- Bill Gross says 10-Year could get to 4.50%

- Why is the 10-year rallying?

- And why I’m not increasing stock exposure at current levels

If you were asked what is the most important metric in global finance – what would you answer be?

The S&P 500? The US Dollar? Gold?

Something else?

My answer is the US 10-year yield.

Everything else in finance is a function of this asset.

For those less familiar with the game of asset speculation – this is a very important concept to understand.

What’s more, its importance extends well beyond the stock market.

To begin, the US 10-year yield is the proxy for financial instruments such as your mortgage, your car loan, student debt, your credit card etc.

More than that – how this bond trades also signals investor confidence.

Let me explain:

As background, the U.S Treasury sells bonds via an auction process and yields are set through a bidding process.

Prices for the 10-year bond drop when confidence is high, which causes yields to rise.

This is because investors feel they can find higher-returning investments elsewhere (e.g. stocks) and do not feel they need to “play it safe”.

The opposite also holds true.

For example, when investors feel that a slowdown could be coming (or worse a recession) – bond prices rise and yields fall (as there’s a greater demand for safety)

Put simply, falling yields indicate caution in fixed income markets.

So what do we find today?

40-Year Trend in Bond Yields

Over the past 40+ years, there has been a persistent trend in long-term bond yields (and interest rates).

Below is the monthly chart for the US 10-year from 1971:

The yield for this duration has fallen from double digits (when inflation was double-digit in the early 80’s) – all the way down to below 1.00% in 2020.

Naturally, these lower yields (and rates) helped fuel higher risk assets (stock and house prices).

Put another way, the cost of leverage was low.

However, something curious happened this year.

The multi-decade downtrend trend of lower yields was broken.

Yields broke out – now trading around ~4.2% – its highest level since 2008.

And my guess the path of least resistance appears higher (e.g. to ~5.0% in the near-term)

Let’s explore what this could mean…

What Happened?

