- Full impact of monetary tightening takes up to 24 months

- Why I see some ‘hints’ of 2007 – but we’re still early; and

- Brace for 7-10% correction within the next ~2 months

It’s been said that whilst history doesn’t repeat – it often rhymes.

For me, 2023 offers some parallels to 2007.

To be clear, things are not exactly the same (they rarely are) – however I will demonstrate some similarities.

If I’m correct (and I may not be) – it could raise a ‘red flag’ for 2024.

But first…

This week the market wasn’t thinking about what happened ~15 years ago – it was partying more like it was 1999 (great song btw).

The animal spirits are alive and well – with the Index up 26.3% from its October low.

Curious don’t you think?

For example:

- have we seen any improvement in earnings?

- do we have a Fed ready to cut rates?

- are there clear signs of Core PCE inflation trending aggressively lower? and

- are there clear strong signs of economic expansion?

The answer is largely a ‘no’ in every instance.

Now there’s a name for this type of phenomenon…

It’s called multiple expansion.

In plain english – investors are being asked to pay a lot more for a dollar of company’ earnings.

For example, if you want to own Apple, you are being asked to pay 28x next year’s earnings.

That’s rich for a company growing at low single digits.

If you want to own Microsoft – that will cost you 31x next year’s earnings.

Ouch.

How about market darling Nvidia?

That’s closer to 60x next year’s earnings.

To be very clear – these are all high quality companies – and the best in their class.

No argument there. I am happy owning a good chunk of both Apple and Microsoft.

Everyone should.

But if you are buying (or adding) now – you are paying a very large premium to be part of their story.

And whilst that might work out in the long run… it’s a lower probability bet.

I digress…

Let’s expand why I see some ‘echoes’ of 2007…

Is there something there? Or am I simply barking at shadows?

Themes from 15 Years Ago

As I’ve watched the market rip higher – my question is whether they are running a victory lap too soon?

I don’t know – but my gut feeling is yes.

For example, questions which come to mind include (not limited to):

- is the fight against stickier forms of inflation definitely won?

- are we more than likely to avoid a recession? and

- is the Fed about to enter an easing cycle (whilst also ending QT)?

If I knew the answers to these (and similar questions) – sure – pin your ears back and buy.

Unfortunately I don’t (but you might)

When I zoom out – there are few observations which deserve comment.

