- Semiconductors vulnerable to a sharp pullback

- The AI story is real – however there’s FOMO in asset prices

- NVDA’s fwd PE is reasonable at 35x – but not its price to revenue

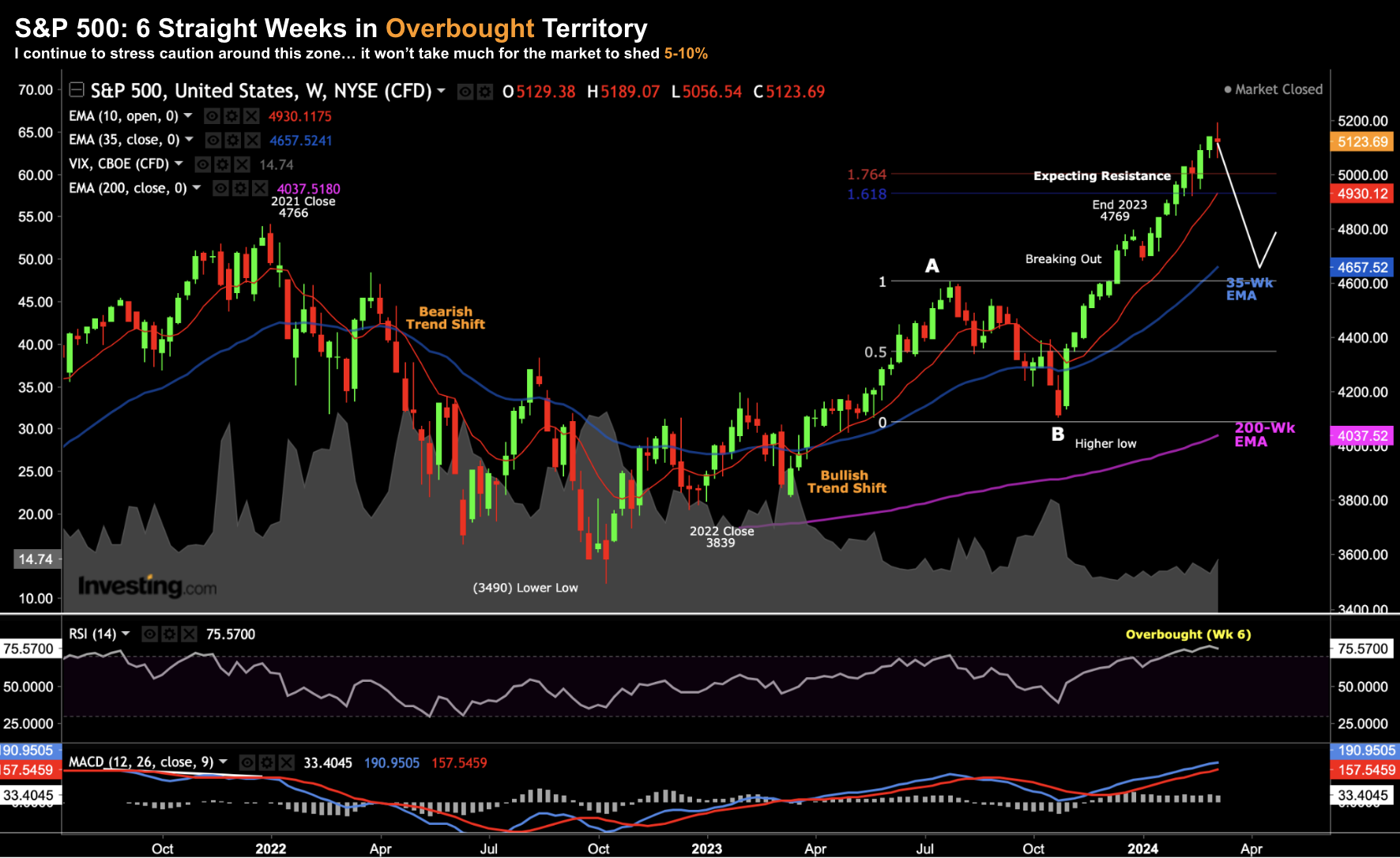

If you’re a regular reader – you will know I think the broader market is overbought.

According to the weekly RSI, it’s been overbought for 6 consecutive weeks (I shared the chart below over the weekend).

March 11 2024

But as I’ve also stressed – that’s not to say it can’t continue for several more weeks. Stocks will always go further than you thought possible (in both directions).

