- Will this be the last hike in the Fed’s cycle?

- S&P 500 led higher by large-cap names

- Why I choose to remain cautious

Last week all eyes were on large cap tech earnings.

They delivered a mixed bag… but on the whole ‘better than feared’.

Q1 earnings didn’t fall off a cliff…

Single digit growth (top and bottom line) was largely cheered by the market – which highlights how low (earnings) expectations were.

But is that reason to cheer?

I will look at the broader chart for the S&P 500 in a moment.

Looking forward – investor’s eyes will turn towards the Fed.

And with economic data showing sharp signs of slowing – will the Fed offer any clues towards a possible pause in the months ahead?

That’s what the market has priced in.

In fact, not only does the market expect the Fed to pause from June – they see as many as three rate cuts by the end of the year.

Very few question whether the Fed will raise 25 basis points next week – especially after a hotter than expected Core PCE read last week.

From Reuters:

Stubbornly high inflation was underscored by other data on Friday showing labor costs increasing solidly in the first quarter as a tight labor market continued to drive wage gains in the private sector.

With the economy, however, shifting to lower gear, the anticipated rate hike next Wednesday could be the last in the current cycle, which is the fastest since the 1980s

Note Reuters language… “could be the last in the current cycle”

Assuming we get the 25 bps and the Fed offers language which suggests it’s potentially the last… this would be considered a “dovish hike”.

Markets will take that.

However, if the Fed inserts language like “we still have more work to do” – then we cannot discount another 25 bps in June.

Will May be the Last Hike in the Cycle?

There is a lot of weight to suggest the Fed has ‘room’ to pause after May.

However, stubbornly higher sticky (services) inflation is throwing a spanner in the works.

Choose your poison.

But let’s look at why the Fed could pause.

