- Core CPI still uncomfortably high for the Fed

- Bond yields could leg higher given the torrent of debt issuance coming

- Why the market wants to see strong revenue growth this earnings season

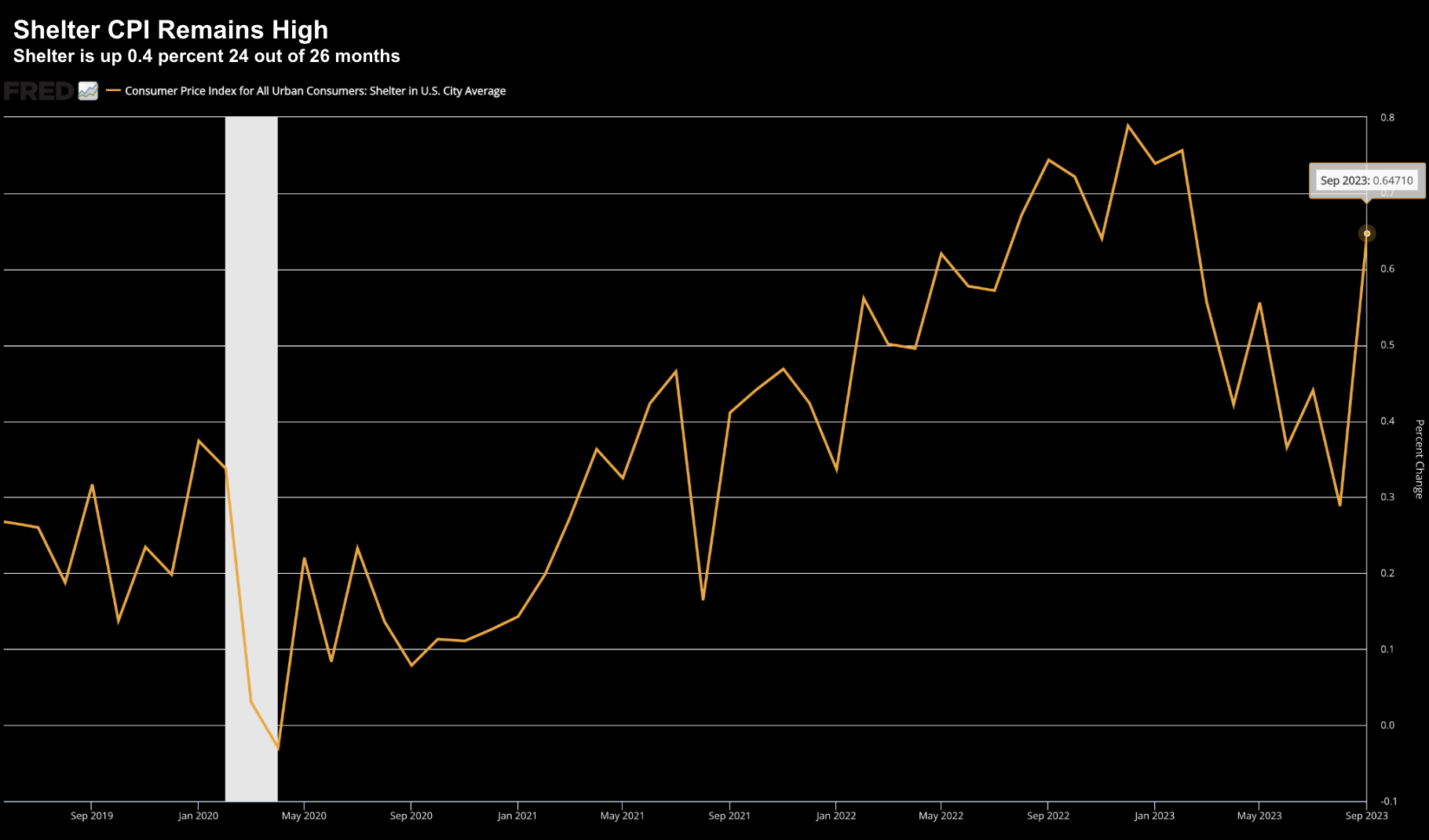

If we needed a reminder on how persistent some components of inflation are – we got it this week.