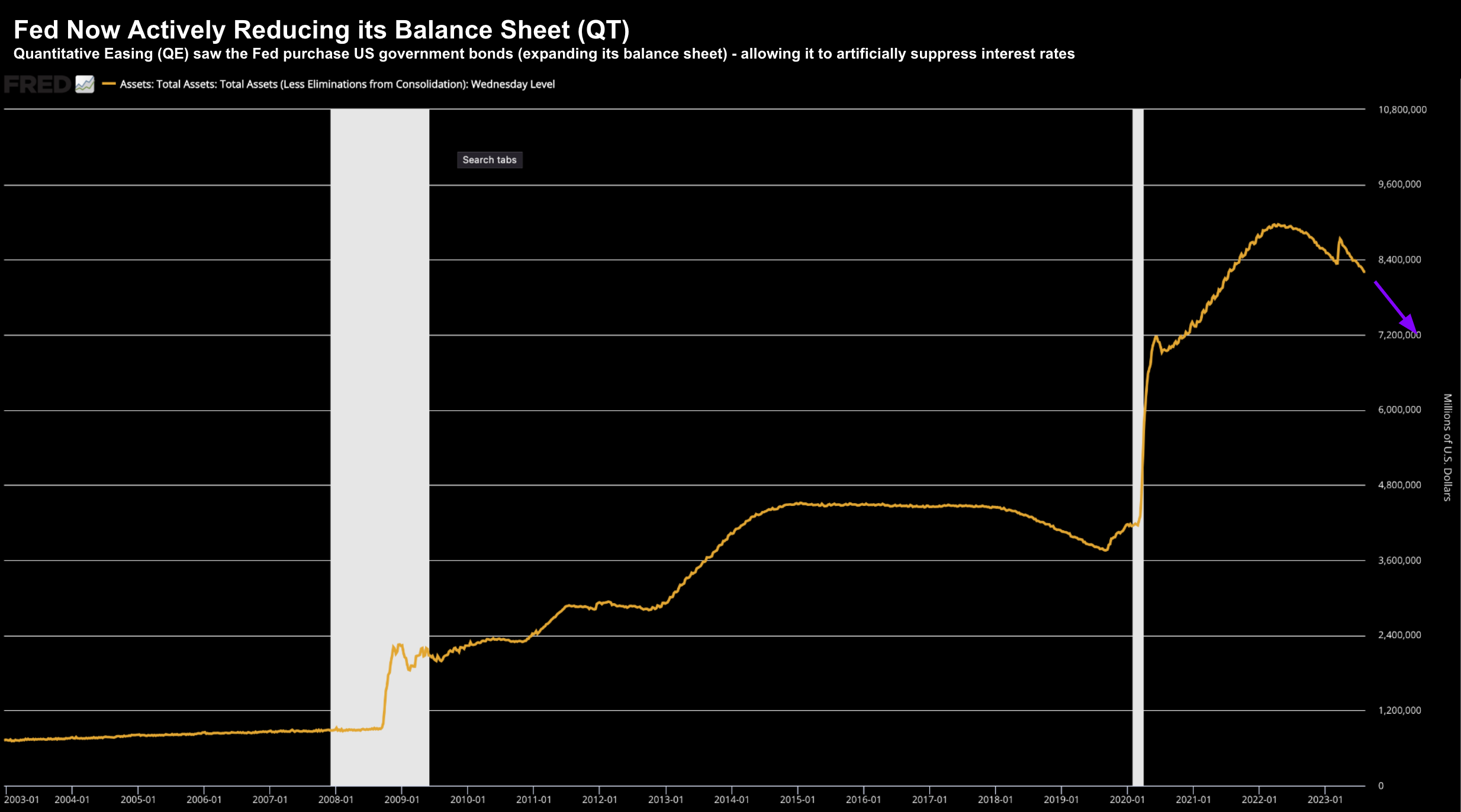

Perhaps the largest driving force behind higher yields was the largest buyer of bonds effectively exited the market.

That buyer was the Fed Reserve.

Now prior to the current episode of unwanted higher inflation – the Fed regularly intervened in the bond market by acquiring US government debt.

This process is known as QE (Quantitative Easing) – which had the impact of driving rates and yields lower.

Over time, the Fed accumulated trillions in government debt – effectively expanding the Fed’s balance sheet to over $8.3 Trillion.

Aug 14 2023

But things changed when the Fed needed to take money out of the economy.

The central bank stepped back from purchasing government debt – allowing its balance sheet to reduce (a process known as Quantitative Tightening (QT).

With the Fed exiting the market – this resulted in bond prices falling (i.e., where yields / rates went higher)

That’s one part of it.

However, more recently there have been other forces at play.

First we had the Bank of Japan changing monetary policy – allowing their interest rates to rise.

Last week ratings agency Fitch issued a downgrade on the US sovereign credit rating – sending yields higher again.

Not long after Fitch’s downgrade – “Bond King” Bill Gross (and former PIMCO CEO) – expressed a view that the US 10-year bond (and stocks) are overvalued – and the 10-year yield should be trading closer to 4.5% (i.e. bond prices need to fall further)

Gross, who retired from asset management in 2019, said inflation may prove sticky at around 3%. He pointed out that 10-year yields historically traded about 135 basis points above the Federal Reserve’s policy rate.

So even if the Fed lowers interest rates to about 3%, the current 10-year yield remains too low, given the historical relationship. In addition, the skyrocketing government deficit will add supply pressure on the bond market, he said, reiterating his view outlined in his recent investment outlook.

“All of the bulls on Treasuries,” said Gross, “I’d like to think their arguments are a little misplaced.”

As for the stock market, Gross said the equity risk premium – measured by the difference between the earnings yields and bond yields, are at historical lows, suggesting that stocks are too expensive.

Gross reiterated that he has sold out his holdings of regional banks, after the recent rally. At the moment, the asset with the “best value” is energy pipeline partnerships, which offers attractive yields and tax advantages, he said.

Bill Gross makes a similar point to the one I shared on Aug 9th “Stocks Treading Water for Good Reason”

Here I talked about equity risk premium.

Repeating a small portion:

Let’s take the analyst’s consensus for earnings and use 18.4x forward 2024 multiple.

The inverse of 18.4 is what we call the (stock market) earnings yield.

1 / 18.4 = 5.4%

Now, we can secure a risk-free 5.26% for 12-months with US treasuries.

So are stocks a great risk/reward at ~4500 (or above)?

The premium is (at most) barely 0.2%!!

That’s a very poor risk reward.

This is exactly what Bill Gross is saying when he states: “stocks are too expensive”

Investors are not being sufficiently compensated to take the (high) risk with owning equities.

(At least there are two of us who are thinking that way 🙂

This is a Big Deal

I’m guessing 90% of you will get very bored with me talking about bonds…

In fact, whenever I issue a post on bonds, I get around 3-5 people who unsubscribe.

And I get it – bonds are not exciting.

But this is important.

A higher bond yield means a higher cost of capital for everyone.

Whether it’s a small business, a big business or the government itself – the cost of capital is rising.

No exceptions.

When I look at the 40-year trend breaking to the upside – it’s effectively the bonds issuing a yellow flag (not that equities have noticed)

Put it like this:

“Drivers – there’s oil on the track – proceed with caution”

To be clear, it’s not a red flag (not yet).

