- A myriad of ways you can invest in bonds

- Evaluating the risk/reward of each pathway

- Compelling reasons to increase exposure to fixed income

If you’ve been following my posts the past few weeks – I’ve suggested it’s a good time to start increasing your exposure to bonds.

As part of these missives – I’ve also had many reader emails asking me how?

Good question!

This missive will offer you a guide on some of the simple ways you can increase your exposure.

But let me offer a caveat… bonds are not risk free (nothing is)

As with equity investing – you should always consider your own risk profile and financial position.

What works for me may not work for you.

But first let’s set the scene as to why. And from there, I will follow with the what and the how.

Why Bonds Look More Compelling

Over the past three years – fixed income investors have been crushed.

In short, the prices of bonds decrease when interest rates rise.

Given we have seen the Fed funds rate go up more than 500 basis points over the past 18 months (the fastest increase in 40 years) – it’s caused widespread losses in bond markets.

It arguably caused three banks to collapse (due to forced (premature) sales of bonds which were underwater).

For example, consider the widely-held long-term (20+ year) treasury bond ETF TLT

October 29 2023

This $40B Bond ETF has lost the equivalent of 17% per year for three years.

And whilst these are a proxy for long-duration – the 50%+ price correction is indicative of what we’ve seen across the fixed income market.

The devastation is not unlike what we saw with equities in 2001 and 2008.

But I will go one further…

This is the worst three-year period for bonds since the 1780’s.

George Washington was President – where the fledgling U.S. was trying to figure out how it was going to pay its debts.

Over 200 years later and it’s still trying to figure out how to pay its debt!

I digress…

Now at some point (e.g., when the supply / demand equation shifts) – these assets will catch a strong bid.

But we are not there yet…

That’s when investors will decide the value is just too compelling.

Now we’re starting to see a sentiment shift in 2-year bonds – as these yields stabilize (i.e., there are buyers at 5.0%+)

And should economic growth slow next year (my expectation) – it follows that yields will fall.

Put another way, buying will start to extend along the curve.

If correct, the price of bond ETFs like TLT will rise.

To give you an idea of the potential capital appreciation in bonds:

If 10-year yields fall ~0.5% (back to 4.50%) – the respective bond price would gain ~13%

You can read more about my thinking on bonds here.

Now you know the basics of “why” – let’s talk about the “what” and “how“.

How to Invest in Bonds

There are a number of ways investors can play the fixed income market.

I will explain at least four ways – starting with US treasury debt.

#1 – US Treasury Bonds

Perhaps the most direct way to own U.S. government debt is via the Treasury’s own website.

Alternatively, you can also do this via most leading banks and/or brokers.

But my personal preference is through exchange traded funds (ETFs)

If choosing an ETF – you can find any duration you wish.

For example, iShares offer the following three types of duration exposure:

This list is intentionally not exhaustive. There are many similar bond funds available.

For example, for long-term exposure, I’ve started accumulating Vanguard’s ETF EDV – which has a lower expense ratio than TLT.

But an important point to note is the concept of duration risk when choosing the fund.

For example, there’s far less duration risk in the SHY (1-3 Year) vs say the TLT (20+ Year)

I explained this concept in a recent post:

The good news is we’re now seeing safety in the front-end of the curve (e.g., what we see with the 2-year yield).

The 2-year has been fairly steady of late despite the action in the “10s” – in turn causing the un-inversion of the 10-2 yield curve (which bond investor Bill Gross said will likely turn positive this year)

For example, up until the last couple of months, there has been an argument that even the 2’s were not safe. I say that because there was uncertainty around where the terminal rate was for the Fed. In other words, how many more hikes were there to come?

That’s now changed. The 2’s are now seen as a much safer place to be and it’s attracting buyers… which is keeping yields steady.

Now to be clear, we don’t see this in the 10’s just yet – but it will come. And if the Fed is more or less done (and I think they’re close) – then it’s safer to start buying 2’s.

Let’s now turn to another form of government bond – however this one offers added tax advantages.

#2. Muni Bond Market

Muni bonds are perhaps the most popular market for individuals due to their compelling tax benefits.

Similar to treasuries – these are also looking very attractive at current yields.

For example, you can get 5.0% long-term returns on Munis with the added tax benefits that Treasuries do not offer.

Some ETFs to consider include (not limited to):

Now the tax equivalent yields on these bonds are getting closer to matching equity like returns (almost 8% in some cases).

I think these also warrant a place in your portfolio.

#3. High Yield Market

Let’s say you are less interested in the tax advantages of a Muni bond – and you’re seeking yields closer to 8% or 9%.

As Howard Marks of Oaktree pointed out in his latest memo (where I summarised his note here) – these yields are almost competing with the 100-year average annualized return of the S&P 500 (which is around 10.5% inclusive of dividends).

Naturally, with yields in this range, it comes with higher risk (not unlike equities)