Core consumer price inflation (CPI) remained more than double the Fed’s target rate – with rents surging to 0.65% month-on-month.

And whilst both headline and core were largely inline with expectations, inflation remains uncomfortably high.

Translation: expect rates to remain higher for longer.

Let’s recap the print from CNBC:

- Headline CPI increased 0.4% on the month and 3.7% from a year ago, above respective forecasts for 0.3% and 3.6%.

- Core CPI increased 0.3% on the month and 4.1% on a 12-month basis, both exactly in line with expectations.

- Shelter costs were the main factor in the inflation increase, accounting for more than half the rise in CPI.

- Real average hourly earnings fell 0.2% on the month but were up 0.5% from a year ago.

The good news?

Inflation is well off the peaks we saw a year ago.

The bad news?

Core CPI remains stubbornly high at 0.3% MoM and 4.1% YoY.

As soon as the number hit the tape – probabilities of an additional 25 bps hike went up.

Markets had not priced that in.

What’s more, the probabilities of rate cuts next year dropped.

Let’s dig into the numbers… and where the Fed has a problem.

Shelter Remains Sticky

To set the narrative – let’s go back to this post from August 10th:

“Why Core Inflation Will Remain Sticky”

At the time, my sentiment was at odds with the market.

Market participants all but assumed inflation was ‘licked’ – a matter of time before the Fed would be cutting rates.

Whilst the market applauded the softer headline number – what deserved closer scrutiny was Core CPI and specifically shelter costs.

I added “about two-thirds of the monthly inflation increase came from shelter“

Repeating some of my language from two months ago:

My thesis is Core CPI will continue to remain well above the Fed’s 2.0% objective well into 2024 (and maybe beyond). If true (and I might be wrong) – it means the Fed are likely to keep rates higher for longer (e.g. above 5.00%). There is just one problem…. that’s not what the market is pricing in

Since then the market has lost ~6%

It’s slowly coming to terms with how sticky inflation is proving to be.

But let’s lean into the data…

For example, rent of primary residence, the cost that best equates to the rent people pay, jumped 0.65 percent month-on-month

October 13 2023

But hang on Ade, I’ve heard rents are falling?

That might be true for the signing of new leases. However, existing leases keep rising.

Existing leases far outnumber new leases.

But take a closer look at the chart above…

Rent of primary residence has gone up at least 0.3 percent for 26 consecutive months!

In fact, the only time in three years it has not risen in any one month was May 2020 – during the depths of the pandemic.

But here’s the kicker:

~34% of all Americans rent.

Again, from CNBC:

Just because the rate of inflation is stable for now doesn’t mean its weight isn’t increasing every month on family budgets,” said Robert Frick, corporate economist with Navy Federal Credit Union. “That shelter and food costs rose particularly is especially painful.”

For the record, food prices were up 3.7% YoY.

And this is where Americans feel the most pain: shelter, food and energy.

Watching Bond Yields

The ‘uncomfortably high‘ CPI print will undoubtedly sow seeds of doubt opposite a decision to potentially pause.

For example, prior to this print, we had a number of Fed officials express the sentiment “the 10-year is now doing the work for us – we may be able to pause”

Yes, the good news is financial conditions have tightened considerably.

That’s helpful in the fight against inflation.

However, with Core CPI trading with a 4-handle – there’s clearly more work to be done.

We cannot rule out further hikes.

Now the next rate hike might not be November or December – but if core continues to remain sticky – expect stickier rates.

