- Fed to pause – but will deliver hawkish tones

- The key will be when the Fed signals the end of hikes

- Why oil makes Powell’s job even harder

Tomorrow we will hear from the Fed.

It’s very unlikely the world’s most influential central bank will raise rates this month.

However, it’s my view Jay Powell is not about to drop any dovish hints.

Remember:

Just because they may be closer to the end of rate hikes – that doesn’t mean they are about to cut.

Rate cuts are dovish.

However, rates staying higher for longer is hawkish.

For example, as inflation comes down, this means real rates are rising (with the Fed on hold)

From mine, we hear a hawkish Fed tomorrow.

But this is a very difficult needle for them to thread.

Powell’s Challenge

One thing I will say about the Fed Chair – Jay Powell – he is becoming very good at press conferences.

And tomorrow he will need his A-game.

From mine, Powell will deliver a hawkish tone leaving the door wide open for further hikes in November or December if needed.

However, he needs to balance that by also saying ‘we don’t need to hike in September’

That’s going to be difficult.

For example, on the more difficult sticking points for Powell will be this chart:

Core PCE – the Fed’s preferred measure of inflation – remains at a stubbornly high 4.23%

Powell’s goal for this is 2.0%

Now last month, Core PCE actually ticked higher.

And whilst we have seen some progress from the 5.4% high in Feb 2022… it’s still exceptionally high.

This is the Fed’s fight…

The nightmare scenario of Powell (and most central banks) is if this continues to remain high.

- Note: as an aside, Canada’s annual inflation rate in August jumped to 4.0% from 3.3% in July on higher gasoline prices, data showed on Tuesday, a sign the central bank may be forced to raise interest rates yet again after 10 hikes since March of last year.

Don’t think this jump won’t go unnoticed by Powell.

But the question is what will central banks do if Core PCE inflation remains around “3.5% or 3.0%” in perhaps 6 or 12 months time?

For example, is the answer further rate hikes? And what impact would that have in an election year?

But these are the types of problems facing the Fed – and why Powell will be wise to remain vigilant.

Key Will be the End of Hikes (Not Cuts)

The market is obsessed with trying to time when the Fed will cut rates.

For example, at the time of writing, the market expects the Fed to cut 125 basis points after June next year.

I think that’s extremely unlikely (just like I said in 2022 that rate cuts in 2023 was unlikely)

The only thing that could induce that sort of outcome would be either (a) severe recession; and/or (b) a major credit event.

But I would argue focusing on rate cuts is the wrong metric.

What we should be looking for in the first instance is when the Fed has the luxury (or confidence) to signal they are finished with hiking.

Now we know they are getting closer to the end of the cycle.

For example, in baseball terminology, we are probably deep into either the seventh or eighth innings.

However, we are not in the ninth or nor are we in the sixth.

There’s still a lot of game time left.

Why do I say that?

Two good reasons:

- 3.8% unemployment rate is very strong; and

- Core PCE is uncomfortably high at 4.23% YoY

That said, we are seeing strong signs of economic weakness (as demand weakens).

Consumer confidence is falling; credit card debt is rising; job additions are slowing; and there are less open positions.

These are all “welcomed” signs from the Fed to help cool inflation

To be clear, it’s bad news for economic growth and corporate profits – but good news for the Fed who are trying to end their rate hiking cycle.

But what I need to hear in Powell’s language tomorrow (and we won’t get it ) is they are finished hiking.

I don’t think we will get that in 2023.

That doesn’t mean that the Fed could be finished with their hikes in 2023 (they might be) – but I really want to hear that message from Powell.

Then we get a better sense that we are at the terminal rate and the next move will be a cut.

For now, we don’t have that.

What Happens Then?

When the Fed eventually signals to the market they’re done hiking – we will see some very sharp moves in bond markets.

For example, you should expect the US 10-Year to leg down from today’s 4.35% all the way below 4.00%.

And it will be fast…

Sept 19 2023

Now above we find the weekly chart for the all-important US 10-Year yield.

With the US government issuing over $1 Trillion in fresh debt the next few weeks (and months) – yields are likely to keep rising.

It’s not hard to explain – the government needs to offer investors attractive long-term yields to get the money to fund their excessive spending.

Higher yields will put pressure on stocks.

Now, when Powell eventually signals the Fed is basically done, these yields will plummet.

That’s too bad for the government – as they will be locked into paying long-term debt at rates well above 4.0% (another discussion)

My expectation is we see the US 10-year trading closer to 3.50% before the middle of next year.

If that’s right (and it may not be) – bond holders stand to make substantial capital gains.

With respect to bonds – their prices rise when yields fall.

For example, I’ve now taken a meaningful position in EDV at the price around ~$76.

Could this long-dated government bond ETF fall further?

Absolutely!

And if the 10-year yield keeps rising (as I expect) – then EDV will fall.

However, I don’t pretend to guess where the 10-year yield will peak.

I’m never interested in trying to precisely “time” market tops or bottoms.

That’s impossible.

For example, the US 10-year yield could peak at 4.50%, 4.75% or 5.0% or higher… who knows?

And that’s fine…

My bet is when (not if) the Fed signals they’re finished hiking (which could be as early as Q1 2024) – the 10-year yield will drop like a stone.

