- Apple drops 7% post earnings – do you buy?

- What I liked most about Apple’s earnings call (and their business)

- Why it should be a ‘core’ position in your long-term portfolio

This week the final two mega-cap tech names reported Q2 earnings.

Amazon handily exceeded what were very low expectations.

AWS (Cloud) sales rose 12% year over year – much better than feared – given the soft results reported from Microsoft’s Azure.

This sent the Cloud and eCommerce giant higher by ~11%

As a long-term share-holder – I was pleased. But at ~$139 per share – it’s still a long way from its former $189 high.

In that sense, it’s still lagging its peers by a good margin.

On the other hand, investors had a very different reaction to Apple’s earnings.

The iPhone maker’s results were mostly inline.

But “inline” is not good enough when it’s trading ~30x to 31x forward earnings.

And that’s the thing…

No-one argues Steve Jobs built one of the world’s greatest businesses of the modern era (for reasons I will explain shortly)

However, that doesn’t mean you should overpay for quality.

Put another way – this game isn’t simply about what you invest in.

We need to buy the best quality businesses at the right price.

The question is of course – what is the right price for Apple?

I’ll offer some thoughts…

Why You Should Own Apple

There are not many stocks that I pound the table saying you should own.

However, Apple is one.

As long-time readers will know – it’s also one of my Top 4 holdings – along with Google, Amazon and Microsoft.

These four stocks comprise about 20% of my total portfolio (which could be too much in this climate – especially with bond yields rising).

Whilst each of these are best in class – they are all very different businesses.

For example, Apple is a standout in the consumer hardware space.

Google leads search and advertising. Microsoft leads enterprise computing; and Amazon dominates eCommerce.

And in some areas – they compete (e.g. cloud services among other things)

Tonight I’m looking at Apple – given its shares sank 7% post earnings.

Is there more to come?

A Deeper Look at Apple’s Numbers

Below is the breakdown:

| Product | Qtr Rev | vs Est. | % Tot. Rev |

|---|---|---|---|

| iPhone | $39.7B | -1.4% | ~49% |

| Services | $21.2B | +2% | ~26% |

| iPad | $5.8B | -11% | ~7% |

| Mac | $6.8B | +9% | ~8% |

| Wearables | $8.3B | 0% | ~10% |

As mentioned, the results were mostly inline with expectations (excluding iPad)

However, what perhaps disappointed the market was their CFO said to expect further revenue decline in subsequent quarters.

That’s not good.

If true, that will mean four straight quarters of revenue decline.

One bright spot was services revenue.

This is the future of Apple’s business – as it transitions from lower margin hardware to lucrative services.

Services is now a $21.2B quarterly business (up from $19.60 billion for the same period last year.)

But what gets investors excited are the gross margins of ~71%

It’s a licence to print money.

By comparison, Apple’s hardware business ‘only’ generates gross margins of around 35%. However, once they get the device in your hand, it’s all upside.

Their services business grew 8% YoY (vs forecasts of +6%) – an all-time high for the segment.

But there were two other numbers investors should focus on…

Why Apple Will Grow

Whilst Apple is likely to report four straight quarters of revenue decline – there are at least two good reasons to believe the stock is very well positioned for the future…

The first of these is the sheer size (and loyalty) of its install base.

The tech giant now has over 2B active devices … which saw growth last quarter.

When I listened to CEO Tim Cook on the earnings call – the very first thing he called out was the growth of their install base.

Cook knows that the key to their (growing) flywheel is that install base.

Let me explain…

The reason segments like services and wearables are now a combined $30B quarterly business is the flywheel effect of the install base.

For example, if you have an iPhone, there is a strong probability you have also purchased AirPods and/or an iWatch.

Just look around.

What’s more, there’s also a high probability you use iTunes to listen to music. Or you might backup your photos (and other important data) using their iCloud.

Or maybe you use Apple’s pay service (linked to your credit card) to buy a coffee or a movie ticket (I did exactly that last weekend!)

If you do any of these things – you are contributing to Apple services revenue.

This is what you call lock-in.

And what’s more, it’s most unlikely you will ‘swap out’ to an alternative device (not easily)

It’s this flywheel effect which is driving the higher-margin growth business… and it’s only going to expand.

