- Are we headed back to negative rates (eventually)?

- S&P 500 hits pause during September

- Consumer confidence takes another hit… not hard to explain why

This week I travelled to Canada enjoying some much needed vacation.

I must say I’ve enjoyed not paying any attention to either the news and/or market.

It just reinforces my theory that at least 90% of the day-to-day news is pure noise.

You are better served without it.

Checking in with the headlines at the end of the week is more than enough to take note of any meaningful shifts (data points) that may be useful.

That said, it also depends on your own trading style.

For example, if you’re a high frequency trader, you are probably trying to trade day-to-day movements (or so-called “ticks”).

That’s not me. I have no interest in that.

I would have more fun at the casino betting on red or black.

My timeframes are years… not days, weeks or months.

However, whilst this timeframe suits me, I recognize it may not work for you.

With that – given this very wet and cool Saturday morning in Canada – let’s review something I did find useful.

Following that, I will take a look at how the S&P 500 ended the week.

Another Perspective on Rates

Before I begin, earlier this week I gave a lecture to a few hundred folks at a leading University.

I was talking to the schools of Computing Science and Engineering (as this was my own post-grad (Masters) degree).

I focused on the challenge of product innovation, scaling and lessons learned.

Somehow (I don’t know how) I managed to keep students (and faculty) in their seats for 2 hours… drawing on personal ‘war stories’ over the past 25 years. And from there, we had about 3 hours of questions!

I concluded the talk with 10 lessons… one of those was perspective of what I call being prepared to play the “long game”

Product innovation (at scale) doesn’t happen fast.

And it’s rare you will get it right from the start. In fact, odds are something will fail (in some way).

But that’s where the gold is…

You are willing to dig into the anomalies… work through why something did not work as you imagined.

The process is incredibly challenging and takes a specific quality which is difficult to teach.

And that’s tenacity.

I talked to the iPhone as just one example (drawing on many other examples of my own).

It was 5 years before Apple achieved scale (excluding any research and development).

But for the “20 to 30-somethings” in the audience (which was most of them) – this is a foreign concept.

They can’t draw on decades of experience.

When I sat down to write this missive – I was reminded of investing.

It’s also playing the long game.

We dig into the anomalies as to why something didn’t work out.

What’s more, we learn from history.

Consider interest rates.

For a good 18 months I’ve been saying to expect them to be higher for longer.

However, 12-18 months ago that was very much against popular opinion. The market (at the time) was pricing in at least three rate cuts in 2023. I didn’t see it… as the data didn’t agree.

Here’s a post from a year ago (Sept 2022) explaining why.

To be clear, there was a possibility my hypothesis would prove false.

However, my interpretation of the data (especially Core PCE inflation) told me probabilities favoured higher for longer.

Fast forward to today and the market has now reached this conclusion.

But here’s another question:

Just how long will rates stay higher for longer?

12 months? 24 months? 5 years?

How Long is “Higher for Longer”?

He explained at a Jefferies (Hong Kong) forum that it’s effectively impossible for data from recent decades to offer insight into whether there’ll be a lasting impact on borrowing costs from the pandemic.

From Bloomberg:

You have to take a much longer look at things. Much, much longer.

