- Why I choose to remain 65% long stocks

- Why it’s also prudent to keep some cash on hand

- Invest with optimism – but keep your eyes open

It’s fair to say this is one of the more hated stock market rallies.

Why?

Rarely have I seen so many caught on the wrong side of the trade.

Sentiment is overwhelmingly negative (more with a survey shortly)

And yet…

The S&P 500 is up ~20% from its October low.

“It’s far too narrow – it lacks broad participation” you might say.

That’s true – these gains have come from less than 10 stocks.

“Earnings expectations are far too high” others add.

Yes.

Forward earnings suggest the Index trades about 19x. That’s rich.

“There’s no avoiding a recession”

We will see.

These are fair points.

But all that matters is how you are positioned.

There is no bullish side or bearish side.

There is only the right side.

For me, I remain 65% long and have been all year.

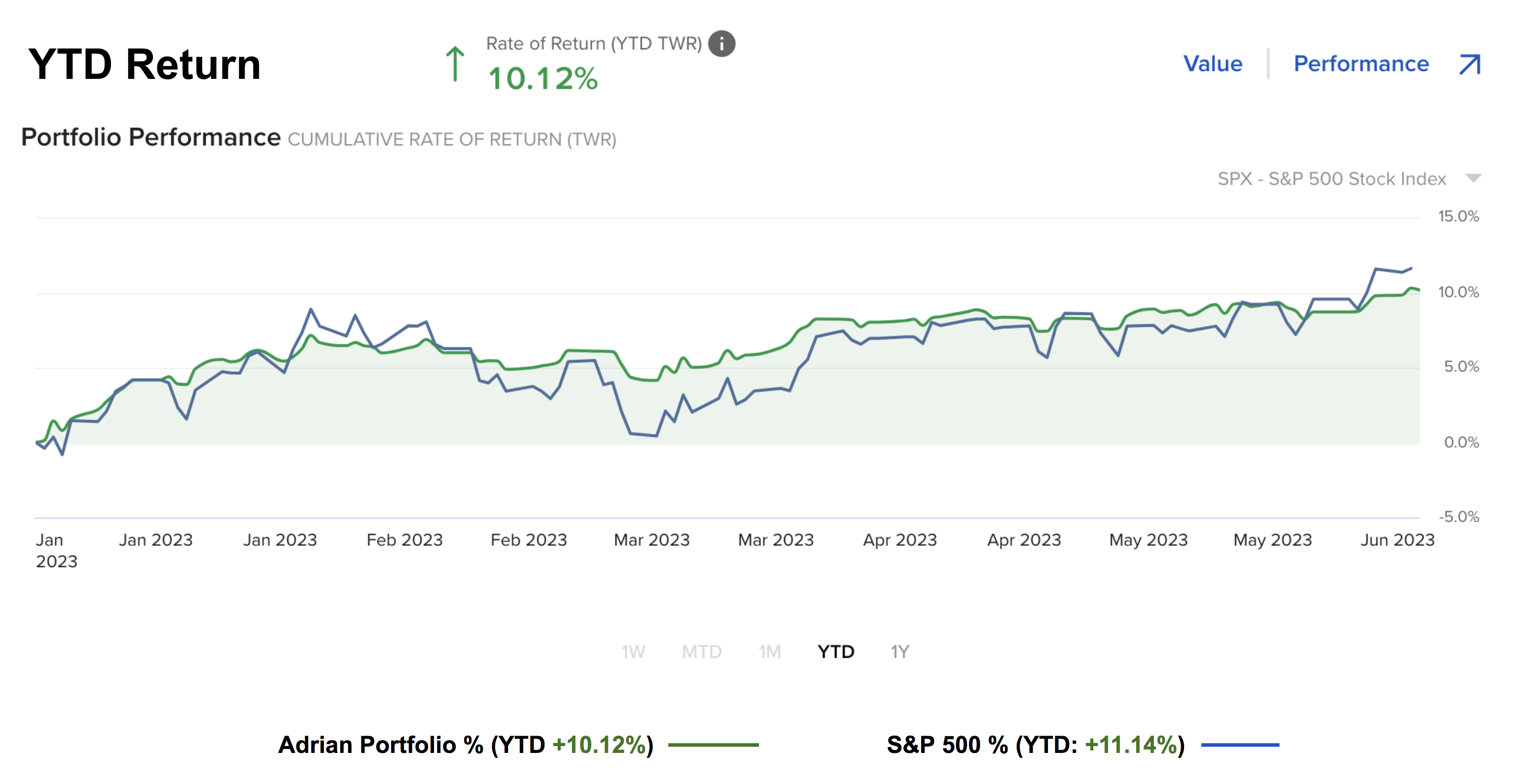

This has my portfolio up ~10.1% YTD (which I will update again at the end of the week).

