- Leading recession indicators continue to flash red

- But there are many who believe it’s different this time

- They could be right – and I look forward to learning why

Whenever history looks like repeating – it’s worth asking what’s different this time?

I say that because the past is never a guarantee of what’s ahead.

Put another way, if you are making decisions on that basis, you might be suffering from “confirmation bias”.

And that can be a blind spot.

My (possible) blind spot today is I think a recession is more than likely within the next 12 months.

Why?

Because I’m leaning into historical data (and leading indicators) which have reliably predicted recessions in the past.

And that feels like the logical thing to do.

But…

I could be wrong.

And if I’m wrong – I look forward to learning why I made this mistake.

For example, there are many economic commentators out there saying “it’s different this time”

I don’t have a problem with that… and I’m willing to listen to their argument(s)

Take Goldman Sachs last week:

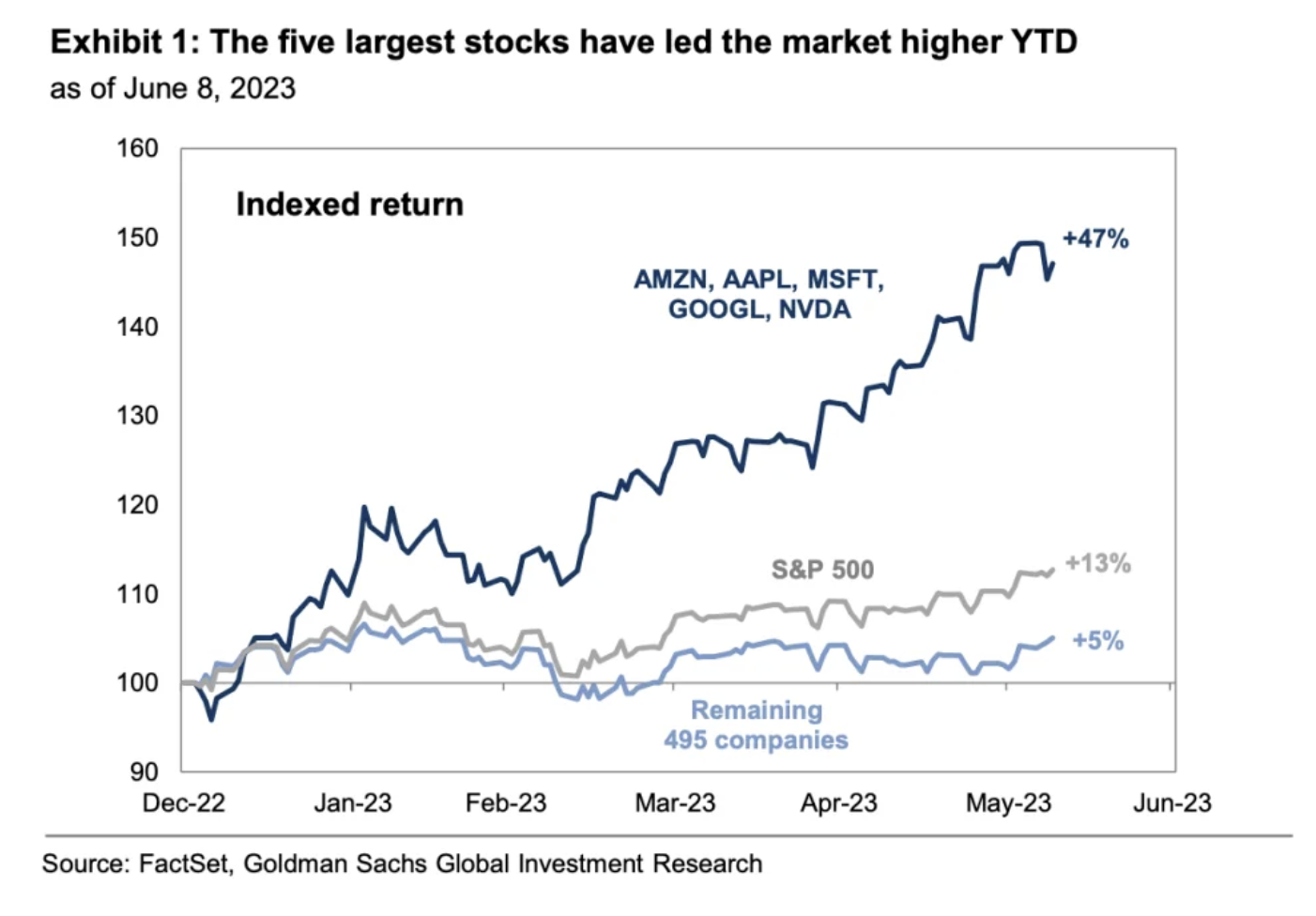

Goldman joined the growing list of market strategists who have boosted their year-end S&P 500 targets.

David Kostin and the equity strategy team at Goldman Sachs increased their year-end target to 4,500 from 4,000, driven by a new “soft landing” forecast and higher-than-expected earnings.

“The P/E multiple of 19x is greater than we expected, led by a few mega cap stocks,” the firm writes. “But prior episodes of sharply narrowing breadth have been followed by a ‘catch-up’ from a broader valuation re-rating.

The potential profit boost from AI has expanded the right tail for equities, while left tail risks from recession and hawkish Fed policy remain.”

Kostin joins a chorus of commentators calling for a new “soft landing” forecast.

Jay Powell told congress something similar this week.