But the other thing people should understand about the install base – it’s very difficult for any competitor to replicate.

Many have tried – most have failed.

The ‘operational moat’ is perhaps as wide and deep as any business on the planet.

And that’s very hard to do…

That’s the first reason to own the stock… a very sticky and loyal install base of over 2B users who are unlikely to churn.

What’s the second reason?

Here I am looking at Apple tapping an entirely new market… India

Last year’s Apple’s share of India was just 3.4% – a market which is dominated by Google’s Android.

This year that number grew to 5.1% (which is meaningful for a population of over 1.4B people)

I see this a massive opportunity over the next 10+ years (and is very likely to replicate what we see with China)

For example, China in 2010 was a $3B business for Apple.

Fast forward just 6 years – by 2016 – it grew to a $59B business – around 19% of total sales.

Last quarter alone, Apple did ~$16B in sales in China which was up 8% YoY (and in a struggling economy!)

So what could that mean for India?

Today India is about a $12B business for Apple (or just 3% of all revenue)

Let’s assume India follows a similar growth path to China over the next 6 years or so.

Expansion in India could easily add 3%+ to Apple’s total revenue growth (as average incomes in India continue to grow).

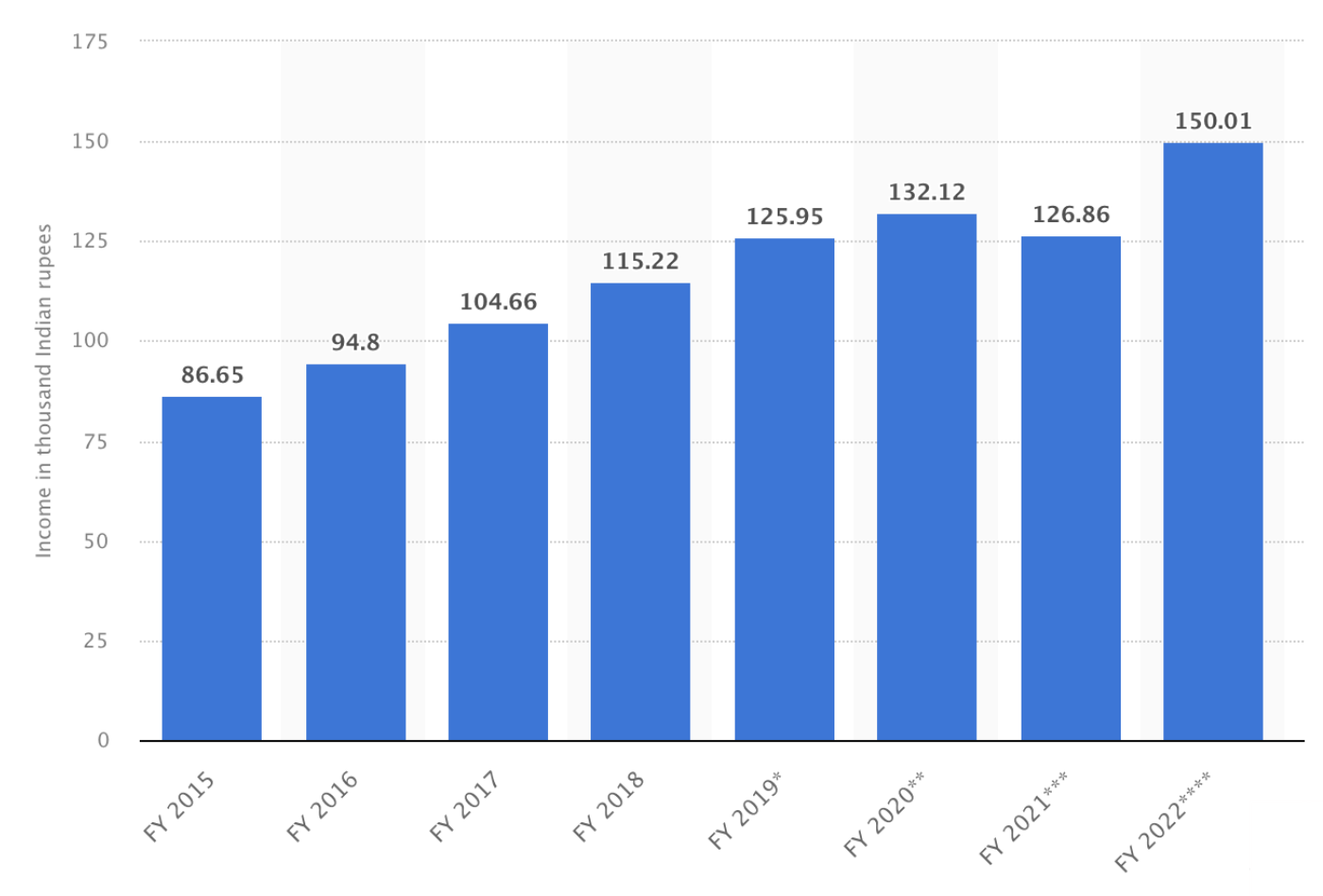

From Statista “India per capita national income 2015 to 2022”

It follows that should countries like China and India continue to become more affluent (as the income trend above shows) – this represents incredible growth potential for Apple.

But the question is what do you pay for this growth?

Do you buy at roughly 31x forward earnings? Is that good value?

What is a reasonable price?

From mine, the stock deserves a strong premium to the market given all of the above.

To that end, I think something in the realm of 25x forward is a decent risk/reward bet.

However, if we are lucky enough to see it back at ~20x – buy it with “both hands”.

Let me show where that is…

