- Fed to pause this week

- Market expects CPI Headline of 4.0%

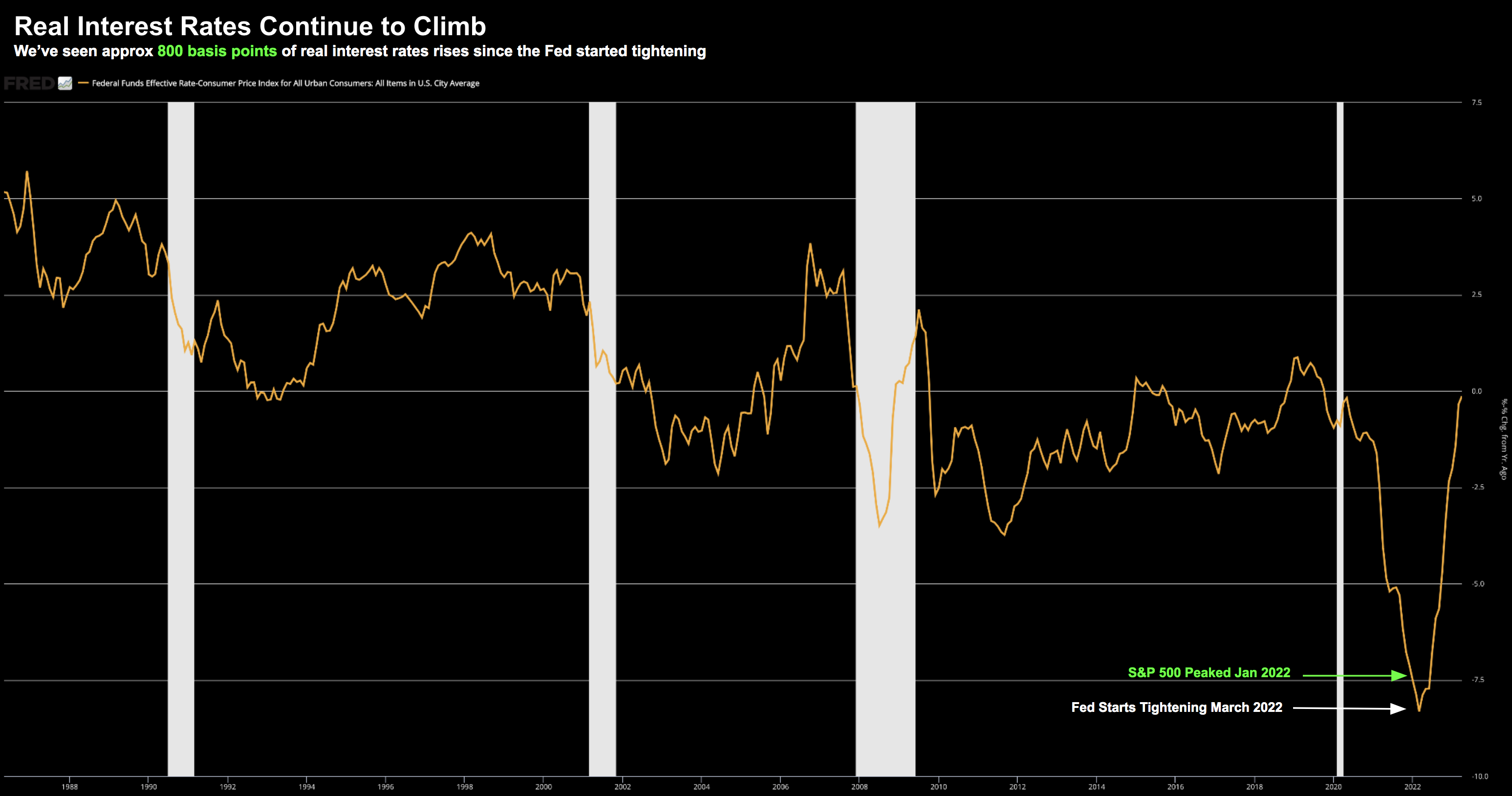

- However, the real rate of interest continues to go up

It’s Fed week.

What will the world’s most watched central bank do?

A surprise hike like Canada and Australia?