June 7 2023

I’ve made some gains in tech – given my core holdings are Amazon, Apple, Google and Microsoft.

Fortunately these stocks gained a handful of points.

But I gave back a little ground on banks and energy (that said I think they will do well in the second half)

Net-net my portfolio is roughly in-line with the Index performance (which I will take this year given my 19% outperformance last year)

The question everyone is trying to answer is whether this market has the ability to keep powering higher?

Or was today a sign things could be finally rolling over (especially in overbought tech names)?

The short answer is I don’t know.

Sorry.

My crystal ball is probably as poor as anyone’s.

But what I will do is make some arguments for both cases.

I do not have any short positions and do not plan on reducing my exposure.

That said, nor do I plan on increasing my exposure at current levels.

Does that make me bullish or bearish?

You decide.

I would say it’s slightly more bullish than bearish given I’m net-long.

So let’s take a look and I will let you decide.

Why Keep 65%+ Exposure?

If you missed out on the rally since October last year – you are probably kicking yourself.

However, if you managed to avoid the 20% downside last year – then you are probably still ahead (over an 18 month timeframe)

Those who are up sharply this year more than likely were killed last year.

That’s what taking too much risk will do.

Below are 5 arguments as to why it pays have to exposure – and why we might see higher prices ahead.

1. Trade the Tape

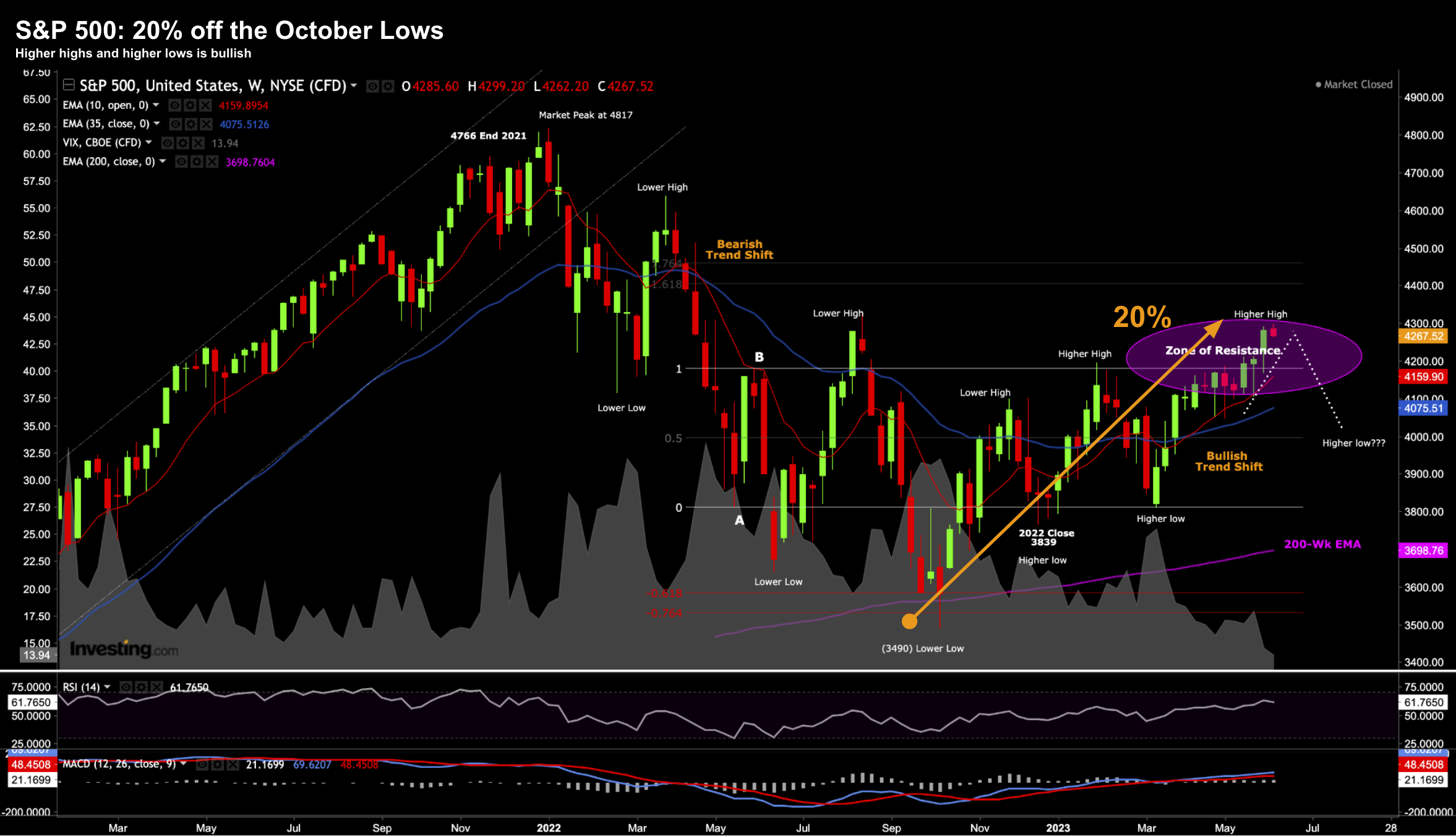

The benchmark index has now risen ~20% from its October 3490 low.

That’s no mean feat… below is the weekly timeframe:

June 7 2023

In theory, some will argue a 20% rally off the lows means a new bull market.

I don’t buy into that narrative however the case can be made.

However, what I do give some weight to are the bullish weekly moving averages.

The 10-week EMA (red line) is above the 35-week EMA (blue line) which tells me probabilities favour higher prices.

The same is true in reverse.

What’s more, we are putting in a series of higher lows and higher highs.

That’s bullish.

That said, the ‘tape’ feels extended in the very near-term.

Therefore, we might see mean reversion back to the 35-week EMA (i.e. 4075) – but I would expect buyers to return around that zone.

If they do – that’s bullish.

2. It’s Been a While

The less talked about aspect of the 2023 rally is how long its been since we made a new low.

We are coming up to 239 days – a solid amount of time.

Typically if things were “so bearish” – we would have re-tested these lows by now.

It hasn’t happened. Instead we have ground our way higher.

