- VIX spikes as market turns

- Don’t expect to hear a dovish Fed Dec 14th

- Remain defensive and patient

Last week I said “my warning signals are flashing red“

Here’s my language:

“Before I get to the charts – major indices have been mostly flat the past few weeks. This has also resulted in the VIX dropping below 20 – which tells me investors are complacent. My warning lights are flashing red”

The VIX had plunged below 20 – which told me investors were all leaning to one side of the boat.

Put another way, they felt that very little could go wrong.

I said it’s the opposite.

As I write, the VIX has ripped back to above 22… on fresh recession fears as bond yields crash.

Let’s start with a mid-week look at the tape… followed by a discussion of how I see things looking ahead.

The VIX Spikes

I don’t pretend to have a crystal ball (I wish!) – but I have a healthy “radar” which keeps me honest.

Dec 7 2022

- First, it’s still premature to suggest I have called this reversal right. I might be right… but there is every possibility we get a very dovish Fed on Dec 14th (with a soft CPI) and the market takes off to the upside. Don’t rule that out. I think it’s a very low probability – but it’s possible. On the other hand, a hawkish Fed will sink the bulls (again).

- Second, take a look at the VIX (grey shaded area) and the green lines I penned in a few weeks ago. I suggested if we see the VIX drop to around 20 (it went to 19.1) – this is likely a sign of a near-term market top (highlighting similar events earlier this year). The VIX jumped to 22.7 in 3 days… and the market has given back ~4% so far this week. And that’s how it works.

- Third, I have had this purple shaded zone of resistance pencilled in for around 10 weeks. I felt we could easily rally to just above the 35-week EMA zone and there we would likely see resistance. Again, it’s still too early for me to call “victory” here but so far this week the price action looks supportive of my thesis.

So what’s that all mean?

In short, you don’t want to be adding to positions here.

And that’s been my narrative of late.

At levels of around 4100 on the S&P 500 – the market looks as expensive as it did when it was 4800 in Q4 2021

How is that possible?

Three reasons:

- Short-term rates are now likely to trade in the realm of 4.75% to 5.00% next year. That matters in terms of valuations;

- We are now very likely to experience a recession in 2023 – that means earnings will contract next year (not expand); and

- Forward multiples are still far too high (around 19x at 4100).

And whilst I hear people say “ahhh but stocks are 15% lower – that means they are cheaper” –– that’s incorrect.

You need to weigh each of the above three points.

And at 4100 – stocks were almost as “expensive” as they were at the market peak in January this year.

Earnings will be much lower… growth is slowing… and investors have a risk-free alternative (at almost 5%)

The Tide Turns

It feels like December is now the third tide shift we have seen this year.

For example, we first saw it in April – where stocks struggled at the 35-week EMA zone with the VIX around 20.

We saw it again in August – a similar set up.

And here we are once again.

Rinse and repeat.

In fact, I did say this will likely be a repeat of what we saw over June and July.

But if I look beyond the technicals – and what I see on a sector level – the shift in money flow has a very recessionary feel about it.

I see the outflows for growth stocks (which have high multiples) and into defensive names (e.g. healthcare).

And we obviously see it in long-term bond yields – where the 10-year yield has plunged a staggering 80 basis points in about a month – resulting in a deeper (yield curve) inversion.

In fact, just about every point along the curve is now inverted (including the popular 3-month / 10-year — another popular metric)

That’s the bond market screaming recession.

Outside that, if you listen to various CEOs this week (especially banks) — their mood is not optimistic.

- “Clearly the economy is slowing” — Lance Fritz, Union Pacific CEO

- “Next year is going to be another challenge” — Doug McMillion, Walmart CEO

- “Those things (inflation, higher rates, higher unemployment) may well derail the economy” — Jamie Dimon, CEO, JP Morgan Chase

Now I’ve been waiting (and waiting) for earnings revisions to come down and company CEO’s tell the market things are “far from great”.

And my sense is that’s what you will start to hear from around February onwards.

But not only do I think a recession is highly likely in 2023 (as I’ve been saying all year) — I want someone to explain to me how we would not have a recession?

Consider what you see (incremental to (very deep) yield curve inversions):

- PMI’s (manufacturing output indexes) are now in contraction;

- Oil is back down to $72 with a supply shortfall (and despite China relaxing COVID restrictions – presumably a driver of oil demand); and

