- Pullbacks in Apple are a long-term opportunity

- Apple is down 12.2% YTD and 15% off its high

- Where I see another opportunity for Apple’s services

Over the past few months – I’ve paired exposure to large-cap tech.

At one point, it was as much as 25% of my total portfolio weight (which I consider high)

Today that number is below 20% – as I questioned valuations.

In short, they looked excessive.

For example, Apple was a stock I paired (something which I consider very carefully)

The iPhone maker traded as high as 31 forward earnings when it pressed $200 per share.

That’s too high given its single digit earnings growth rates.

However, at a valuation of somewhere between 20x and 25x, it represents a more reasonable long-term risk/reward.

Whilst pairing my exposure to Apple (and Google) looks like being a prudent move – it wasn’t for Amazon and Microsoft.

That cost me…

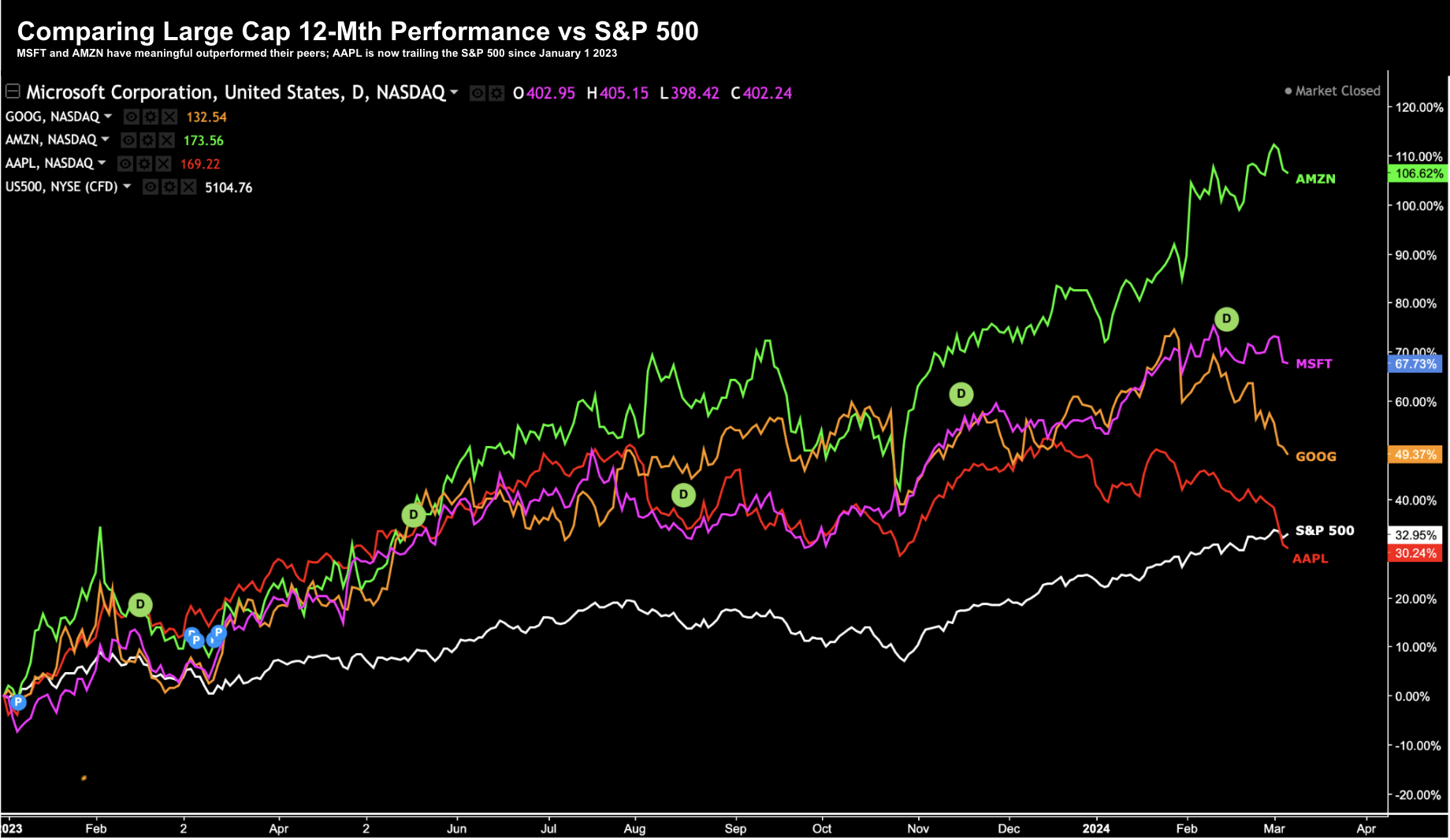

Large-Cap Tech ~12-Mth Performance

Below is the comparative performance for each of Google, Amazon, Apple and Microsoft vs the benchmark S&P 500 from Jan 1 2023

Mar 6 2024

Since the start of this year – Microsoft (up 7.0% YTD) and Amazon (up 14.2% YTD) have continued their impressive run – whilst Google and Apple have gone the other direction.