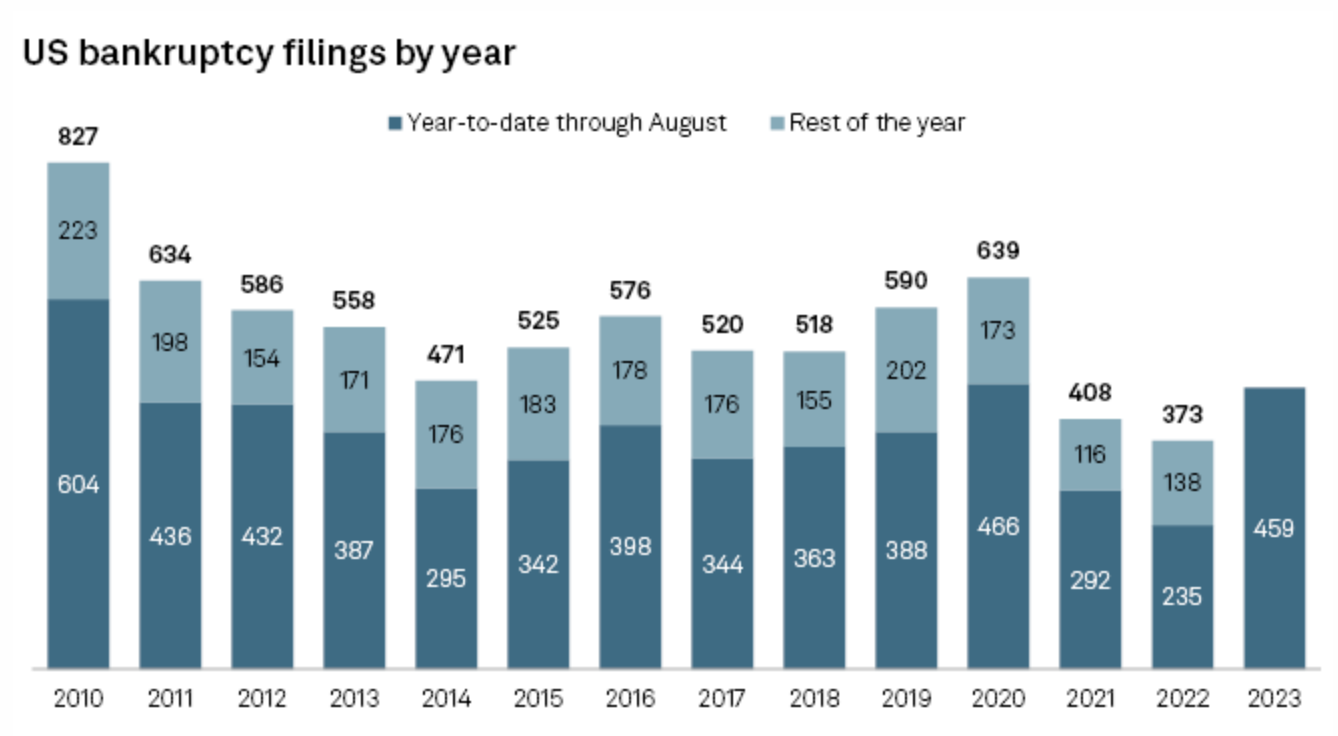

For example, corporate bankruptcies are as high as they have been since 2010 – up something like 30% on last year.

Expect these to increase as yields remain high.

But that’s why you can demand a yield in the realm of 7-9% or more.

For example, when credit conditions were more favourable – the returns were closer to 4-5% for high-yield debt.

That doesn’t add up – you were better off owning the equity.

That said, there are “safer ways” to play high yielding corporate debt (but they are certainly not risk free)

For example, ETFs in this category include (not limited to):

An important point of difference here:

- OSTIX is an actively managed fund; vs

- HYG and JNK are Indexed based (and lower cost)

You should inspect each of these ETFs to see exactly the companies, quantity and concentration of debt they’re holding.

I’ve recently started adding exposure to HYG.

#4 Investment Grade Corporate Debt

The last approach I want to share is investment grade corporate debt.

The returns here are higher than government debt (due to the risk); however less risky than high-yield.

In this instance, yields are in the realm of around 6% (where debt includes the likes of say Apple, Google, Microsoft, Coke and other quality names)

An ETFs to consider here is iShares iBoxx Investment Grade Corp – LQD

As an aside, when we were at the peak of the pandemic – the Fed said they were willing to step up and buy LQD.

As soon as this was announced – its price rocketed higher.

Note: an alternative to LQD is iShares AGG – however AGG also includes a blend of treasury debt (about 42%)

Putting it All Together

In “Rethinking Asset Allocation” – I explained why I felt the longer-term risk/reward for bonds was now starting to make more sense.

Three reasons (perhaps not limited to):

- Longer duration bonds are getting to a point where the value is just too compelling. When we consider 5-year, 5-year forward inflation expectations are 2.5% – this tells me the 10-year at 5.00% is value. Typically the difference between the 10-year and inflation expectations is closer to 1.0% to 1.5%

- If Real GDP growth is to trend back to levels of 2.0% (or less) next year (which I expect) – and you’re getting the 10-year at 5.00% – that’s a great deal. Over time, the 10-year yield will track real GDP.

- If you’re of the view inflation is trending lower (meaning the Fed will move back to easing within ~12 months) – bond investors will see capital appreciation

For example, when the US 10-year traded at 4.00% and below – you were arguably better off in equities.

And when these yields were below 3.0% – you really had to question your exposure to this debt.

Not now.

These yields are closer to 5.0% and could easily trade higher (given the current supply / demand imbalance in the market)

But at a guaranteed 5.0% – with the prospect of capital appreciation – this is starting to make a more compelling argument (especially in a slower growth environment)

If you are new to bonds – I consider starting at the shorter-end with the 2-year.

They do not carry the same duration risk as the 10+ year.

I highly doubt you will lose money (given you have the buffer of a guaranteed 5% return).

However, if you have a longer-term (3+ year) lens – you can start accumulating longer-term duration.

There’s no need to be too aggressive yet.

For example, if we see the 10-year yield inch higher (e.g., 5.25%) – consider adding more.

I don’t think anyone will be able to predict the top in yields.

In any case, you have a number of different bond vehicles to choose from.

Each has their own risk profile and none are risk free.

Typically if it’s a higher return – it implies higher risk.

Please carefully choose what’s best for you and your own financial position.