- Fed remain tight lipped on what’s ahead

- However, market sees Fed cutting rates by March 2024; and

- How the Bank of Japan caused US Bond Yields to spike

If nothing else, I took one thing away from this week’s Fed decision:

Don’t expect rate cuts anytime soon.

The market had priced in a 25 bps rate increase – with the Fed flagging it well in advance.

And the Fed didn’t disappoint.

But what they were hoping for was more of “dovish hike”

It wasn’t coming… Powell is keeping things tight-lipped.

Data Dependent

There were no real surprises from the Fed… as the market took the decision in its stride.

However, when Powell was pressed on what could be ahead – he flatly refused to offer a forecast.

And with good reason…

Below is what the Chairman told the press conference.

“Looking ahead, we will continue to take a data-dependent approach in determining the extent of additional policy firming that may be appropriate”

And that’s all he can say!!

Put simply it’s still too soon to be declaring victory on inflation.

I said that going into the meeting.

But looking ahead to September – things get interesting. I say that because we will have a host of data to process:

- Two monthly inflation prints;

- Two months of jobs data; and

- A benchmark reading on wage inflation.

If you ask me, if pressed for an answer, Powell would like to say another hike is coming before year’s end.

But he can’t… as that removes flexibility.

However, he stressed that it was pointless making these types of forecasts as he simply doesn’t know.

It all depends on the data.

That said, with underlying (core) inflation still far too high (e.g. something with a 4-handle) and a robust economy (GDP north of 2.0%) – the Fed still has ample scope to raise rates at least once more.

Powell was willing to offer two potential pathways:

Pending inflation data – he said they could either (a) raise rates; or (b) pause.

But notice what he didn’t say….

They are not considering cuts.

A pause is not dovish (despite what some are saying)

My view is until we see (far) softer core inflation prints and a loosening labor market – the Fed will not be in any rush to ease monetary policy.