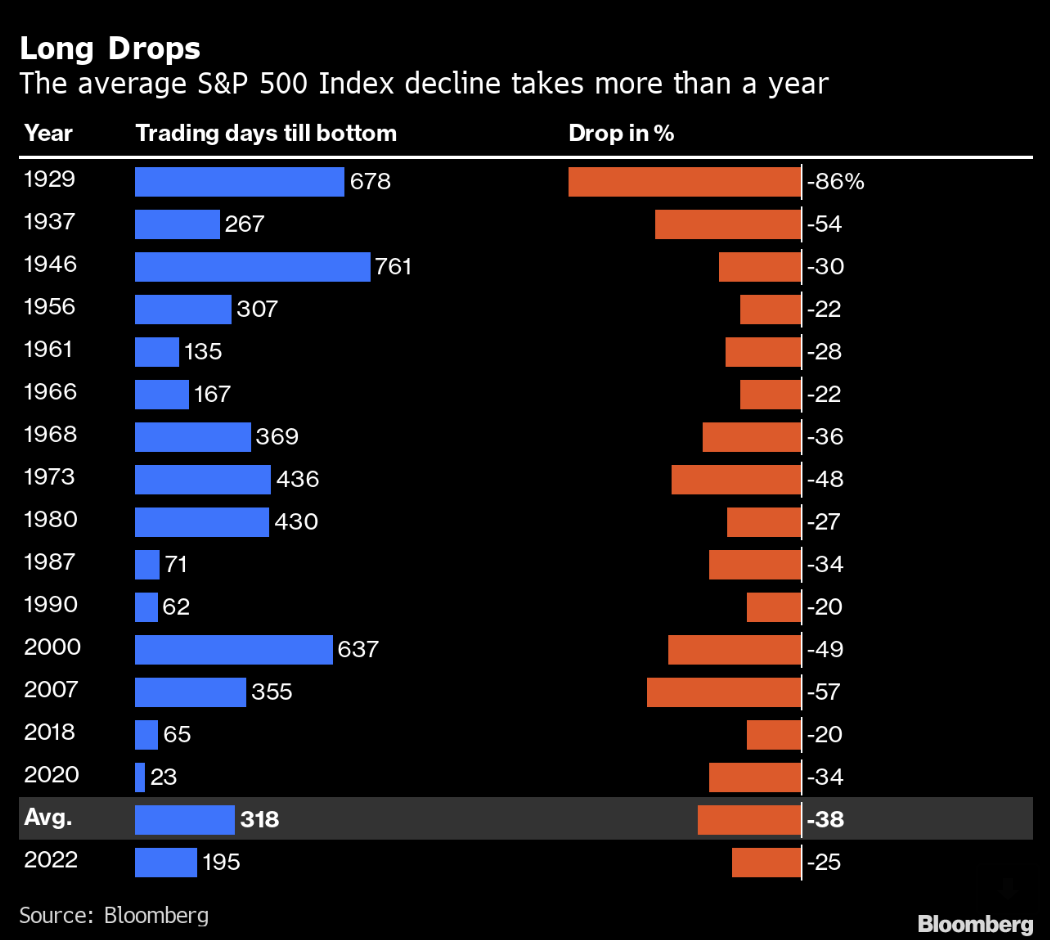

Bloomberg reported that the average number of trading days until the S&P 500 bottoms is 318.

This is interesting and something we are likely to exceed.

Bloomy highlights there have been longer stretches (e.g. 761 days in 1946 and 678 days in 1929) — it feels like if things were going to fall apart – we would have retested the lows by now.

Bloomberg also cites research from Todd Sohn of Strategas Research Partners.

Sohn points out that the S&P 500 broke a 12-month streak of negative year-over-year returns in April.

It’s unusual for negative returns to persist so long, and historically, the market has been up a year after breaking the streak every time that’s happened.

We can put this in the “bullish” column.