In terms of the sector ETFs that have outperformed YTD – there are two which stand alone:

- Technology (XLK) +9.41%

- Communication Services (XLC) +10.26% (mostly due to gains in META)

Financials and Healthcare are both +7% YTD – matching the broader index.

Today I want to take a closer look at the technology and specifically semiconductors.

They’ve had one of the sharpest surges we’ve ever seen… up ~33% YTD.

Too much too fast? And is it sustainable over the long run?

The Semiconductor “AI” Surge

Whilst the technology sector is outperforming the benchmark index — semiconductor stocks have done the bulk of the heavy lifting.

Consider the weekly chart for the VanEck Semiconductor ETF – SMH:

March 11 2024

- Weekly MACD and RSI (lower window) showing overbought conditions;

- Based on the current price of $220 – its 10-year CAGR is 26.5%

- By comparison a 10-year CAGR of 20% would see the fund closer to $130 (more realistic growth profile); and

- A 10-year CAGR of 17% would be ~$100

These theoretical 10-year CAGRs of 20% and 17% were included to give you a sense of how fast these stocks have rallied.

For example, maintaining a CAGR of 26.5% is unrealistic.

But hey… here we are!

That said, it’s not difficult to explain investor FOMO.

It’s entirely due to the hype around “AI” and specifically something called “Generative AI”

For example, in a report by Grand View Research, they valued Gen-AI at ~$13B last year.

However, its anticipated CAGR is estimated to be ~36% – which puts the industry hitting $109B by 2030.

That’s a sharp ramp higher from basically zero two years ago.

Hat-tip to ChatGPT!

With respect to the chips that power these generative applications – it’s estimated companies will invest up to $400 billion a year in Graphics Processor Units (GPUs) before 2027 – as the race for AI differentiation heats up.

Consider these four industry use-cases (and addressable market valuations):

- According to estimates by McKinsey, Gen-AI could add $200-$340B annually in the banking industry;

- $400-$660B annually in the retail and consumer packaged goods industry; and

- Gartner estimates 30% of all outbound messages by large organizations would be generated by AI by 2025, compared to only 2% in 2022.

With respect to the messaging use-case – I shared this case study by payments firm Klarna – where AI fielded 66% of all client chat conversations (2.3M) over the past month – driving a $40M profit improvement for the company.

What this case study shows is the excitement (and AI use-cases) are very real. Klarna’s application could be replicated for any business that interacts with customers (internal or external).

That said, there’s a lot of FOMO when it comes to the prices investors are willing to pay for their slice of the AI pie.

And that’s the challenge…

Will Semis Correct Soon?

Coming back to the ETF SMH – I’m wary of a solid pullback given how far (and how fast) prices have rallied the past 12 months or so (and especially the past ~6 months)

And if true – that will not bode well for the broader market.

Here’s the weekly chart again for SMH – with additional annotations:

March 11 2024

Consider the following 5 technical observations:

1. The first observation is the striking doji candle at the recent high. For example, the ETF ripped to $239 intra-week before closing at $224 last week (a pullback of 6.3%). This typically suggests indecision from traders;

2. Since October 2023 – the ETF has been in a consistent trend channel (purple lines). The chart broke out in the first week of Feb. Look for it to come back inside this channel.

3. The previous major high (and area of resistance) was $160. Former areas of resistance often become new areas of support.

4. The 35-week EMA is $174. Often prices in bullish trends will revert to this moving average before finding buying support.

5. The weekly RSI suggests overbought conditions (a value above 70). However, it’s been technically overbought since mid-January. Put another way, prices will often continue to rally despite being overbought. This is not an indication a pullback is necessarily imminent. It’s likely… but it may not be imminent.

In short, I would not be chasing the aggressive momentum in semi stocks.

My best guess is we see profit taking – with prices falling back into the well defined trend channel from October.

From that perspective, I think a price of between $160 to $170 could represent a better (longer-term) risk reward bet (if adding exposure).

