- Stocks hesitate ahead of Jackson Hole

- Home Depot’s CEO says the outlook remains ‘uncertain’

- The yield curve is steepening – is that a good thing?

My last post talked about how the market is now taking its cues from bond yields (less so the Fed)

Don’t get me wrong…

What the Fed does (or says) matters.

Just on that, we will hear more from Chair Jay Powell at the end of the week.

Expect hawkish tones.

To recap on what I shared earlier this week – globally long-term bond yields trade at their highest levels in 15 years.

However, what’s interesting is the shorter-end (e.g. 2-year and below) is not keeping pace.

This has net the effect of “steepening” the all-important 10/2 yield curve.

Question is – will that be a problem?

Maybe history offers us some clues.

Why Are Yields Rising?

I offered three primary reasons for the rise in long-term yields:

- The change to the Bank of Japan’s yield curve control policy make US Treasuries less attractive to Japanese investors because of a reduced yield differential (in other words – giving Japanese investors motivation to bring money home)

- The US government is planning to issue a significant increase in Treasuries (i.e. debt) to finance its aggressive spending (and borrowing) plans; and finally

- The recent Fitch Ratings downgrade of US credit.

Now, when you also consider the largest buyer of Treasury debt is no longer participating in the market (the Fed) – this also changes the supply / demand equation of the past decade (putting further upward pressure on yields)

That said, economic theory suggests bond yields (for developed economies) can be broken down into two primary components:

- The real yield; and

- Breakeven inflation

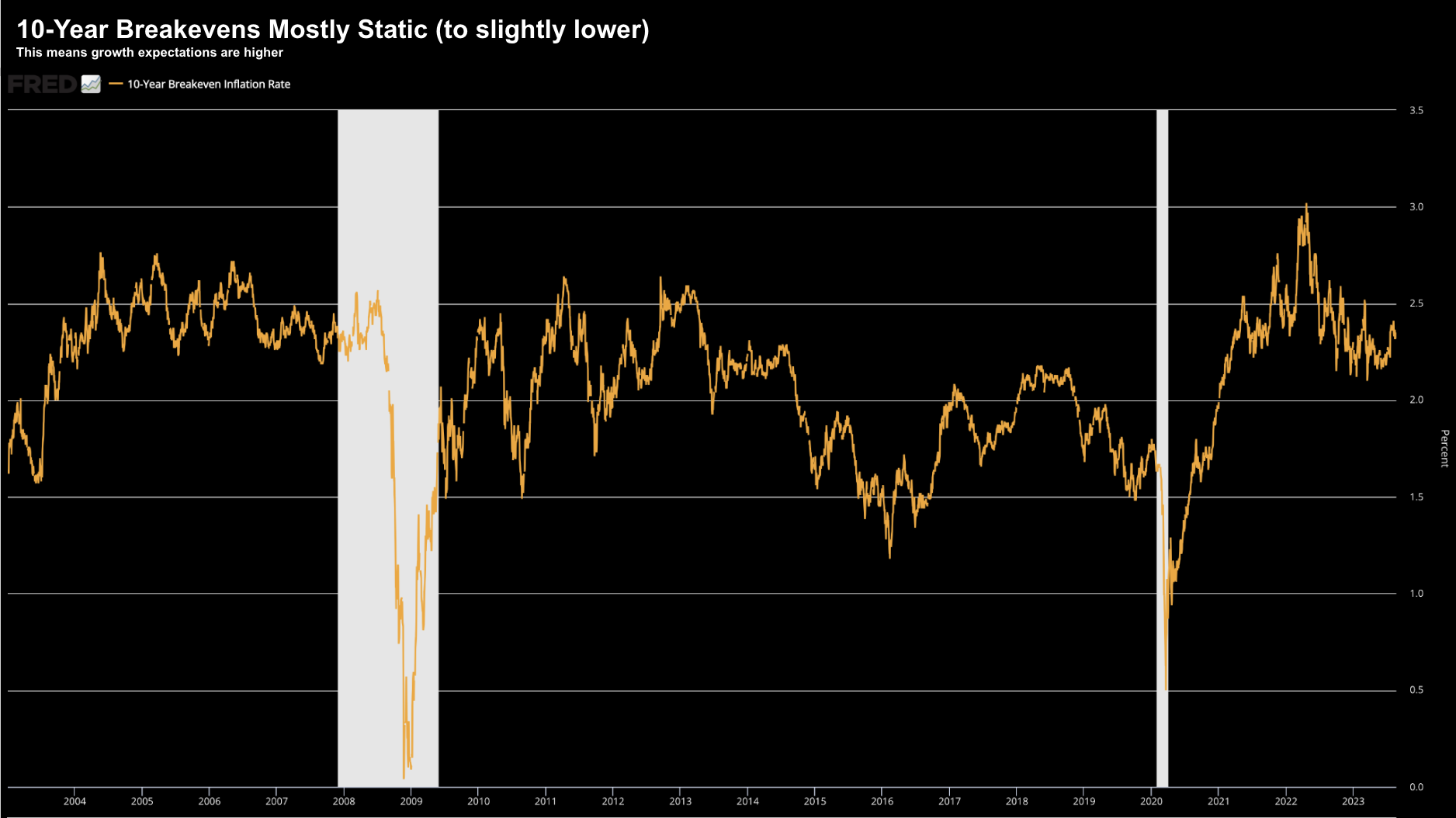

Breakeven inflation is simply a market-based measure of inflation expectations

On the other hand, the real yield is viewed as a reflection of growth expectations.

Therefore, if breakeven inflation remains static (or even declines) – then a rise in the Treasury yield can be assumed to reflect growth expectations.

At the time of writing – the breakeven rate on the 10-year has remains largely static (trending slightly lower)

August 22 2023

Put another way, this chart implies higher expectations for growth.

And with near-term recession probabilities easing – this would make sense.

However…

Be Wary of a Bear Steepening

Personally, it still feels presumptious to assume stronger growth ahead (e.g., 9 to 12 months)

And there are any number of reasons for that. Some include (not limited to):

- Over $1 Trillion less consumer savings;

- Higher reliance on the availability (and increased cost) of credit

- Far less government stimulus (relative to post COVID); and

- Rates remaining higher for longer

But in the short-term – growth appears intact – inflated by the ballooning government deficits.

Remember:

Every cent the government spends is considered a positive contribution GDP (regardless of whether that spend is productive)

