- A “20%” fall by mid-October according to one manager

- Why forecasting is near impossible

- Stocks make another technical bounce

However, be careful reading too much into it.

Valuations are not cheap.

I will update the weekly chart shortly – but before hand it’s worth repeating language from Fed Chair Powell this week on monetary policy:

Odds now favour a 75 basis points for September – and if correct – will see the Fed funds rate at 3.25%

Beyond 2022 – I would also not be surprised to see short-term rate challenge 4.0%

Remember:

If we see 4.0% nominal rates – the real Fed funds rate is likely to be negative when adjusted for inflation.

Therefore, you need to ask how ‘restrictive’ 4.0% will be?

I don’t know.

Whatever the case, forecasting monetary policy (and macro events) is very much a fool’s errand.

For example, can you tell me (with precision) what:

- inflation (Core PCE and CPI) will be in 3, 6 and 12 months?

- whether there will be recession in 2023; and how deep or long it will be?

- what the unemployment rate will be in 3, 6 or 12 months?

- where the 10-year yield will be; and how far the Fed will raise rates?

- how will the war in Ukraine end; and where oil prices will be?

- will China invade Taiwan; and what impact will that have on US / China relations? and

- who will win the election in 2024?

They might have an opinion but the truth is they don’t know.

But turn on the TV and there is no shortage of ‘financial experts’ that can tell where prices are going to be – advising you on things like foreign affairs, politics and interest rates.

Reality is they don’t know a lot more than anyone who has access to the internet and the news.

But they think they know…

Repeating an apt quote from economist John Kenneth Galbraith:

Most belong in the latter category.

The unfortunate tendency (and I’m often guilty of it) is leaning into information that confirms some pre-existing bias.

A good example is say left-leaning people only watching CNN; and right-leaning only watching Fox.

You listen to what you want to hear. And anything else you automatically think is ‘rubbish’.

Right?

But confirmation biases are typically proven wrong. The idea is to eliminate them (or as a minimum – ‘stress test‘ them)

Which brings me to the heart of today’s missive…

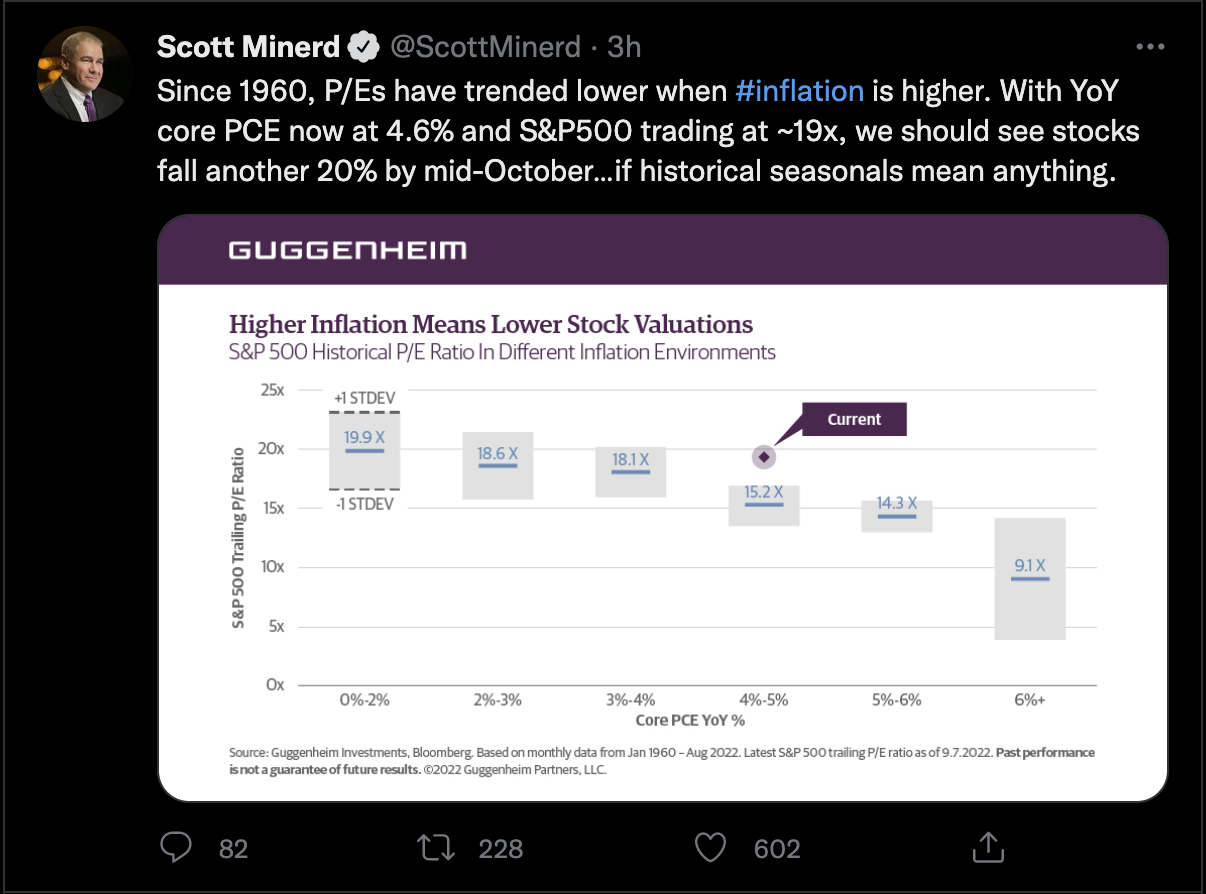

A ‘foolish’ forecast from the CIO of Guggenheim (who has ~$325B in assets under management)

Foolish Forecasts….