3. What Happened to Fear?

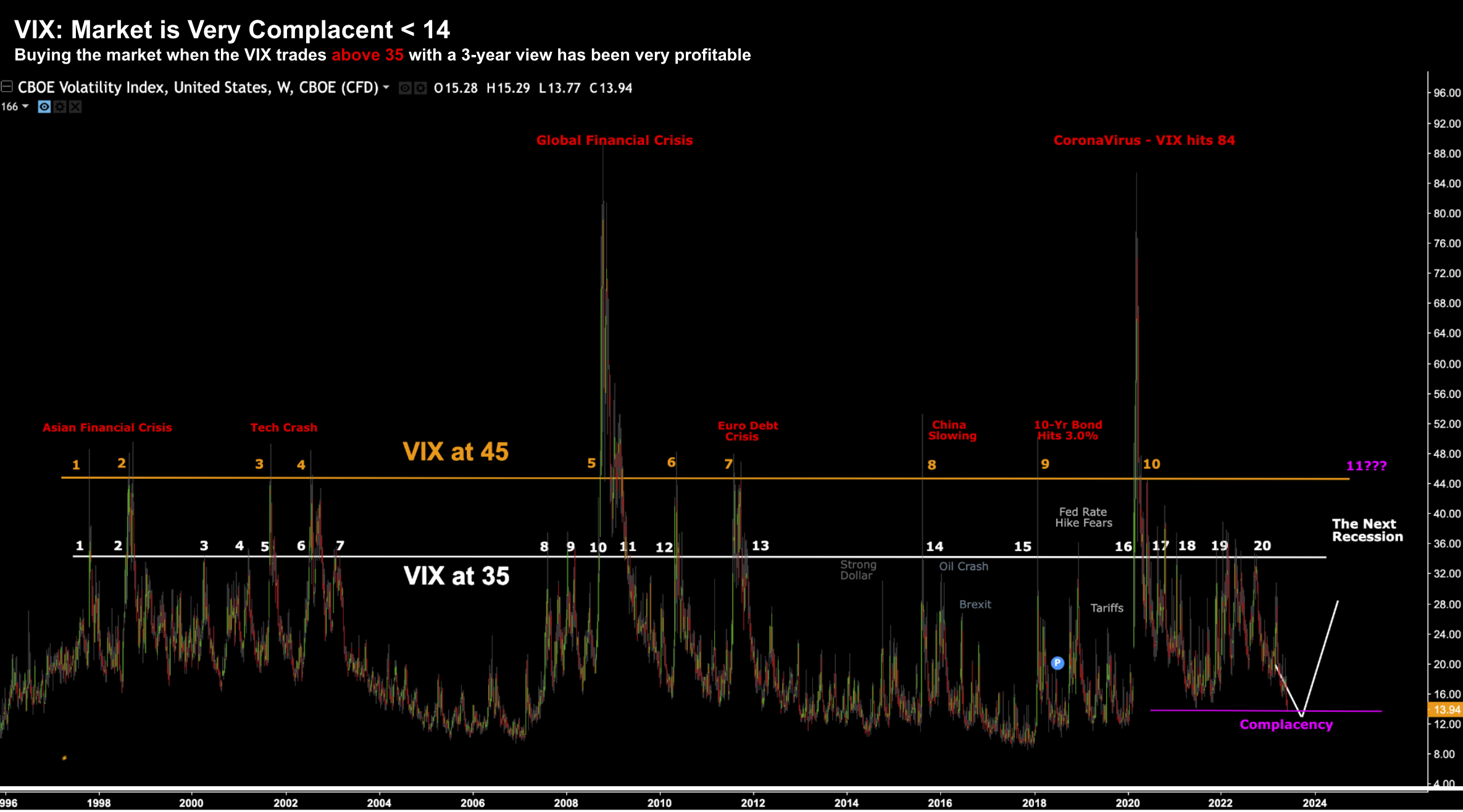

One of my favourite metrics to track is the fear index; i.e., the VIX.

I chart the VIX against the S&P 500 every week – it’s now below 14.

Put another way, the market is pricing in less than 1% daily moves over the next 30 days.

Here I have annotated recent events which has caused the VIX to spike:

June 7 2023

With the VIX below 14 – we have not seen it that low in 2 years.

Why?

That’s the question I have.

Today it’s barely reacting to the various elements of risk still present (e.g., recession, earnings risks, higher rates, China etc etc)

But what is that telling us?

Are we barking at shadows?

Here’s something we do know:

Multi-year lows in the VIX only occur in bull markets (not bear markets).

Another one for the bulls.

4. Earnings – Better than Feared

There was a lot of fear coming into Q1 earnings.

And whilst the market knew it was going to mark the second consecutive earnings contraction – how bad was it going to be?

Answer: not as bad as some assumed.

To be clear, earnings and revenue were not great. Far from it.

But the point is they were better than expected. And that means the tape will likely push higher.

What’s more, we are seeing forecasts for the S&P 500 being revised higher

Now whether you believe that or not is the question to ask.

But that’s what is happening.

As I say, I think earnings will surprise to the downside.

However, this is increasingly becoming a contrarian call.

For now, the market sees strong earnings growth in the two quarters to come.

5. Too Many Bears

There’s an old saying:

Whenever everyone leans too far to one side of the boat – generally things have a tendency to go the other way.

This is what has happened.

Further to my preface, this would have to be one of the most hated rallies in recent memory.

