- Analysts increase year-end prices targets for the S&P 500

- Recession callers now lean towards ‘soft landing’

- It’s Fed week… will it be “one and done”?

It’s the rally everyone loves to hate.

Why?

Because very few got it right.

Most fund managers missed this rally entirely… thinking it was only a matter of time before things collapsed.

The thing is – they haven’t.

I will admit – I also got this wrong.

My initial forecast (last year) was for the S&P 500 to rally to a zone of 4200 where I thought we would see resistance. And that proved accurate for about 6+ months.

However, if that broke (which was looking likely) – I was looking for an upside move to the zone of 4400 to 4500.

Well… we went straight past that without the slightest hint of a pause.

The S&P 500 now trades 4536 – making me look foolish (and it won’t be the last time I am sure)

We’re now just past the mid-point of the year – with the S&P 500 up 18.2% YTD.

Remarkable by any measure.

I don’t even pretend to know what the second half will bring.

My own performance looks ‘sub par’ at 12.4% YTD (mostly choosing to sit in ~35% cash)

Again, I got it wrong.

So far (and it’s still early) we have defied the gloom of near-term recession risks, soaring inflation and aggressive monetary tightening.

What’s more, earnings have been “better than feared”

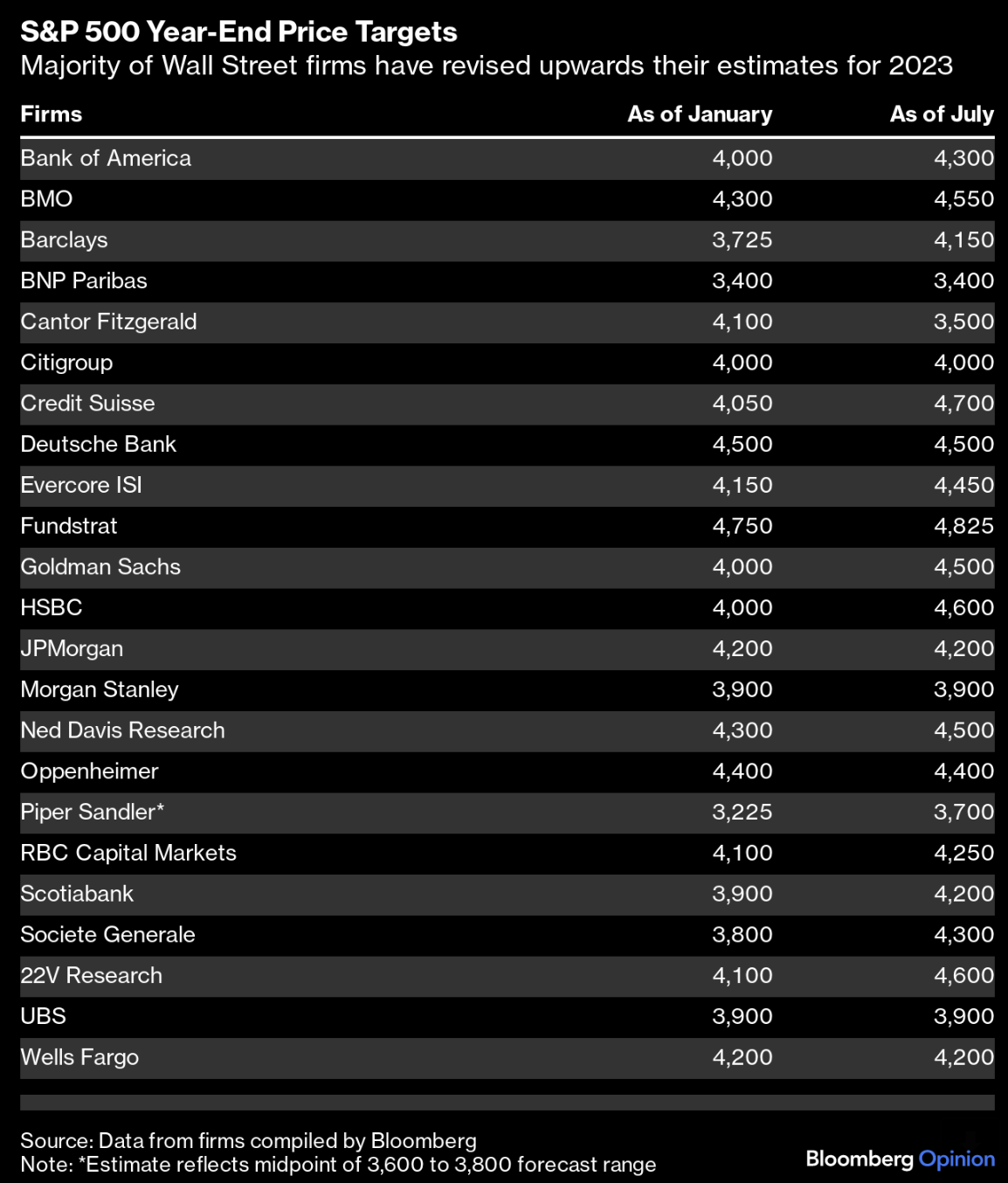

What’s happening now is strategists are now increasing the year-end targets

For example, at the start of the year, Wall Street estimates had the market ending 2023 between 4000 and 4500.

Funny isn’t it…