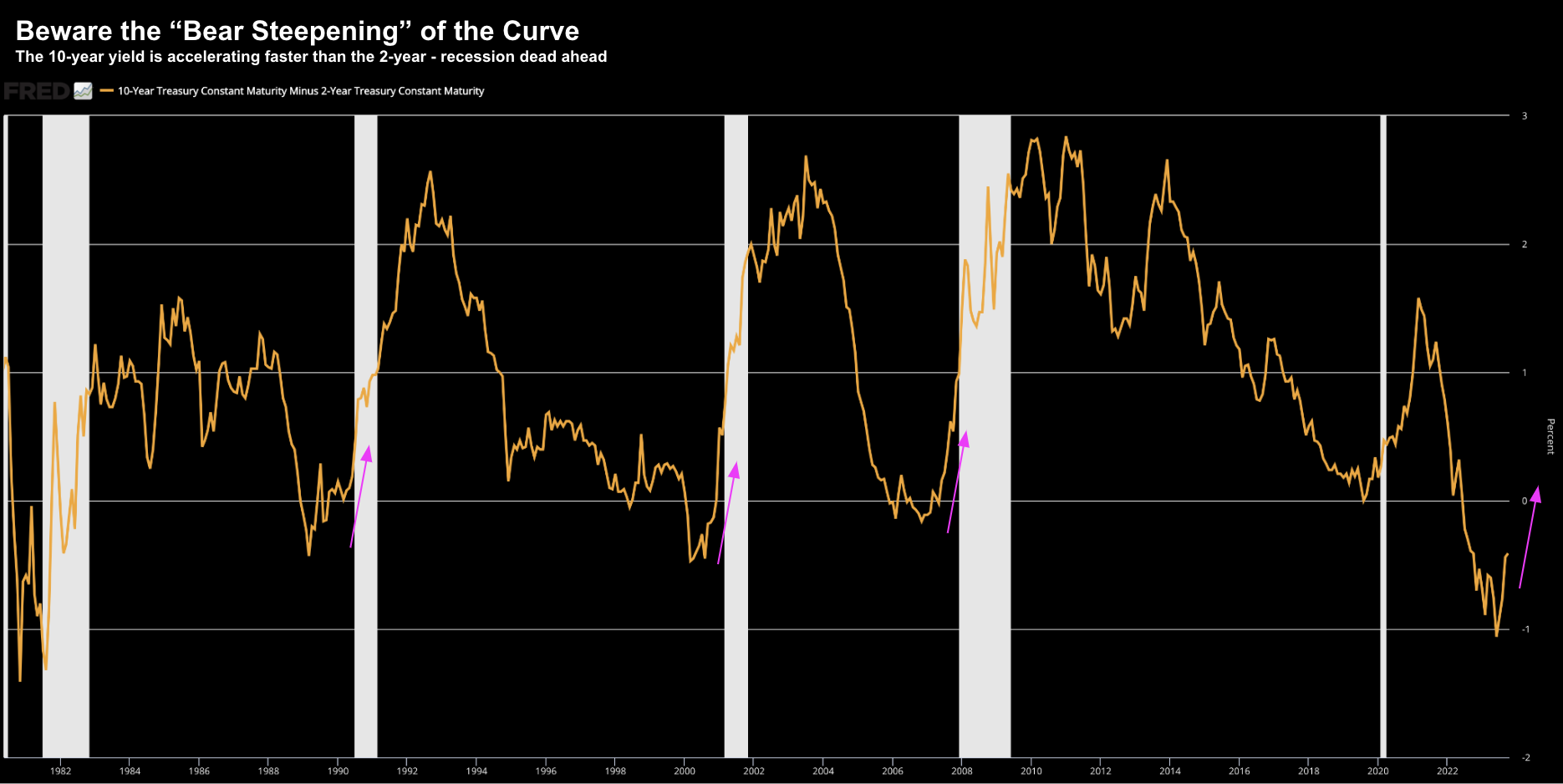

To that end, let’s come back to the bond market.

Fed officials are right the bond market is finally doing what the central bank hoped it would 12 months ago.

October 13 2023

10-year yields peaked at 4.887% last week… the highest we’ve seen in 17 years.

This week, the bond market was able to process two key data points:

- moderately strong jobs report (where yields fell); and

- yesterday’s uncomfortably warm CPI (where yields jumped).

Perhaps what trumps each of these data points is what’s coming at the end of the month.