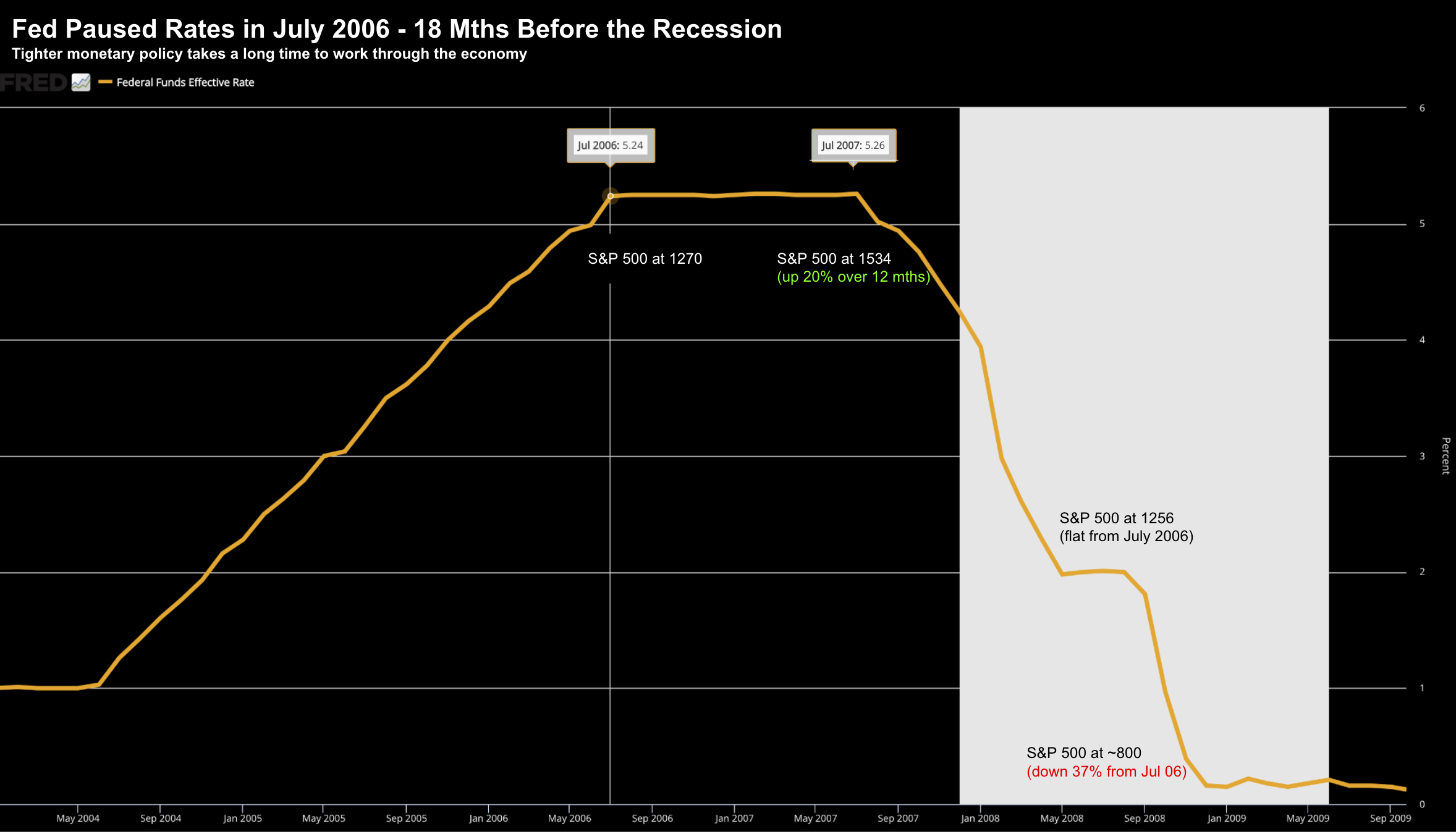

#1. Tightening Takes Time

My first casual observation to anyone calling the next bull market is to recognize it takes time for monetary policy to work its way through the system.

How long?

Typically it’s in the realm of 12 to 24 months.

With this cycle, the Fed first raised rates in March of 2022.

So that puts us about 15 months in.

Let’s look back at what we saw in 2006/07.

The first Fed pause was June 2006.

However, the recession started 18 months after the Fed paused on rates (see below).

But guess what…

As the Fed paused between July 2006 to July 2007 – the S&P 500 rallied 20%

Question is – are the Fed on pause now?

The market certainly thinks so (or at least believes they are very close to).

Irrespective – if we assume we only see another one or two rate hikes – it could feasibly take another 10 months (approximately) before things really start to bite.

That’s what we saw 15 years ago.

This also lines up with my forecast for likely recession towards the end of 2023; or first half of 2024.