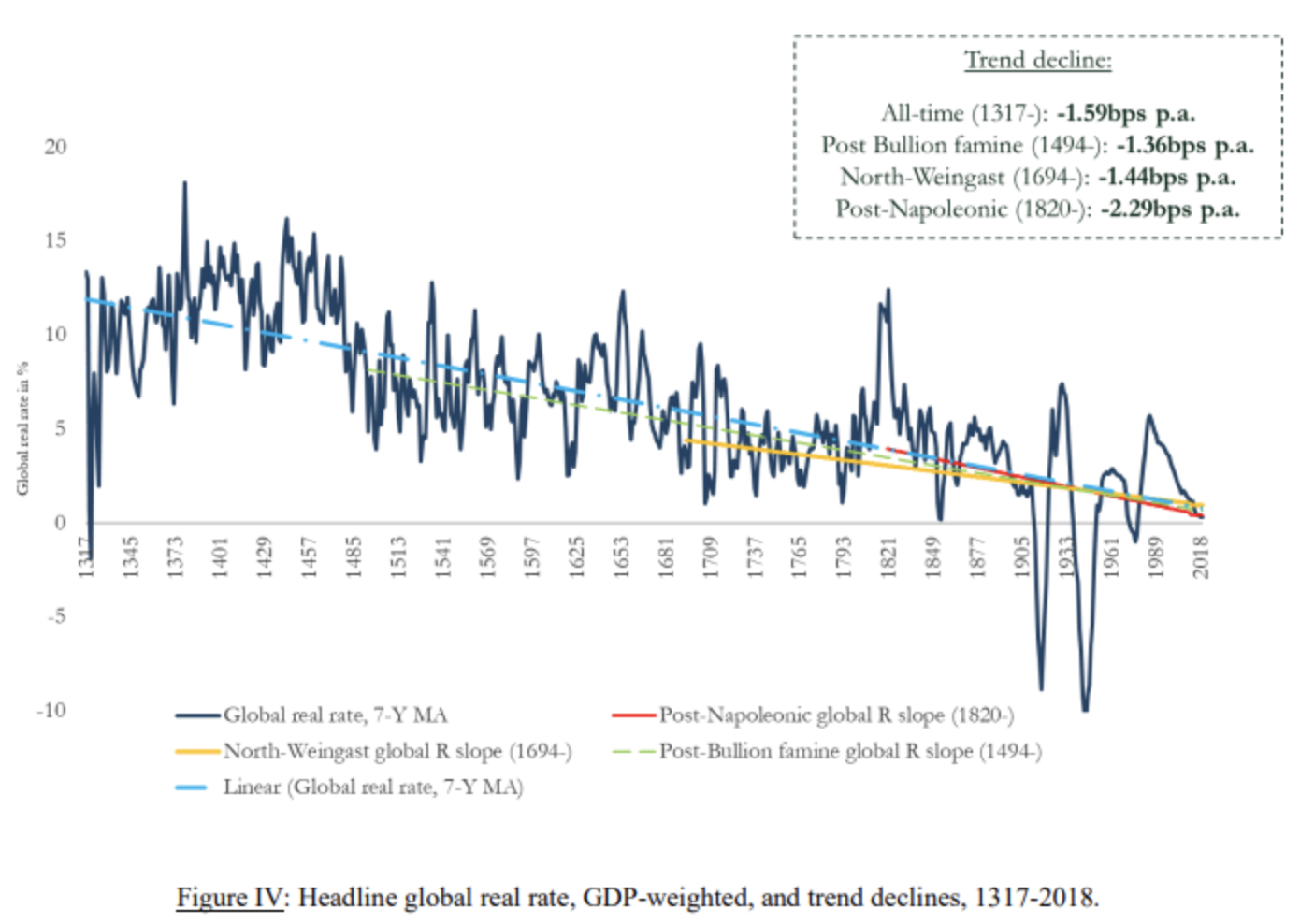

Schmelzing, an assistant professor at Boston College, has a database that goes back to 1311, which he compiled several years ago.

And it shows a clear declining trend for inflation-adjusted, or real, interest rates, with bouts of volatility above and below the trendline.

As long-term readers will have heard me say… ‘everything ultimately reverts to the mean’.

Everything!

Safety and Liquidity

He says “… this is a story about safety and liquidity over time”

And I agree with that.

Question is… how do we accurately dimension time?

That’s hard.

More on that in a moment…

Schmelzing’s view a key dynamic has been less conflict among major powers (n.b., let’s hope that remains). I quote:

“The public sector has become amazingly safe and secure — that’s the amazing thing, the absence of conflict,” he said.

He adds whilst Covid, the inflation surge and aggressive monetary tightening of recent years might appear to amount to a step-change for borrowing costs, the world has seen even bigger shocks.

He offers the following examples:

“Typically it takes about four years for half of that shock to reverse,” he said.

So, for the Covid shock, “by 2024 we should be half way back to that trend line,” he said.

“Where do we end up in 2035, in 2050?,” Schmelzing asked. “In deeply negative interest rate territory.”

If rates decline – I stand to enjoy capital appreciation.

However, I am also partially protected from further downside risk with price — as I’m collecting a ~5% yield to offset that risk.

But 2035 and 2050 is a long time…

However, if he’s right (and I understand his logic), that’s troubling.

I say that because negative rates don’t work.

Capital (and risk) has a cost. And the model of capitalism itself does not function at 0% (or negative) rates.

S&P 500 Hits Pause

And so far, that’s proving to be true.

Perhaps what weighed on the market’s sentiment was the hotter-than-expected consumer and producer price growth alongside stronger-than-expected retail sales.

However, Friday’s University of Michigan Consumer Sentiment data show that households are feeling the pain of inflation.