They were horribly wrong for the first half (as they were with calendar 2022) – why would anyone listen to them for the second half?

But I digress…

Upside (Expensive) Targets

As Wall Street is busy ratcheting up their S&P 500 to levels of 4500 and above – things are not getting any cheaper.

From Bloomy this week:

How Many of These Will be Wrong in 6 Months?

Tom Lee at Fundstrat (a perpetual bull) believes we could see 4825 at the end of the year.

Then again, Tom also called for 15% gains last year (and not a 20% correction).

Mmm….

Note BNP’s bearish call for 3400 at year end (that would be a correction of 25%)

Who will be right?

3400 to 4825 is quite the range.

But it shows you the different views some fund manager’s having looking ahead.

With the S&P 500 at 4536 – and assuming earnings of ~$220 per share – that’s a forward PE of 20.6x

Not cheap.

However, with earnings set to contract by ~5% this quarter (give or take 200 basis points) – that represents three straight quarters of decline.

Therefore, Wall St is expecting these earnings to pivot sharply.

And hey – maybe they will.

But sharp earnings growth assumes a few of things (perhaps not limited to):

- Dollar weakness (i.e., an earnings tailwind)

- A strong (spending) US consumer (i.e., limited job losses)

- Lower (stickier) inflation; and

- Continued economic growth

And all of those things could happen.

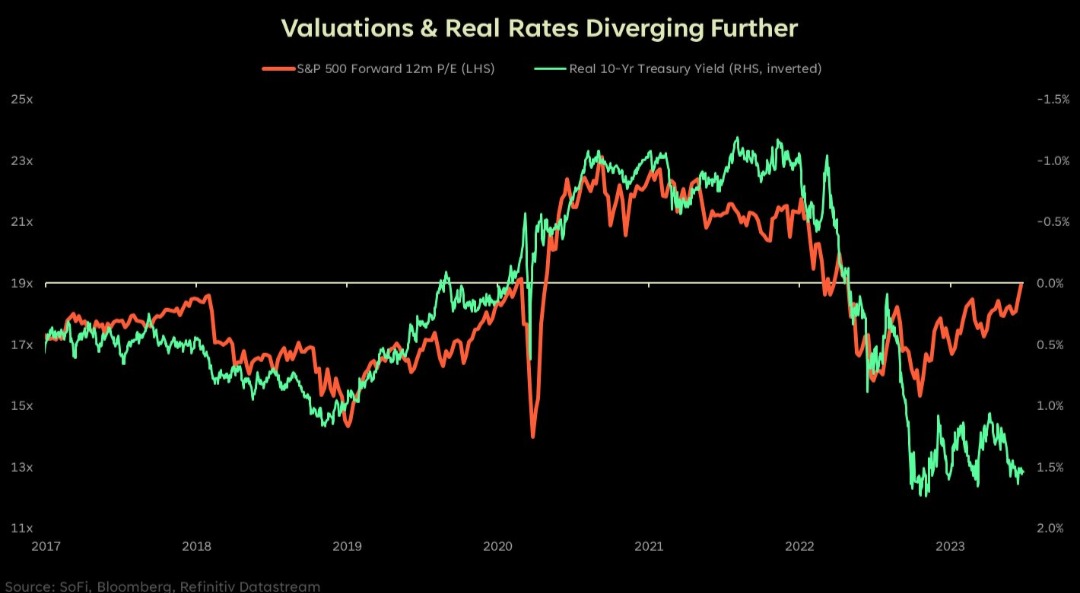

That said, today things are expensive. I talked about this recently (June 29) where I compared the earnings yield of the S&P 500 against the risk-free treasury rate.