Unlikely.

Maybe time to hit the pause button and take a look around?

That’s what markets are pricing in.

Or will this be a ‘hawkish skip’ implying their work is not yet done?

From mine that will depend on two key metrics:

- Core Inflation; and

- Employment

Dialing in a ‘Hawkish Skip’

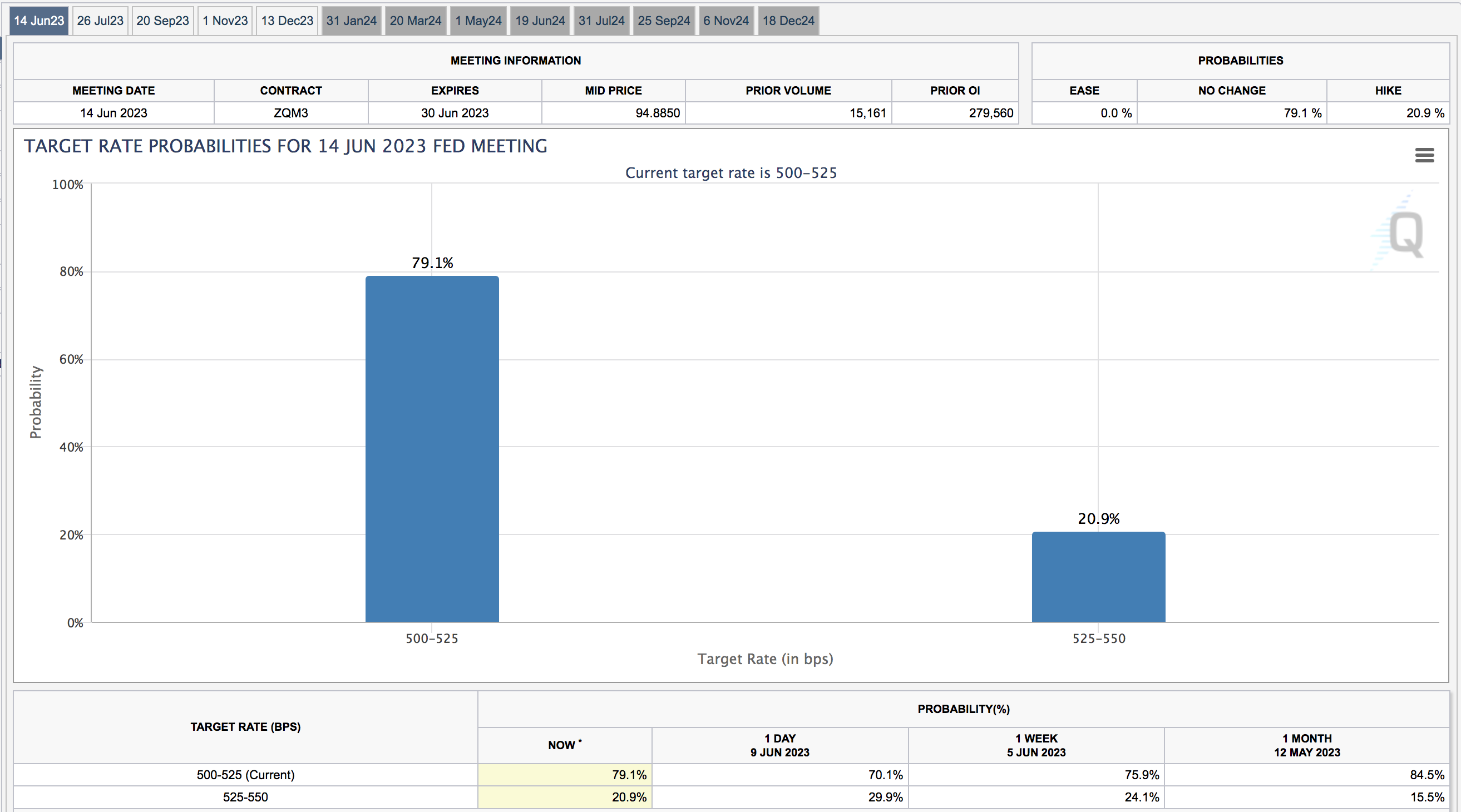

If we lean into the CME FedWatch Market Tool – we should expect the Fed to pause this meeting with a high probability of further hikes in July.