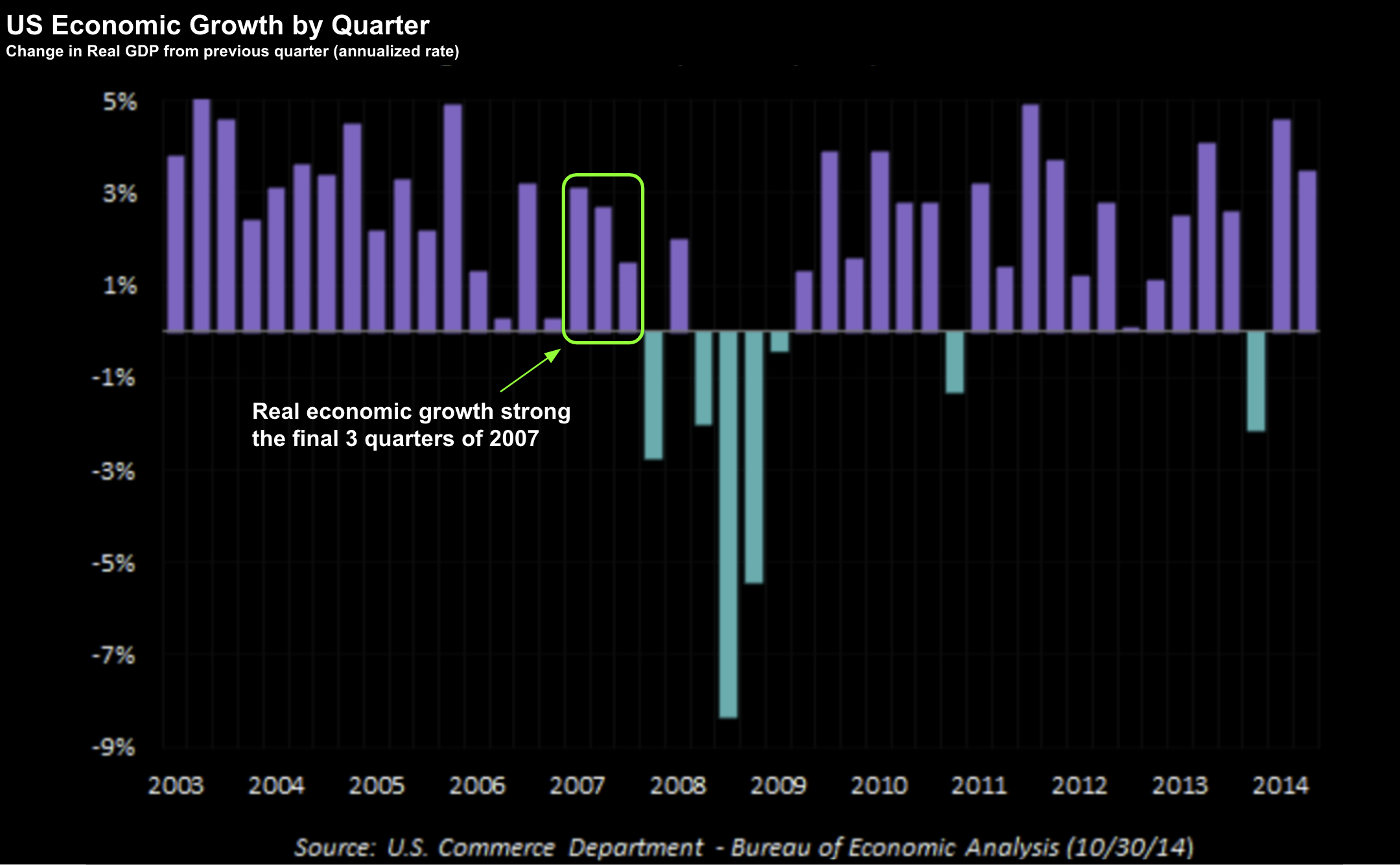

#2. The Economy Looked Good then Too

Throughout 2007 – all the way into Q4 – the economy was in great shape.

In fact, it was far stronger than the sluggish (~1% growth) economy we have today (in real GDP terms)

GDP was firing at around 2.5% annualized in 2007.

Unemployment was very low – around 4% – and no-one was calling for an abrupt slow-down.

Now I’ve heard similar calls today; i.e. along the lines of ‘the economy and consumer is strong’... there’s no recession.

And I get it… the consumer is in reasonably good shape.

For one thing – they have jobs.

What’s more, they are seeing their wages increase around 4% (negative in real terms) – and do not seem to be excessively stretched.

And with many borrowers locking in 30-year fixed home loans around a rate of 3.0% – they are not too concerned with the Fed raising rates.

Many have enjoyed the value of their homes increasing; and now the value of the 401Ks and stock portfolios appear to be on the rise.