Taking a Bite out of Apple

To help with perspective, below is a 5-year chart.

My intent here is to demonstrate that it’s not unusual for the stock to offer you an opportunity.

Nothing (not even Apple) rises or falls in a straight line!

From example, from 2019, Apple has seen 9 sharp pullbacks of at least 11% or more (one as large as 40% at the end of 2018)

Aug 4 2023

- The 9 pullbacks over the past 4+ years have ranged from 11% to 40%. Typically they’re in the realm of 15% to 20%. At the time of writing, the stock is only ~7% off its all-time high… there is arguably more to come

2. It remains in a strong bullish weekly trend – with the 10-week EMA above its 35-week EMA. Therefore, probabilities suggest higher prices over the long term (i.e., dips should be bought)

3. The weekly RSI (lower window) was overbought the past few weeks – which indicates a pullback was likely. We’ve seen similar retracements in the stock when the RSI was above 70

4. The distribution I’ve been watching is labelled 0 to 1. Apple found expected support ~61.8% outside the distribution on the low side (i.e. ~$130 – where I was adding to the stock); and resistance at 61.8% on the high side (i.e. ~$200). The mid-point of this structure is around $165 – which is where I expect we could trade.

5. Finally, I’ve added the 11-year CAGR at an assumed 20%. In 2013 the stock traded at a price of ~$20. If you apply a 20% compounded annual growth rate (which is quite high) from 2013 – you arrive at a price of ~$150.

From a fundamental perspective – when the stock was trading ~$197 – that represented a forward multiple of around 31x (i.e. estimate earnings of $6.35 per share)

Today the stock closed around $182 – which reduces that PE to around 28.6x

From mine, if we see the stock trade with a forward PE in the realm of 25x to 26x forward – it’s worth buying.

For example, 25x would be $159; and 26x would be $165

And at $165 – this would represent a healthy pullback in the realm of ~16%

Where Apple Goes… So Goes the Market?

At almost a $3 Trillion market cap – Apple represents a massive 7% of the total S&P 500