For those less familiar, the FedWatch Tool uses market activity to gauge traders’ interest rate predictions.

According to its most recent data, Wall Street believes there’s only a 20.9% chance that the Fed will raise rates this week.

From the CME:

June 12 2023

If we were to see a rate rise this week – markets will be caught off side.

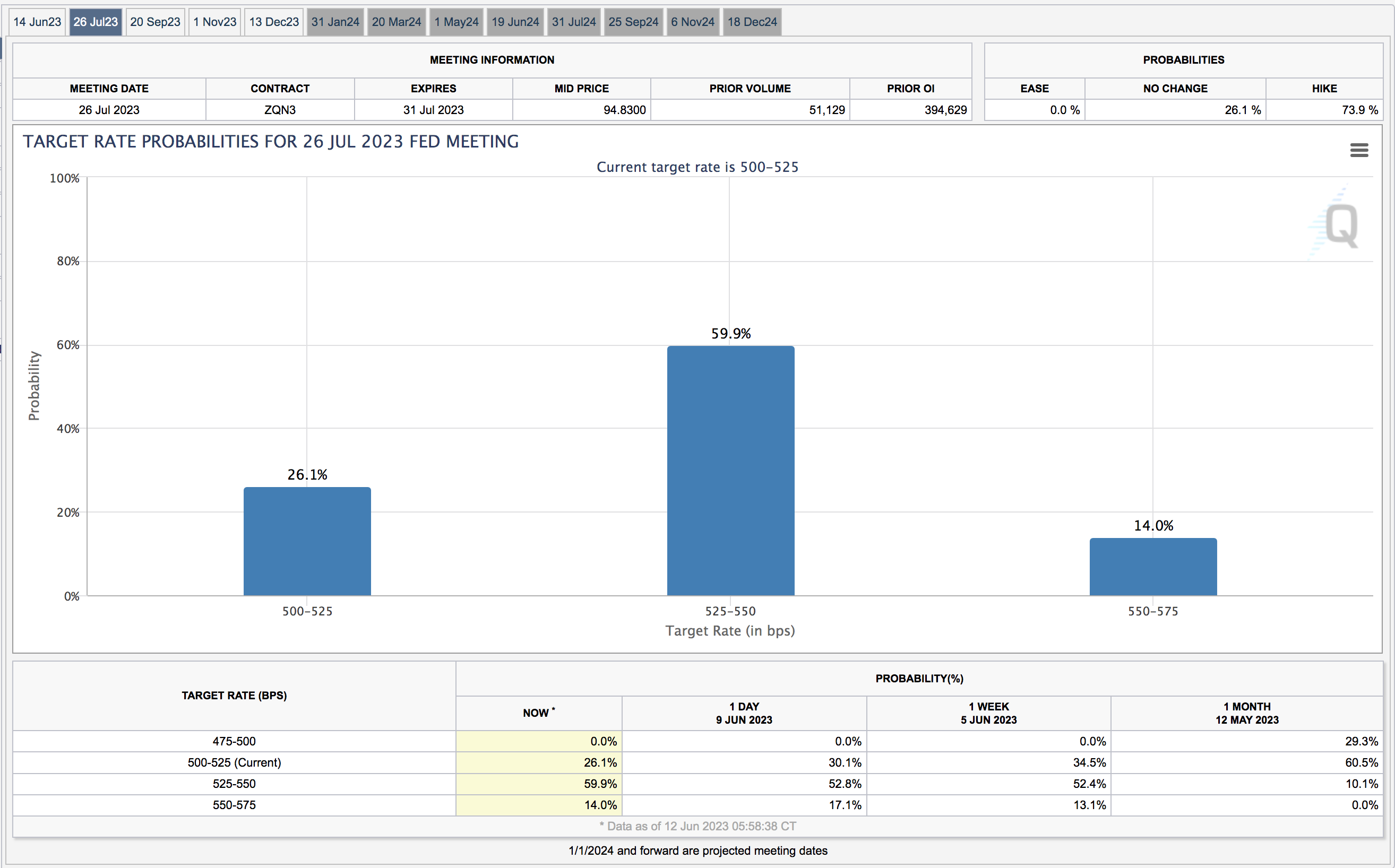

That said, markets expect a ‘hawkish skip’

For example, the same tool predicts a 60% chance of a hike in July.