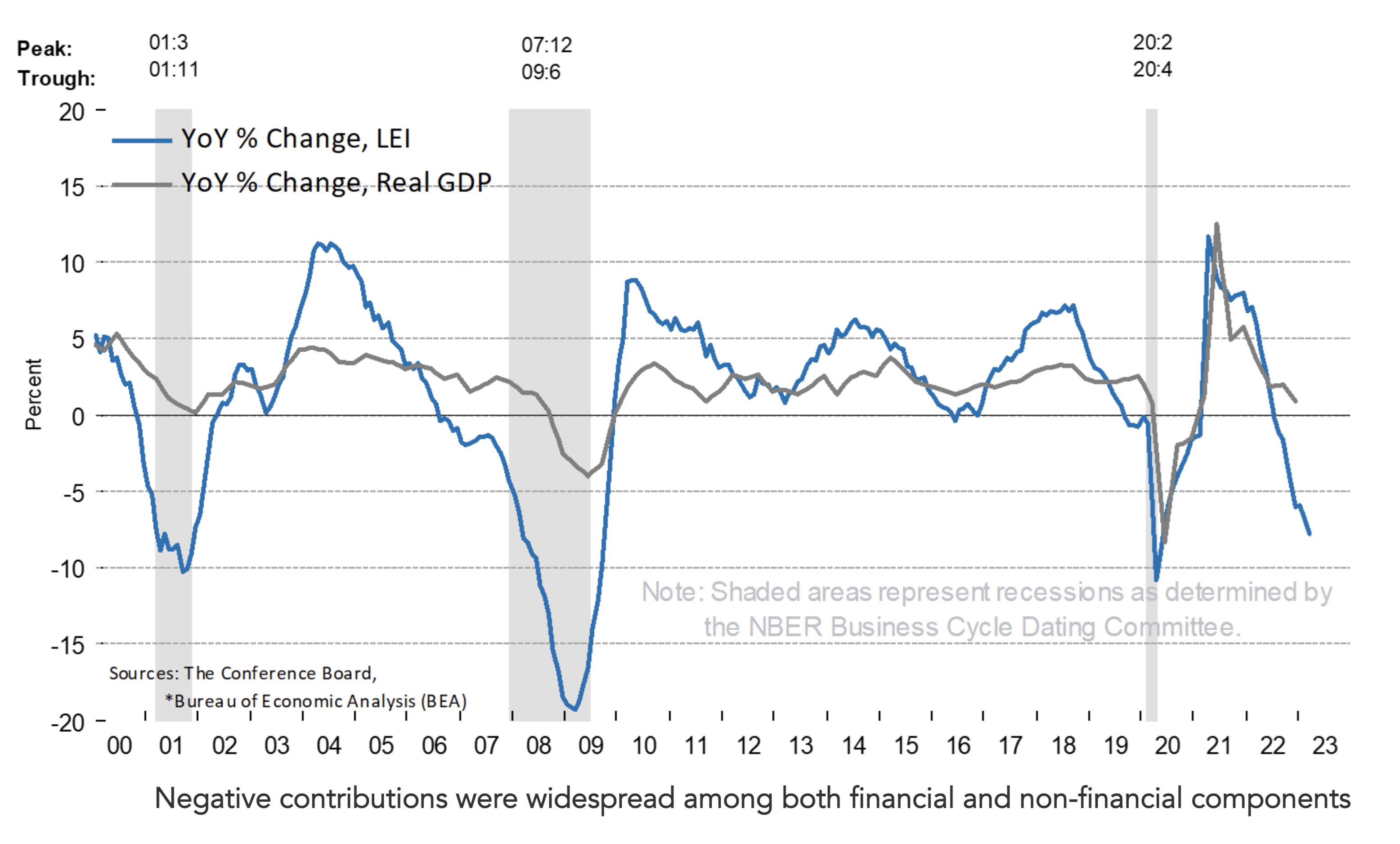

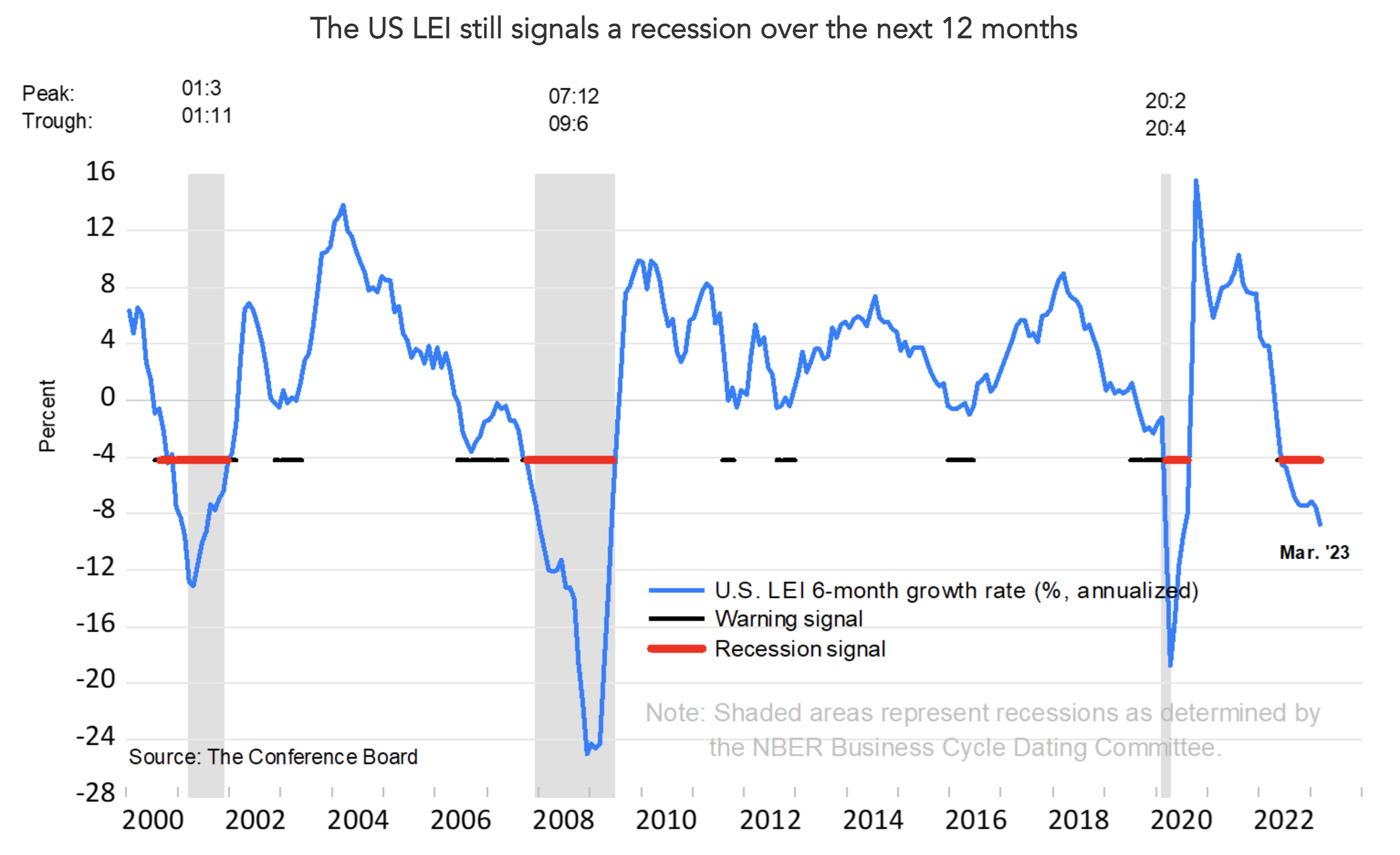

I will start with the leading economic indicators from the The Conference Board:

From the Conference Board:

The Conference Board Leading Economic Index® (LEI) for the U.S. fell by 1.2 percent in March 2023 to 108.4 (2016=100), following a decline of 0.5 percent in February.

The LEI is down 4.5 percent over the six-month period between September 2022 and March 2023—a steeper rate of decline than its 3.5 percent contraction over the previous six months (March–September 2022).

“The U.S. LEI fell to its lowest level since November of 2020, consistent with worsening economic conditions ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“The weaknesses among the index’s components were widespread in March and have been so over the past six months, which pushed the growth rate of the LEI deeper into negative territory. Only stock prices and manufacturers’ new orders for consumer goods and materials contributed positively over the last six months. The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023.”

This is mostly consistent with what I’ve been saying on the blog the past 6-9 months or so; i.e. expect a recession H2 2023 or early 2024.

The precise timing of recession is near impossible to predict (we could be in it right now) – however nonetheless it’s on the way.

If you look at the chart above – it peaked about 15 months ago and it’s been in steady decline since (now at -8%)

That is deep in recession territory.

By comparison there are only three other periods where it was this low: (1) 2001; (2) 2008; and (3) 2020

On each of these occasions there was a recession (and why I’m confident that’s where we are going – despite what others suggest).

With respect to consumption – which drives ~70% of US GDP – the previous quarter looked ‘okay’.

On Friday, we learned that Core PCE (Personal Consumption Expenditures) were up 4.6% YoY and 0.3% MoM

This is probably ‘hotter’ than what Powell wanted to see…

Given all the above – it will be interesting to hear how ‘hawkish’ the Fed’s language is looking beyond May.

Again, the market is pricing in a ‘dovish hike’.