However, conditions are now more dangerous than they were say a year ago (which is what Gross is saying)

For example, James Penny, chief investment officer of TAM Asset Management, who now have their highest exposure to bonds in five years (not unlike Warren Buffett who is also buying bonds), said the volatility was driven by inflation expectations and rate cut speculation, exacerbated by the Fitch downgrade and heavy new (government) issuance which “boosted supply without meaningfully increasing demand.”

He said:

I think fundamentally if you look at where markets are, if you look at prospects of a recession, if you look at how high equities have gone, the bond market hasn’t gone up with them.

But there are fantastic opportunities in bonds right now. And you may never see this again. If you want to take advantage of that, now is the time.

Has Mr. Penny has taken a page straight from “Trade the Tape”?

For example, here’s the post I issued July 9th “Think About Adding Bonds”

At the time, I added you can be patient as I thought yields could rise further (knowing that the government was about to issue even more debt).

But now is a good time to start adding some exposure.

Penny adds there’s a general agreement that stocks have peaked, while bond yields have risen too far after the fastest interest-rate hiking cycle in many people’s 40-year careers.

He says there are plenty of moving parts, of course, including the need for greater government debt issuance as the deficit grows, but the single most important driver — as it has been for at least two years now — is inflation

I agree.

What About Inflation?

Further to my post last Friday – I argued inflation is likely to remain far more sticky than what the market assumes (which echoes Gross’ sentiment)

I specifically explained the importance of shelter and why this is a problem.

Shelter comprises around one-third of total CPI – and it’s not likely to fall with any great velocity.

What’s more, the Fed is pushing on a string with monetary policy in terms of getting house prices and/or rents down.

That’s unlikely to happen.