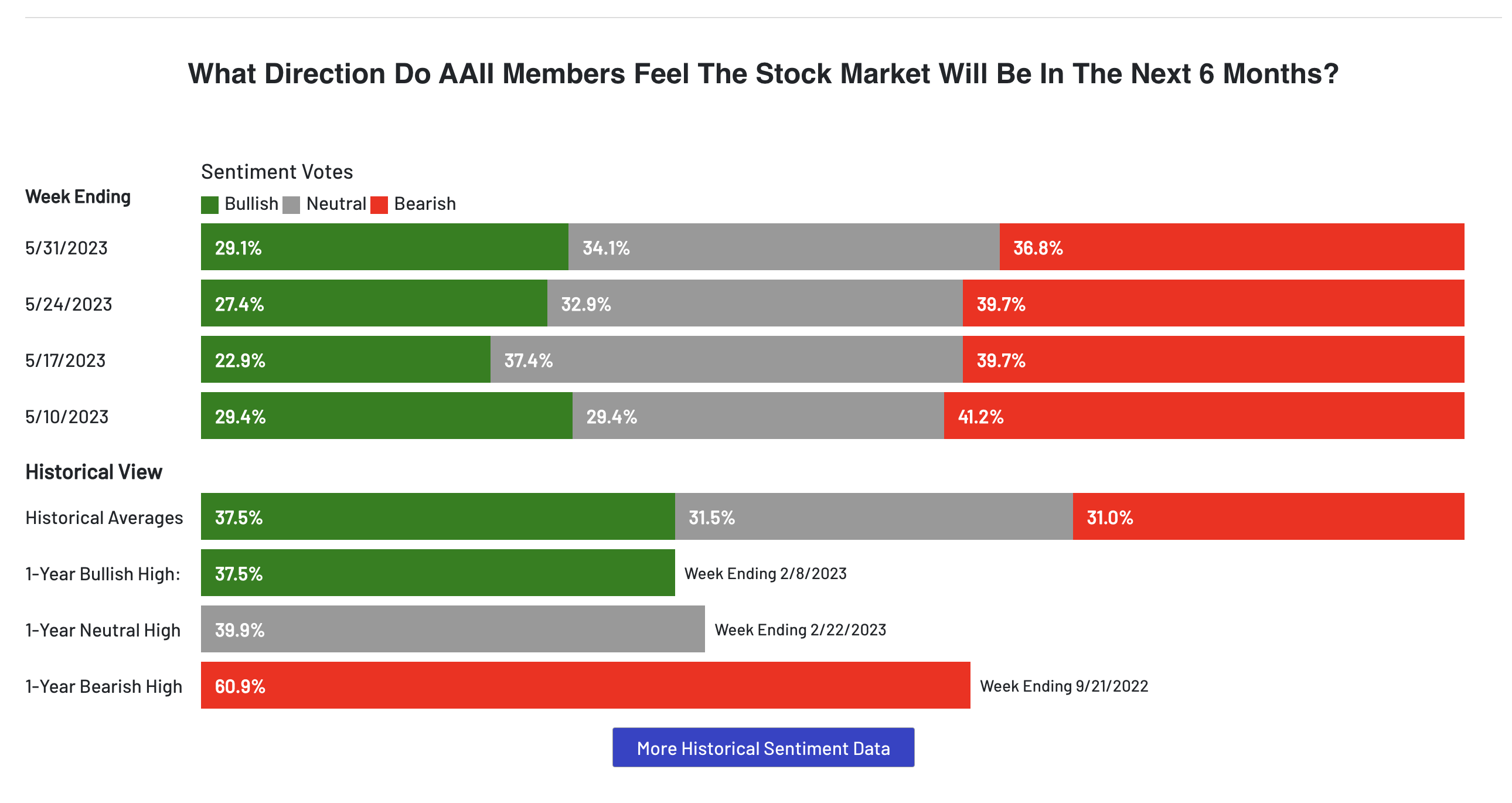

If you don’t believe me, check out the American Association of Individual Investors’ weekly survey

There are far more bears than bulls (36.8% vs 29.1% respectively)

And there are 34.1% who simply can’t make up their mind.

Fair enough!

The peak of pessimism was September last year – where 60.9% of investors were bearish.

Note: that’s when I was happy adding to positions.

So things have improved a little bit the past few months however things still skew bearish.

Generally, bull markets take off once all hope is lost.

The sellers cave – the pain becomes too great. That was September / October last year around 3600.

Will we see that again?

I would not rule it out…

Let’s now visit the other side of the coin (where I address this question)

Why It Could Pay to Have Cash Ready

Keeping some cash on the sidelines is never a bad thing.

The question of course is how much?

For me that number is 35%.

And that’s fine with me when it’s earning 4.2%

The downside to that position is when the markets really take off (like they have recently) – I’m left behind.

Year-to-date I trail the market by around 1%.

Not terrible but not great either.

But let’s look at the bearish case… as there are at least three equally valid arguments.

1. The Market Is Not Cheap

Whist revenue and earnings are being revised higher in the quarters ahead – the market still feels expensive around 4200.

Based on my calculations – we are trading in the realm of 19x forward.

Now that could be considered “value” (or a more palatable risk/reward) if rates were closer to 1%.

But it’s not when I can get ~5% risk free.