You are being asked to pay a lot for stocks whilst taking risk. On the other hard, you get a higher yield from treasuries risk free.

Here’s the chart I referenced:

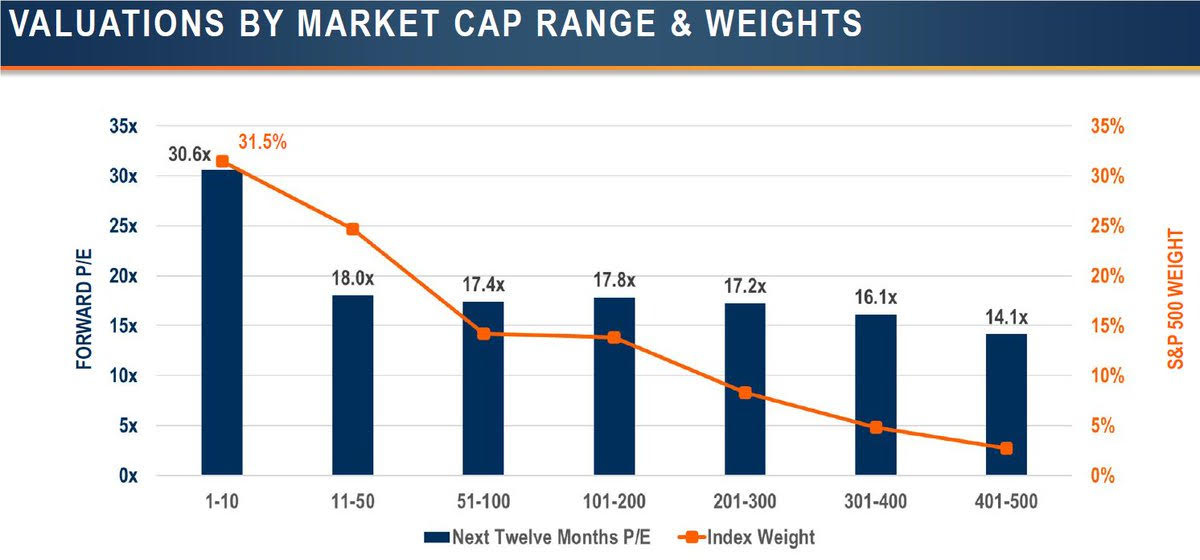

Earlier this week I came across another useful representation of how expensive (and narrow) the market is.

This chart shows valuations by market cap:

Here’s how it works:

The x-axis indicates the number of stocks and their associated forward PE ratios.

For example, on the far left hand side, the ‘Top 10’ S&P 500 stocks command an average forward PE ratio of 30.6x

What’s more, these 10 stocks constitute 31.5% of the total market capitalization of the S&P 500.

In other words, the concentration risk is exceptionally narrow.

As you go down the scale (to the right hand side) we find 200 stocks trade at forward PE’s around the 100-year market average.

However, these stocks represent less than 7% of the weight.

