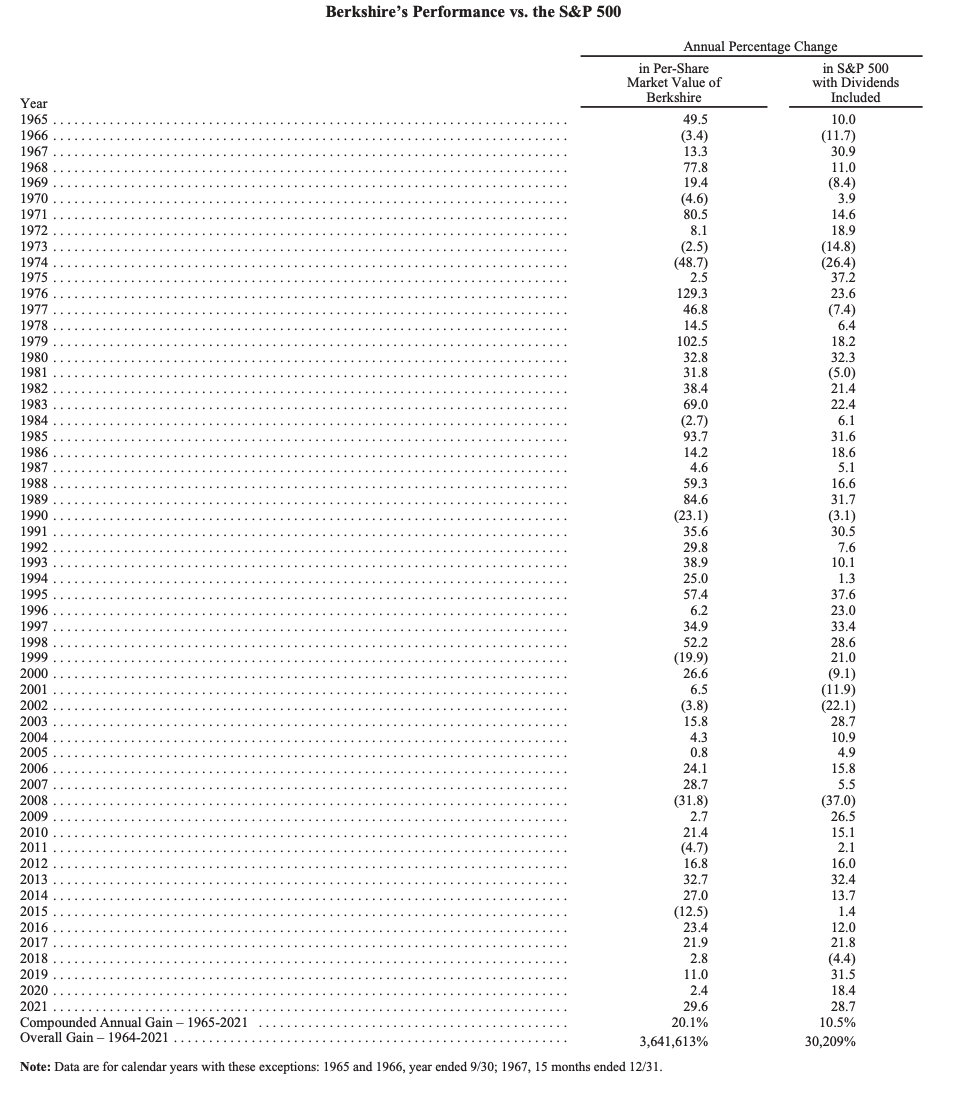

- BRK avg 20.1% CAGR for 57 Years vs S&P 500 10.5%

- 19.3% of BRK’s 57 years were negative returns

- BRK underperform the annual returns of the market 33% of the time

The 11-pages are filled with investing wisdom and life lessons (some of which I will share in this missive).

But the thing which struck me most is right there on the first page…

It’s a table which summarizes Berkshire’s annual percentage returns vs the S&P 500 since inception (1965).

57 years after the 35-year old Buffett founded the company – he has delivered an incredible Compound Annual Growth Rate of 20.1%

Remarkable.

Let’s explore other insights from this report…

20.1% CAGR over 57 Years

For example, if you invested $1 with Buffet in 1965 – that dollar would be worth $36,416

That’s over 3.6 million percent.