June 12 2023

These probabilities may be higher or longer pending when you read this post.

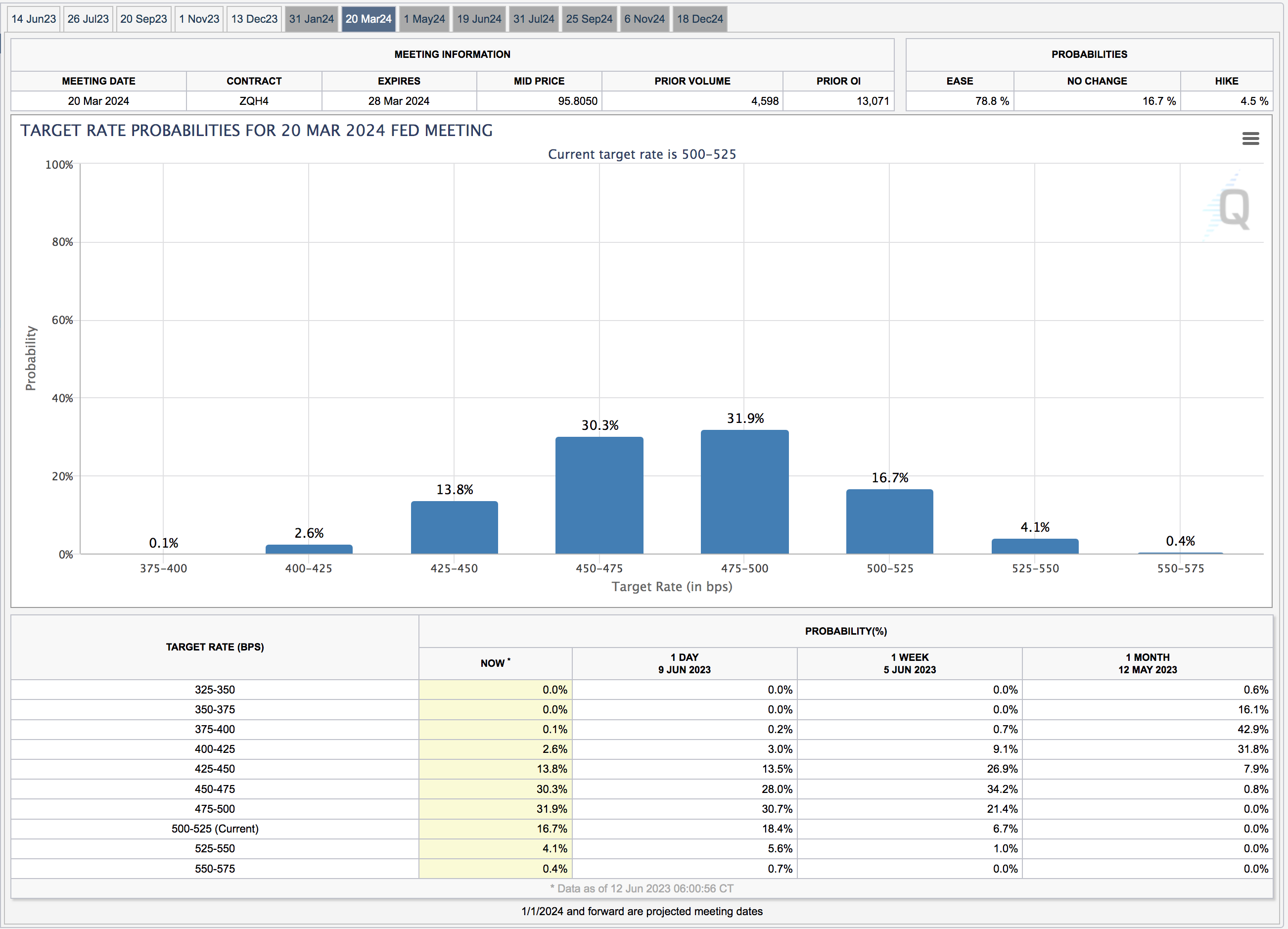

But here’s where it gets interesting…

If we move all the way out to say March 2024 – markets see a 61% probability rates will be above 4.75%

June 12 2023

That is the very definition of higher for longer.