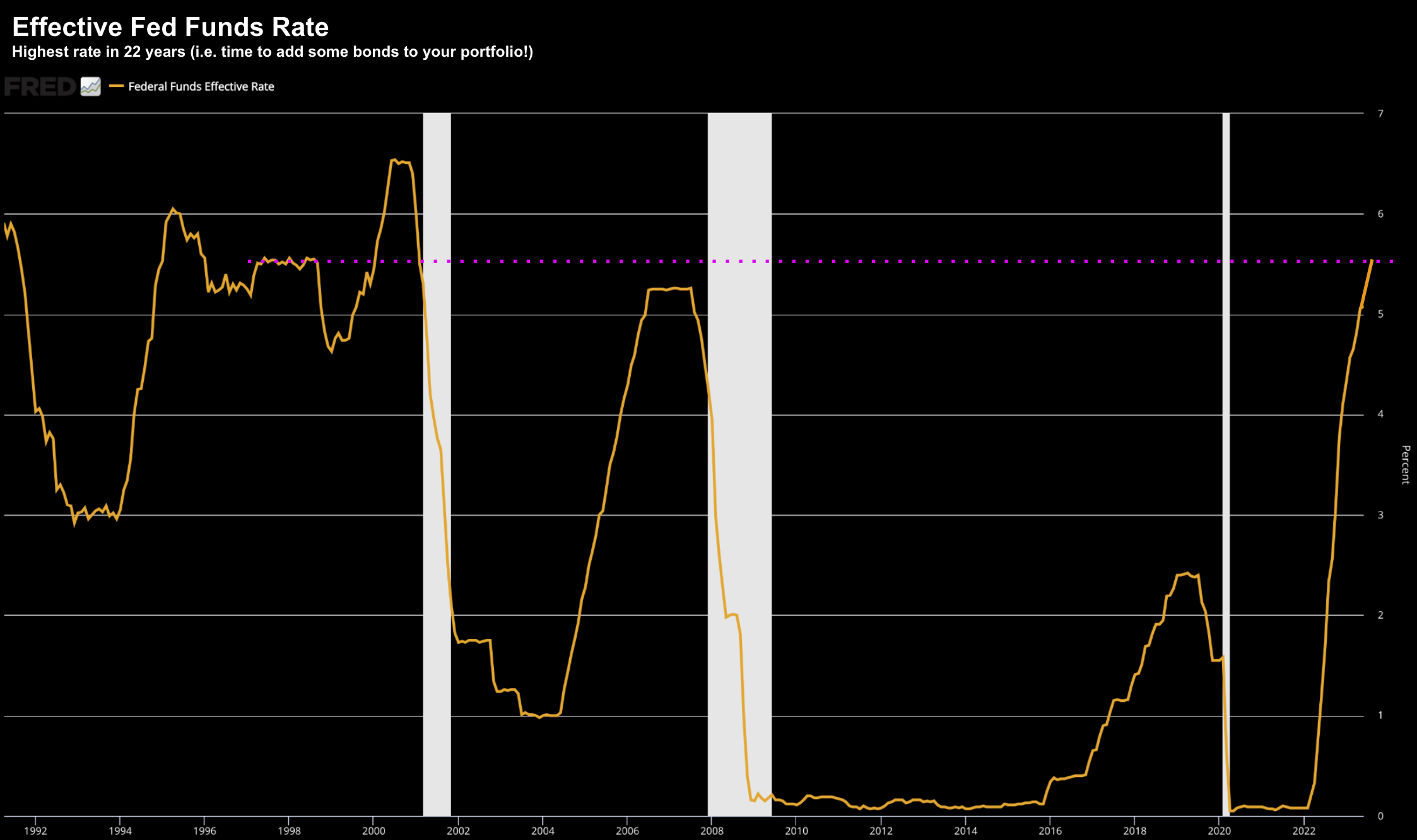

And it would not surprise me to see the nominal rate at 5.25% this time next year.

But that’s not what the market is pricing in (see below from Bloomy).