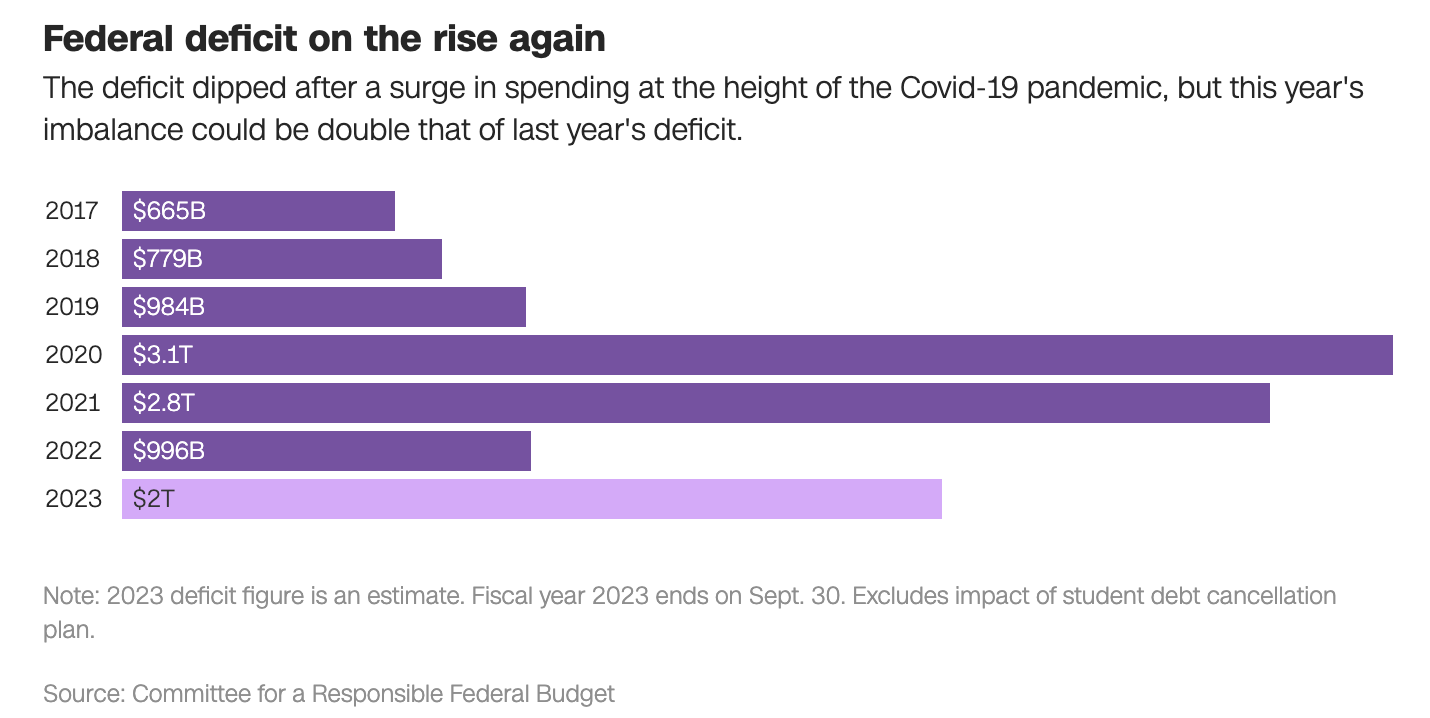

Here I’m talking about what Janet Yellen plans to announce in terms of new government debt issuance.

For those less familiar, as part of my last post, I said the “nail in the bond coffin” was July 31st 2023.

This date coincided with the S&P 500 market top for 2023 (July 24).

On that day, Yellen told us the government was about to increase treasury issuance by one-third more than expectations.

Yields surged and stocks fell.

So here’s my question: will the former Fed Chair repeat the dose?

I think so.

For example, one thing I know is the Treasury Secretary is going to announce a massive deficit that needs to be financed.

CNN offered this troubling graphic:

If you want to know why rates are surging (and going to stay high) – there’s your answer.

A $2+ Trillion deficit in 2023… with no emergency!

During times of economic strength – you run fiscal surpluses. In other words, you fix the roof when the sun is shining.

And during times of crisis – you have the optionality to fund a deficit.

So where’s the crisis today?

And now there’s talk of Congress seeking a similar $2 Trillion deficit next year?!

Now this kind of fiscal recklessness ‘may’ work with rates “below 2%” – but they don’t work with rates north of 5%

Someone tell Congress…

I digress…

Now Yellen has a choice at the end of the month:

- Issue longer-term (10 and 30-year bonds at rates of ~4.60% to ~5.00%);

- Fund the government’s excessive spending with shorter-term Treasury bills (at rates above 5.0%)

My guess – she will continue with bonds.

