- Bond yields fall after $40B 10-year auction

- Equities happy to see the sharp drop in yields

- WTI Crude falls on expectations of weaker demand

Today was an important day in the bond market… not that anyone noticed.

The US Treasury auctioned $40B of 10-Year notes.

Coming into the auction – I was worried there would not be a decent bid.

For example, if we faced further buyer’s strike – these yields were likely to resume their path higher.

However, we saw the opposite. The 10-year yield drifted lower.

I will review the weekly chart shortly…

Whilst yields moving lower was well received by both bond and equity investors (in the near-term) – it also had me asking questions.

For example, is bond yields moving sharply lower a good sign?

Part of me says yes…

Lower bond yields will relieve some pressure on financial conditions (the opposite of what the Fed want to see)

However, it also suggests that investors are potentially concerned about what they see ahead.

Remember:

Over the long-run – the 10-year yield will track real GDP.

US 10-Year Retreats Post $40B Auction

Let’s first review the long-term trend for these yields…

Nov 8 2023

The bullish trend for the US 10-year commenced in December 2020.

At the time, these yields doubled from ~0.50% (a historic low) to around 1.00%

This saw the 10-week EMA (red) move back above the 35-week EMA (blue) – which is how I choose to define a long-term bullish trend.

Now last week – these yields retreated around 54 basis points from their peak.

Bill Ackman and Bill Gross were both ringing the bell on yields.

The move lower continued today…

As I say, this has been a massive reprieve for the equity market.

For example, the 5-6% surge in equities of late (it’s best run since 2021) is almost entirely opposite what we see in the bond market.

But the question I’m asking is have we seen 10-year yields peak in the near-term (e.g., next 12 months)?

I don’t know…

For example, technically we could see 10-year yields test the 35-week EMA or ~4.20%

If that happens – equities will probably continue their ascent.

Now let’s assume the 10-year drifts down to around 4.20% — the long-term trend would still be intact.

For example, it’s not unusual for bullish trends to test the 35-week EMA where they will often find support.

What’s more, I would be surprised if the 10-year was to go much lower than 4.20% in the near-term.

Why?

Look no further than the torrent of debt to be auctioned to the private market. It’s substantial.

The market will need to absorb this.

Now it’s hard to know how these auctions will be received.

For example, if buyers don’t show up because they’re not being adequately compensated for duration risk – then expect yields to climb.

My guess is the 10-year will need to be priced at 4.20% and higher for the market to soak up the long-term debt Treasury needs to sell.

Equities Happy Watching Yields Fall

Recapping what I wrote last week – there were arguably four factors helping to send yields lower (and in turn equities higher).

In no particular order – they were:

- US Treasury reducing the amount of long-term debt it planned to auction (however it’s still very high);

- Bank of Japan allowing 10-year yields to rise, but still maintaining some levels of yield curve control;

- The Fed suggesting they might be closer to its terminal rate (on the assumption financial conditions remain tight and economic growth slows); and

- US unemployment data meaningfully weaker than expected (with prior months revised lower).

Each of these are having an impact for different reasons.

The first three are reflective of what we see with the bond market.

This was reiterated by Powell last week when he suggested the bond market is finally doing some of the Fed’s heavy lifting.

However, he added that higher yields (or tighter financial conditions) will need to remain persistent if they are to remain on hold.

The fourth variable is also “helpful” for central bankers.

A weaker employment picture typically means demand for goods and services is likely to fall.

In turn, that will ease pressure on inflation.