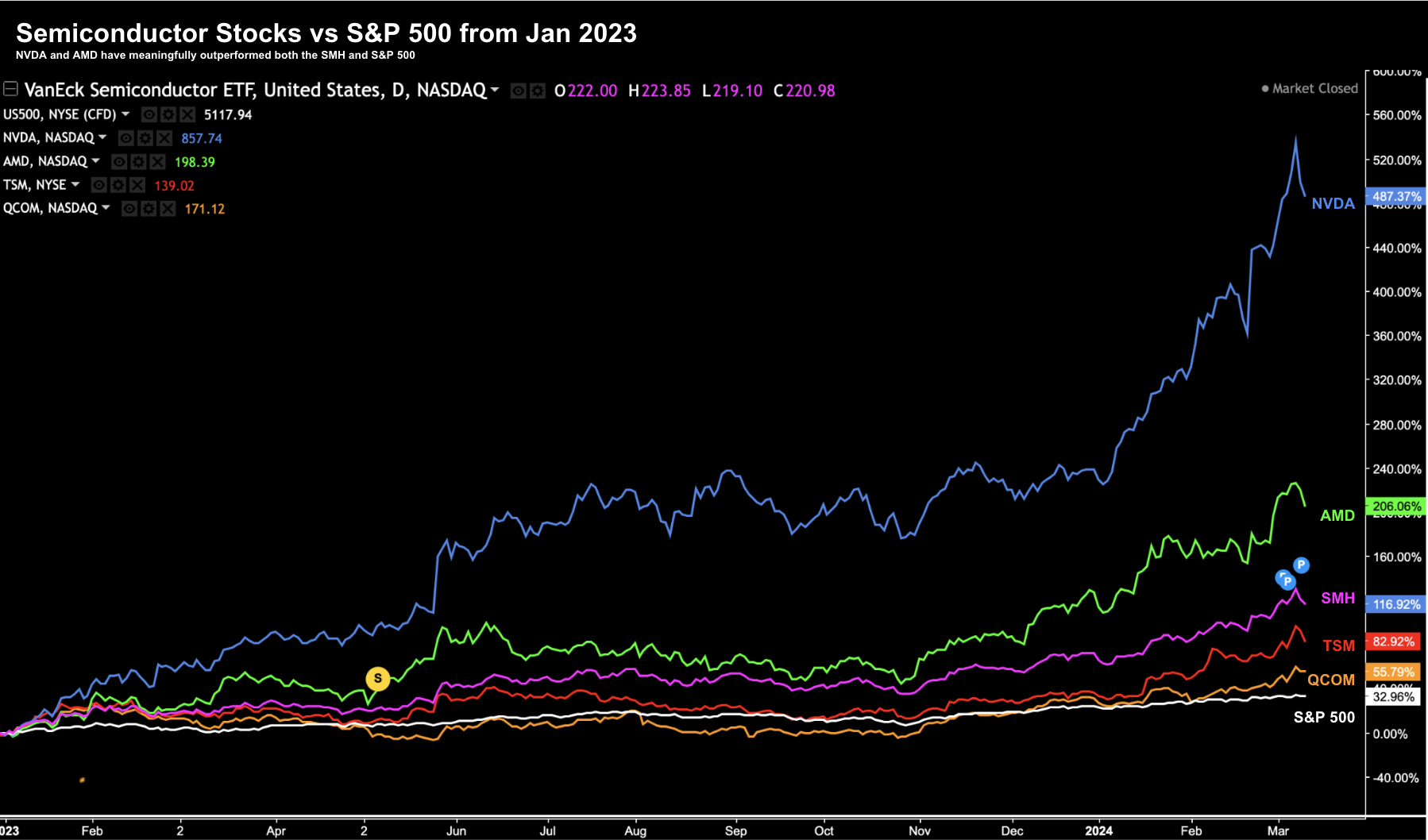

As an aside, below is what we’ve seen with some (not all) of the larger semi stocks from Jan 2023 (all of them outperforming the benchmark).

March 11 2024

Given it’s performance of late, NVDA (blue line) deserves special comment – what some consider the “poster child” for all things AI.

Two things fundamentally:

- Forward PE ratio of 35x;

- Price-to-sales multiple of 35x.

The problem is not the forward P/E ratio given its hyper rates of growth. How long that can be sustained is another question. But for now the forward PE is not unreasonable.

However, what should raise an eyebrow is its price to sales multiple of 35x.

That’s astronominal.

As a rough rule of thumb – I will always add further scrutiny when companies trade higher than 10x sales.

That’s a lot to pay for growth.

Therefore, as an asset speculator, your risk is that much higher.

For example, I’m willing to bet that as the (AI chip) market matures – competition will emerge and Nvidia’s massive AI chip lead will diminish.