That same dollar investing in the S&P 500 would be worth $302.

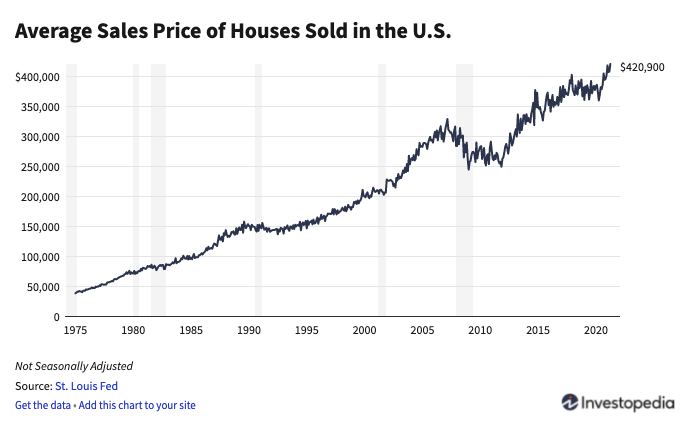

Consider many investor’s preference for bricks and mortar.

The chart below from Investopedia shows how US property has performed over the past five decades.

And on the surface, the results look impressive… right?

In 1965 the average price of a U.S. home was $20,000.

56 years later (2021) the average price was $420,900

Put another way, the CAGR for US property (on average) has been a paltry ~5.59%

If you invested $1 into property in 1965 – your dollar would now be worth $22.

And that’s exclusive of ownership / management costs – which are meaningfully higher than stocks.

What about gold?

Some like to say that gold has outperformed stocks.

Well that depends on what window you choose (like most things).

Here I am going back to 1965 (i.e. the year Berkshire was founded) – where the shiny yellow metal set you back $35.12 a troy ounce.

Today the price is $1,890 – implying a CAGR of 7.24%

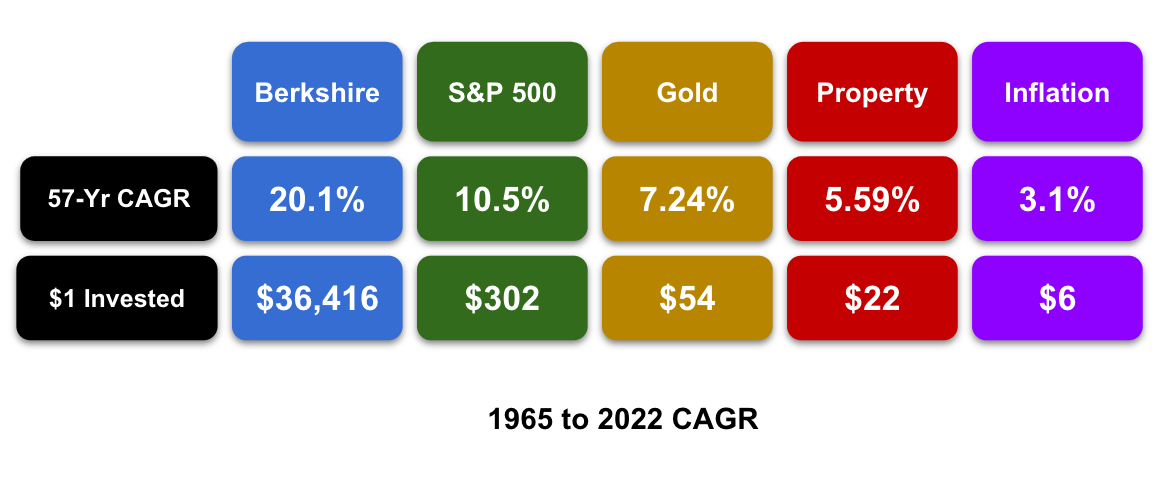

So let’s summarize:

Here is what $1 invested in 1965 returned against these asset classes (including inflation at 3.1%)

Unless you are Warren Buffet – very few assets have performed as well as the Index.

And whilst many of us aspire to be the “Oracle of Omaha” – this is someone who has dedicated his entire existence to analyzing and understanding the market (and associated risk / rewards of any investment).

That’s not most people.