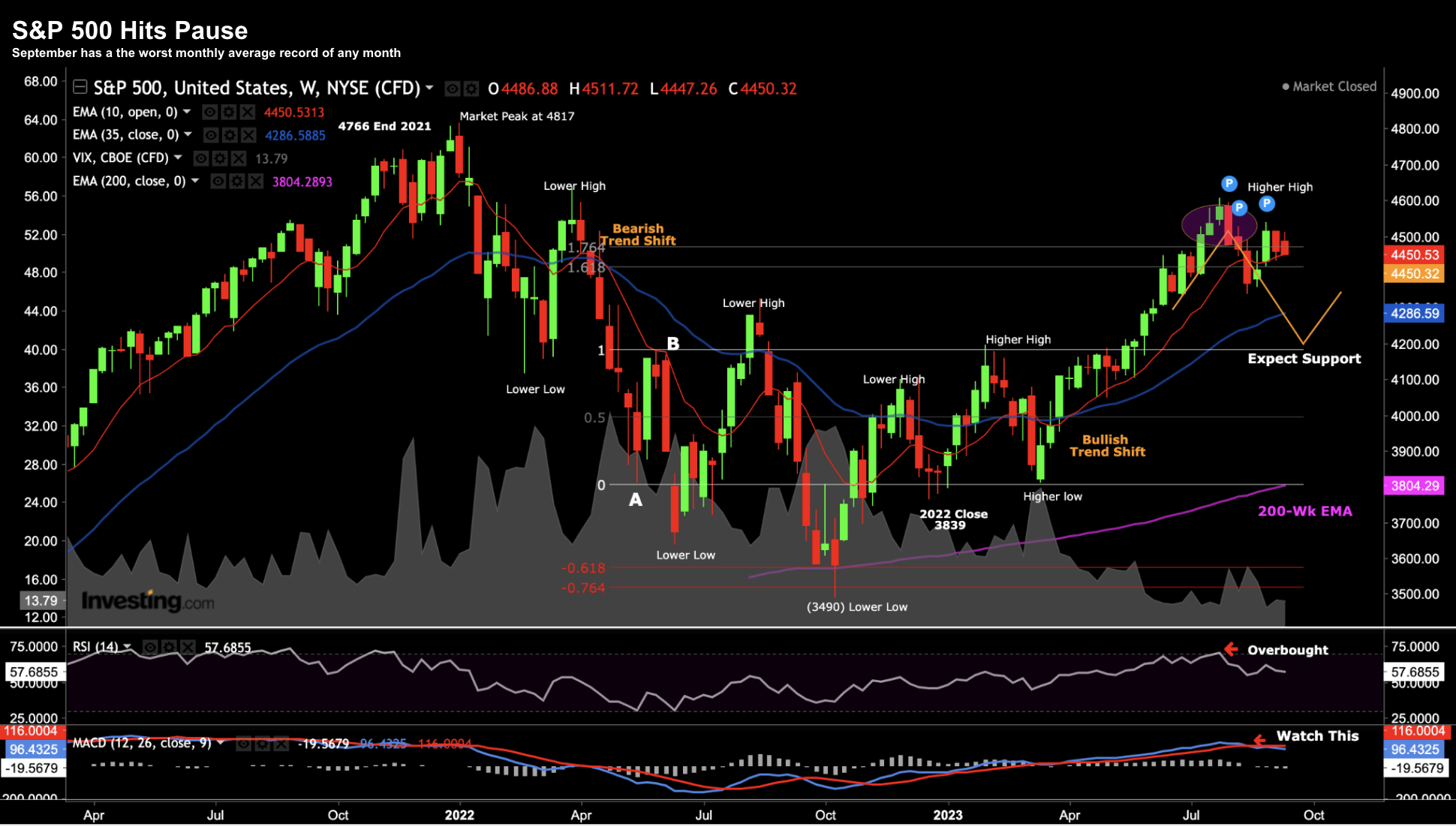

With that, let’s look at the weekly chart for the world’s largest Index:

Sept 16 2023

My question was whether the run to 4600 was essentially nothing more than a false break higher.

For example, once we cleared 4200, I was looking for a move to the 61.8% to 76.4% zone or around 4500

We went fractionally higher – then pulled back sharply.

This what I consider a ‘head fake’.

We appear to be finding strong resistance in this zone since June.

Now what I don’t like is the fading momentum (bottom window)

Our weekly MACD is indicating the bulls might have “run out of legs” to push things higher.

I was also concerned a few weeks ago about how far the RSI had come (middle window).

That has since cooled and it essentially called the market top.

If I were to bet – the market continues to lose momentum this month and retests the 35-week EMA zone.

That’s a level between 4200 and 4300

Now if we were to see 4200 – I still don’t think that’s an attractive valuation.

For example, if we assume 2024 earnings of $235 – that’s a forward PE of 18x.

But I question the “E” of $235 – which assumes 12% growth.

If we experience a recession next year (my base case) – forget the 12% growth.

For example, you could take that back to around $210 or less.

Earnings always contract during recessions – they do not expand. Consumers spend less.

$210 x 18 = 3780.

Very few today are pricing in that outcome for next year.