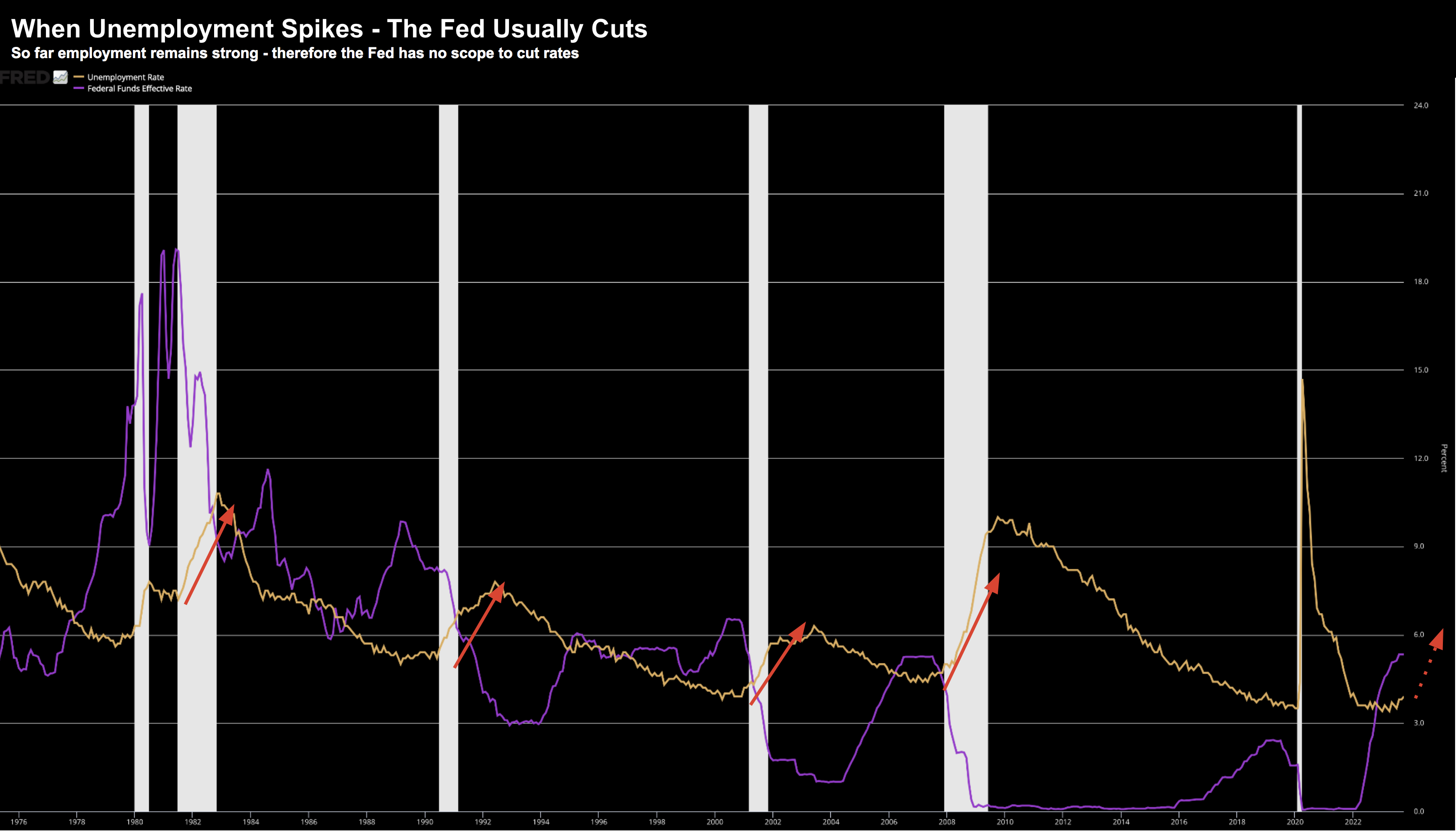

Now history tells us that a rising unemployment rate will eventually force the Fed’s hand when it comes to cutting rates.

However, we are still a long way from that:

Any change in direction from central banks matters a great deal for risk assets.

Forward looking employment indicators suggest that the employment picture is weakening (as I explained here)

Jay Powell acknowledged this.

However, the Fed will need to see the orange line start moving materially higher before they suggest a change of direction is coming.