The problem of course is the market will need to absorb this torrent of debt – which will come at a lofty price.

As an aside, Treasury bond auctions this month have been terrible. There are no buyers for this debt. From Yahoo Finance:

- The US Treasury sold $20 billion of 30-year bonds, but dealers had to take up more supply after investors balked.

- The soft auction sent yields on longer-dated Treasurys sharply higher.

Remember – the Fed is no longer participating in any bond buying (that was QE).

They’re reducing their balance sheet (QT) to help combat inflation.

Excessive government borrowing and spending works against the Fed’s objectives to beat inflation.

So what we have is a new supply demand dynamic for US Treasuries.

Here’s the lesson:

Econ 101: make more of something – it becomes worth less.

In this case, that ‘something’ is US government debt. And that debt is becoming worth less – meaning their yields go up.

To that end, I would not be surprised to see the 10-year challenge 5.00% to 5.25%

And if so, this would see a dramatic (bear) steeping of the yield curve – from inversion – cementing my argument for a recession next year.

October 13 2023

Do I think the 10-year could go appreciably higher than 5.25%?

Hard to say… maybe… but I doubt it.

From mine, the market and the economy is very close to “crying Uncle”.

But with the government wanting to continue to finance excessive spending – it will only help keep a floor under these yields.

And at some point, the bond market will force the government into (much needed) austerity.

Again, this is Econ 101.

Stocks Feeling the Heat

Higher yields don’t make it easy for stocks to rally.

In short, higher yields will likely result in multiple contraction.

I’ve been saying it all year – like a broken record.

We’ve seen a little bit of that the past few weeks – but I think there’s more to come.

For example, at the time of writing (Oct 13) – the S&P 500 trades at a forward PE of ~18.5x

That’s an earnings yield of 5.4% (i.e.,1/18.5)

Put another way – you’re receiving zero premium to what you can earn risk-free from a 6 month treasury at 5.55%

What’s more, if we’re to head into a recession in 2024 (which is my base case) – the “E” in PE will come down.

Therefore, why pay 18.5x for stocks?

That’s the question investors should be asking themselves:

What is the equity risk/reward here given the likely upside bias with rates?

Let’s turn to the weekly chart…

October 13 2023

Whilst it was technically a positive week – the trading action was sub-par.

Stocks rallied earlier in the week – but were unable to hold the momentum.

You can see how the weekly candle pressed the 10-week EMA (red-line) and was rejected.

Note – the earlier momentum we saw in stocks was entirely due to the 10-year pulling back from 4.88% to levels of ~4.55%. However, as soon as the 10-year rallied back to 4.70% – stocks sold off.

We’re at a very interesting juncture…

The bulls have lost momentum – as we see with the weekly-MACD (lower window)

And whilst we found expected support around 4200 – will it hold?

On the bulls side – we are heading into a seasonally strong time of year.

November and December are typically the strongest months.

What’s more, we have seen a large amount of lower earnings revisions from analysts the past few months, so the (earnings) bar will be easier to clear.

For example, when we see the majority of analysts lower their earnings expectations – we see an upside surprise in stocks to the tune of 4%.

However, as I said the other week, I’m arguably less interested in earnings.

What I want to see are two things:

- Strong top-line growth; and

- Strong forward guidance

Whilst I’m sure we will hear companies talking to various “cost efficiency measures” and stock “buy backs” – that’s not impressive.

That was 2023’s magic trick to boost prices.

But this strategy is not going to work for 2024 – not at the ‘growth’ multiples the market has been given.

My best guess is earnings will beat (given the lower bar) – however revenue will disappoint.

And looking forward – most will describe the environment as highly uncertain.

