- What I need to see to turn aggressively bullish

- Recession calls gets stronger with consumption falling

- Services inflation still ripping at 5.2% YoY

Over the past twenty weeks or so – markets have staged another impressive rally.

The S&P 500 is now 16.6% off its October low (3491) – however remains 15.7% below its January 2022 all-time high (4817)

This has many wondering whether the 6th major rally of the past 12 months is finally the real thing?

My short answer:

It’s still premature to say.

Investors should maintain a healthy sense of caution (and I will explain why)

Yes, there are more positive signs than ~6-9 months ago (both economically and technically)

However, there are reasons to temper our enthusiasm.

To start, let’s look at the tape.

3 Things I Need to See

The S&P 500 has now put together six consecutive bullish weeks (green candles) – propelling the Index to highs not seen since the week of December 13

Jan 28 2023

Further to my preface, some are asking if this is the start of the next bull market?

I don’t think so… not yet.

First up, the 16% move higher was not unexpected.

And I hope you had some (long) exposure.

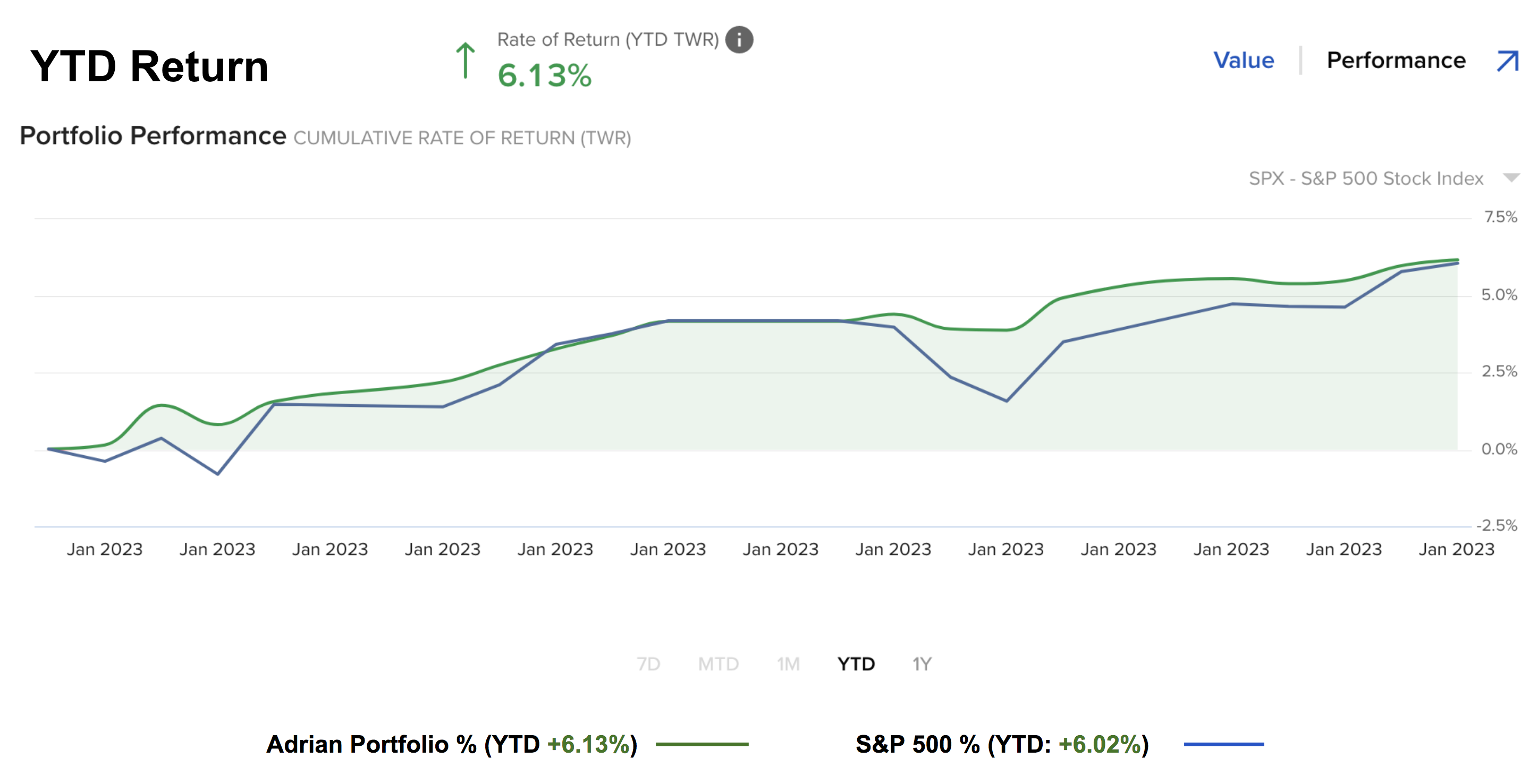

And whilst it’s great to see our portfolios up ~6% to start the year – the market is about to face its first litmus test.