Most people have families and jobs – and don’t have the time to dedicate to understanding the market.

If that’s you – I would simply invest in Index based funds and let time (and the power of compound returns) work its magic.

Interesting BRK Takeaways

#1. ~20% of the time – BRK lost money

Despite the impressive 20.1% average annual returns – there were 11 of 57 years where Berkshire had a negative year.

Years where BRK saw the value of its fund fall double-digits included:

- 1974 – (47.4%)

- 2008 – (31.8%)

- 1990 – (23.1%)

- 1999 – (19.9%)

- 2015 – (12.5%)

By way of comparison, the S&P 500 had 12 losing years in 57. The worst performing years were:

- 2008 – (37.0%)

- 1974 – (26.4%)

- 2002 – (22.1%)

- 1973 – (14.8%)

- 2001 – (11.9%)

What’s the lesson?

You’re going to have years where your portfolio will decline.

It happens.

Markets and economies work in cycles.

For example, the average recession occurs every 7-8 years. If we divided 57 by 8 – that is 7 recessions.

And since 1965 – there have been 7 recessions (excluding the brief govt induced recession from COVID)

Buffett’s portfolio endured a whopping 47.4% decline in 1974.

But over time – stocks will rise ~80% of the time.

#2. 33% of the time BRK Underperformed the S&P

The second takeaway is one-third of the time – Buffett underperformed the S&P 500 in any one year.

For 19 of 57 years – BRK’s average underperformance to the S&P 500 was 15%

The worst of these years was in the lead up to the dot.com (tech) boom – where in 1999 BRK’s underperformance was 40%.

Here Buffett held stocks like Coke, American Express, Insurers and Banks – which traded at PE’s closer to 10-15x.

He didn’t hold high-flying (internet) tech stocks trading in excess of 40x earnings (sound familiar?)

Many thought the 70-year old had lost his touch…

But over the subsequent three-year period (2000, 2001 and 2002) – Buffetts cumulative outperformance against the S&P 500 was 72%

Note: with respect to the 66% of the time Buffet outperformed the Index – the average was 18%

Lessons

However, there are other snippets which struck a chord:

- With low interest rates driving up the prices of “productive” investments, he and Charlie Munger “find little that excites us” in the equity markets

- “Fortunately we have had a mildly attractive alternative for deploying capital” that has helped them “make reasonable progress in increasing the intrinsic value of your shares – which has been his “primary duty for 57 years.” (n.b., that alternative was repurchasing Berkshire shares).

- When the price/value equation is right, this path is the easiest and most certain way for us to increase your wealth.

Buffett has amassed a cash pile in excess of $144B (and has been heavily criticized in recent years).

He spent $51.7 billion in 2020 and 2021 to buy back 9% of the shares that were outstanding at the end of 2019 (note: we saw the likes of Apple, Facebook and Google do similar)

My feeling is Buffett will be looking to put some of this cash to work in the next 2-3 years as rates rise.

For example, as interest rates rise – the multiples for the market will start to come in.

And that’s when Buffett will likely put more cash to work.

For example:

- Buffett says he and Munger still have an “overwhelming preference for business ownership,” although Berkshire will “always” have more than $30 billion in cash to keep the company “financially impregnable.”

- “Charlie and I have endured similar cash-heavy positions from time to time in the past. These periods are never pleasant; they are also never permanent.”

They are the insurance subsidiaries, Apple, the freight railroad BNSF, and Berkshire Hathaway Energy (BHE).

Apple represents a whopping 44% of BRK’s portfolio… a higher than average concentration for BRK (but not something he is concerned with)

- Apple’s buybacks have increased Berkshire’s ownership to 5.55% from 5.39% the previous year. ”

- Tim Cook, Apple’s brilliant CEO, quite properly regards users of Apple products as his first love, but all of his other constituencies benefit from Tim’s managerial touch as well.”

- I taught my first investing class 70 years ago. Since then, I have enjoyed working almost every year with students of all ages, finally “retiring” from that pursuit in 2018. Along the way, my toughest audience was my grandson’s fifth-grade class. The 11-year-olds were squirming in their seats and giving me blank stares until I mentioned Coca-Cola and its famous secret formula. Instantly, every hand went up, and I learned that “secrets” are catnip to kids.