And if inflation is said to come down over this time (which we should expect) – it means real rates will be higher.

Real rates are the nominal rate less the rate of inflation.

That’s important.

I raise this because some investors will probably ignore talk of a “skip”.

They might see this as being only one step closer to a “pivot” (a move to rate cuts)

I think that’s misplaced optimism.

Inflation Expectations

Whilst it’s Fed week – we also get important reads on inflation.

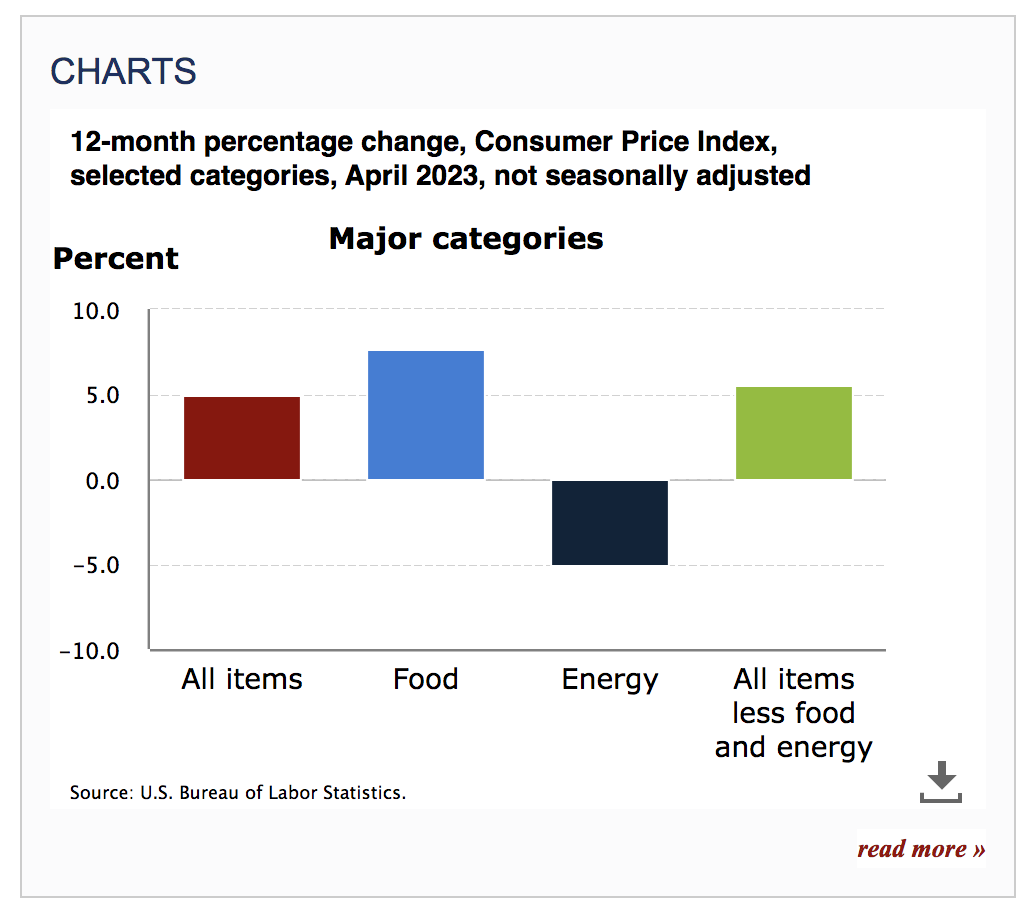

Tomorrow we get CPI – both headline and Core.

Headline CPI is expected to fall to ~4.0% YoY.

And whilst a headline number of 4.0% will be welcomed – what’s more important is what we see with Core CPI.

This is what the Fed measures.

The market expects ~5.3% for Core – which is similar to where it traded 12 months ago.

If so, that will be disappointing.