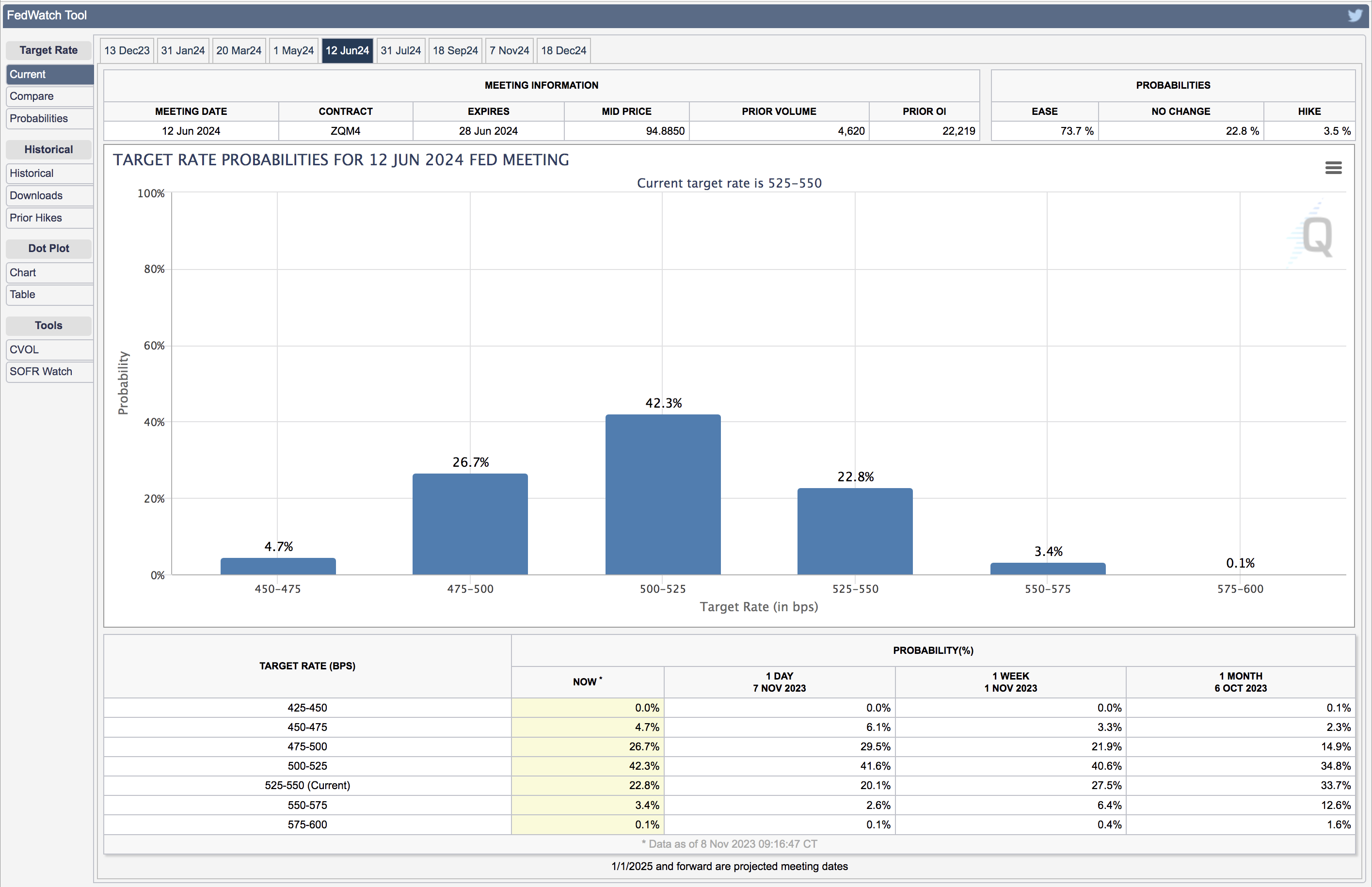

Equities believe this will happen as early as June 2024… pricing this at 42% (from the CME’s FedWatch Tool)

Nov 8 2023

Oil Craters on Demand Concerns

The other chart starting to show some “growth” cracks is WTI Crude.

Below is the weekly chart:

Nov 8 2023

For a brief period, there was a small amount of risk premium built into the oil price of a prolonged war and potential spillover effects.

That’s gone.

It would appear that traders (and equity investors) don’t see the Middle Eastern hostilities spreading out and affecting supply.

However, they do appear concerned with the demand picture and specifically – further weakness in China.

And it’s China which is where they should be focused…

China’s growth is failing – largely due to far too much speculative debt.

All that stimulus over the past few years is now coming home to roost.

China imported about 13.5% more crude this October compared to last (mostly opposite COVID YoY comparisons)

However, they also saw their trade surplus drop unexpectedly last month (its worst level in 17 months) – with exports falling 6.4% year over year and imports declining 6.2%.

From Yahoo!Finance:

Chinese exports fell more than expected in October amid worsening overseas demand, while an unexpected rise in imports saw China’s trade surplus shrink to its worst level in 17 months.

China’s trade balance fell far more than expected to $56.53 billion, missing expectations of $81.95 billion and falling sharply from the $77.71 billion seen last month, data from the General Administration of Customs showed on Tuesday.

The surplus was at its worst level since May 2022, when Chinese economic activity had ground to a halt due to the COVID-19 pandemic.

Chinese exports slid 6.4% year-on-year in October, missing expectations for a decline of 5.4% and accelerating from a 6.2% drop in the prior month. The decline was driven chiefly by worsening economic conditions in China’s biggest trade destinations- Europe and the U.S.

Now if we combine what we see above with the “higher for longer” narrative in developed economies – you can see why traders and investors see demand falling.

Putting it All Together

For now, financial and economic outcomes depend on soft, stable data, not too hot, not too cold.

Markets are pricing in a goldilocks soft-landing scenario for 2024…

They may be right but I need more convincing.

Consumers are tapped out; the employment picture is deteriorating; and demand is clearly weakening.

What’s more, analysts are busy revising down their earnings expectations for Q4

From Factset:

Given concerns in the market about a possible economic slowdown or recession, have analysts lowered EPS estimates more than normal for S&P 500 companies for the fourth quarter?

The answer is yes. During the month of October, analysts lowered EPS estimates for the fourth quarter by a larger margin than average. The Q4 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q4 for all the companies in the index) decreased by 3.9% (to $55.61 from $57.86) from September 30 to October 31.

This is what I said is likely to happen…

From mine, both bond and energy markets are starting to price in a much weaker consumer next year.

However, equities remain optimistic the consumer is set to re-accelerate from here.

Be careful paying too much for equities here…