An Increasingly ‘Narrow’ Market

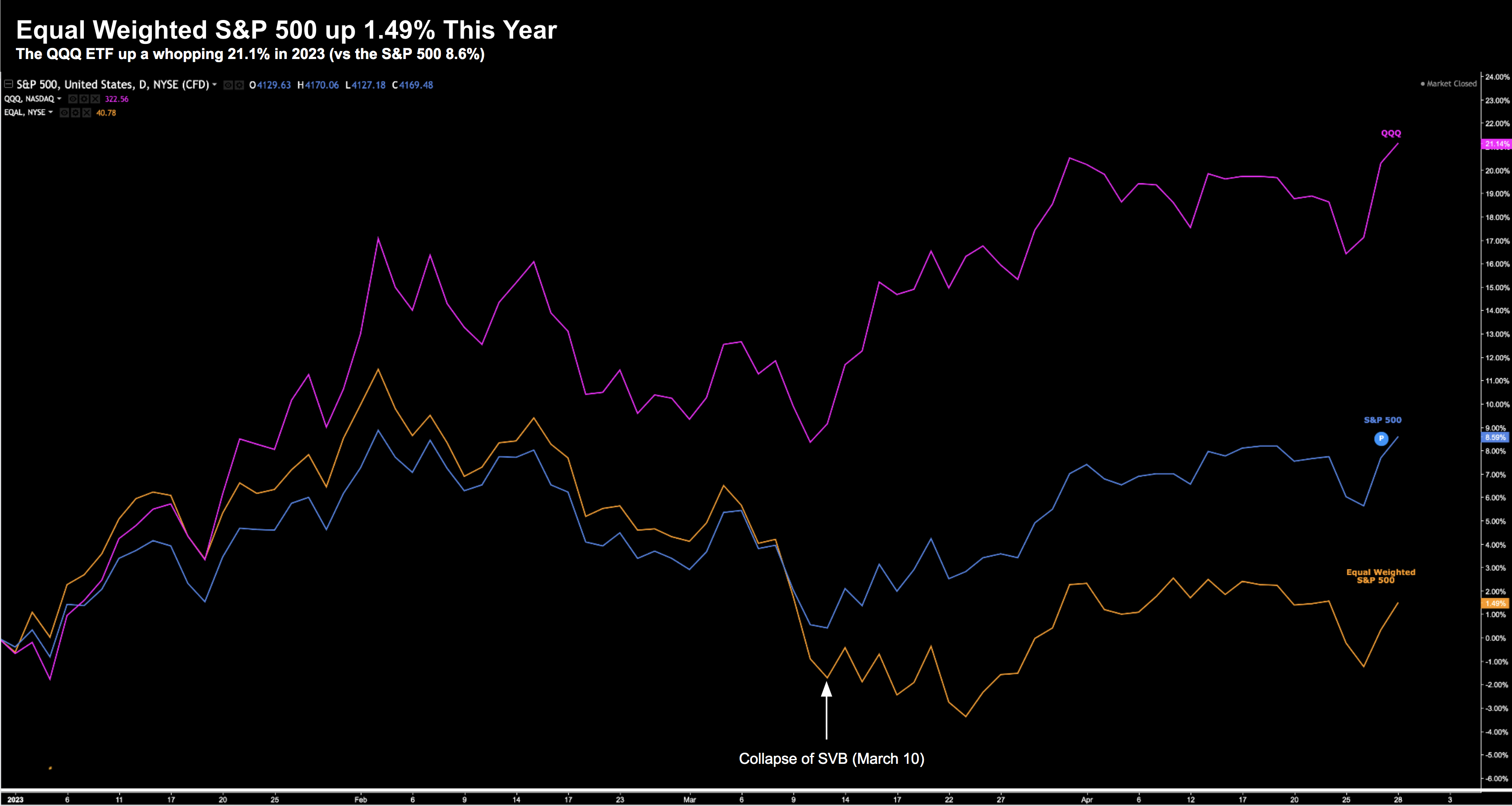

Speaking of things ‘hotter than what Powell would like’ – it’s remarkable how narrow the market has been post the collapse of SVB.

I talked about this a little while back here – citing the lack of breadth.

For example, I referred to this chart which compares the tech ETF QQQ to the S&P 500; versus the equal weighted S&P 500

April 29 2023

The divergence in these three indices should act as a loud warning (well for those willing to listen).