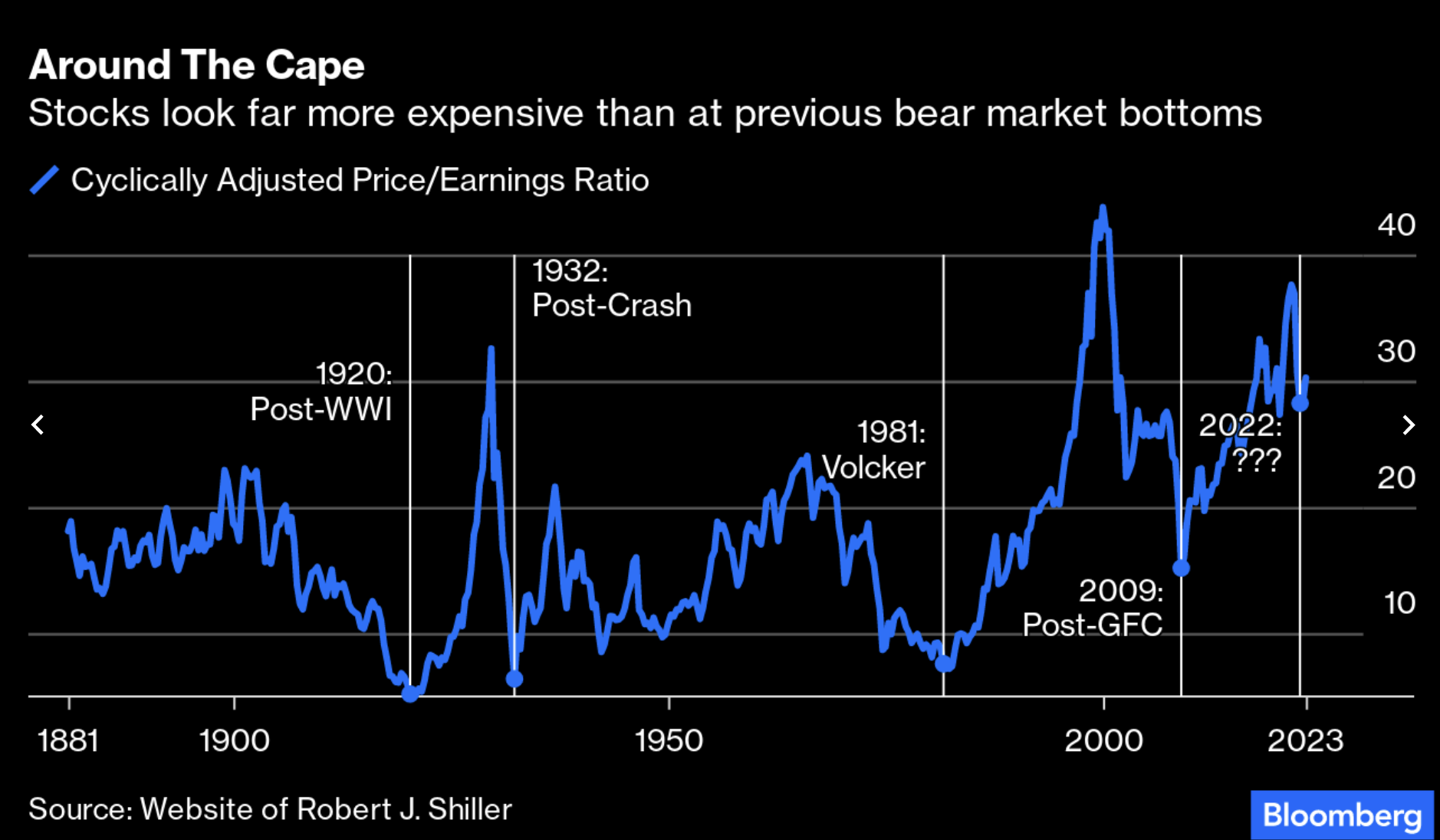

Another popular fundamental metric which measures ‘value’ is Yale University Professor Robert Shiller’s CAPE ratio.

It’s a cyclically adjusted price-to-earnings ratio.

For those less familiar – it’s also known as the Shiller P/E ratio, and is based on the average inflation-adjusted earnings from the previous 10 years, not just from the previous 12 months.

Here’s Bloomy:

June 7 2023

Now Shiller’s CAPE ratio is not a great short-term indicator.

However, it has been excellent if viewed over the longer-term.

Looking at Bloomberg’s chart – the bottom of 2022 doesn’t look like a traditional bottom.

This suggests we could have much lower to go.

In any case, it’s very hard for the bulls to argue the market is cheap at 4200 (based on earnings)

They might suggest it could be close to fairly valued (assuming we see massive earnings growth) – but that’s a stretch if we are heading into a recession (which I will talk to shortly).

My personal view is the market is overvalued by around ‘2-3 turns‘ here.

In other words, 16x forward is perhaps the most I would consider paying for the Index.

2. Are There Only 10 Investable Stocks?

I’ve been beating this drum all year…

Are there really only 10 stocks out of 500 which are considered investable?

Because that’s exactly what the market is telling us.

