- Fed has a problem with shelter costs

- Why rents are not likely to come down

- Expect higher (rates) for longer

Markets got excited on news of the softer-than-expected CPI headline print today.

Headline inflation came in at 3.2% YoY vs expectations of 3.3%

Good news?

Well maybe in part… from CNBC:

- Headline CPI rose 3.2% from a year ago in July;

- Core CPI ran at a 12-month rate of 4.7% (slightly lower than estimates)

- Most of the increase came from shelter which rose 0.4% and up 7.7% YoY;

- Real wages adjusted for inflation increased 0.3% on the month and were up 1.1% YoY

What deserves closer scrutiny is not the headline number – it’s Core CPI at 4.7% YoY and shelter costs.

For example, about two-thirds of the monthly inflation increase came from shelter – where rents rose 0.4% MoM (more on why shortly)

This is now the 18th straight month the price of shelter has risen at least 0.4% MoM

That’s what you call persistent.

But for almost a year, analysts have (incorrectly) predicted not just a slowing pace of increases, but falling prices.

It hasn’t happened.

Shelter costs (and perhaps wages) is where the Fed has a problem.

And it’s something that they can’t easily ‘fix’ with higher rates.

But there is a fix (it’s just not pleasant)

Why Shelter Remains Sticky

My thesis is Core CPI will continue to remain well above the Fed’s 2.0% objective well into 2024 (and maybe beyond).

If true (and I might be wrong) – it means the Fed are likely to keep rates higher for longer (e.g. above 5.00%)

There is just one problem…

That’s not what the market is pricing in.

In fact, after today’s print, the market now thinks the Fed is finished hiking – with cuts starting as early as March next year.

Sure, whilst the Fed may not deliver any more hikes… that doesn’t mean cuts.

Remember:

If the Fed continue to hold rates steady as inflation (slowly) falls – real rates are higher.

But my logic for “higher for longer” and ongoing sticky Core CPI is a function of house prices (and rents).

Yes, new leases might be coming down.

I get that.

But reality is most renters are not going to move house to save a mere “$100 or $200” per month.

It’s just not worth it.

Moving house is both painful and expensive.

Therefore, until house prices come down sharply (and/or interest rates plunge back below 3.0%) – those looking to buy an affordable home will be stuck renting.