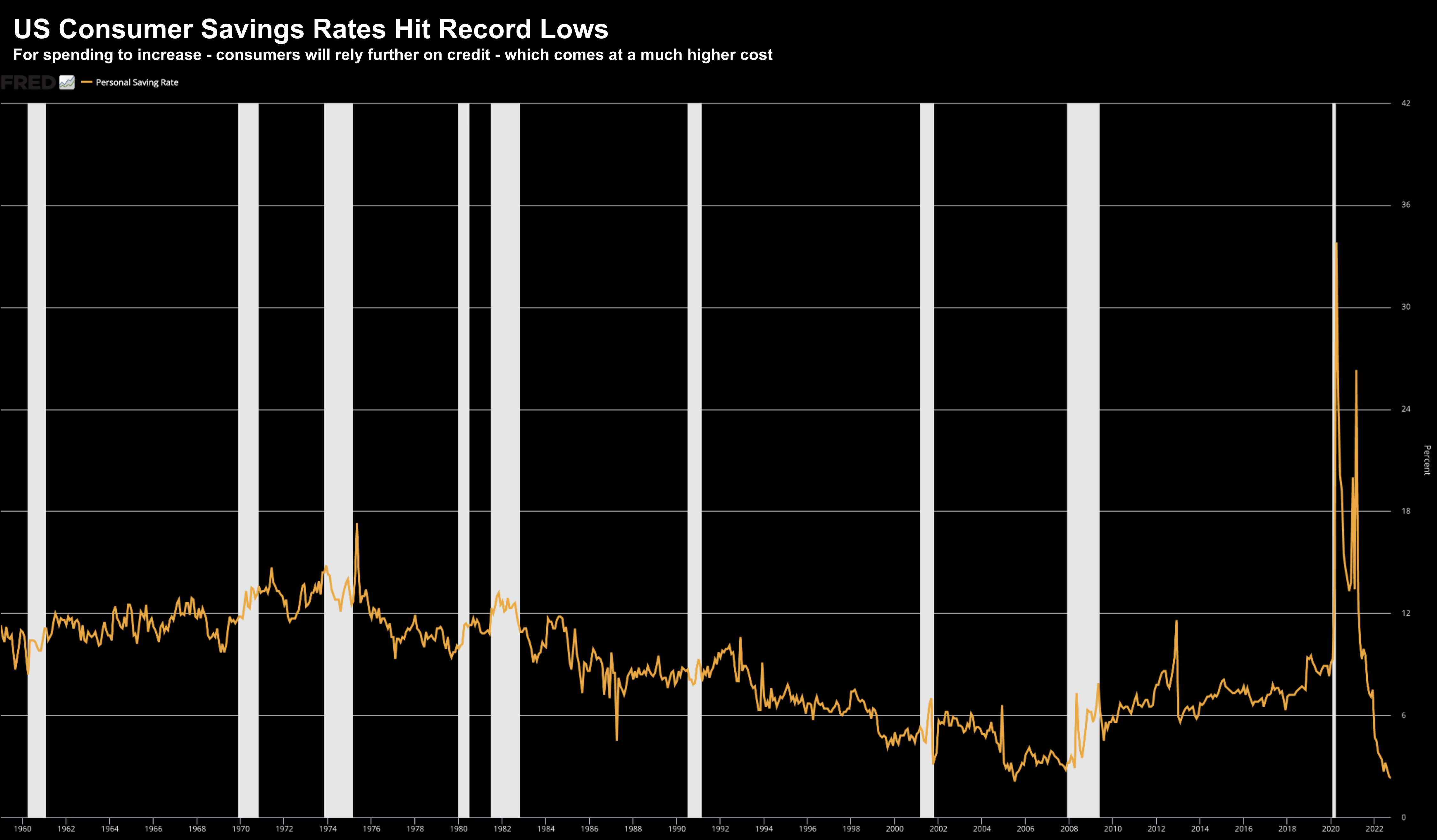

- Consumer savings are at record low levels – now drawing on credit

Dec 7 2022

But the last dominos to fall will be:

- the labor market cracking; and

- consumer spending falling

At early December – both remain intact (and perhaps why many can’t see a recession coming) – but my guess is they will come in the first quarter of next year.

And I think that’s where some analysts are coming unstuck…

With labor still strong (where unemployment is just 3.7%) — people feel the economy is very strong.

But labor has a lag effect…

It takes at least 3 to 4 quarters before the Fed’s policy starts to have an impact.

However, when this tips, it will happen with sharp velocity.

And as awful as this may sound – it’s exactly what the Fed want to see – an unemployment rate closer to 5.0%

That’s when you crush demand (and inflation with it)

Don’t Expect a Dovish Powell this Xmas

Before we close 2022 – all eyes will be on our favourite grinch – Jay Powell

Will he save Christmas?

My guess: no

But what would a Christmas gift look like for traders?

Perhaps a pause early in 2023? A pivot maybe in Q3?

Let’s play it out for shits and giggles… and Powell decides to play Santa and get dovish.

That would be one of the biggest mistakes he could make.

Powell is facing another monthly print with CPI well above 7.0%

That CPI headline number could be 7.3% (which is what is priced in) or 7.5% or even higher… but it’s coming with a 7-handle.

What’s more, we had white-hot wage inflation last week at 5.1%… something that Powell said is the “Fed’s biggest challenge”

For example, he specifically said last week that this needs to be closer to 2% to be sustainable.

How does Powell get dovish with wages growing in exess of 5.0% a year?

He has nowhere to go.

Powell may choose to moderate the pace of hikes to 50 bps for a couple of months (e.g. Dec and Feb)… possibly even going as low as 25 bps by March (if that data complies)… but he can’t hit pause for a while.

As he has told us – if he stops too early – and inflation becomes entrenched (e.g. wages at 5%) – then we are in far worse trouble than today.

And if that means he overshoots at the expense of a recession – then so be it.

Overshooting is far better than undershooting.

And right now – the market is pricing in the Fed “getting it just right”

That’s unlikely… we will see rates higher for longer.

Putting it All Together

Inflation is now trending in the right direction (i.e., lower).

That’s good news.

We can all see that. And the Fed acknowledged it.

But it’s not at the velocity that the market is pricing in.

And it’s certainly not at the velocity the Fed need.

Next week we will likely see Powell reiterate the Fed’s commitment to fighting inflation.

He will likely remain very hawkish.

Some bulls will try and look for bullish undertones (e.g., Fed moderating the pace of hikes) – but this will be a committed hawkish Fed.

Look for the 2-year to resume its upward path to 5.00% – that’s where we are headed.

The other thing is we get a “break” from the Fed in January (i.e., no meeting) – so we will have more data to come in.

And maybe the Fed will have time (in Feb) to see the lag effects (e.g. that could be a negative impact on holiday spend data — especially given the low savings rates)

In closing, we have done much of the heavy lifting on rates.

Again, that’s good news.

The rate rise cycle is maturing.

But the question is how long they maintain rates at a high level (e.g., north of 4.50%)?

That’s where I think the market remains (potentially) offside.

Stay patient…

I think we get another solid flush with equities (which is a good thing)