- No banking crisis for JP Morgan (or other large banks)

- The Fed still in play for May – despite soft economic data

- VIX trades down to 17.1… overly complacent

Q1 2023 earnings season is officially underway…

JP Morgan led things off by smashing all expectations.

Its stock surged 7% on news of higher revenue, profit and net interest income.

I will circle back to bank earnings shortly – however it appears things are ‘more than fine’ with systemically important banks.

Regional banks could be a very different story.

But first, we were treated to a host of economic data this week.

First we had headline March CPI coming in at 5.0% YoY:

- Food up 8.5% YoY

- Energy down 6.4% (primary reason for the fall)

- Used vehicles down 11.2%

- Shelter up 8.2%

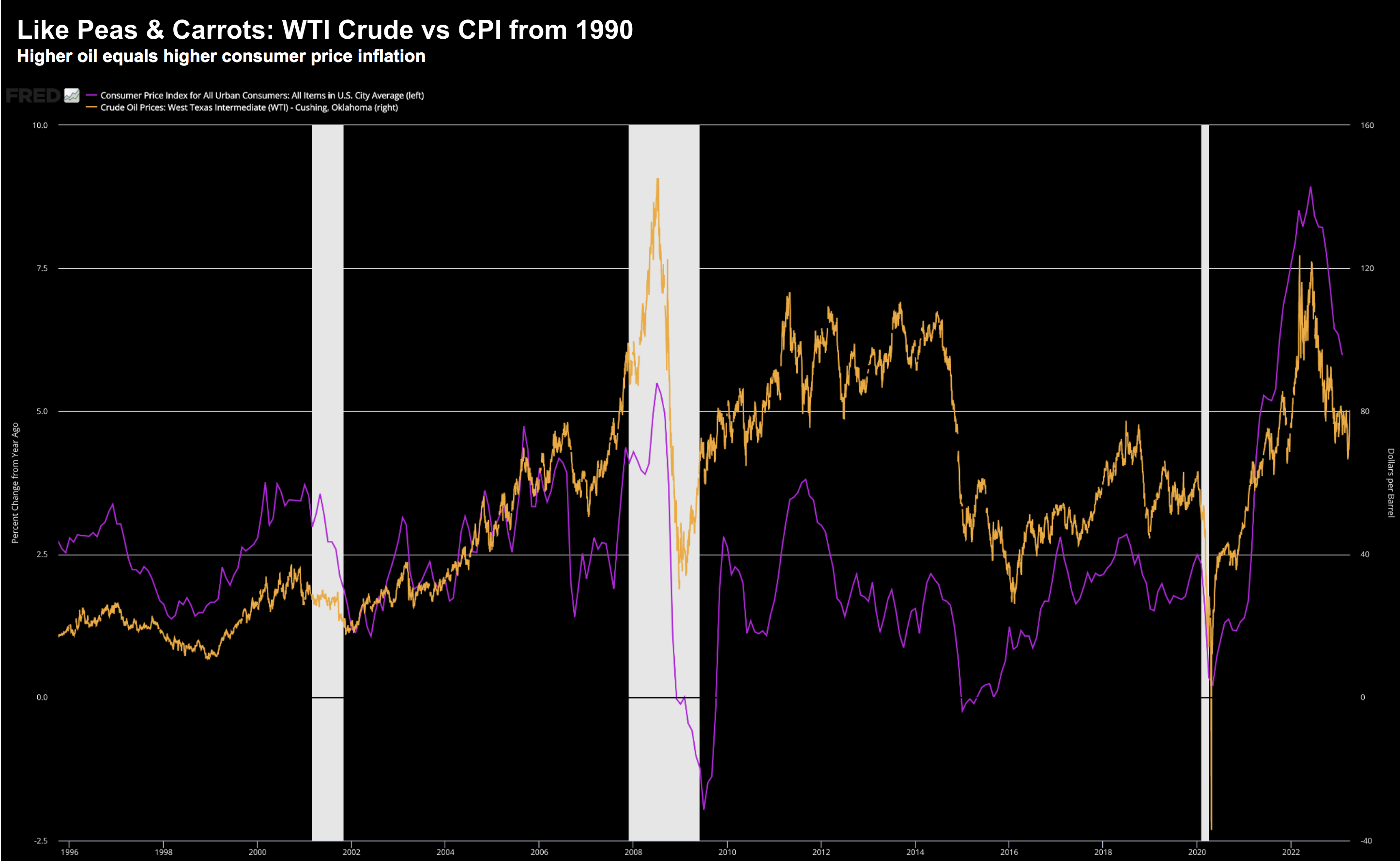

Arguably most influential element on the headline CPI number last month was the sharp decline in energy (as the chart demonstrates below – comparing the two)