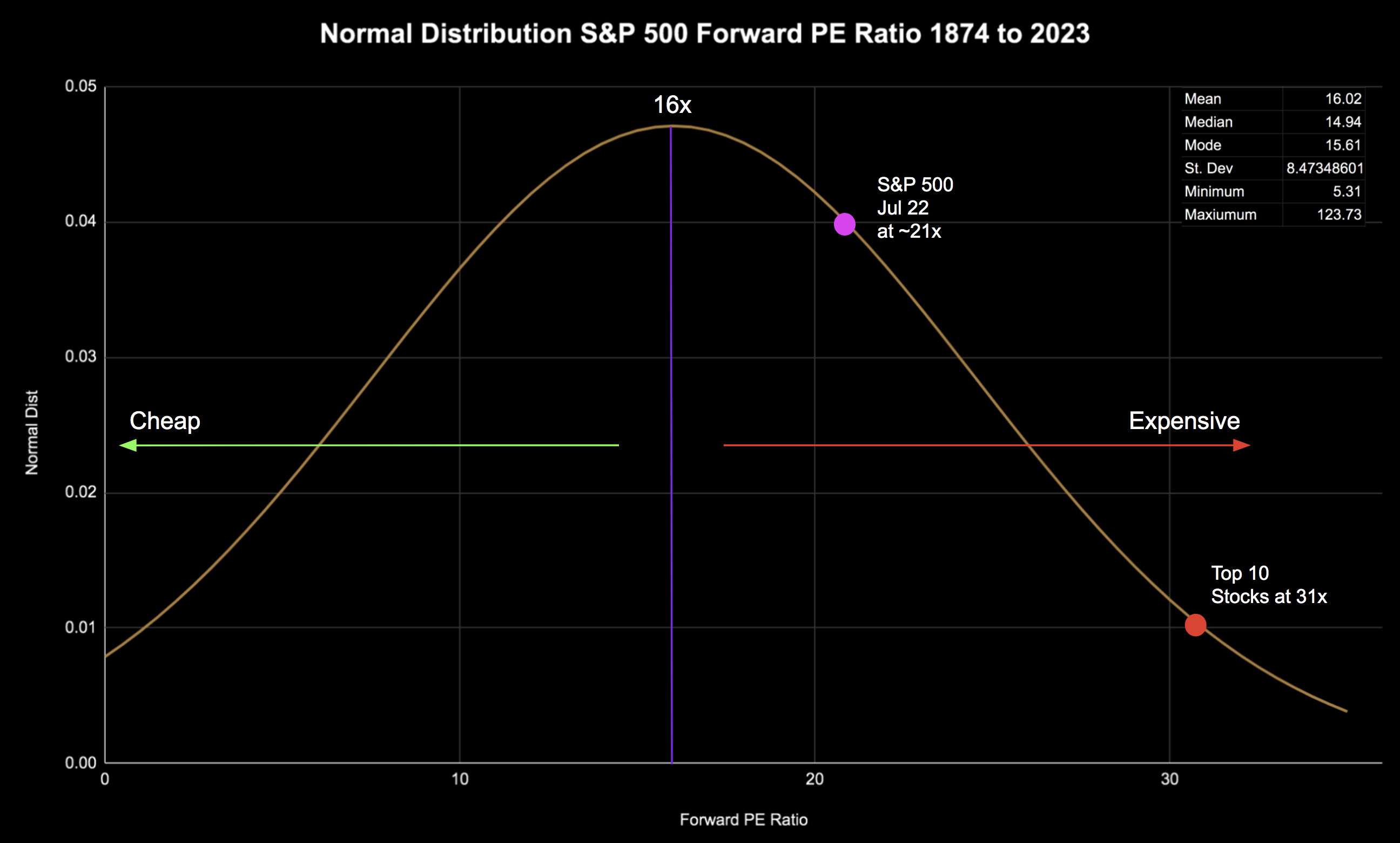

For shits and giggles – I ran a Normal Distribution curve on PE ratios for the S&P 500 between 1874 and 2023 (using historical PE data from multpl.com)

Here’s what that looks like:

Using 1832 data points (monthly PE’s from 1874) – the mean is 16.02; and the median is 14.94

In short, around 16x is the 150 year average — implying we are ~31% on the ‘pricey’ side.

However, much of that is skewed by the Top 10 stocks – which trade around 31x.

And if you look at where 31x sits on the 150-year distribution curve – we are in “rarified air”

Now if we were to remove those Top 10 stocks — one could argue 98% of the market (490 of 500 stocks) trade close to fair value.

This is why I’ve been rotating money from large cap tech into banks, energy and industrials of late.

The risk / reward is more attractive.

My opinion is large cap tech feels too expensive (however I still own them); where there is more longer-term value in the sectors with PE’s closer to 17x

So far this year – that strategy has not worked.

Big tech rallied and stocks like banks and energy treaded water (although that reversed a little last week)

However, as I keep saying, I’m positioning my portfolio for the next 3 years (not the next 3 months)

Your timeframe will likely be different to mine.

Will We See a Recession?

If you ask me – yes.

However, I’ve always felt that it would most likely be late 2023 or early 2024.