Again, very similar to 2007

I will circle back to the consumer shortly when I talk about the single most important factor to watch…

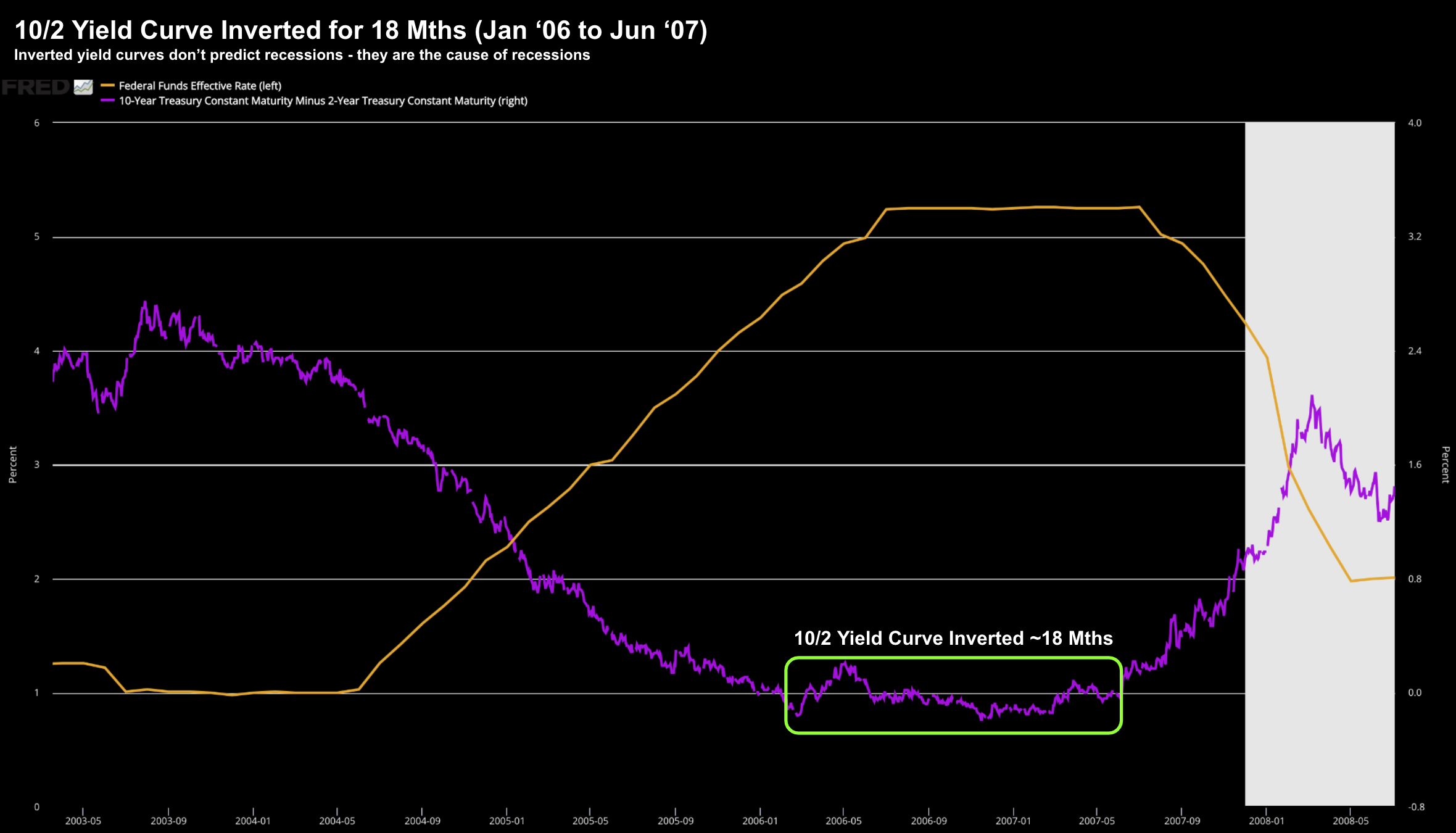

3. Inverted Yield Curves Cause Recessions

Let’s take a look at what we saw with the 10/2 yield curve over 2006/07

No surprise it was inverted for a lengthy period… around 18 months

From early in 2006 this remained mostly below 0% (right hand axis) – steepening only once the Fed started to cut rates.