With respect to Goldman’s chart talking to the possibility of cyclical stocks playing “catch up” (i.e. the market rally broadening) – they shared this chart:

I have shared similar charts in recent weeks and agree with the potential for cylical-stock buying.

For example, on the assumption there is a soft-landing – it’s likely we see more money put to work in these names (e.g., banks, energy, etc)

Cyclicals are under-owned (vs say large cap tech) largely opposite the risk of a potential hard-landing.

If that happens – the market has the potential to rally.

Another optimist – Joey Politano – former Bureau of Labor Statistics analyst shared this in a recent newsletter:

Arguably, the biggest cause for optimism is that monthly growth in core services inflation, the most cyclically-sensitive aspect of inflation, has taken a significant step downwards over the last three months.

That does not mean the Fed believes its job is done in fighting inflation, with it forecasting core PCE inflation to remain at a high 3.9% this year and rates needing to continue rising to a peak of 5.6%.

Nor does it mean the Fed believes disinflation will be painless, as its forecast of unemployment rising 1% over two years is still anomalous outside of recessions.

Still, its current economic projections suggest a scenario closer to a soft landing than a hard landing… Businesses, too, are steadily becoming convinced that the worst of the inflationary episode is behind us.

Makes sense… if you believe we are to avoid a recession.

Given the “soft landing” premise – this lends itself to possible rate cuts next year (vs higher for longer)

For example, if we have definitive signs of falling inflation (at an appropriate velocity) with a stagnant economy – we could see a Fed become more “carrot” than stick.

Possible? Sure

I am open to the possibility – however there are two (trusted) indicators which make me a sceptic.