Therefore, with crude oil surging more than 10% over the past month, don’t be surprised to see CPI reverse in subsequent months.

This is good news as it means lower prices could be passed onto consumers.

Friday we also learned consumer sentiment rose in April (up from a 4-month low) – however concerns over inflation remain.

From MarketWatch:

An index of consumer sentiment rose slightly to 63.5 in April and rebounded from a four-month low, but Americans showed more anxiety about high inflation. The index, produced by the University of Michigan, rose from 62 in March.

The public has been broadly pessimistic since last summer, largely due to high inflation.

The index had fallen to a record low of 50 last summer before partly rebounding. Sentiment remains well below a recent peak of 88.3 in 2021 and a pre-pandemic high of 101.

From mine, if you want to know what consumer sentiment will be – you don’t have to much too much further than the price of energy (specifically WTI Crude)

Below is the 30-year relationship between the two:

April 15 2023

I’ve inverted the price of WTI Crude (RHS) to show the correlation.

As the price of energy fell sharply last month – consumer sentiment bounced.

Naturally, when the price of crude peaked, consumer confidence hit its low.

You tell me, what effect do you think $90+ oil might have on consumer sentiment over the coming months?

Good or bad?

Finally, we also received an update on retail sales.

They were down in March by 1% – the worst month since November.

Here’s USA Today:

Retail sales slowed sharply in March, underscoring that Americans’ wherewithal to spend is waning after a weather-induced buying spree early in the year. Sales fell 1%, more than the 0.4% decline economists expected.

Excluding volatile autos and gasoline, sales declined 0.3%. A core measure of retail sales – that excludes autos, gas, building materials and food supplies – dipped 0.3%. Business declined across a broad range of categories, with sales declining 1.6% in autos, 3% at generally merchandise outlets, 1.2% at furniture stores, 2.1% at electronics and appliance stores and 1.7% at clothing shops.

We will soon learn just how much of an impact this will have on corporate sales growth (and earnings) in the next few weeks.

From mine, a 7% earnings decline for Q1 is optimistic.

But we will see..

More Fed Speak… Don’t Expect Cuts

- Mary Daly of the SF Fed said “the strength of the economy and inflation suggest there is more work to do”

- Thomas Berkin of the Richmond Fed said “demand is cooling and I’m still waiting for inflation to crack. We haven’t see that yet”

- Chris Waller said “Financial conditions have significantly tightened, the labor market continues to be strong and tight, and inflation remains substantially above target. Monetary policy needs to be tightened further”

The newest member of the Fed – and former Obama advisor – Austan Goolsbee – suggested the need for a pause.

Makes sense given his political lens.

I tend to side with Daly, Berkin and Waller… however I would be surprised if we saw two more rate hikes of 25 basis points.

But as I’ve outlined repeatedly, it matters little if the cash rate is “5.00% or 5.25%”…. it’s how long they stay at this level that matters.

For example, rates staying at 5.00%+ for “3 months” will be a lot different to “12 months”.

And whilst we continue to see Core PCE at levels of 0.3% MoM… the Fed is unlikely to cut rates.

In summary, the economy is slowing along with inflation.

No-one will argue that.

However, inflation continues to be sticky.

Therefore, with the economy proving to be resilient (with unemployment at a 50-year low 3.5%) – expect at least one more hike in May.

All going well – with far tighter financial conditions from the banks – the Fed may be in a position to pause for a few months.

And therein lies the rub:

Markets are generally most comfortable (taking risk) when central banks shift towards easing mode.

And we are nowhere near that yet… despite what the market is pricing in.