Three things I want to see to increase my bullish (technical) conviction.

- First, can the S&P 500 rally beyond the zone of 4100 to 4200 and hold it? For example, let’s say the market is rejected in this zone (which I expect), it reinforces the bear market trend. However, if we see a sustained move above this zone – e.g., challenging 4300 made in August – my tone will be more bullish.

- Second, I would like to see the VIX move down to levels of 15 to 16 and hold there. At the time of writing, the VIX trades ~18.5 (a complacent market). However, as we have seen on multiple occasions the past 12 months, whenever the VIX drops below 20 – it coincides with a market top. I want to see the VIX below 16 for multiple weeks – something we have not seen since Q4 2021.

- Third, can the 35-week EMA (blue) move back above the 200-week EMA? The good news is we do have a short-term weekly bullish trend (the 10-week above the 35-week EMA) – however the longer-term trend remains bearish. And whilst it would be great to get this signal… I give more weight to the first two points.

If I was to lean one way – it’s to the downside.

Put simply, this feels like a case of ‘too much too fast’.

The bulls could be too optimistic.

That said, it’s also important you have long exposure to capture the (very real) possibility of more upside.

For example, if you are sitting on say “60%” or more in cash – this isn’t helping you.

Here would you be underperforming… hoping for a large market correction (which may or may not come).

What’s more, I’m also not short the market (nor would I suggest going short)

As I said the other day, there is a bull case to be made.

But I don’t expect this velocity to last… as a ~72% annualized gain (e.g., 6%*12) is not sustainable.

Here’s another way of saying it:

If you were to guarantee me 15% full year gains today (which would imply the S&P 500 near 4500) – I would happily take it and put my tools down for the next 11 months.

A Warning on Tech

At the time of writing, my ~20% portfolio weighting to tech has helped deliver some of the 6% YTD gain.

However, it’s noted that 20% is underweight the market by about 5%.

The S&P 500 is currently around 25% weighted to tech.

I moved to underweight tech as I don’t think it will lead in 2023 (but happy to be wrong).

Now I want to spend a brief moment looking at the weekly chart for the QQQ – as I think there’s a case to fade this rally (vs chasing it)

Jan 28 2023

Just a quick note on what I mean by “fading”:

- Fading this rally is more for those who are tactically trading (for example, trying to capture ‘week-to-week’ or ‘month-to-month’ moves. That is not me.

- I maintain positions in quality names (e.g., AAPL, AMZN, GOOG, MSFT and some others) – but I’m not tactically trading these.

- I’ve owned them for well over a decade; and assuming their businesses remain strong (e.g. strong positive free cash flows, revenue growth, strong operating margins, strong moats in their respective sectors etc – I will continue to own them).

With that said, I see the likelihood of a move lower in the near-term (which will see me give back gains).

Using the QQQ ETF as a proxy for tech – it has rallied ~16.5% off the lows and ~10% YTD.

That’s a lot of optimism.

Technically we’re challenging the 35-week EMA whilst in a weekly bearish trend.

Probabilities suggest we could see profit taking in this area.

Now on the fundamental side, I’ve mentioned that I think valuations for tech are still too high with rates above 4.0%

Microsoft for example is trading 26x forward earnings – where revenue growth has slowed to ~2% (and going down based on their guidance).

Should this be valued as growth? Or is it more “high quality”?

26x (for me) is too high in this climate.

Apple is trading at around 24x forward – and will likely only show single digit growth (at best) when they report.

When I look at tech as a basket (using the QQQ) – $250 is ~20x forward earnings.

That’s a far better long-term risk/reward multiple to pay (vs $296 today)

As a complete aside, if you apply a 20-year 12% CAGR to the QQQ (~2% more than the S&P 500) – it would imply a price of around $204.

If nothing else – it shows you how extended we are (despite the pullback)

My take is tech still feels too expensive in this environment.

However, next week we will hear what the rest of big-tech has to say. These stocks have rallied substantially… so the bar is already high.

Core PCE Encouraging… More to Do

Some of the optimism of late is opposite the expectation of (much) lower inflation (and a less hawkish Fed).

Just on this, on Friday we learned of further declines in goods inflation (down 0.7%).

