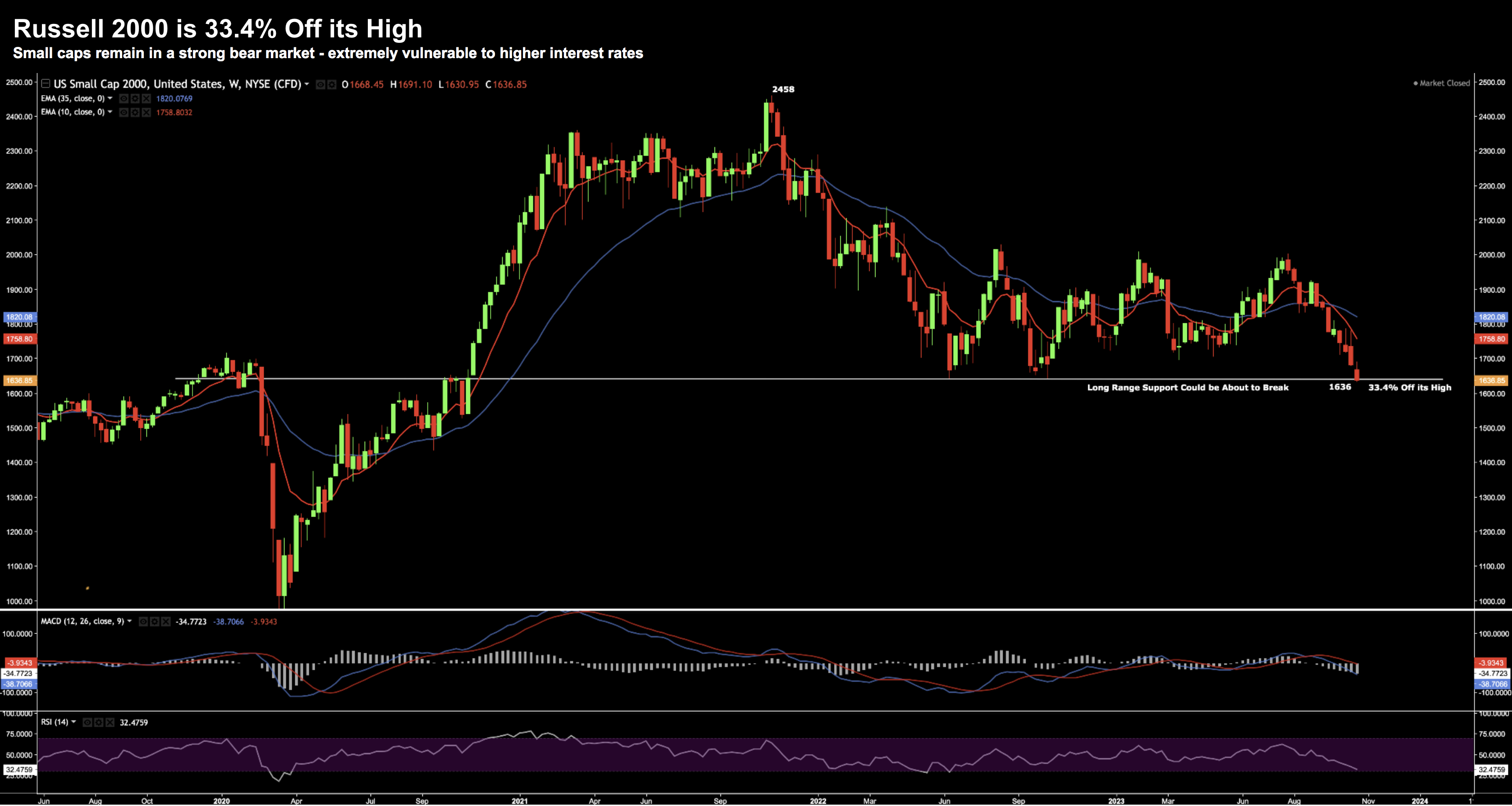

And if I look at small caps – they have been decimated – 33% off their highs.

October 28 2023

The tale of bear markets outside the tech sector is long (and growing).

And if I look at just the equal weighted index – it is a bear market.

So yes, I agree with a bull market in tech (that’s now under pressure) and maybe some energy names.

But not much else.

One final point:

For big-cap tech to outperform – they depend on the balance of the economy to do well. After all, who is it that spends on things like advertising and iPhones?

Putting it All Together

Here’s the question I think investors should ask themselves:

Are we going to see growth re-accelerate next year?

If we are – how is it going to re-accelerate? From where?

And if not – are we going to see a recession?

I’ve been steadfast all year that we’re likely to see a recession in 2024 – around the middle of the year at a guess.

Here’s a stat to consider…

Third quarter GDP this year could be as high as 5.0% (thanks to excessive consumer spending and unsustainable fiscal deficits (i.e., a sugar high))

Fast forward 12 months – what sort of GDP YoY comp do you expect to see (given the coming headwinds)?

I will bet you anything this number will not be “5.0%”

Growth will slow.

Now in terms of data, next week we get the non-farm payroll report.

I expect a softer number… but we may not get it.

If it is soft, the result may cause bond yields to decline – which may also give equities a boost.

Remember – a lot of the headwinds today are higher rates / yields.

However, it’s my thesis that bond yields fall next year as growth slows and the Fed moves closer to an easing cycle.

In addition to this, I think we will also see the Consumer Price Index continue to slow (e.g., 0.1% MoM).

Again, if this transpires, then equities may get more confidence that the Fed is closer to the end of its tightening.

To sum up, this continues to be a very difficult market to navigate.

Those who “found safety” in large-cap tech got hit hard last week (myself included)

And those who sought “value” outside tech (on the basis of very low PE’s) also saw stocks get sold.

What’s more, there isn’t yet “safety” in long-term bonds… as yields continue to trade at near 20-year highs.

I was not immune from the selling… however I have my “nose in front” of the Index by 1.71% YTD

But there’s still two months to go… it promises to be a close finish.

Expect stocks to perhaps catch a bid around the zone of 4,000 – particularly if we see payrolls data come in soft.