The collapse of SVB happened March 10 – about the same time the divergence accelerated.

Again, investors perceive large-cap names as a safe havens in times of uncertainty (e.g., given their balance sheet strength, self-funding ability; and reliable free cash flows)

If you look at the equal-weighted S&P 500 – it’s essentially flat for the year – up ~1.5%

Put another way, its largely due to large cap names (mostly in the tech space) that the S&P 500 has managed to post gains of around 8.6% YTD.

My question is whether the balance of the market plays catch up?

That is, those companies that don’t offer:

- superior balance sheet strength;

- self-funding through strong free cash flows;

- generate high profit margins; and

- operate with strong defensible moats

Because if they don’t – and the leadership names stumble – the market will come down very fast.

To that end, my investing mantra has been to stick with quality.

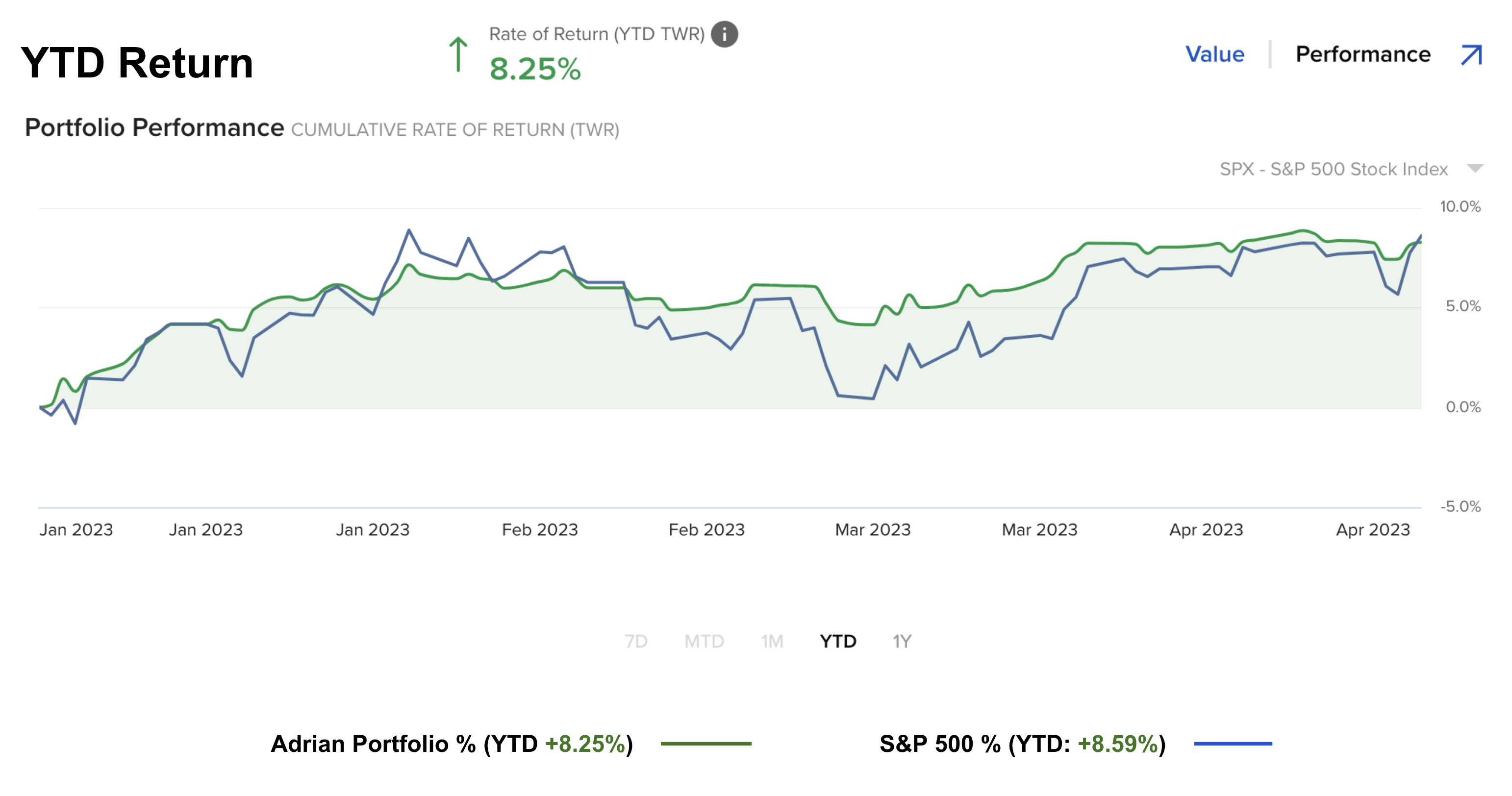

My performance so far this year is in-line with the broader S&P 500 YTD (which I will take given my 19% outperformance last year)

Again, this is a balance of playing strong defense with some offense.

Those who are too defensive will be underperforming.

And those who are taking on excessive risk (e.g. overweight tech) will show outperformance.

However, it’s my guess they probably had very poor performance last year.

For what it’s worth, I lowered my exposure to tech this year (below market weight); and increased my exposure to energy and quality large-cap banks

However, my total exposure long is about 65%

That is on the conservative (defensive) side.

For example, last week I sold JP Morgan (JPM) July $120 strike puts for an annualized yield of 8%.

Put another way, I think we would see JPM trade a bit lower (where I’m happy to own it) however I will happily be paid 8% to wait.

Let’s take a look at how things finished the week for the S&P 500

April 29 2023

For three weeks in a row – I have not needed to change this chart’s title.

It’s like watching grass grow – and why we see the VIX all the way down at 15.

The market continues to trade up against the wall of 4200 – grinding through a well defined trading range.

The question is whether the market:

- Breaks through 4200 (implying a forward PE in excess of 21x); or

- Meets resistance in this zone (which could be as high as 4300) and fails

My bet is on the latter for the reasons I outlined above.