In other words, around 18 to 24 months after the Fed commenced their tightening cycle.

The lag effect of 500 bps in tightening (with another 25 bps to come this week) takes time.

But I still think it’s coming…

That view is now very much contrarian.

For example, about a year ago, calls for a 2023 downturn was the consensus view.

That said, what they missed was four-fold:

- $2.3 Trillion in excess consumer savings (which is now below $1T)

- ~70% of consumers had locked in 30-year fixed mortgages below 4.0%

- Extreme new liquidity measures from the central bank (following the collapse of SVB); and

- Massive fiscal deficits from the government (helping to boost GDP)

All of these things helped provide consumers with a buffer against 500 basis points of rate hikes.

That said, some of these ‘buffers’ are losing some of their impact.

Consumers are burning through savings; the Fed is now reducing its balance sheet; and the government is being asked to curtail (excessive) spending.

Nonetheless, given where things are now with inflation (and employment), recession callers are re-thinking any possible “hard-landing” (which in turn has Wall St increasing their price targets).

For example, Tom Hainlin at US Bank Wealth Management, called it close to an“economist capitulation.”

It’s the feared slowdown of the consumer that feeds into slowing corporate earnings that just hasn’t happened. And it’s been a fear for six months and 20 days coming into this year so far. So it’s the event that we’ve been concerned about that just hasn’t happened and people have had to revise their expectations of if it does, maybe it happens in the fourth quarter and maybe it’s more mild than we thought from the beginning of the year.

In a report this week, Deutsche Bank described it this way:

“The view that a recession would be needed to enable the Fed to achieve its firmly held goal of returning inflation to its 2% target has gone from a long shot, to a consensus view, to now essentially a toss-up.”

In other words, they think “soft landing” is on the table (i.e. a recession isn’t needed to bring down inflation)

That said, they added a caveat that the case for a downturn remains strong – suggesting the following:

- History shows that that’s the result when central banks are actively trying to drive inflation down;

- There are shades of the 1970s “Great Inflation” in the current bout;

- “Excess demand” and tight labor markets are still driving wage gains and core inflation, which excludes food and energy; and

- Historically reliable leading indicators have been flashing recession (e.g. inverted yield curves)

But Deutsche are not alone in their possible ‘soft landing’ argument… Goldman offered something similar.

Deutsche Bank’s economists wrote “the soft-landing scenario has become less outlandish in part because it’s clear that the pandemic shock that triggered the cost-of-living surge means that history is an “imperfect guide,”

It’s also true, as Fed policymakers highlight, that public expectations for inflation have been anchored at “much lower” levels than in the past.

This is important because when people generally expect inflation to ease before very long, that reduces the cost of getting price gains down.

In other words, the Fed doesn’t have to massively overdo it and keep rates ultra high in order to eradicate a high-inflation mentality in wage and price-setting.

As for me, I’m not sold (not yet).

I believe Core PCE (and Core CPI) will remain stickier than what most expect.

I say that as we had the benefit of very high base effects the past few months (e.g., high gas prices this time last year) – but those comps get more difficult in the second half.

And with energy prices rising again… we could see inflation head the other way.

Cautious on the S&P 500

Before I close, it was another bullish week for the Index.