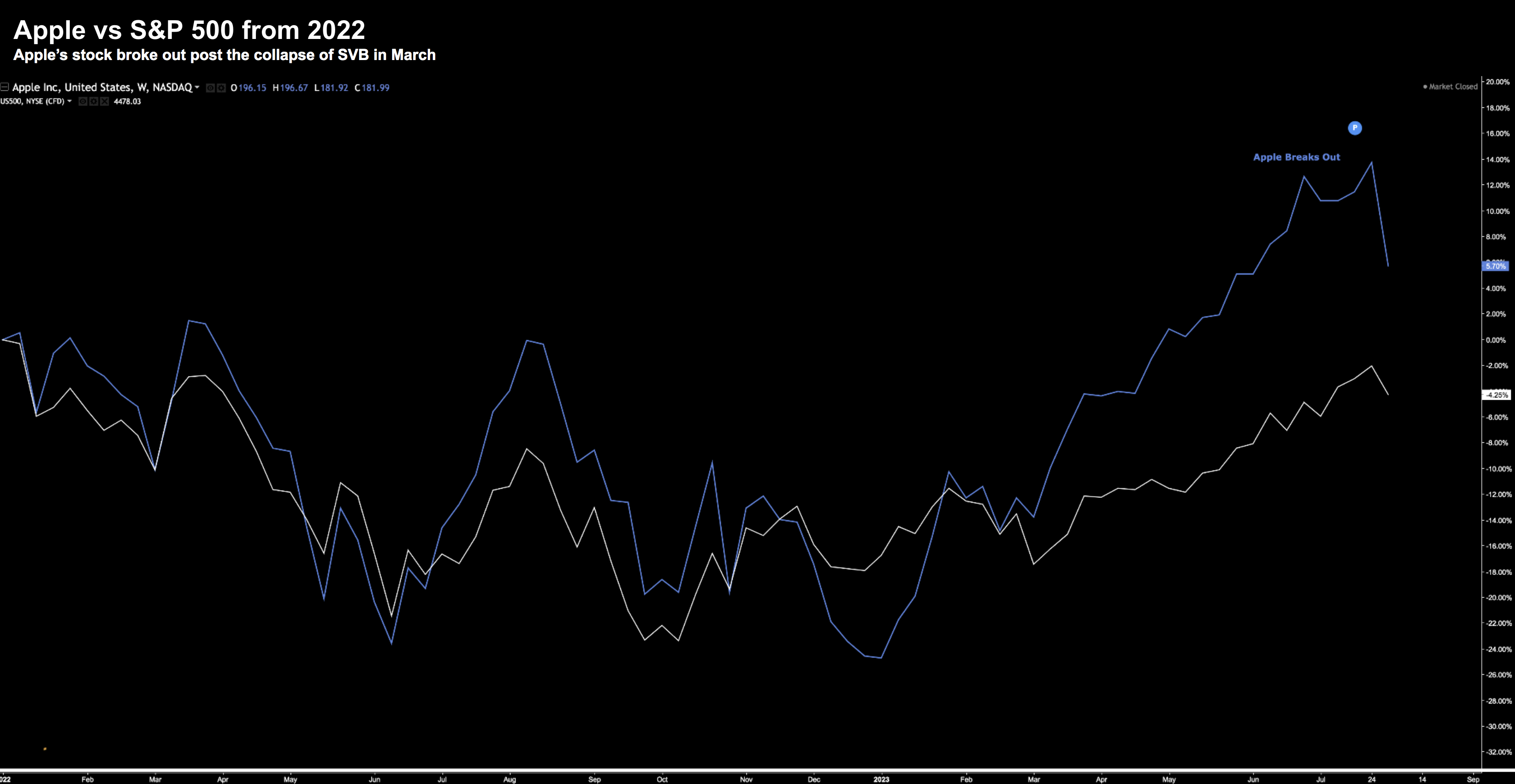

Now take a look at the price action between Apple and the S&P 500 over the past 24 months:

Aug 4 2023

Here we can see how they mostly trade in lock-step.

However, when we had the mini banking crisis (the collapse of SVB) – Apple’s stock broke out to the upside.

And it’s not difficult to explain….

Apple is perceived as the ultimate safety stock (in terms of its free cash flow and fortress like balance sheet).

Money will always seek the best risk / reward form of return.

That said, I think Apple will most likely “revert to the mean” and move back towards the Index performance.