That said, I am not shorting the market.

That would also be a mistake.

Anyone shorting the market is getting killed today.

The S&P 500 would need to rally another 10% or so for me to place short trades.

But equally – I’m not increasing my long exposure in this zone.

And whilst that will likely lead to under-performance should the market continue to rally — that’s fine by me.

My sense is the downside risks still meaningfully outweigh the upside reward.

Putting it All Together

Before I close, Factset reported where we are at the mid-point of earnings season:

At the mid-point of the Q1 2023 earnings season, S&P 500 companies are recording their best performance relative to analyst expectations since Q4 2021.

Both the number of companies reporting positive EPS surprises and the magnitude of these earnings surprises are above their 10-year averages.

The index is reporting higher earnings for the first quarter today relative to the end of last week and relative to the end of the quarter. However, the index is still reporting a year-over-year decline in earnings for the second straight quarter.

As I say, earnings so far are “better than feared” – however they are still in decline.

Here’s the thing:

Just because the market set the bar low doesn’t mean revenue and earnings are great.

Far from it.

However, that’s been the reaction from the market. As I said during the week – Meta’s stock is up ~170% from its lows opposite zero revenue growth over that time.

What we are seeing across tech is nothing more than multiple expansion.

Investors are paying a lot more for what cash these companies are generating.

And that’s fine… but they are taking a lot more risk by doing so.

I’m not willing to pay the premium being asked therefore I will sit things out (until better prices are offered)

And this is a function of your own risk preference.

Some traders and/or investors are willing to take a lot more risk; and there are others (like me) who are more conservative.

You might say I will always play far stronger defense than offense.

And this is the reason why I outperformed the market by 19% last year – strong defense. Put another way, over the past 16 months I’m still 19% ahead of the S&P 500

For me, today’s climate still calls for caution in the face of tighter monetary policy; ongoing earnings pressure; and a looming recession.

But that’s what makes a market.

How you see things will probably differ to me.