And this means ETFs like EDV and TLT will shoot higher.

As an aside, the ECB issued a statement only last week which indicated they are now very close to being done.

Putting it All Together

Before I close, the other troubling variable in the inflation fight are higher oil prices.

As readers will know, I was calling for $100 oil in 2023.

At the time of writing, WTI Crude is now trading $90/b.

This works against the Fed’s inflation objectives.

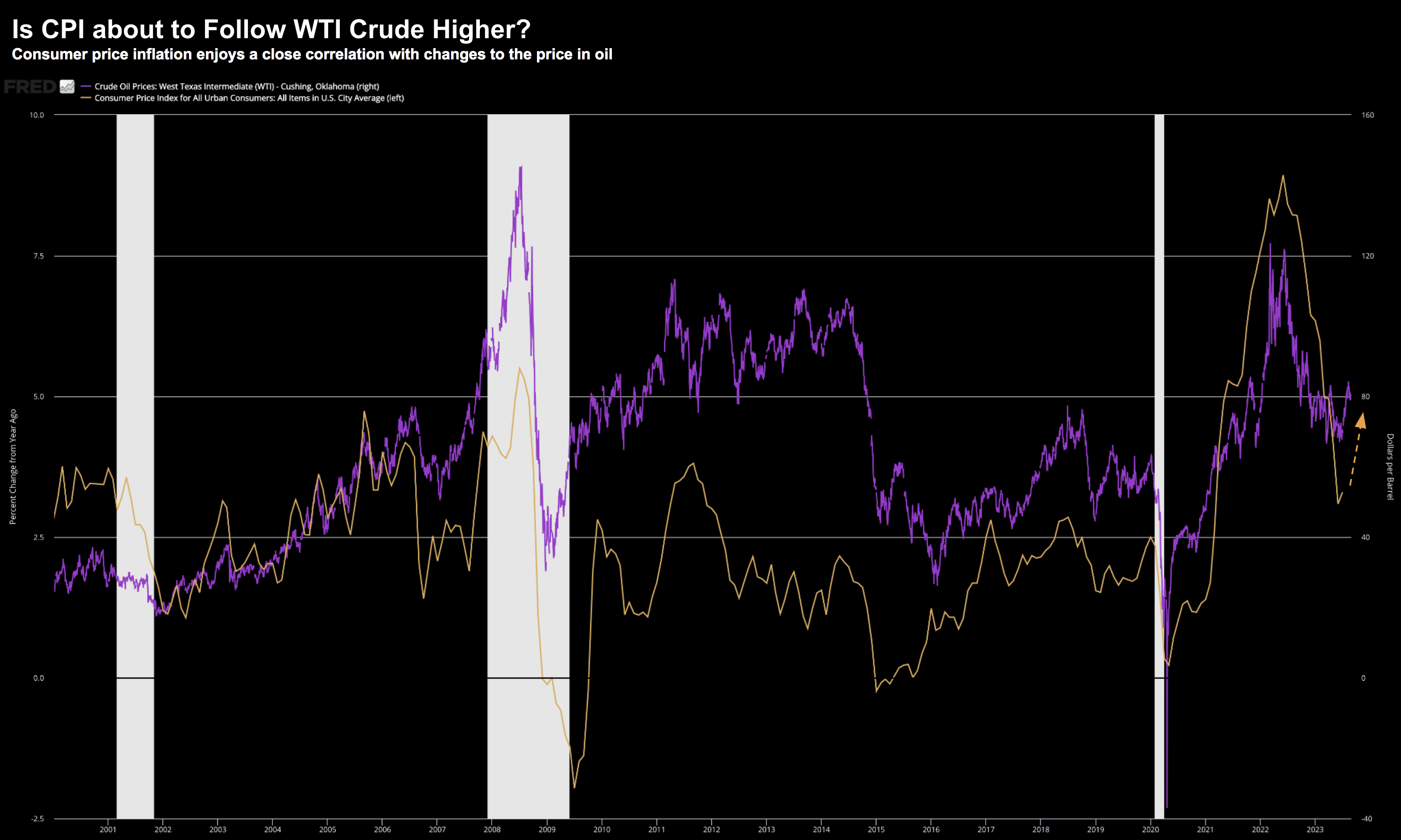

For example, I shared this a few weeks ago showing the correlation between inflation and oil.

In short, the price of oil matters a lot.

You can’t just say “well this isn’t part of Core inflation – so ignore it”.

That’s lazy first-order thinking.

You need to think second and third order.

The price of oil will impact everything we do and/or consume.

Therefore, don’t be too surprised to see the next headline inflation print jump higher (as we saw in Canada)

How will the Fed respond to that?

The average American consumer worries about four primary things:

- Keeping their job;

- The price of shelter

- The price of energy; and

- The price of food

That’s it.

With respect to shelter, energy and food – they are not coming down.

This is why confidence is dropping.

Now if the Fed has to raise rates again at some point before the end of this year – this will only inflict more pain on the economy.

Again, this is a difficult needle for the Fed to thread.

Don’t expect them to raise rates tomorrow – but Jay Powell isn’t about to signal they are finished hiking.

Not yet.