What’s more, their largest customers (which is large cap tech) – make up 50% of their data center sales.

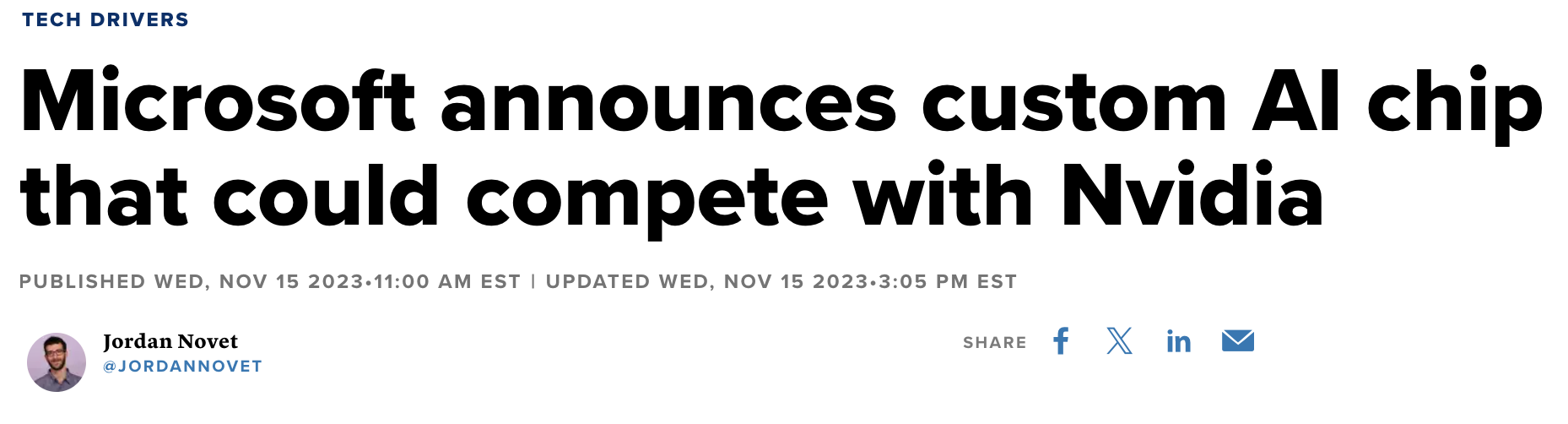

But as we know, each of these companies are making their own AI chips.

For example, Google manufactures its own Tensor Processing Units (TPUs); Amazon have both AWS Trainium and AWS Inferentia; and Microsoft recently introduced the Maia 100 AI chip.

And as I was saying recently with respect to Apple – look for it to dramatically enhance (and invest) in its own AI chips on the phone (not to mention iPads, MacBooks and Vision Pros).

Apple’s new GPU allows for greater camera features (e.g. think computer vision with image recognition) – which will also run more complex applications and features.

And if you think about it – the bigger opportunity for AI is potentially not data center (the case today) – it will likely be on-device (i.e., desktop and phone).

That’s lucrative for a company with a install base of 2.2B devices.

Regardless, each of these tech giants will continue to scale their hardware (and software) in this segment – lowering their exposure to NVDA – whilst also creating much needed differentiation.

This raises a question for me:

If NVDA’s largest customers are scaling investment into their own AI chips – what will that do to their demand in subsequent years?

If nothing else, it makes me question whether you should pay 35x sales revenue.

In addition, it also begs the question whether this is a longer-term cyclical or secular story?

From mine, it could end up being the former. And if that’s true, it means margins (and earnings) will come down.

Then we need to question the “E” in PE and its assumed rate of growth.

But for now….

Investors are pricing NVDA and AMD as a secular play.

And that’s reasonable as AI chips are not (yet) commoditized. For now, these two chip makers can’t keep up with demand.

However, will that be the case in say 2-3 years (or less)? Or is this the market suffering from its own form of “generative hallucinations”?

Place your (AI) bets.

Putting it All Together

If we see further profit taking in semis (specifically stocks like NVDA and AMD) – it could weigh heavily on the broader market.

For example, the last two sessions have seen NVDA and AMD pullback – where the S&P 500 closed lower.

And when I consider the charts above – it feels ripe for a 10% to 15% pullback.

That said, I also think investors should look to capitalize on lower prices.