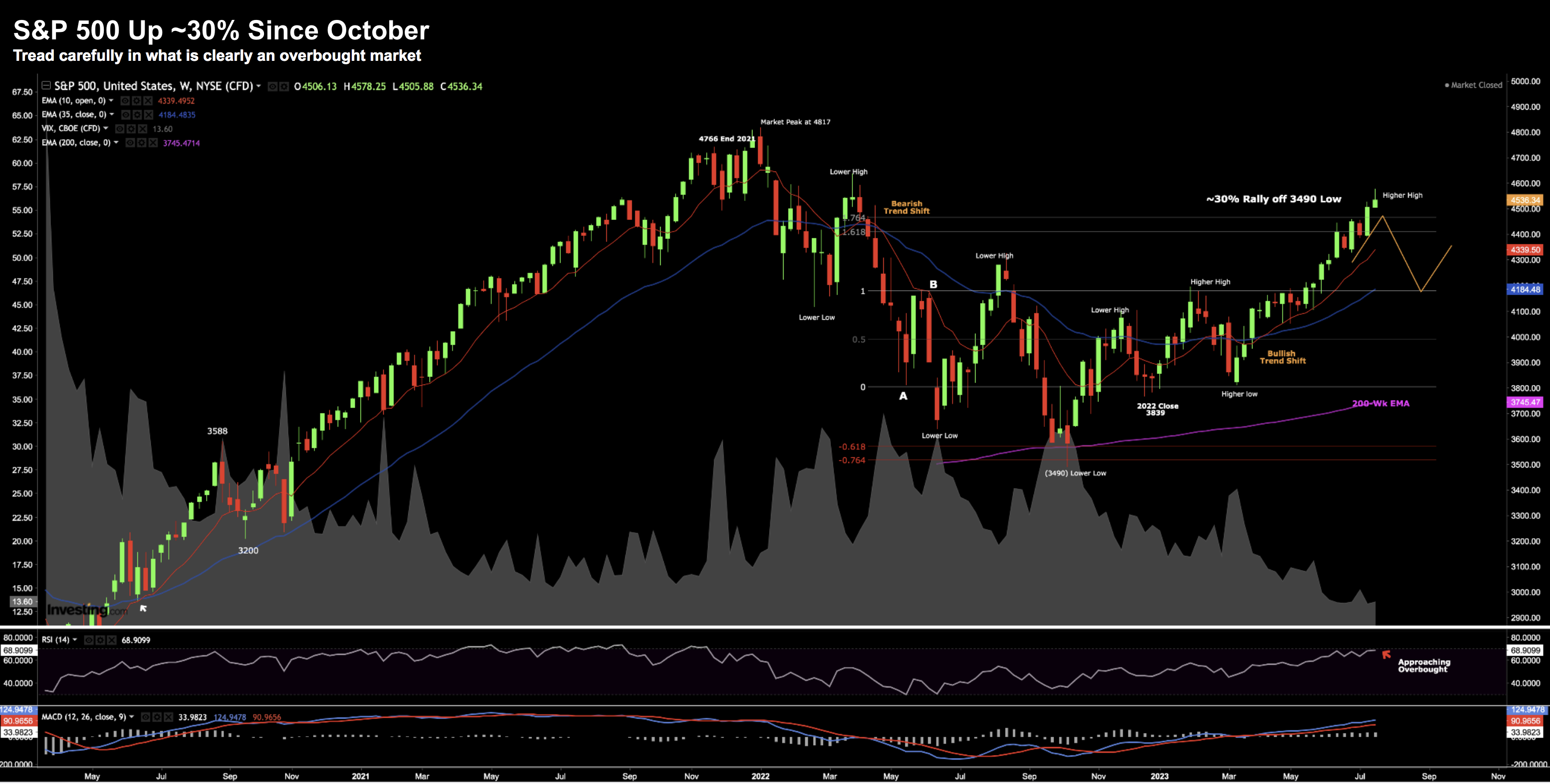

The S&P 500 continued its march higher – now up 30% from the October low:

July 22 2023

It’s very hard for me to consider putting new money to work… not at these levels.

This decision has led me to underperform the market YTD – but again – I am okay with that.

I think the odds of a 5-10% pullback only increase from here – perhaps down to the 35-week EMA.

That would see us back around 4,000 (where I see strong support)

Remain cautious.

Putting it All Together

This week we will hear from the Fed and a host of corporate earnings.

Large cap tech such as Meta, Microsoft, Google and Amazon will all update us on the previous quarter.

Are forward PE’s of roughly 31x justified?

And will they offer guidance?

With respect to the Fed – the market has already priced in another rate hike of 25 bps.

However, the question will be whether we get a dovish or hawkish hike?

My view is the latter.

I just don’t see how the Fed can use a dovish tone with Core CPI and PCE still trading with a high 4-handle.

It’s more than 2x their objective.

What’s more, with equities surging and a strong labor market, this gives the Fed “plenty of room” to be hawkish.

A very hawkish Fed could see the market pull back – as they expect this will be “one and done”

For example, at the time of writing, the market is pricing in less than a 20% chance of a further 25 bps rate hike beyond July.

I think that’s optimistic…. but I could be wrong.

Maybe the Fed will ‘declare victory’ on inflation (as the market believes)… and the doves won’t cry.