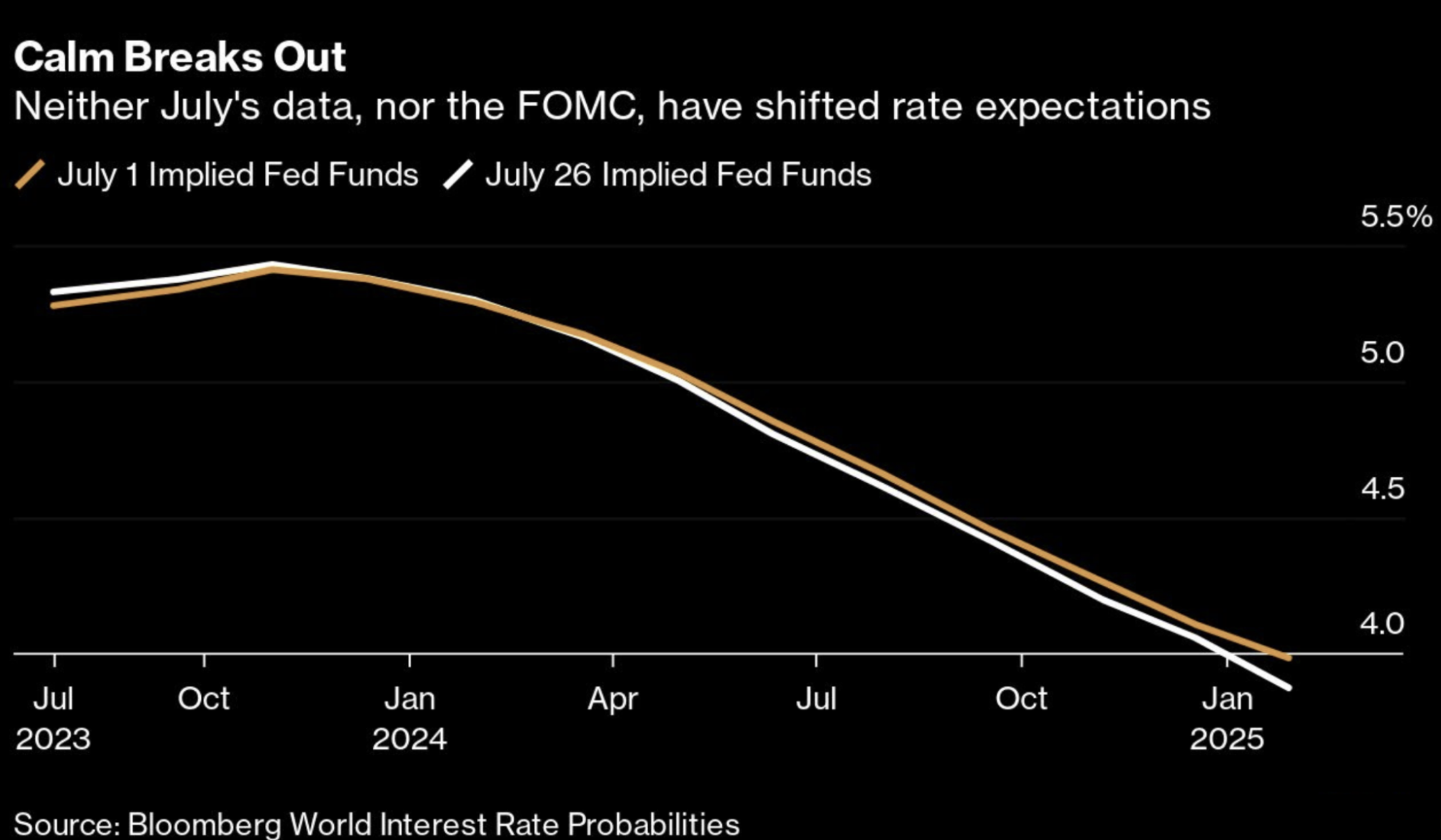

As it stands today, the market thinks the Fed will be cutting by March 2024.

And from there, continuing to cut rates through 2024.

The question you need to ask yourself is why would they do that?

Recession? Credit event? Something else?

But choosing to sit tight for an extended period is very different to cutting rates.

In fact, by holding rates at 5.25%, they are tightening in real terms (on the likely assumption inflation gradually falls).

Allow me to illustrate:

- If the Fed Funds Rate is 5.50% and inflation is 4.0% – the real rate is 1.50%; or

- If the Fed Funds Rate is 5.50% and inflation falls to 3.0% – the real rate rises to 2.50%

And it’s the real rate we should pay attention to.

By the way, we also have the Fed reducing its balance sheet each month (QE) which is also a form of tightening.

My thesis is the Fed will want to see “the whites of inflation’s eyes” before they try and second guess what could happen.

Analysts and the media always try to bait Powell at his press conference to ‘second guessing‘ – but he will not have any part in it.

Again, that’s not his job to second guess.

And with Core PCE (their preferred measure of inflation) tradig with a 4-handle (more than 2x their objective) – we are a long way from that.

Bond Yields Wake Up

What’s interesting (to me) is the Fed has had zero impact on the equity market.

“Do your worst Fed” – says the S&P 500.

If anything, I think equities are taunting the Fed given how prices are rallying.

In fact, as Powell spoke, traders found a way to his press conference as an excuse to buy stocks.

But by the end of the day, the S&P 500 was almost exactly where it had started.

However, we have seen a strong move in bond yields.

And this is what I said we might see after the Fed decision (i.e., bond yields to rise / bond prices to fall)

But…

Perhaps what really sparked a rally in US bond yields (a negative for the market) was far less to do with the Fed — it was a possible move from the Bank of Japan (BoJ)

As context – Japan’s central bank is set to keep ultra-low interest rates on Friday but may make minor tweaks to extend the lifespan of its yield control policy.

Under yield curve control (YCC), the BOJ guides the 10-year bond yield around 0% and sets an allowance band of 0.5% above and below that target.

The Nikkei newspaper reported the central bank will maintain its 0.5% cap for the 10-year government bond yield, but discuss allowing long-term interest rates to rise above that level by a certain degree.

As I wrote this post – CNBC just reported that the “BoJ Pledges to guide the YCC with ‘greater flexibility’

This potentially has ramifications for US bond yields.

And if anything – these yields are likely to trade higher.

Today, the US 10-year surge back above 4.0% (which I think is a great long-term opportunity for bond investors).

July 27 2023

From mine – whenever we see the US 10-year trading north of 4.0%, it’s an opportunity to add duration.

As part of this post, I suggested the Treasury Bond ETF EDV is a good way to get exposure.

July 27 2023

Putting it All Together

Coming back to Jay Powell – he is doing what he has to do.

That is, he needs to bring the real rate to positive territory to combat inflation.

And that’s what the (monetary policy) text book tells him to do.

It’s exactly what Volcker did in the early 1980s.

And whilst the media were pressing him for guidance (or forecasts) – he remained tight lipped.

What can he say?

For example, if the economic data takes a turn one way or the other, he needs flexibility.

Powell will never move to take away ‘optionality’.

And that’s his job.

Whilst we all love to try and predict what the Fed is going to do (or what the economy will do)… I can tell you they don’t even know!

In any case, Powell told us one thing:

Don’t expect rate cuts anytime soon (i.e. this year).

It’s still too soon to declare the fight against inflation has been won. But things are trending in the right direction (albeit very slowly).