Twitter: Sept 8 2022

Minerd is willing to forecast that stocks will fall 20% by mid-October.

He has the ability to not only answer some (or all?) of the questions I posed above – but also knows where stocks “should be” in ~5 weeks time.

Wow!

What an ability.

I certainly don’t have it… not even close.

But for what it’s worth, I generally agree with Minerd’s sentiment.

And who knows – he might be spot on and people will be calling him a genius.

However, rarely you will hear about the “20” other forecasts they made which were wrong (e.g. not unlike the long list of “doomsday” callers who get one call right every 10-15 years).

I digress…

Earlier this week I made the argument that PE’s were far too high given the environment.

Minerd is coming from a similar lens.

My argument was we need to be mindful of potentially higher bond yields and less liquidity; however Minerd cites high inflation.

In this case, he argues forward PEs are 19x... which would imply EPS of $210.

I came to a similar number based on market expectations for 8% growth in 2023 were optimistic ($240 forward).

For example, tightening cycles will typically result in EPS decline (not growth) – e.g., where 2015 saw a decline of 2%.

And if a decline of 2% is correct – it would put EPS in the range of $210 to $215.

Applying a 15.2x multiple (at 4-5% Core PCE) — we get:

$210 x 15.2 = 3192 (or ~20% lower than today)

Again, I get his sentiment and I’m not saying it’s wrong.

However, to say that “should” happen by mid-October is ambitious.

I don’t have that ability.

In this case, Minerd is drawing on historical seasonality — where September through early October is often poor.

Therefore, if we are to see a ‘20% swoon’ – you could argue it lines up well with history.

S&P 500: A Technical Bounce

Over the past three weeks – the market gave back around 10%.

That’s a very sharp decline in a short space of time. Therefore, it’s not unexpected to see some short-covering.

For example, it was the high-beta stocks (e.g., “Cathie Wood” names) rallying (not low-beta).

This tells me it has been more short-covering than quality buying… and I think negative sentiment still remains high.

Let’s take a look:

Sept 9 2022

What’s more, there’s nothing yet which suggests we have a strong catalyst to move it higher.

For example, the Fed is now in a “blackout period” until their next statement on monetary policy (Sept 20-21)

We get CPI next Tuesday which is likely to drop from 8.5% to something with a 7-handle.

And the market knows that.

But my feeling is a CPI drop from 8.5% to “7.5%” will do nothing to shift the Fed’s sentiment on aggressive hikes

As I say, going from “9 to 5” will be easy enough.

Year on year comps get easier as time goes on.

What’s more – commodity prices have fallen sharply as demand slows and supply chains ease.

But let’s see how we go from 5% to 2% (with wages and rents still rising)

Repeating my sentiment of the past few weeks – be wary of chasing bear-market rallies.

They are likely to be short lived.

Putting it All Together

And when it comes to forecasting economics (and the impact of stock prices) – it’s near impossible

Most forecasts (or models) are made along the lines of:

“If A happens, then we are likely to see B”

For B to be the result, then A needs to be accurate.

Now here we are trying to model the behaviour of ~330 million US consumers (not to mention tightly inter-rated economies)

Hundreds of millions of consumers, workers, producers, and intermediaries… where we are trying to forecast their behaviour.

What they spend and borrow across tens of billions of transactions.

And none of it in a vacuum.

For example, what will consumers do if:

- They get one less dollar of income?

- Lose their job?

- Prices at the pump rise 10%?

- Mortgage rates go higher?

- Etc etc

It’s beyond complex and rarely (if ever) do economists and/or central banks get it right.

They can’t.

And yet, there is no shortage of “media experts” telling us where things are headed in the “next 5-weeks”.

My foolish thesis is this:

- Stocks feel expensive given the environment of higher rates and less liquidity;

- Earnings growth tends to fall during tightening cycles (not expand); and

- The Fed is yet to give any indication they’re likely to either ‘pause or pivot’ (or start adding back liquidity)

Up one day and down the next. Rinse and repeat.

However, for me it’s hard to argue why stocks are set to rally meaningfully higher in the near-term.

And from there, the downside risks feel like they handily outweigh any upside reward.

That’s where I am.

But equally, this doesn’t mean stocks “should” plummet 20% in 5-weeks either.

However if they do… fantastic… my long-term risk /reward equation improves a great deal.