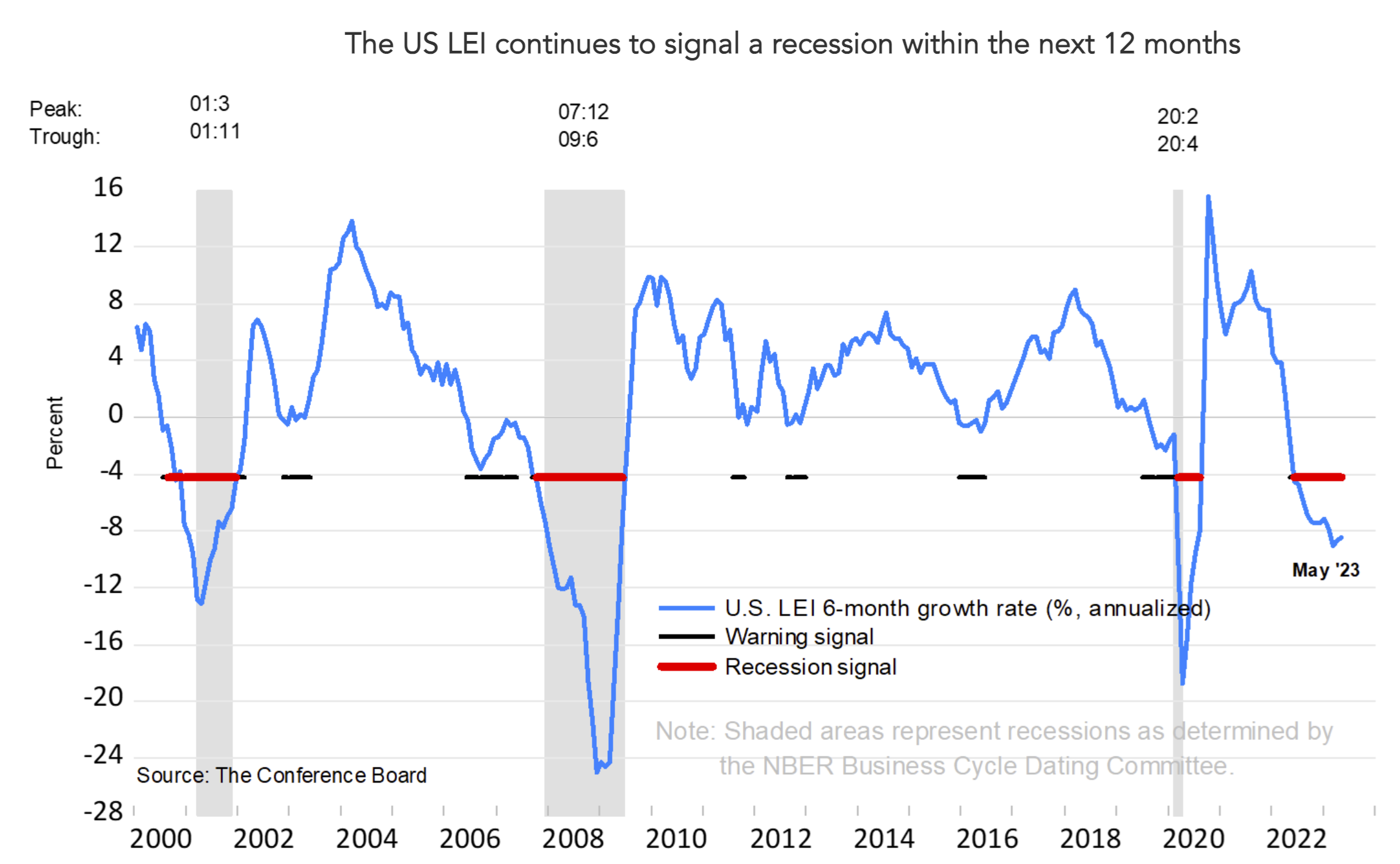

Recession Indicators Flash Red

I can understand the soft-landing optimism from the likes of Goldman Sachs (and many others).

And look, there were also optimists in 1999 and 2007 when we had things like very low unemployment, three quarters of GDP of 2.5%, with rising house prices etc.

But it would be remiss of the bulls to completely ignore two of the most reliable recession indicators of the past 50+ years.

And here I’m referring to:

- Conference Board’s Leading Economic Indicators; and

- The depth and duration of the inverted 10/2 yield curve

Let’s start with the former.

The Conference Board’s Leading Economic Indicators have now fallen month-on-month for 14 months.

“The US LEI continued to fall in May as a result of deterioration in the gauges of consumer expectations for business conditions, ISM® New Orders Index, a negative yield spread, and worsening credit conditions,” said Justyna Zabinska-La Monica.