Putting it All Together

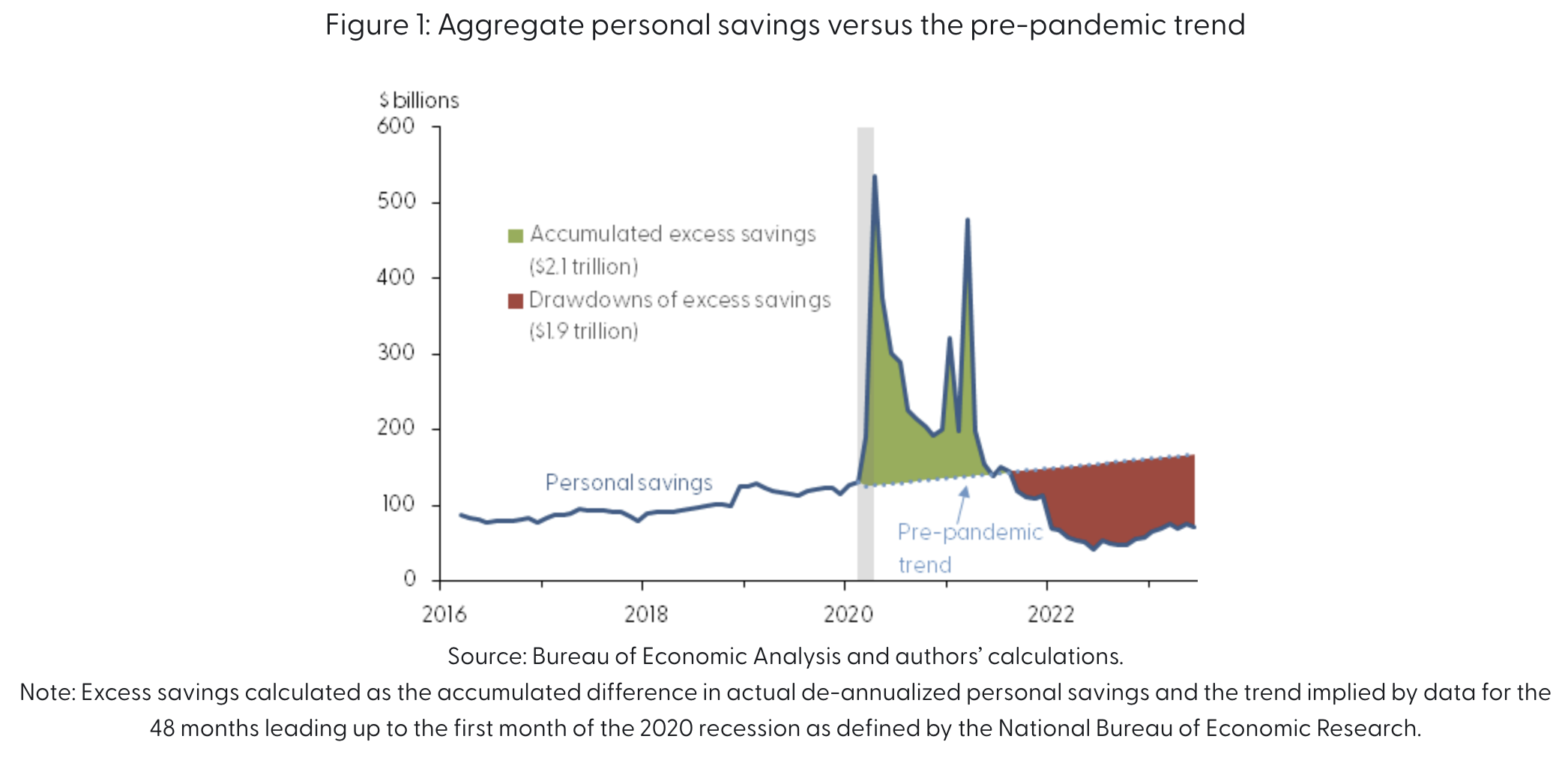

From mine, this is a forward (not backward) looking indicator of economic conditions. For example, if consumers are concerned, they will typically reduce their spending.

Friday’s figure came in at 67.7 vs the forecast of 69.1.

From mine, look no further than what you see at the pump!

With oil prices ripping back above $80/b – this hits consumers where it hurts most – their hip pocket.

Now add to that a rapidly declining savings rate (as credit card debt soars) – and you get the picture.

Earnings growth assumes a “cashed up and confident” consumer.

From mine, a combination of higher (sticky) inflation, higher interest rates, declining credit availability, rising debt-payment delinquencies and rising credit card balances does not help confidence.

That said, never underestimate the US consumer’s desire to spend.

Living beyond one’s means isn’t a concept that resonates.