Apple is down 12.2% YTD and Google is down 5.9% YTD

This missive is going to focus on Apple – as I think the current pullback is setting up as another great (3+ year) opportunity for investors.

Let’s start with the tape.

Potentially More Downside Yet

Mar 6 2024

1. Apple has pulled back 11 times since 2017 of at least 11%. The average pullback has been around 23% and lasts around 8 weeks. The current pullback is 15.3% and is 12 weeks in duration.

2. This the first weekly bearish trend we’ve seen in a year – typically a sign prices will head lower

3. We find strong negative divergence with the MACD (middle window). This is where the MACD makes a lower high vs the two corresponding peaks in the price action. This typically indicates lower prices.

4. The weekly RSI (lower window) is not yet oversold. The last time Apple was oversold was early 2019 when it fell 40%.

5. The first area of support looks to be around $165 – which was the low of late October last year. However, below that level it’s a quick trip down to $150 (the bottom of our distribution)

As an aside, a price of $150 would represent an average CAGR of 20% from 2013 (when it traded around $20)

In summary, the technical set up favors lower prices.

And as I will describe below, a price of between $150 and $165 could prove to be a good entry point if your view is longer than 3 years.

For example, you could add one-third of your intended position weight at $165 (which could prove to be the current bottom).

If it falls to $160 – great – add another third. And if we see $150 – add the final third to create a full position in the stock.

But let’s talk to these numbers – as they aren’t based on technical analysis alone. Whilst the charts are always helpful… in isolation they’re not complete.

Why I Really Like this Stock

At various times since writing this blog (I started writing in 2011) – I’ve suggested investors secure a position in Apple (along with the other large cap tech names)

However, I’ve balanced that by suggesting investors should avoid paying too much.

As I often say:

It’s not just what we buy – it’s equally important we don’t overpay.

I last shared my thoughts on Apple August last year – when the stock was trading ~$200.

At the time I said you might be able to pick this stock up for ~$165

As it turns out – it retraced to $165.67 (~17% pullback) and found strong buying support.

Technical analysis proved useful on this occasion.

However, my logic for owning it has not changed a great deal. Below is my key thesis:

- Apple has an install base of over 2B devices. And whilst they don’t report Monthly Active Users (MAUs) – we can assume they are in the realm of perhaps 1.2B to 1.5B users (based on iPhone sales alone)

- This user base is not only extremely sticky – they are also affluent. Apple commands a 54% market share in North America and 33% in Europe (two very affluent markets – where they spend on services)

- Whilst the market is concerned about the 24% slowdown in China smartphone sales – I think India is the bigger opportunity.

- Today India is a ~$12B business for Apple (or just 3% of all revenue). Let’s assume India follows a similar growth path to China over the next 6 years or so. Expansion in India could easily add 3%+ to Apple’s total revenue growth (as average incomes in India continue to grow).

- Apple’s multiple is based on its services business. That’s the division that includes subscriptions, warranties, licensing fees, AppleTV, iCloud and Apple Pay. Services grew 11% in the December quarter to $23.1 billion

- Apple now generates more revenue from services than any other product category except the iPhone. While sales of products produced a gross margin of 36.5% in fiscal 2023, sales of services generated a gross margin of 70.8%

But there is another key services area which the market could be mis-pricing… and that’s Artificial Intelligence (AI)

Let me explain…

The Power of Apple’s Bundle

Stocks like (not limited to) Nvidia, Microsoft, Google, Meta and Amazon have benefited from the “frenzy” surrounding AI this year.

And that makes sense given they are ‘directly’ in the space.

We have Nvidia making the AI chips, Microsoft with its Copilot and investment in OpenAI, Meta using AI to grow its ads business by 25%; and Google more recently with Gemini.

However, it’s fair to say that Apple has not entirely benefited from the speculation around AI.

And that could be a miss.

As a preface, those who don’t work in tech may not fully acknowledge the power of having hardware and software locked up under the ‘one umbrella’.

It’s incredibly hard to do and I don’t know of a single other company who has been able to emulate this ‘bundle’ at Apple’s scale.

None.

For example, Google has tried with its Pixel and Chromebooks – but lacks meaningful market penetration.

Samsung has tried to develop its own software stack (and operating system) to differentiate their phones – but instead they opted to license Android.

Amazon tried with its Fire Smartphone – but again – failed to get meaningful adoption. And Meta is still trying with its “XR” hardware Quest platform – barely selling 20M units.