“The US Leading Index has declined in each of the last fourteen months and continues to point to weaker economic activity ahead.

Rising interest rates paired with persistent inflation will continue to further dampen economic activity. While we revised our Q2 GDP forecast from negative to slight growth, we project that the US economy will contract over the Q3 2023 to Q1 2024 period. The recession likely will be due to continued tightness in monetary policy and lower government spending”.

Side note: Lower government spending is never a bad thing (as it’s less money that has to be paid back later; and also leads to less ‘crowding out’ of the private sector)

Looking at the US LEI chart above, the decline in any one month has still not been as severe as during the recessions that have taken place since 1980.

However, it’s hard to argue we will not see a downturn of some significance.

And perhaps this is the debate.

If this is right – we know that stocks have never bottomed before a recession.

To be clear, it does not mean stocks can’t continue to rally (they probably will) – however this should serve as a warning.

The second indicator not to ignore is the depth and duration of the yield curve.

As I like to say – inverted yield curves cause recessions – they don’t necessarily predict them.

Why?

Because credit and lending grinds to a halt.

Below is the current gap between the US 2 / 10-year yields (where the purple line is 0%):

June 23 2023

At the time of writing – the inversion sits around 97 basis points.

Not unlike the Leading Economic Indicators index – the curve has not been inverted this deeply, or for as long, since the early 1980s.

Again….

History doesn’t always repeat.

Events which happened in the past do not necessarily predict the future.

But if we do avoid recession – and these indicators prove to be wrong – I look forward to learning exactly what was different this time.

S&P 500 Hits Pause

It wasn’t only the Fed which hit pause in June – the S&P 500 could be about to follow suit.

June 23 2023

After 5 bullish weeks – where the market rallied 8.5% – this week it took a well-earned breath.

As indicated in previous posts – I flagged the zone of 4400 to 4500 as likely resistance.

As an aside, Goldman Sachs’ year-end for the S&P 500 target is now 4500 (on the premise we see a soft-landing).

My best guess here is the market continues to consolidate.

If that’s correct – it also implies the upside reward from today’s close is far less than the downside risk

Note: if we take Goldman’s year end target of 4500 – that is only 3.5% upside.

That said, if we’re to see the market ‘mean revert’ to either the 10-week EMA (4224) or 35-week EMA (4109), it will most likely find support.

Markets are in a bullish trend.

And when we see that – dips are typically bought.

That’s what we should expect.

Putting it All Together

Before I close, Jay Powell told US lawmakers this week that, “our recovery is by far the strongest of any country.”

Good news.

Barclay’s economists echoed Powell with this note to clients:

“The US economy has proven exceptionally resilient to aggressive rate hikes, standing out against its peers at this advanced stage of the hiking cycle”

- Healthy US household balance sheets – supported by excess cash accumulated during the pandemic

- Robust jobs gains that are in turn helping sustain income and spending growth; and

- Long-term interest rates that haven’t gone up as much as the Fed’s policy rates

They also call out the surge in immigration which is adding supply to the labor market (something Powell also mentioned).

This is now the strongest it has been since 2016 (subject for another discussion).

Powell had this to say to Congress: “more labor supply is helping the labor market get back into balance, including through immigration.”

Econ 101: make more of something (e.g., labor) and expect lower prices.

Barclays added the construction industry hasn’t seen the usual wave of layoffs during a Fed hiking cycle – suggesting housing demand continues to move higher.

And finally, they state banks’ balance sheets seem “well positioned” against deposit outflows.

Whether you are bullish or bearish – you should always attempt to balance your view with counter arguments.

What you want to do is understand your blind spots.

What are the arguments you’re potentially missing? What questions are you not asking?

We all have blind spots. And we all suffer biases.

Not knowing where your blind spots are (or suffering any form of bias) will typically lead to poor decision making.