- How fast? How high? And for how long?

- There’s a big difference between ‘peak inflation’ and achieving ‘price stability’

- Market far too optimistic on a dovish Fed

My last missive offered 4 key hypothesis I have going into year end:

- The US economy will fall into recession in 2023 (based on leading financial indicators; e.g., a deeply inverted yield curve);

- Earnings will contract between 5-10% (currently not priced into the market);

- Short-term rates are likely to be at least 4.75% – implying a fair market forward PE multiple of 15-16x; and

- The Fed have not finished tightening

We will see how I go 12 months from now.

Who knows – I could be wrong on all four counts.

Today I want to expand more on the last point; i.e. why the Fed has not finished tightening.

And if you want to ‘fight the Fed’… well that’s your decision.

I wish you well.

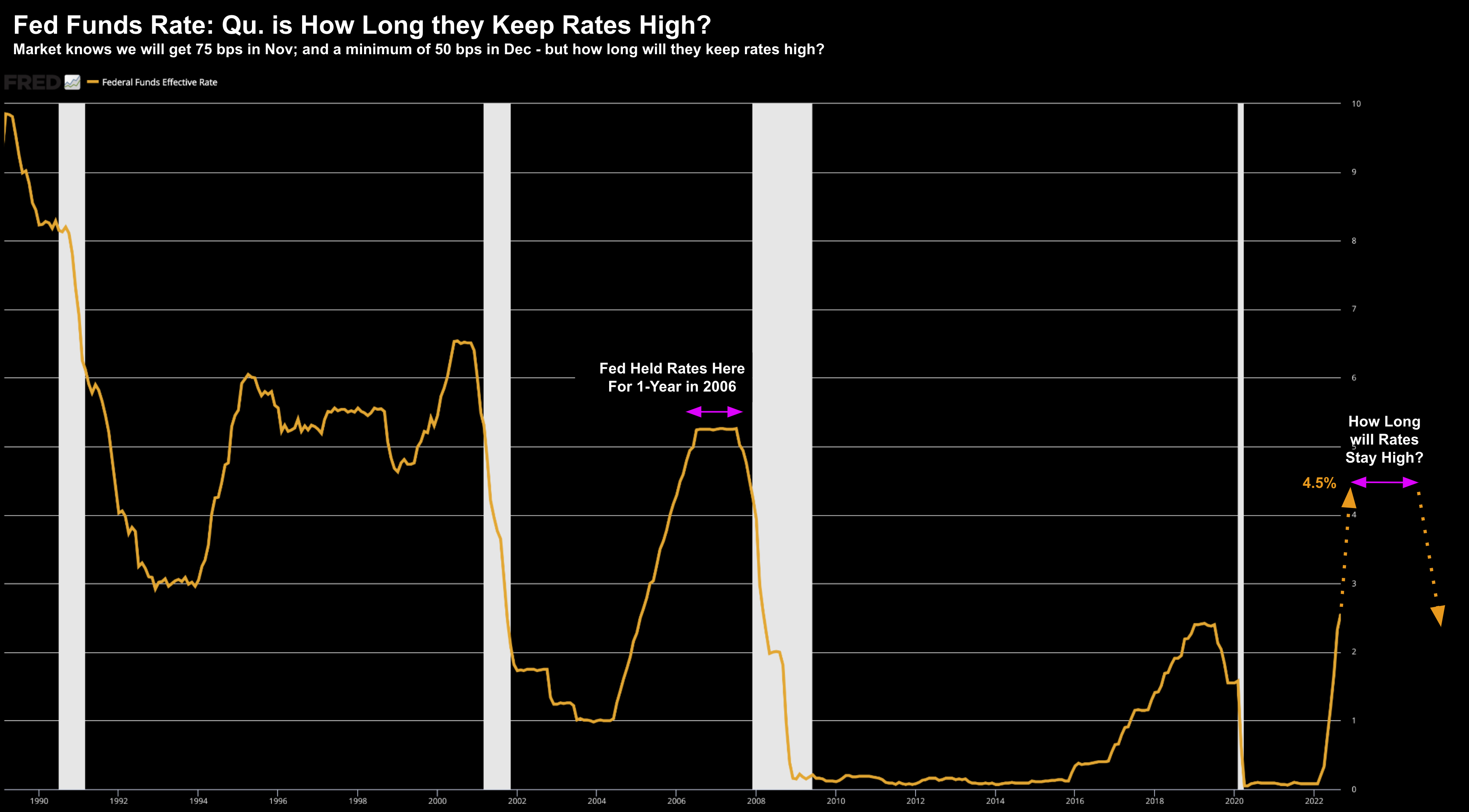

Now mainstream media (perhaps investors by proxy) continue to anchor more on what the Fed terminal rate will end up being.

For example, some argue it won’t be higher than 4.50%… however some others (e.g., Goldman) are calling for 5.25% or more?

I think the terminal rate is only part of the equation; i.e. how high they go.

But what about how fast and how long?

Let’s start the discussion with inflation… and another common misunderstanding.

For example, it’s becoming more likely that inflation has peaked… but that’s a far cry from achieving price stability.

And this is why the question of ‘how long’ will soon become the focus.

Inflation Peaking vs Price Stability

Let me begin with a caveat…

I don’t pretend to know where interest rates will end up in 2023; and how long they remain there.

I also don’t pretend to estimate the timing of such things.

All I can opine on is what how it shapes my decision making (i.e. whether to take more or less risk)

Right now – I think less risk is prudent.

Now when I take a look at the most recent set up for inflation and employment – I don’t see a tremendous amount of softening.

Sure, there are pockets where prices have eased.

And some sectors (e.g., tech) are announcing long overdue layoffs (where only ~9M are employed of ~160M in total (~5.6%)

Put another way, tech sector layoffs may not move the unemployment needle a meaningful amount.

I digress….

But those small areas of ‘weakness’ are arguably not enough to sway the Fed’s “lag effects” (called out in their most recent statement).

(n.b., I’m still waiting for someone to define precisely what “long and variable” means with respect to lag effects)