Fed Balance Sheet Shrinks…

Perhaps the most interesting data point this week (for me) was what we saw on the Fed’s balance sheet.

I say this as it’s a window into any ongoing “financial stress” in the banking system.

In short, things continue to improve however it still remains elevated compared to before the collapse of SVB and Signature Banks.

Here’s what we saw with specific bank borrowing at the Fed’s window:

- Discount Window Loans: $67.6NB – down $2.1B WoW

- Bank Term Funding Program: $71.8B – down $7.2B WoW

- Loans to FDIC Bridge Banks: $172.6B – down $2.0B WoW

In summary, banks (mostly regionals) are still leveraging the Fed’s facility.

To that end, it’s far too early to say that regionals are out of the woods.

But it’s a very different story for the large banks (which I am happy to own) and/or “super” regional banks.

Put together – their balance sheet was down $17B week-on-week:

April 15 2023

Again, despite the drawdowns, it remains elevated.

The Fed’s intent is to continue to wind this down (if conditions allow) as a means to help cool inflation.

And if we see that (and we may not) – it will pressure equities.

There’s little doubt in my mind the increase in the Fed’s balance sheet was a large part of why we saw equities bounce (that with the expectation of rate cuts in the second half)

However, if the opposite holds true, it will act as a headwind.

S&P 500 Meets Resistance (Again)

News of slightly softer CPI and PPI along with strong big bank earnings – meant the bulls were happy to add risk.

My take is they ignored Core inflation – which actually rose MoM (just saying)

The S&P 500 enjoyed its 5th straight week of gains… however it trades in what I think will be a zone of resistance.

April 15 2023

Tread with caution here as traders do not have a green light.

What worries me most is the strong complacency with the VIX.

It hit the lowest level since November 2021 – trading 17.1

The corresponding low in the VIX also saw the market hit its all-time high. In other words, all traders are “leaning to one side of the boat”.

From mine, traders are too complacent given the unknowns.

For example, if you are trading on the basis the Fed are about to imminently cut rates (whilst adding to the money supply) – that’s dangerous.

And whilst I’m not willing to short the market (or sell my positions) – I’m not adding to positions either.

I remain 65% long – having reduced my exposure to tech (it looks overpriced) – but on the other hand increased my energy and (large) bank holdings.

Time will tell if they prove to be wise decisions (they may not be)

So far, my performance is up 8.36% vs S&P 500 up 7.77% (certainly nothing to write home about):

April 15 2023

Why?

Because markets have never bottomed before we enter a recession.

However, if you believe:

– we will avoid a recession over the next 12 month

– the Fed is likely to aggressively cut rates); and

– earnings are likely to exceed expectations going forward…

… then sure… add more risk here.

But that’s not my thesis.

Putting it All Together

Coming back to what we heard on Friday with the big banks…

JP Morgan crushed the market’s expectations – proving they were the direct beneficiary of the mini banking crisis.

Here’s how they did:

- Adjusted earnings of $4.32 per share vs. $3.41 estimate

- Revenue of $39.34 billion vs. $36.19 billion estimate

- Raised guidance for Net interest income to $81 billion this year – up $7 billion

There’s no crisis for the folks at JP Morgan, Citibank or Wells Fargo.

And there never was (despite some of the hysteria we saw)

My guess is we hear something similar from Bank of America next week (i.e. record revenue and a raise on net interest income guidance – benefiting from a surge in deposits).

As I often like to say, if you’re picking up these banks below 1x book, that’s a good risk/reward bet over time.

The trade may take 2-3 years but that’s fine.

From there, wait until they trade 2x book and sell them.

As an aside, banks have always been trading vehicles for me (not assets I choose to own for ‘decades’).

In closing, there was enough in the Core CPI print this week to keep the Fed in play. Equity markets were happy ignoring this.

However, bond markets noticed and sent the 2-year yield back above 4.0%

What’s more, Fed Presidents reinforced their work is not done.

To that end, I think the market is coming around to the fact we will see another 25 bps in May, however it still believes we will get cuts in 2023.

And we might… but what scenario comes opposite cuts?

A recession? A major credit event?

Generally the economy is in desperate need of help if the Fed is cutting.