Putting it All Together

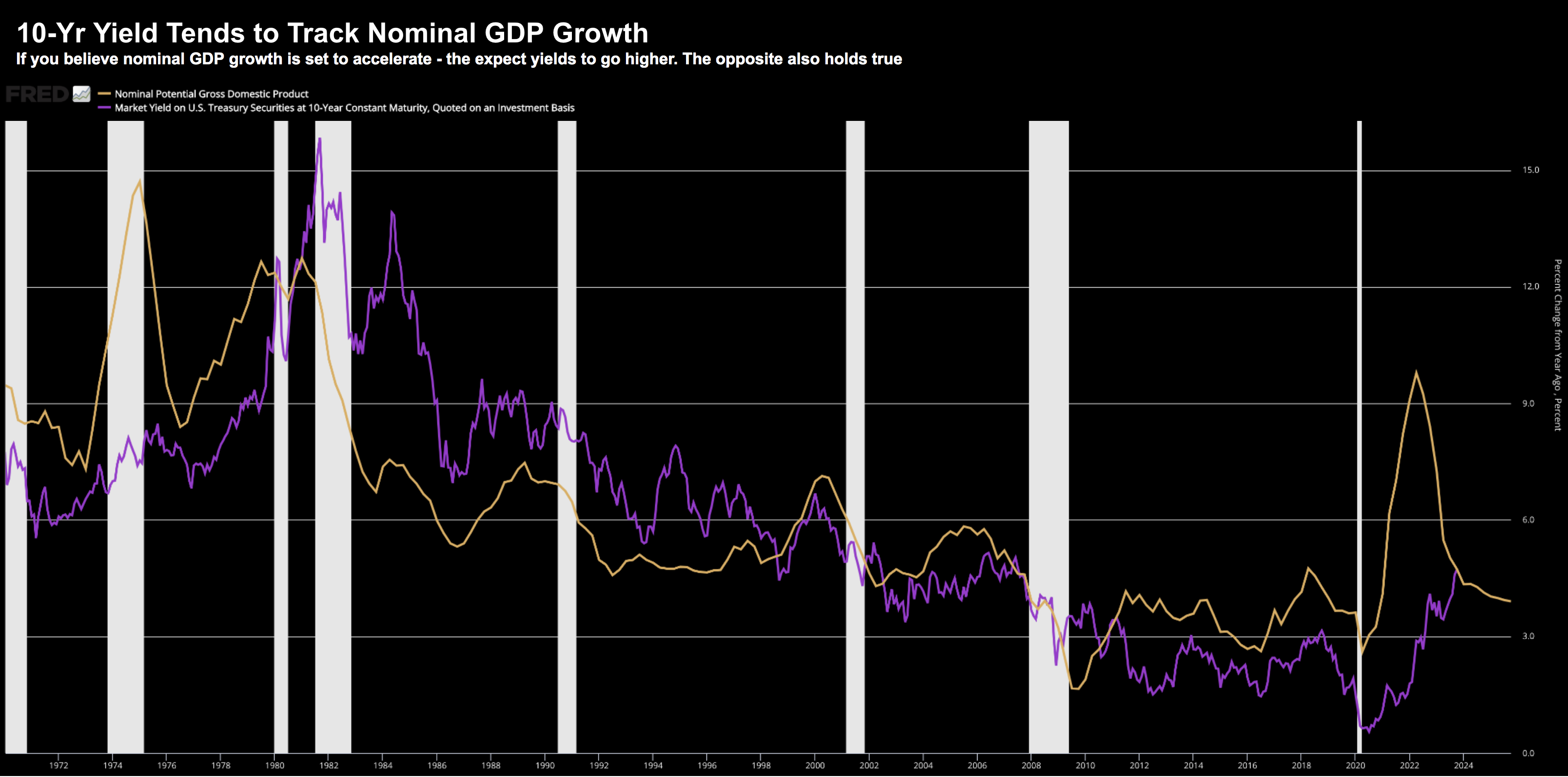

Before I close… one more observation with the bond market.

As I indicated the other day, if yields are going higher, you could equally argue it implies a strong economy.

For example, over the long-term, 10-year bond yields tend to trade in lock-step with nominal GDP growth.

In that regard, that could be a positive for earnings…

But…

I can’t buy the narrative that we will see earnings growth of 12% into next year (to ~$235 per share)

Certainly not in the event of a likely recession.

From mine, there are two key risks for the market looking ahead (not including the heightened geo-political black swans):

- We can’t rule out another Fed hike before the end of the year (given core inflation); and

- The torrent of debt being issued from the government could see further upward pressure on bond yields.