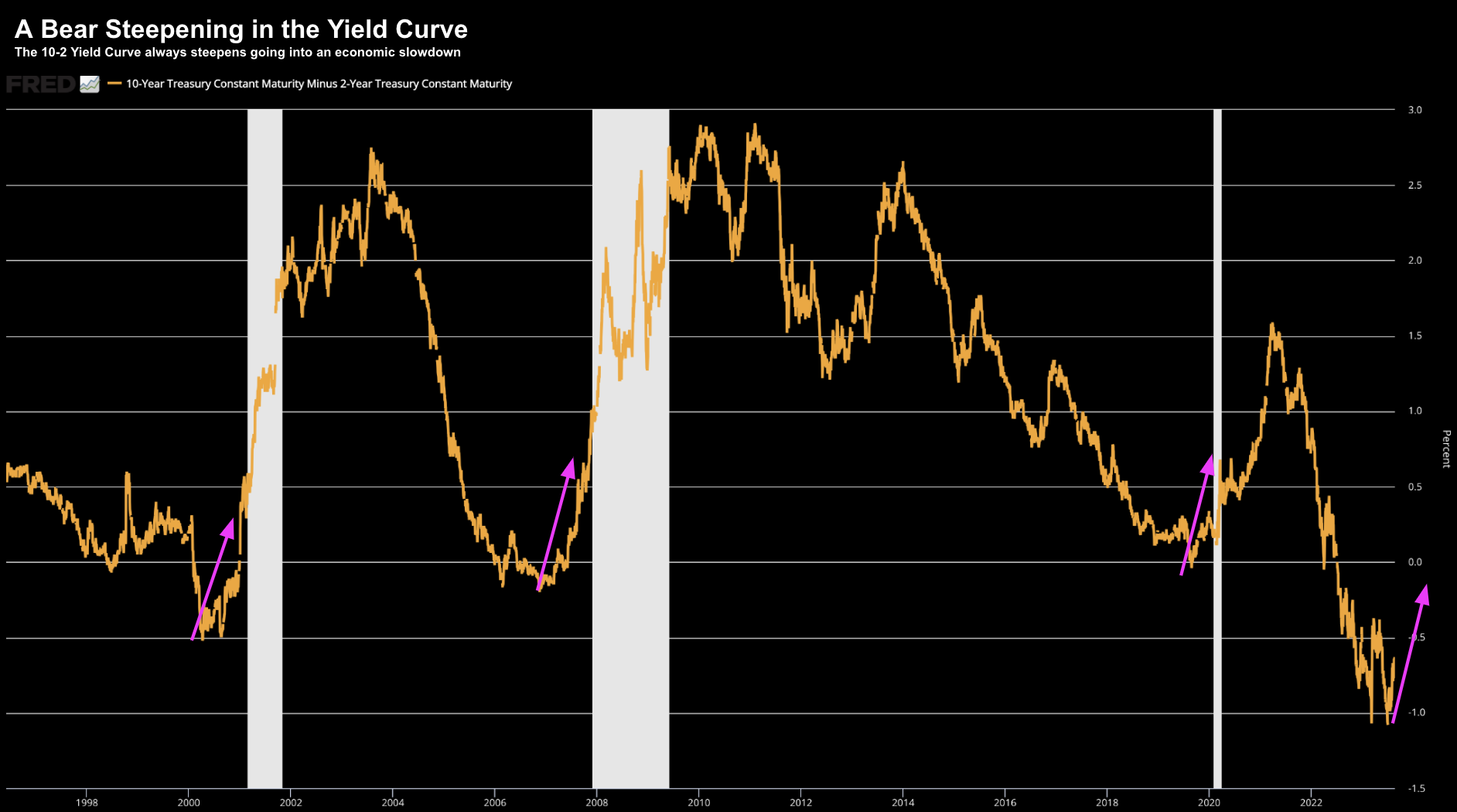

But let’s come back to the steepening yield curve and what it could portend.

For that, we take a look at history.

The pink arrows show when the 10-year yield was rising faster than short-term rate (e.g., 2-year yield)

August 22 2023

- First, the yield curve is negative for a sustained period; and

- Second, it’s followed by a steepening of the curve

Generally this steepening (from inversion) doesn’t bode well for the economy.

The reason this happens is investors tend to avoid the long-end of the curve (ie., the sell longer duration bonds) – seeking more attractive returns at the shorter-end (which comes with less duration risk).

This has the effect of pushing long yields higher.

To be clear, it’s not typical to see this. However, they do tend to occur prior to recessions.

Should We Be Concerned?

I would say not overly concerned just yet – but it’s something to watch.

For example, it’s possible the bond bears (those driving up yields) are correct and we avoid a recession all together next year.

That’s plausible.

If that’s the case, then the selloff in long-term bonds could be justified.

For what it’s worth – I’m not in that camp – but that’s what makes a market.

However what will be interesting is what Jay Powell has to say this week at Jackson Hole.

Should we expect dovish or hawkish tones?

For example, if Powell is still concerned about inflation (and I suspect he will be) – he will suggest they’re not finished tightening.

That’s hawkish.

Now, that could turn out to be good news for bond investors.

Why?

The market will interpret any further tightening as increasing the likelihood of a recession.

My best guess (based on the FOMC minutes) is the Fed will err on the side of hawkishness (especially whilst we have Core CPI and PCE well above their 2.0% objective).

However, I could be wrong.

Putting it All Together

One thing which caught my attention was language from Home Depot’s CEO on the US consumer:

“Uncertainties remain … and we don’t know how the monetary policy actions, which are specifically intended to dampen consumer demand, what that impact will ultimately have on consumer sentiment in the overall economy.”

What Edward Decker is saying is monetary policy impact(s) are often long and varied.

Like me, he thinks that’s still playing out.

“Lag effects” can be anywhere from 18 to 24 months after the first rate rate (which was March 2022)

Now if you also consider:

- US consumers have burned through over $1 Trillion in excess savings;

- Fiscal stimulus will be far less than the previous two years; and

- Where rates are some 550 basis points higher…

… how does that support the (bullish) growth thesis in the second half of 2023 (and into 2024)?

Decker is fair to suggest that “uncertainties remain”.