From mine, Apple is in a league of its own – giving it tremendous strategic advantage across its 2.2B install base.

Put another way, those who rely on third party integrations have a large number of dependencies in order to scale their platform.

Third party integrations require extensive commercial and technical alignment – which also introduces breakpoints (not to mention “co-opetition“)

Note – Remember when Meta, Pinterest and Snap felt the brunt of this not long ago when Apple changed its privacy laws with respect to ad serving? This saw them take a revenue hit and reengineering their (ad) platforms.

Apple on the other hand avoids almost all of this fragmentation.

Not only does this enable speed to market (although Apple tend to be a fast follow with innovation) – more importantly it gives them total control over quality and delivery.

And generally they get it right.

But let me explain how they can leverage this unique strategic hardware / software moat…

For those who use an iPhone – they have a voice assistant called “Siri”

If you have used it – it’s rubbish.

And whilst it’s probably the worst single product that Apple has developed (and they would agree) – equally it could be their biggest opportunity.

Siri only does a couple of things well today.

For example, it can set a timer or alarm; and it can tell you the weather. But ask it anything else… and you will end up having an argument!

“No Siri. Stop. Just stop”

However, imagine when (not if) Apple starts to focus more on AI and the (useful) services it could do. For example:

- “Hey Siri, optimize my electricity bill and make sure I’m getting the best price”

- “Hey Siri, I need to travel to New York next Wednesday and I have three meetings before noon with a, b and c clients – please schedule flights and accommodation”

- “Hey Siri, take a look at what’s in my fridge (as you use the phone’s camera), let me know what I can cook with this tonight. And please order what food I need for the week”

These are random use-cases but intended to be indicative of what Siri could do.

How many of Apple’s 1.2B daily users might adopt this service (and be willing to pay for it)?

For example, let’s say you saved a person say 1-hour per week on some menial task – there’s “$100” per week saved. What’s more – it gives you back your most precious commodity – time.

To help demonstrate why this kind of saving is real – consider this AI use-case from payments firm Klarna.

Last week they announced its AI assistant powered by OpenAI. It’s been live for 1-month – here are the numbers:

- The AI assistant has had 2.3 million conversations, two-thirds of Klarna’s customer service chats

- It is doing the equivalent work of 700 full-time agents

- It is on par with human agents in regard to customer satisfaction score

- It is more accurate in errand resolution, leading to a 25% drop in repeat inquiries

- Customers now resolve their errands in less than 2 mins compared to 11 mins previously

- It’s available in 23 markets, 24/7 and communicates in more than 35 languages

- It’s estimated to drive a $40 million USD in profit improvement to Klarna in 2024

They said they’ve also seen massive improvement in communication with local immigrant and expat communities across all markets thanks to the language support.

From mine, it’s reasonable to think Siri could (one day) become a lot more than “hey – tell me the weather”?

The Numbers

Apple’s earning per share are currently around $6.43

At a price of roughly $170 – that represents a trailing PE of 26.4x

If we assume Apple will grow its earnings by say 8% next year – that brings earnings to around $7.00 – or a forward PE of 24.2x

My thinking is Apple will handily grow EPS to $8.00 per share towards the end of 2025.

From there it’s a question of the multiple.

We know the market trades at a forward PE in the realm of ~20x (where that PE is expected to be $235 per share – up 11% on last year)

However, given the quality (and strength) of Apple’s business (e.g., its strategic moat, free cash flow, balance sheet etc) – it deserves a multiple of ~25x (some might say more – especially with the growth in AI)

This puts the stock at ~$200 (or higher pending the assumed multiple)

In summary, if you’re picking up the stock around $165 (or lower) – the upside reward outweighs the downside risks over the long-term.

Sure, the stock could easily fall to as low as $125 looking at the chart (the lows we saw early 2023) – but that would represent an opportunity (not a reason to panic)

Putting it All Together

As I write this – I’m underweight large-cap tech (which includes Apple).

My last entry point for the stock was $138 – however was happy taking some (not all) chips off the table with the multiple extended to 31x.

I’m now watching the stock closely and will start adding back to my position at $165.

And if we see anything near $150 – I will have a full position.

This is a stock you want in your ‘core’ portfolio. For me, its operating moat, strength of cash flow, strategic advantage and overall business is unparalleled. Therefore, it’s just a question of what I’m willing to pay.

And from that perspective:

- 30x forward earnings is too much.

- 25x – a reasonable long-term risk reward entry (but you can get better); and

- 20x or below – you’ve paid a “fair price for a wonderful business”

For what it’s worth….

Buffett acquired Apple for about $23 per share (Q1 2016) when its earnings were about $2.16.

That’s PE ratio of 10.6x. Apple represents a staggering 50% of Berkshire’s portfolio.

You might say he did better than a “fair price” for a wonderful business.