- Teaching, like writing, has helped me develop and clarify my own thoughts.

- Charlie calls this phenomenon the orangutan effect: if you sit down with an orangutan and carefully explain to it one of your cherished ideas, you may leave behind a puzzled primate, but will yourself exit thinking more clearly.

My blog is now in its 11th consecutive year.

Every week (without fail) for 11 years I have penned a few thoughts on the market (sometimes multiple times per week)

I personally find the (daily) practice of writing helps with my own clarity of thought.

What’s more, if I can’t explain something clearly to you without using complex jargon – chances are I don’t understand it myself.

Applying Avg CAGR’s to Today’s Market

And whilst I can’t plot the returns inclusive of the average ~2.9% dividend for the S&P 500… I can chart the ‘capital’ CAGRs.

Let’s take a look from 1970 for four alternative CAGRs:

For example, the total return for the 8% CAGR line would be 8 + 2.9 = 10.9% (slightly above the long-term 57 year average for the market)

First, it shows how extended the market has been the past 24 months (and why Buffett amassed a $144B cash pile)

For example, we saw something similar from Buffett into the tech bubble of 2000.

He underperformed the S&P 500 by 40% in 1999 (staying in cash).

However as the market corrected through 2001 to 2003 – Buffett outperformed the market (in aggregate) by 72%

Could something similar repeat?

Now when I plot the long-term average CAGRs – I see good long-term risk/reward around the 3700 to 4100 zone (as I’ve communicated in recent posts)

Sure it may fall below 3700 in the subsequent years (a correction of 23% from the market peak of 4817) on the back of higher rates / Fed balance sheet reduction – I would buy the Index ETF for the long-term.

Put another way, there’s 50+ years of data to suggest you do far better buying when there is blood-on-the-streets (even if it’s your own) – if held over the long-term on depressed levels.

And I believe investors will get that opportunity (at some point) over the next 2-3 years.

Further to my missives over the past 6+ months – I see the Fed having little choice but to hike rates above that of inflation (whilst meaningfully reducing its $9T balance sheet) to combat unwanted inflation.

And that is likely to see multiples sharply retract.

That will be your opportunity…

Putting it All Together…

Perhaps only Stan Druckenmiller (who’s fund I follow closely) and Howard Marks come to mind (who also pens an excellent investment newsletter)

A few takeaways from this missive:

- If you do not have the time to spend on understanding (and analyzing) the market, individual stocks, the interest rate environment, Fed policy decisions etc – simply buy an Index-based ETFs (e.g. SPY or IVV) ideally during times of weakness. Note – IVV has much lower expense ratio.

- If held over the long-term (e.g. 10+ years) – you’re likely to average returns of ~10.5% per annum (inclusive of dividends). Index Funds (over the long-term) have significantly outperformed other asset classes like property and gold.

- What’s more, you can own an Index funds for a fraction of the cost of owning property (e.g. where costs include but are not limited to insurance, taxes, rates, repairs, advertising, management fees, mortgage etc)

- Stocks are volatile. Buffett saw his fund swing lower by as much as 30% to 40% in some years. And individual stocks can lose 100% of their value. However, if you are buying an Index-based ETF – you eliminate individual stock risk.

Your portfolio (pending its composition) is likely to swing to the tune of 20% or more.

Markets are now working through a meaningful transition.

Central banks (globally) are moving from being extremely accommodative to tightening against the risks of sustained unwanted inflation.

Rates will rise and their balance sheets will be reduced.

They have no choice.

This will see valuations and multiples for all stocks come down.

Buffett has built a $144B cash reserve not by choice – but because valuations were simply far too high.

Multiples are now starting to come in… but in most cases have further to go.

And if we do see the S&P 500 trade in the zone of 3700 to 4000 over the coming months or years – I would be a buyer for the long-term (especially in the case of your 401K or Superannuation fund).

Ps: calculate your own CAGR for your investment property or portfolio here. Did it outperform the long-term average of the S&P 500?

Simply enter (i) the acquisition price; (ii) its current value; and (iii) years held – to calculate the return.

I hope this was helpful… and please forward to anyone you know who may be starting on their investment pathway.

I wish I had this kind of advice when I was 20!

Regards

Adrian Tout