Actionable market insights delivered weekly

Welcome!

I’m Adrian Tout…

Whilst I’m not a fan of long-winded bios – it’s only fair you should know a little more about me (and why this blog).

My educational background is in fields of computing science and engineering – which found me working at Google the past ~10 years in the fields of machine learnings and artificial intelligence.

Since departing Google in 2025 – I now focus my time on investing.

This newsletter is written out of a genuine love for all things learning, making better decisions, business, analysis, investment, psychology, economics and free markets.

The blog is now in its 14th year (2025)

It’s written to help you make better financial decisions. And to that end, I think author Peter Bevelin, put it best:

“I don’t want to be a great problem solver. I want to avoid problems—prevent them from happening and doing it right from the beginning.”

I’ve been at this game of investing for just over 27 years.

Needless to say, I didn’t get it right from the beginning.

At the ‘bulletproof’ age of around 30 – I lost around $200K during the dot.com crash. It felt like a lot of money at the time. But it was enormously helpful.

I learned from some important (life-long) mistakes early in my investing career. And as I navigated my way through the recession of 2008/09 – I was able to learn a bit more.

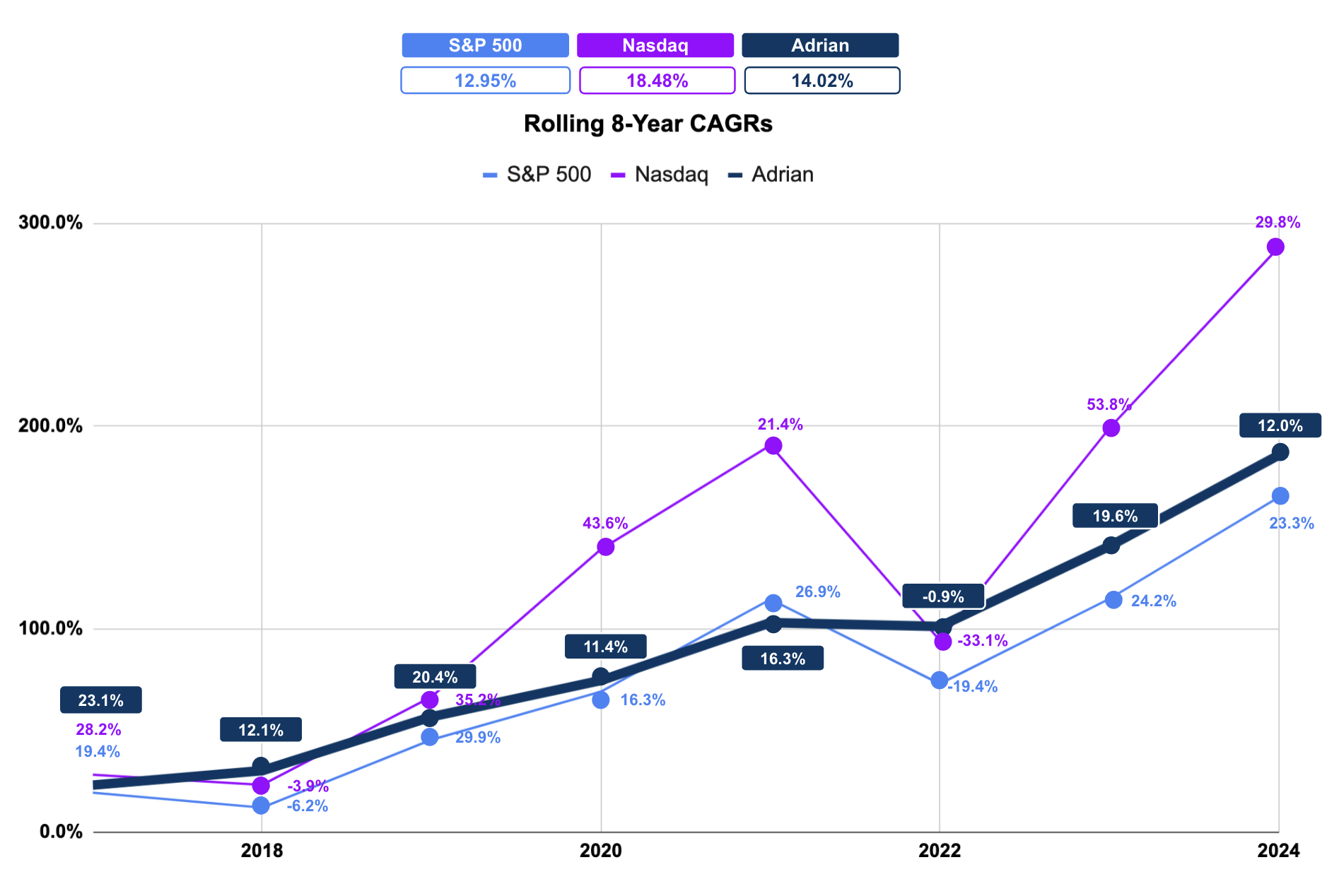

For example, during 2022 I outperformed the S&P 500 by +20%. Last year (2023) – I was only a couple of percent below the market. Put together – my outperformance over the past couple of years was +19%. And over the past 8 years – my CAGR is 14.02% (vs the S&P 500 12.95% over the same period)

I attribute this to two key things:

- decreasing my risk exposure when I felt valuations were excessive (as I’ve done in 2024); and

- increasing my exposure when the odds were in my favour (e.g. the S&P 500 ~3600 or ~16x fwd earnings late 2022)

However, during these two specific years (see below), many investor maintained excessive risk exposure into 2022 (at very high valuations) – leading to subpar returns. And when the market represented fair value – they failed to take advantage.

Last Update Q4 2024: My Performance (Dark Blue) from 2017

It’s take time, focus and deliberate practice.

I like to say that both traders and/or investors will pay at least one of the following with this endeavour:

- time spent learning how to invest; and/or

- capital losses

Some of you may avoid #2 – but you cannot avoid #1.

There are no shortcuts and no get-rich-quick schemes. There’s no magic formula which will promise you success.

The only way you will learn is by making mistakes.

Over time you build a process (a mental model) of making better decisions. And from there (if done well) you tend to make fewer mistakes.

When it comes to the game of asset speculation – making fewer mistakes far outweighs taking big risks.

There are old traders. And there are bold traders. But there are very few old bold traders.

Below are the four primary objectives I aim to achieve with this free newsletter:

- Making better financial decisions based on what’s worked for me over the past 25+ years;

- Eliminating the noise and misinformation which accompanies markets day-to-day;

- Asking better questions that are often overlooked or assumed; and finally

- Support any thesis with facts and data. Anything outside something that is factual is nothing more than a thesis (or your story).

Probabilities suggest your interpretation of facts and data will not turn out the way you expect.

That’s more than fine…

Successful investing requires accepting we get things wrong along the way. It also requires a long-term mindset – where we manage self-defeating behaviors (such as fear and greed) and being mindful of risks we take.

This blog details how I do that…

cheers

adrian