But…

What Powell is interested in is less about goods and commodity prices falling… it’s services inflation (i.e. the core).

For those less familiar with how the Fed assesses inflation – I described that here.

Services inflation was up 0.5% MoM (5.2% annualized) vs up 0.3% the prior month. That’s problematic for the Fed.

Friday’s report shows the continued shifting of inflation pressures from goods, which were in high demand in the earlier days of the pandemic, to services, where U.S. economic activity is traditionally focused.

On an annual basis, goods inflation rose 4.6%, down sharply from 6.1% in November, while services inflation held steady at 5.2%. Goods inflation peaked in June 2022 at 10.6%, while services inflation bottomed at 4.7% in July.

Overall, the market cheered the news Core PCE was only up 0.3% MoM (or 4.4% YoY)

But as I’ve written at length – we need to focus on what we see with services.

The other interesting data point is what we saw with consumer spending

I call this out because consumption drives around 70% of US GDP

Adjusted for inflation, real consumer spending declined 0.3%.

I’ve been talking about this for a while – citing the depleted savings rates for consumers – as they leverage their credit cards (at very high levels of interest).

Here’s Paul Ashworth, chief North America economist for Capital Economics:

“Even if real consumption returns to growth over the first few months of this year, the disastrous end to the previous quarter means that first-quarter real consumption growth will be close to zero,”. Ashworth now expects first-quarter GDP growth to decline at a 1.5% annualized pace.

This is exactly what I’ve been stressing.

Now if I map this to how markets see this – I still see a strong disconnect between the 2-year yield and the Fed’s course of action.

We will hear from the Fed next week on what they intend to do.

For example, the market has priced in a 25 basis point hike… it will not react well to 50 bps.

What’s more, if the Fed uses sentiment like “we still have a long way to go”... that will also send the market lower.

But with services inflation still around 5.2%… the Fed may have a case to go for 50 (I don’t think they will).

Today the disconnect in yields means either:

(a) the market will be wrong; or

(b) the Fed has it wrong in terms of how far they need to go.

What is it?

For example, the Fed said the upper limit of their rates hikes will be 5.25%

But as I said about 4 months ago… I doubt they will get there.

My best guess is the economy will be “crying uncle” with rates sustained at ~5.00%

For example, with layoffs increasing; house prices falling; goods prices falling; and consumption dropping…. things are slowly starting to move the Fed’s way.

And when I look at the depth of the inversion on the 10/2 yield curve… it screams “recession dead ahead”

If that’s right, it bodes well for the bearish thesis (and not stocks going meaningfully higher)

Putting it All Together

It has been a solid January for stocks.

But I still exercise some caution.

I am not putting new cash to work (but nor am I selling).

Yes, we’re seeing some positive signs economically and with earnings.

And over time things will progressively get better.

But this is a process – we are working through it.

Let me offer a quick word on earnings (with ~25% of all S&P 500 companies reporting):

The number of companies beating is well below the long-term averages (see Factset’s Jan 27 report here). Here’s what they say:

The Q4 earnings season for the S&P 500 continues to be subpar. While the number of S&P 500 companies reporting positive earnings surprises increased over the past week, the magnitude of these earnings surprises decreased during this time.

Both metrics are still below their 5-year and 10-year averages.

As a result, the earnings decline for the fourth quarter is larger today compared to the end of last week and compared to the end of the quarter. If the index reports an actual decline in earnings for Q4 2022, it will mark the first year-over-year decline in earnings reported by the index since Q3 2020

To that end, earnings are not that impressive despite what the talking-heads are saying — especially given the bar was already revised down.

Put another way, stocks are “beating” at less than the average rate on lowered numbers.

Hardly impressive.

If we then also consider the weak guidance from those who have reported… why would we get overly optimistic?

I also think the long-term (lagging) ramifications of this tightening cycle are yet to be fully felt.

There is a solid 9-month lag on the economy when it comes to tightening.

Therefore if we think markets can fall…. how far is that?

No-one knows.

But what I do know is there will be no shortage of opinions (‘Beware of Permabears‘) — where estimates range from a ‘50% correction‘ (difficult to imagine) to as high as 4600 for the S&P 500.

My best guess:

Things wobble again before they get better.

And that could easily see us retest 3600 (or below).

That said, if you do not have any exposure to the market today, that’s not a good move either.

For example, if your view is long-term (3-years) – you should be adding some exposure here to quality names.

You just need to ignore the volatility.

But if your view is less than 12-months (i.e., you’re tactically trading) – I think we see some near-term selling.

I hope this is helpful.