- Fed President Loretta Mester wants nominal rates above 4.0%; and does not see cuts in 2023

- Morgan Stanley targets 3400 for the S&P 500 if we see a ‘soft landing’ – citing earnings downside to come

- Monthly chart suggests wait for a better opportunity to buy

August wasn’t kind for stocks – with the S&P 500 losing 4.2%

Bulls had all the momentum last month – pushing stocks 18% off the lows – however that’s gone.

The market is now just 8.8% off the June 3636 low.

At the end of every month – I find it’s helpful to zoom out from the (short-term) weekly lens – and use a monthly timeframe.

As an aside, it was the monthly timeframe where I expressed my concern about how over-extended stocks felt during Q4 2021 – bracing for a move down to the 35-month EMA.

And we got it…

Let’s update the chart for August…

S&P 500: Monthly Lens

Personally, I find this excessively noisy.

The shortest timeframe I use is the weekly lens… and even then it has a tendency to be ‘noisy’.

I’ve found the longer your timeframe – the more reliable the signal (and prevailing trend).

With that – what can we glean following August’s decline?

Aug 31 2022

A few technical observations:

- The S&P 500 found support around the 35-month EMA (blue line). In bullish trends (where the 10-period EMA is above the 35-period EMA) – this is often the case.

- The MACD (lower window) continues to move lower. From mine, this was the indicator that ‘flashed red’ in January. When it turned lower — I told traders to be very careful of a move lower. I give more weight to the MACD with a monthly timeframe (vs a weekly)

- The zone of 3200 looks like a strong technical area of support on any break of the June low. I say that because of the resistance we saw here through late 2019 and early 2020. What’s more, it was support before the bull run of 2021. I would be a strong buyer in this zone

- Finally, any break of 3200 could easily see us trading down around the psychological 3,000 zone. For example, this was (a) a clear area of resistance for two years; and (b) it aligns with a long-term trend line from 2012.

Put another way, I would like to see the monthly MACD turn before I think we are in for the next ‘bull run’.

For that, we will need to see indications of a policy shift from the Fed.

Stocks will rise when the Fed indicates it’s thinking about pivoting to a dovish stance (and starts adding back liquidity).

And for my money – that’s a solid 12-18 months away (at a guess).

It’s definitely not going to be in 2022.

Here’s (yet another) reason why…

Fed President Reiterates Hawkish Stance

This time it was Cleveland President Loretta Mester – who sees interest rates rising considerably higher before the central bank can ease off in its fight against inflation.

She sees benchmark rates rising above 4% in the coming months – which echoes my sentiment from this missive

Three ‘pain points’ I offered readers:

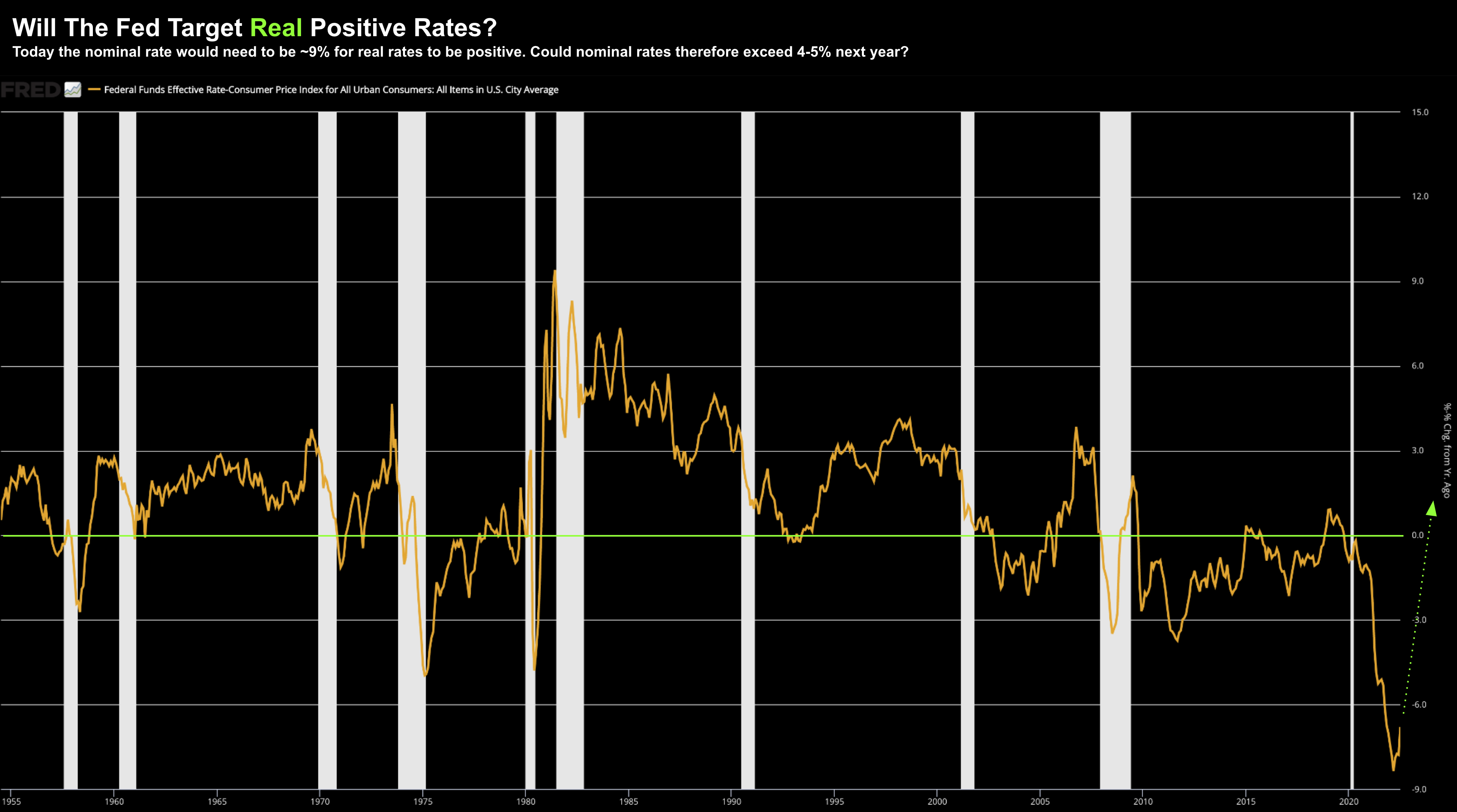

- Nominal rates to exceed 4.0% in 2023 (as the Fed targets positive real rates)

- 10-Year yield to stay above 3.0% (as the 10-year rarely moves more than 1% below the nominal rate)

- If we see higher rates – we need to lower valuations and earnings estimates

I think this is misguided.

My argument is if the Fed are to become restrictive – they will need to ensure real rates are positive.

I say that because negative real rates will continue to act as an inflationary force (i.e. your cash is effectively trash).

Below is the chart I shared showing where real rates are today:

“My current view is that it will be necessary to move the fed funds rate up to somewhat above 4% by early next year and hold it there. I do not anticipate the Fed cutting the fed funds rate target next year.”

Morgan Stanley Reiterates Bearish Case

Before I close, Bloomberg interviewed Morgan Stanley’s Mike Wilson today and he believes the market is “too optimistic on earnings outlook – with the market too preoccupied with the Fed”

“The index usually is the last thing to fall. June probably was the low for the average stock, but the index, we think, still has to take out those June lows. We view 3,400 for the growth recession or soft landing.

A “proper recession” would bring the index somewhere close to 3,000. And while it is difficult to predict a market bottom, the bank’s chief US equity strategist said the “direction is down at least for the next quarter or two”

On fundamentals, Wilson adds:

“P/E multiple is wrong not because the Fed is going to be hawkish, but because the equity market is being too optimistic about the earnings outlook.

The multiples will start to come down as earnings get cut and then somewhere in the middle of that earnings cut process the market will bottom and we think that’s probably between September and December.”

However as Wilson correctly notes – analysts are yet to meaningfully cut earnings estimates for next year.

That’s still ahead.

Putting it All Together

As Wilson says, it’s impossible to know where the bottom could be for stocks.

However, if we are lucky enough to see prices back around 3600, you can start nibbling at quality names.

And if we are really lucky to see 3200 (or below) – buy with confidence for the longer-term.

Now, that’s not to say you might experience more downside (e.g. 20%)

And that’s fine…

But I think the longer-term (3-5 year) upside from there starts to look compelling.

For example, a move back to 4800 would be 50% upside.

And when the Fed starts to indicate its thinking about a shift in policy – stocks will take off like a rocket.

Missing that upside would be a bigger error than avoiding the downside this year.

As I wrote yesterday – playing “strong defence” during bear markets is just half of the equation.

Equally you need to be well positioned from a compelling risk/reward zone when conditions turn more favourable (e.g. like we saw in 2009)

Between now and then – you can be patient and selective.

Stocks are going “nowhere fast” in this climate.