As I’ve explained in various posts – a large reason for falling headline inflation are lower energy prices.

Let’s see where energy prices go in the second half of the year as Saudi Arabia continue to cut supply (subject for another post).

The other swing-factor (with inflation) will be shelter.

Recently I shared this chart:

Shelter costs are approx one third of CPI — currently rising at an annual rate of ~8%.

If they were to ease from current levels, then that would likely bring inflation down.

The good news is this is coming down.

For example, real-time housing data from property aggregator Zillow suggest this is already a lot lower than the government CPI suggests.

This is because the government’s reports uses a methodology which is lagging.

Other parts of the report worth looking at closely are used vehicle prices, which jumped 4.4% on a monthly basis in April and are expected to be high again in May.

The CPI report tomorrow – plus another month’s worth of data before the Fed’s July 25-26 meeting – will largely determine if we get the follow-through rate July hike.

For example, let’s say Core CPI continues to show a 5-handle in July – why shouldn’t the Fed keep going?

With total unemployment below 4% – wage growth still above 4.0% – I see no reason to pause.

Market Remains (Wildly) Optimistic

Whether it’s a pause, skip, hike or pivot – the market remains bullish.

In fact, it’s wildly bullish.

For anyone who is short the market – or betting against it – they are probably feeling the pain.

It’s a brave person to step in front of a fast moving train…

June 12 2023

This is not a market you want to be short.

There is simply too much momentum in favour of the bulls (as I highlighted in this post).

In that article, I outlined 5 arguments for the bulls and 3 for the bears.

Both sides have a strong case.

For now, I feel comfortable with my 65% long exposure in quality names.

You should have some exposure to this market.

Not participating is a mistake.

However, going short (this year) has been a bigger mistake.

Technically I think the market can continue to rally here.