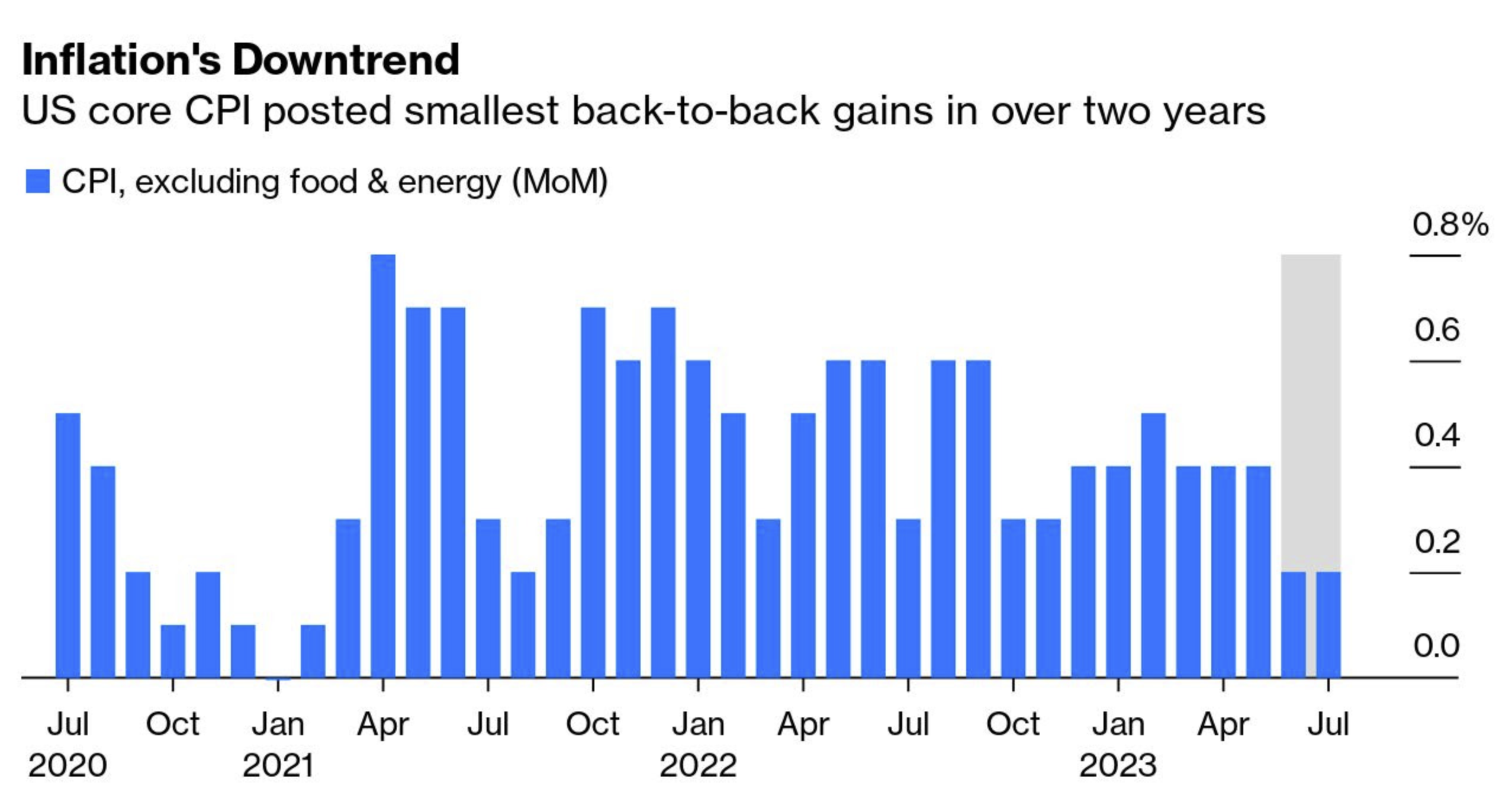

But there was some good news – the Core CPI is seen as slowing:

And whilst it’s slowing – there was nothing to suggest the Fed have the ‘optionality’ to cut rates anytime soon.

Best case, they simply keep rates where they are (with a 10 to 20% probability of one more 25 bps increase before year’s end – pending inflation)

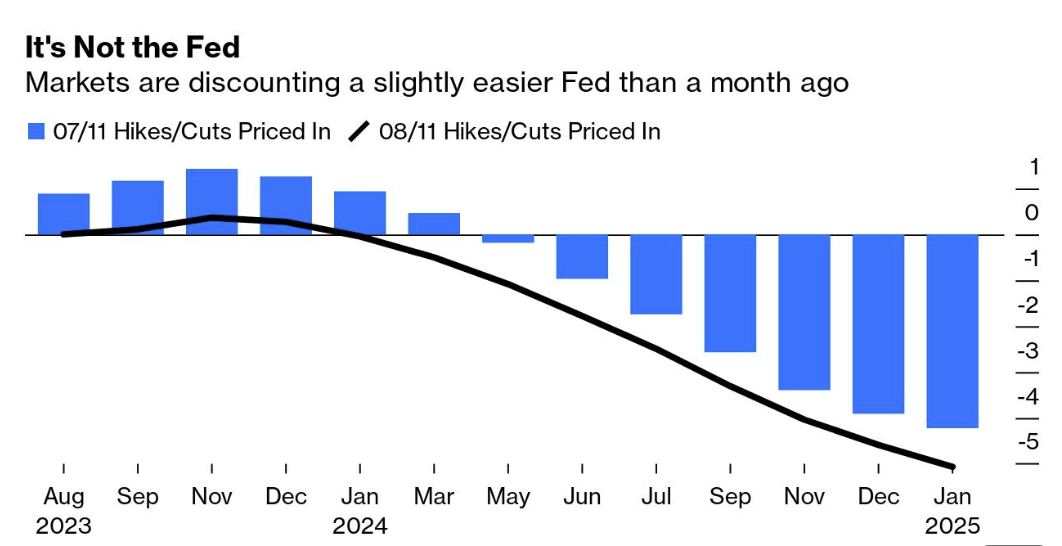

A second chart from Bloomberg below suggests the market sees cuts in the first half of 2024

And if true – then bond yields will likely fall (benefiting bond investors)

But what’s very clear is the battle against inflation isn’t won yet.

And it won’t be won anytime soon.

To that end, my view is the rate cut forecast above feels more on the optimistic side.

From mine, the hard work is getting Core CPI from levels above 4.0% to down to ~2.0%.

Going from “9% to 4%” was lower hanging fruit – as things like goods and commodity prices fell sharply (as supply chain snarls eased)

That part was easy.

But from “4% to 2%” will take another year or more.

In addition, Powell will be mindful of the lessons from the 1970s and 1980s.

Volcker made the mistake of declaring victory far too early – only to see it jump higher again (note – we are already seeing oil prices rip back above $80/b).

Powell wants to see the “whites of inflation’s eyes” before he thinks about rate cuts.

Putting it All Together

My advice is to continue to trade equities with caution.

I would be adding to bond exposure however you don’t need to rush into the trade.

Long-term yields are likely to continue rising which means lower bond prices.

For example, bond ETFs like EDV and AGG are likely to trade lower.

Therefore, exercise patience.

For example, you could add some exposure now and more when they fall further (as bottoms are impossible to predict)

With respect to stocks, be mindful if adding to exposure.

At the Index level, the market feels expensive (especially in terms of the risk premium)

But as Gross highlights – there are pockets of the market which trade at far better long-term valuations (e.g. energy and high quality banks look attractive).

However, you need to be selective.