For example, consider the prices received data from Manufacturing firms this month.

This went up to 34.6 from around 30 the previous month.

Now we heard a lot of fuss about headline CPI falling just 0.2% YoY – but this barely made news?

From the Philly Fed:

The indexes for prices paid and prices received continue to indicate overall price increases for inputs and the firms’ own goods. The prices paid diffusion index ticked down 1 point to 35.3. Nearly 47 percent of the firms reported increases in input prices, and 12 percent reported decreases; 41 percent reported no change. The current prices received index moved up 4 points to 34.6, its highest reading since June. Almost 38 percent of the firms reported increases in the prices of their own goods, 3 percent reported decreases, and 59 percent reported no change

My read on this is there’s a big difference between:

(a) inflation peaking (which it has); and

(b) getting back to price stability

The mainstream narrative focuses almost entirely on (a); however is largely remiss of (b)

It’s the latter which is the Fed’s mandate.

When I read this Philly Fed report last week – it only reinforced my belief that we are far from defeating inflation at this point.

For example, the current prices received index moved up 4 points to 34.6, its highest reading since June.

But I have another data point…

Consider the rent story… sticky inflation.

As I highlighted recently, rents within CPI are rising roughly inline with the headline number (i.e. neither adding or subtracting).

Think about this…

Paying for housing, food, energy are critical in terms of people’s inflation expectations.

They are all rising by at least the headline number (where food and energy are meaningfully higher).

Now the argument made about “newer rents” falling might be true…

Sure.

But existing rents (the bulk) continue to be running at almost 8% year on year.

Put another way, my landlord has not said to me “hey Adrian – I am slashing your rent next month”.

Yeah right!

I will be paying the same lease amount until that lease period is up.

Now Fed policy makers see this – but do markets?

Reality is inflation is still a problem.

And whilst certain items may have come down (e.g., apparel and used-cars) – may stickier elements remain as just that! Sticky.

Headline CPI starts with a high 7-handle (globally)

And until the excess liquidity / stimulus (which was run for too long after the pandemic) is “soaked up” – it will remain a problem.

Excess money chasing too few goods and services.