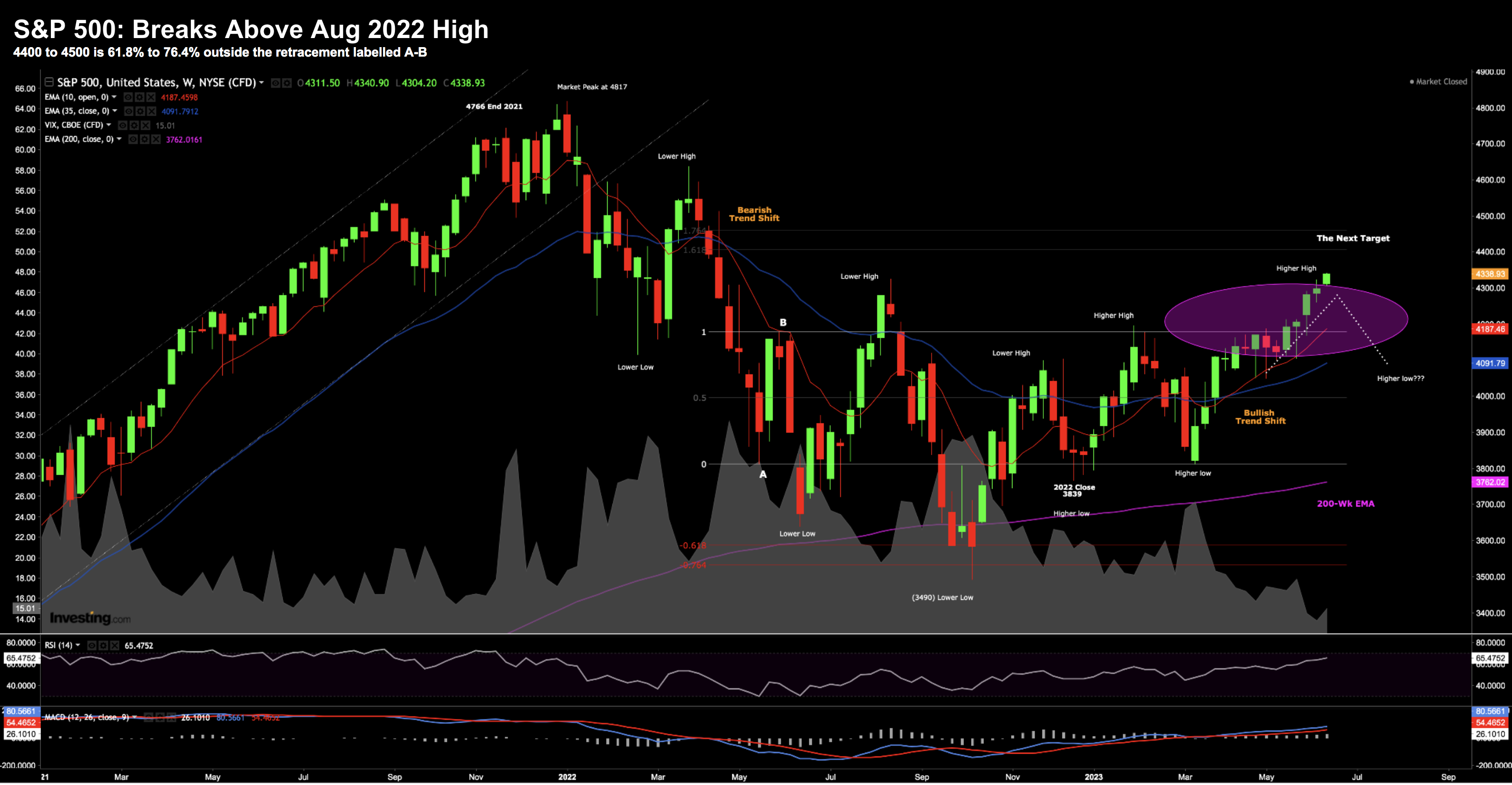

For example, the distribution I outlined in May 2022 (“A – B”) has continued to remain in force over 12 months later.

That is, the market has spent the large majority of time trading between the levels of 3800 (“A”) and 4200 (“B”)

On occasions, it has tested the 61.8% to 76.4% outside that zone (mostly on the downside).

That zone is around 3600 (where I was happy adding to quality names)

On the upside, that represents an zone between 4400 and 4500.

It would be remiss to rule out a test of this upper zone (which is only 2.3% to 4.6% higher than today’s close)

That said, it’s not a rally I could be chasing (again, for the reasons I outlined here).

For example, I think we could see inverse of what we saw in October last year.

That is, we briefly test the zone before reversing.

The other technical indicator I’m casually watching is the Relative Strength Index (RSI) in the lower window

The last time we saw the indicator this overbought was November 2021.

During that time, it remained overbought for around 10 weeks before the market crashed.

Keep an eye on this.

Putting it All Together

Markets fully expect a pause in rate hikes this week.

That’s probably what we will get.

But I think that’s neither here nor there.

Here’s something to consider:

The S&P 500 is back at levels not seen since April 2022.

Sure, almost 100% of the 20% rally from the October low is limited to less than 10 stocks.

But that’s where we are.

The Fed started this current rate tightening cycle in March of 2022.

Put another way, the market now trades at the same level but with 500 basis points of rate rises (not to mention a meaningful amount of QT)

However, if we look at real interest rates, it’s arguably more troubling.

In March of 2022, CPI (headline) was 8.5% (implying real rates were closer to negative 8.0%)

Real rates are now closer to zero.

From mine, this needs to be questioned from a valuation perspective.

For example, the economy is proving to be somewhat less sensitive to interest rate rises as it has been in past cycles.

This is due to (in part):

- ~$2.6T in excess liquidity sloshing around the economy;

- the majority of homeowners locking in mortgage rates ~3.0% on 30-year fixed loans; and

- a wide array of government stimulus measures (e.g. the ability to defer student debt repayments).

As such, when the Fed reviews what we see with speculative asset prices (stocks and houses) – there has basically been no change since their rate hikes.

For example, despite these (tighter) monetary measures, we still find:

- Stocks trading where they were over a year ago;

- Core CPI and PCE still around 5.4% (i.e., where it was a year ago)

- Unemployment at 3.5% (or 70-year lows)

- Wage growth still above 4.0%

From my perspective, nothing here should prevent the Fed from keeping rates higher for longer.

Remember:

Any pause in rates (with headline inflation moving lower) means real rates are going higher.

My question is how much have stocks priced in?