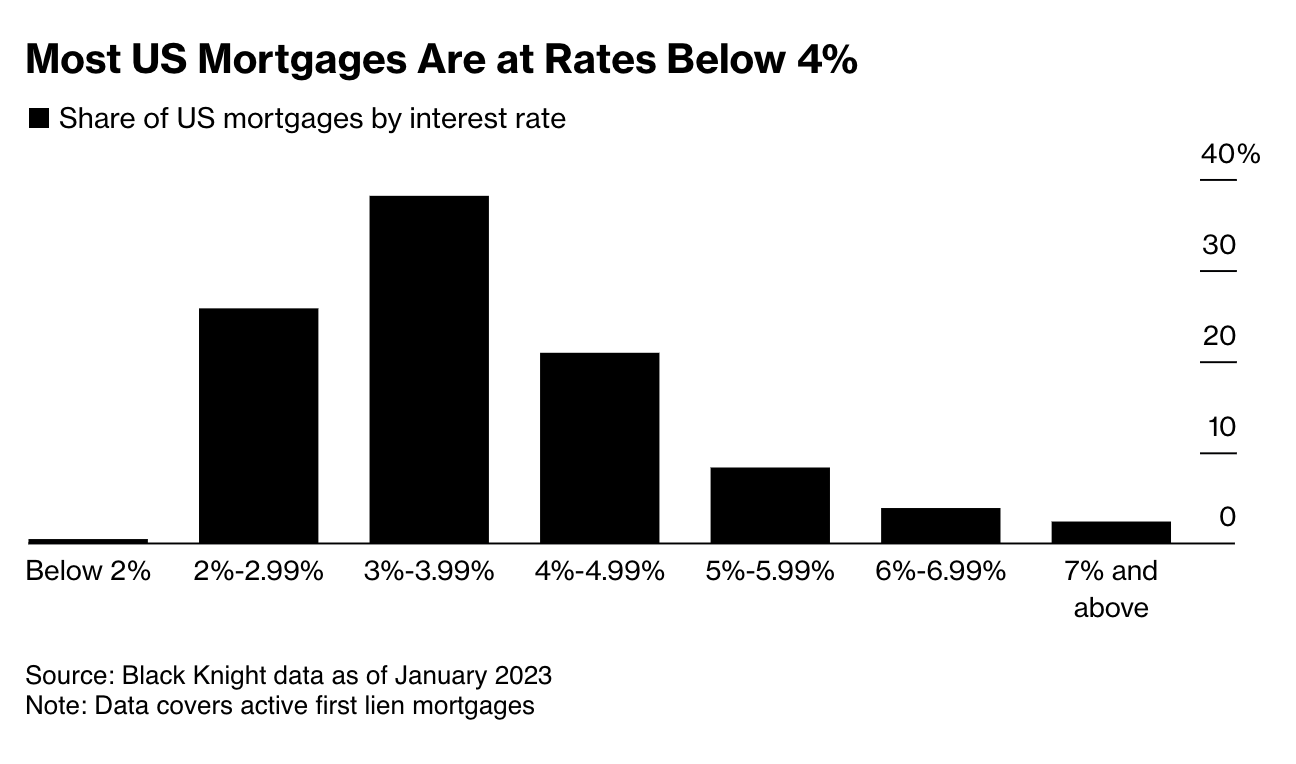

Now as we know, ~80% of homeowners have secured 30-year loans below 5.00%

As a result, you can be sure these home borrowers will not be in a hurry to sell.

They don’t want to effectively swap a (very attractive) low-cost 30-year loan at “4.0%” for a new “7.0%” loan!

Why would you!

The net result is housing supply will remain tight (in turn keeping prices high)

Obviously this has widespread implications for households, inflation and the broader economy.

It means, many people are effectively “trapped into renting”.

But the question is how much of that rental pressure is priced into Core CPI looking forward?

And does the market see it the same way?

The Fed Can’t Do Much

Unfortunately the dynamic with housing (and rents) will continue to frustrate the Fed.

For example, with most home borrowers locking in ultra-low 30-year rates – it’s hard to understand how higher rates will lower shelter costs?

If anything, higher rates are likely to slow the pace of investment into new dwellings.

That works against bringing inflation down – as it’s another impediment to creating supply.

In parallel, landlords have every reason to raise rents opposite higher rates / costs.

The irony of course is the Fed created this mess!

On the one hand, they held rates artificially low for far too long (i.e., which has the effect of distorting the price of all risk assets).

But they also do not factor in home prices into their inflation model.

So what can the Fed do?

Not much (as far as I can tell)

Sure, the Fed is working hard to reduce demand (where they have been effective).

However, lower demand is offset by simultaneously reducing supply of new dwellings (given the higher cost of construction etc).

Net-net we will continue to see higher rents until house prices come down.

House prices will only meaningfully come down when people can no longer afford to pay the mortgage.

And when they can no longer pay – you get forced sales.

Prices crash.

That’s when higher shelter costs come down.

Putting it All Together

My immediate thought when I read today’s print was “higher for longer”

I didn’t need to go past Core CPI and shelter.

And whilst the market connected the dots by the close – the real price action was in bonds.

Bond yields rallied sharply as the day wore on.

I think we’re likely to see upward pressure on yields in the near-term (given the flood of new debt issuance from the Treasury)

However, as we approach the end of the year, I think the market will start pricing in much slower growth.

For example, that could see the 10-year yield trade back down towards 3.50% (vs ~4.10% today)

At that point, investors will start looking for a hedge.

If that happens – it bodes well for bond ETFs like EDV and AGG.