Here’s how I think we should frame any discussion around monetary policy:

- How fast the Fed raises rates;

- How high they raise them; and

- How long will they stay there?

How Fast / How High / For How Long?

That’s how I’m thinking about monetary policy today.

For me, the more difficult question is not how high (which many are anchored on) — it’s the latter.

If we start with how fast – they have clearly signalled they are going to slow the pace of increases.

Powell made that very clear in his last statement.

For example, the market is now pricing in a 50 bps rate rise in December… and pending what we see with inflation and employment… perhaps only 25 bps in January.

But don’t mistake that with them being ‘dovish’ (as many are).

The good news is the bulk of the heavy lifting (if you like) has now been done in terms of pace.

In terms of how high and how long — we don’t know.

For now, the 2-year yield is our best proxy as to how high:

Nov 19 2022

As I’ve been suggesting for a couple of months – this appears to be in the range of 4.75% to 5.00%

It could easily go higher – but this is where we stand now.

What’s more, the market has this fully priced in (but arguably not higher than 5.0%)

This now brings us to how long?

This is where the market could be offside.

For example, I think the market believes the Fed will get to 4.75% – 5.00% and then quickly move to cut rates thereafter.

I say that because some see cuts towards the end of the year.

From Forbes:

In 2023, the first half of the year is expected to see the Fed reach a point where it can hold rates steady. However, the second half of the year depends on how the economy fares, if it weakens, then the Fed could be cutting rates later in 2023.

This now becoming consensus among most analysts…. however I think that’s highly presumptuous.

For example, a few weeks back I shared how the Fed held rates at ~6% for a year in the lead up to the last recession.

Who says they can’t again?

Of course they can.

And if so – what does that mean for equities?

S&P 500 Hits Pause

Monetary policy – more than anything else – will determine where this market goes.

Period.

The sharp (expected) rally of the past few weeks was due to markets leaning towards easier conditions to come.

They are starting to price in one or two cuts in the second half of 2023.

Again, that’s ambitious given there is very little in the data to suggest we have decisively won the battle with inflation (i.e. where winning means a stable rate of 2%)

Now markets took a breather this week.

And as I will show in a moment — we are trading close to what I think will be a “zone of resistance” (where valuations are also expensive).

This week is Thanksgiving in the US – which marks the official start of the 2022 holiday season.

And given there are no Fed interest rate meetings until Dec 14 (we get Nov CPI on the 13th) – I don’t see markets moving meaningfully either way the next 3 weeks.

That said, we know that markets are traditionally strong during the fourth quarter.

So don’t be surprised if the S&P 500 challenges the zone of 4100

Nov 19 2022

Very little has changed in my commentary over the past ~6 weeks

For example, note the white dotted lines I sketched in on October 3rd (showing the expected rally)

Oct 03 2022

You might say things have “traded per the script” — pretty much as they have all year.

From here, we could see markets move up to the tune of 5% ahead of the Fed meeting.

But I would not be adding to positions…

The S&P 500 is fully valued at current levels. For example, if we assume earnings next year will be around $210 per share (at best) – 4100 sees us trading at 19.5x forward

That’s a frightening number opposite interest rates north of 4.50%

The smarter (patient) play is to wait for a retracement early next year.

Putting it All Together

What we know about the US 2-year yield is it reflects Fed policy expectations.

In other words, expect rates to trade somewhere in the realm of 4.75% to 5.00% next year.

That’s the “how high”.

We also know that the pace of rate rises will likely slow – given how far we have come.

That’s the “how fast”.

But where the market could be caught offside is how long?

I doubt it will be a case of “hitting 5.0%” and then soon after – pushing for rate cuts.

That’s presumptuous and would assume something very bad has happened (e.g., widespread default).

At this stage (and it’s a function of both employment and inflation) – we could see rates trade north of 4.75% for most of next year.

But that’s not what the market is pricing.

Now in terms of the longer-end (e.g., 10-year yield) — this indicates what’s next.

And based on the relative depth of the 2/10 inversion (which isn’t finished) – we are headed for a major economic slowdown (i.e. recession)

The Fed is not oblivious to that.

And if anything – it’s by design.