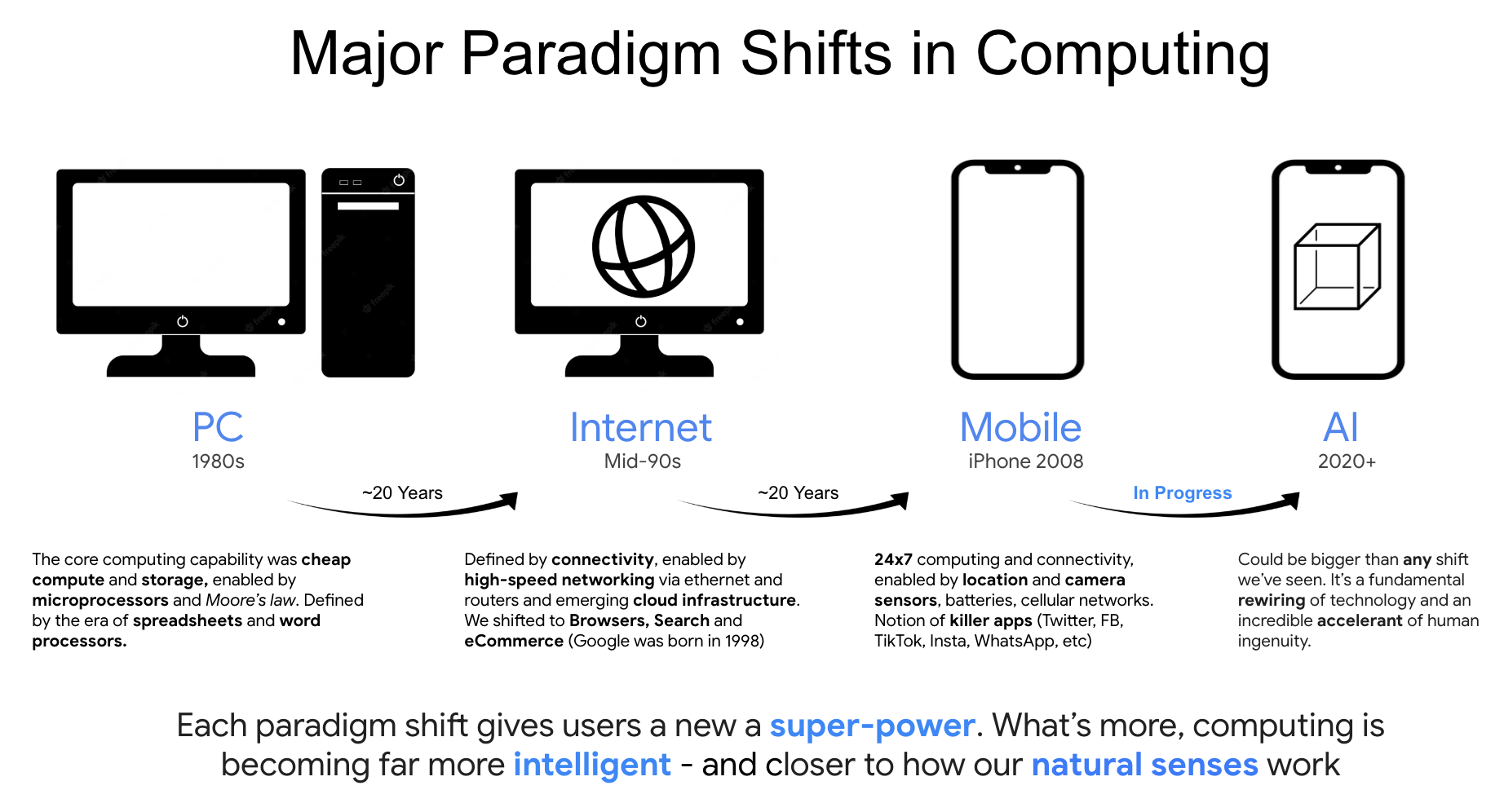

The AI story is very real.

And you will want exposure to this booming market (in some fashion). Whether it’s the “picks and shovels” like NVDA; the “services” layer (with the cloud providers); or the “application” layer (e.g. ChatGPT and others) – AI is transforming everything we do.

As I’ve written in the past – this is the next major paradigm shift in computing – potentially bigger than anything we’ve seen in the past:

Source: Adrian Tout

But with respect to a company like NVDA – paying 35x sales revenue is not what I would consider a “fair price for a wonderful business”