We see something similar today – the inverted curve is far deeper – close to 90 basis points.

That’s not a climate which incentivizes lending and/or credit growth.

Quite the opposite.

Here’s What to Watch

A growing economy… low unemployment… inverted yield curve… a resilient consumer… rising house values… and a Fed about to go on pause… are all parallels to ~16 years ago.

And there is nothing to say the S&P 500 cannot continue to rally in that environment.

Last week I said it most likely will.

But I think there is just one thing to watch…

Jobs.

As I said at the beginning of the year – when offering my 5 most important charts – employment was #1.

For 2022, I said it was all about oil, inflation and the US dollar.

For 2023 it was all about employment. Repeating a portion of that post:

Perhaps more than any other macro economic indicator – this carries the most weight into 2023.

Why?

This will most likely dictate both the pace and duration of (restrictive) interest rates (i.e. anything above ~4.75%).

As we know, the Fed’s problem with inflation is services (and specifically wage growth)

It’s not goods inflation… that is dropping like a stone.

Now part of that problem is a very strong labor market… where unemployment today sits around 3.7% (with the economy still adding around 200K jobs per month)

6-months later unemployment still sits at just 3.7%

This is the linchpin holding it all together.

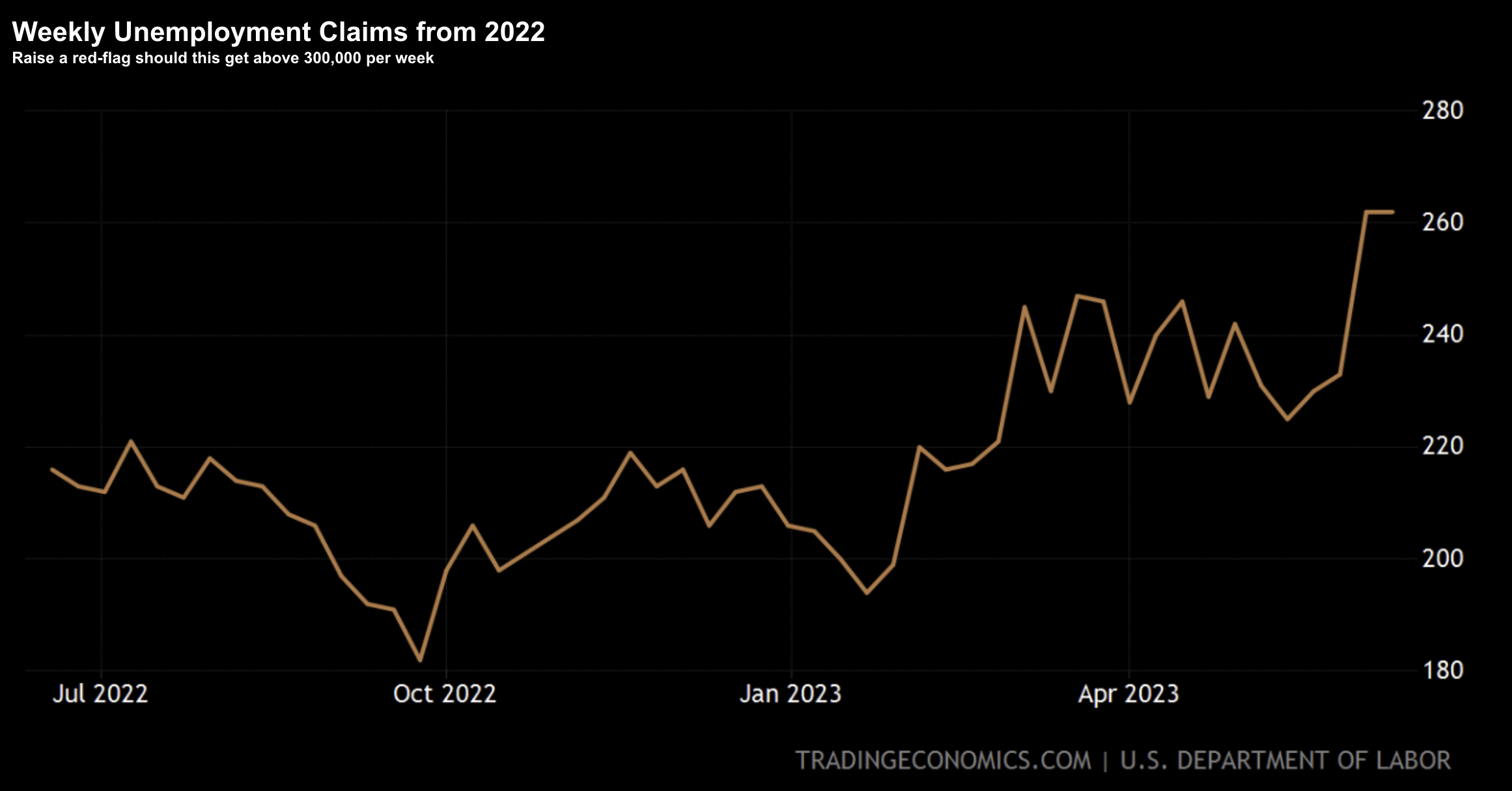

Therefore, my thesis is we now need to carefully watch weekly unemployment claims.

They are our best ‘real-time indicator’ of any potential weakness in the underlying economy.

Now take a look at this long term chart showing the 4-week moving average:

The good news is we are nowhere near recessionary levels (purple line).

You can see whenever we get close to this level – a recession is not far away.

The “magic” weekly number to watch is anything above 300,000

So let’s look at the current (weekly) trend:

June 16 2023

As you can see – despite unemployment staying low – this is nudging higher.

The last two weekly reports are around 260,000

My question is – at what point will this force the Fed’s hand?

Or will it (if Core PCE has a 4-handle)?

Getting back to one of my earlier points — the lag effect of 500 basis points of tightening (with more to come), quantitative tightening and more recently – additional bank credit tightening – is yet to be felt.

But it’s starting…

Think of the three primary legs of tightening in play:

- the duration (and depth) of the inverted yield curve (highlighted above); and

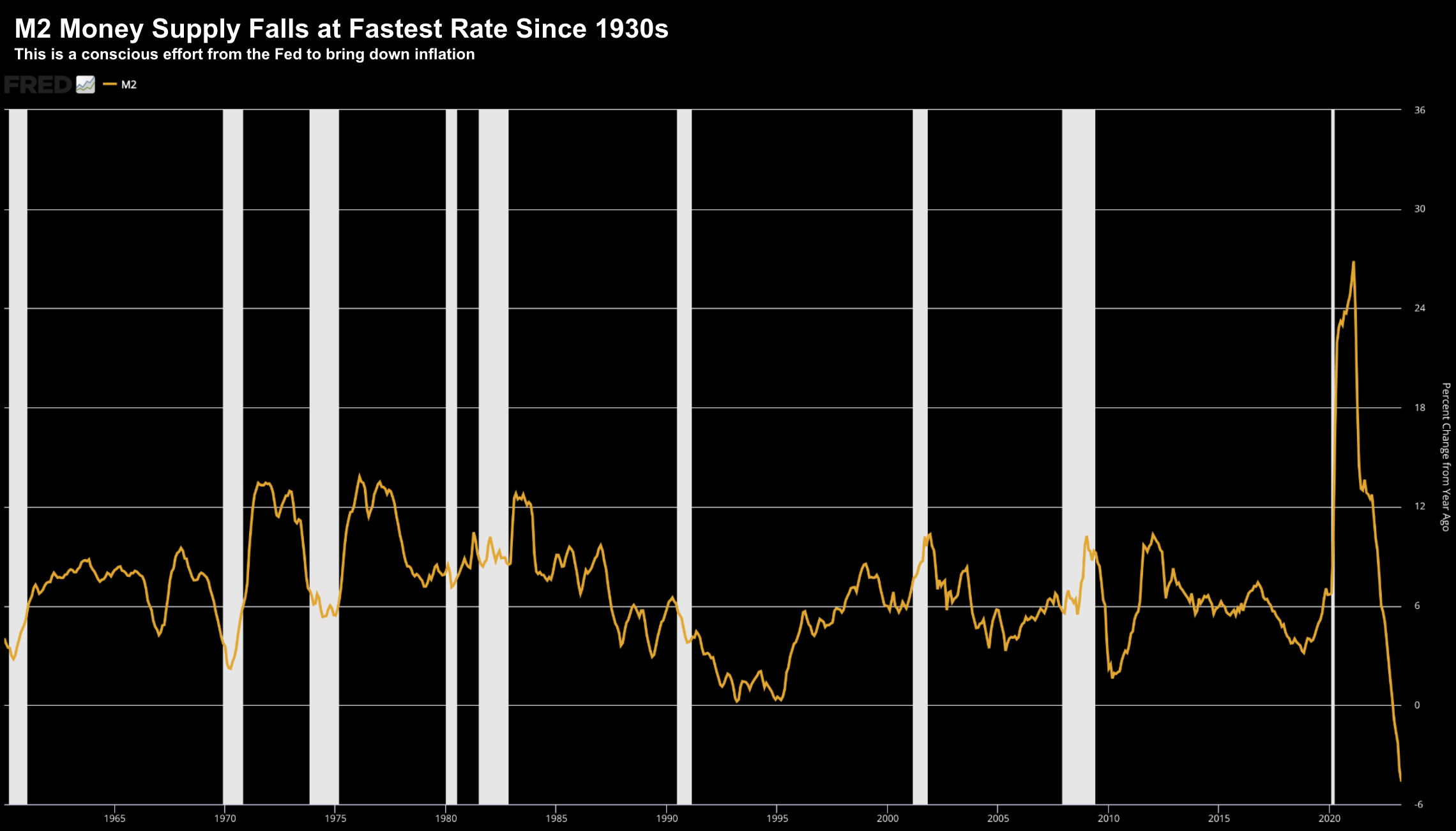

- the contraction in money supply; and

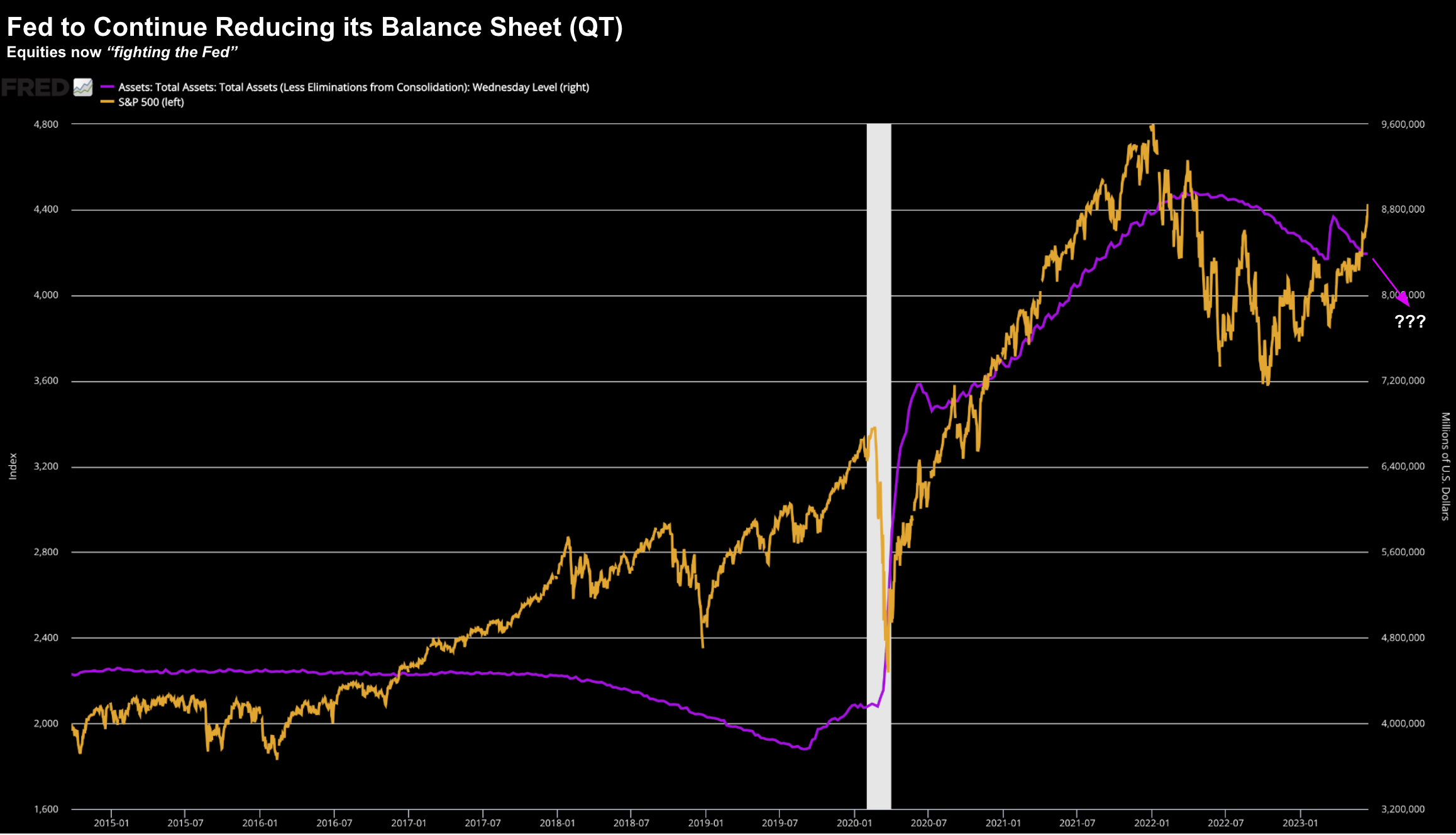

- quantitative tightening (i.e. QT – Fed reducing its balance sheet)

With respect to money supply – it has contracted faster than anytime since the 1930s (as a conscious effort to reduce inflation)

And below is the contraction we see with the Fed’s balance sheet reduction (QT) – which often enjoys a relationship with the S&P 500 (in orange)

Again, all of these ‘tightening’ effects are yet to be fully felt.

But they will come…

Putting it All Together

Don’t get me wrong – none of this means the market is about to lose “50%” in the near-term.

Not at all.

Only a very brave person would be short this market.

The market can rally further from here.

In fact, that’s what is likely to happen.

Last week I said pencil in targets in the zone of 4400 to 4500.

That said, we do look overbought in the very near-term and I think we will see a technical pullback somewhere between 7% and 10%

How much further beyond that in the absence of earnings – that’s hard to know?

I think we may need to see broader participation for the market to move higher (e.g., banks, energy, cyclicals) – as large-cap tech feels stretched.

And we might see that if participants believe the economy is going to avoid a recession.

But I am reluctant to declare this is the “new bull market”

What I see are early hints of 2007… which served as a warning.

The full impact of central bank tightening can take 12 to 24 months to work through.

We are ~15 months in and have experienced very little pain (apart from two idiosyncratic bank failures – both of which were poorly managed)

Weekly unemployment claims are starting to inch higher but nothing too alarming.

However, it deserves our full attention.

When (not if) this starts trending above 300,000 per week… a yellow-flag will be raised.

All of this falls apart if unemployment gets closer to 5%+.

In closing, I can’t get on-board the “soft landing” camp.

Not on the basis of what I see with the amount of Fed tightening, money supply contraction, yield curve inversion and recent bank tightening.

The bulls clearly see things I don’t – but that’s what makes a market.

That said, I’m fine maintaining my 65% long exposure in the quality stocks (for now at least).

And so far, so good.