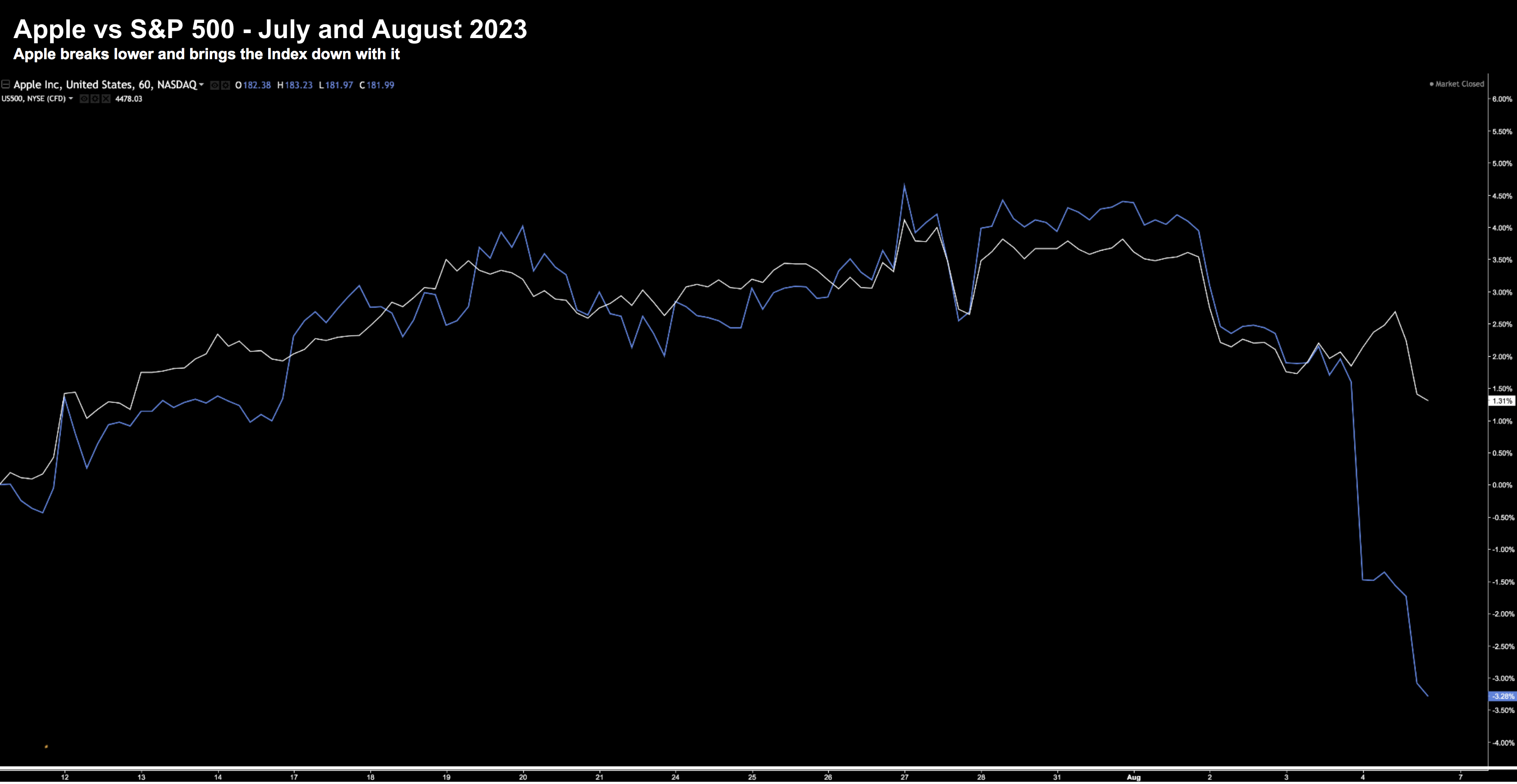

For example, take a look at what we have seen over July and August:

Aug 4 2023

Again, we see the two in lock-step (until today)

However, the move down in Apple had an impact on the S&P 500.

And given I’m of the view we could see Apple continue to trade lower – this is likely to act as a headwind for the broader market.

Putting it All Together

Apple is one of the best stocks you could hope to own.

And if you own it from much lower levels – continue to hold it.

However, if you don’t have exposure, you might get an opportunity to add to the name around $165 in the coming weeks or months.

And who knows – perhaps it trades even lower?

I don’t pretend to guess.

However paying $165 for the stock (or ~26x forward) is a lot better than paying $200 (or 31x forward)

The stock is likely to remain under pressure with the prospect of at least four straight quarters of negative revenue growth.

What’s more, they are about to head into some very tough YoY comparisons.

But I think that’s being short-sighted if you are selling the stock on that basis… you are missing the larger picture.

Looking out years into the future – I would use any material weakness in the stock to add for the long-term.

There are very few other better businesses than Apple.