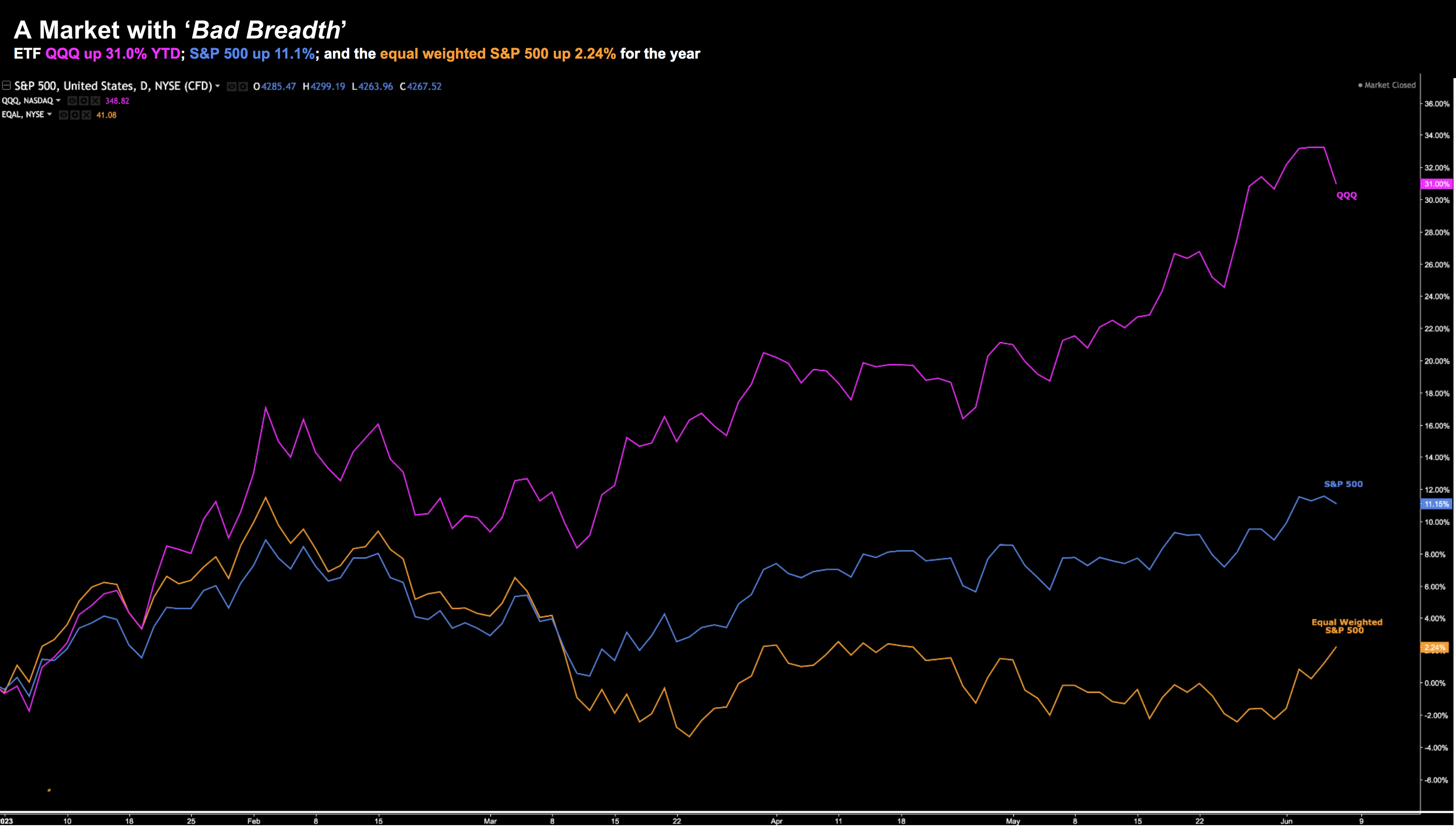

Below is the year-to-date chart which compares:

- ETF QQQ (as a proxy for tech)

- S&P 500; and

- Equal Weighted S&P 500

June 7 2023

Here we see the massive outperformance from the tech sector – up 31% YTD.

Those who ‘rolled the dice’ with over-exposure to tech are likely outperforming the broader market – patting themselves on the back (that’s not me!)

The S&P 500 however is ‘only’ up 11.1%

The equal weighted S&P 500 (orange) is only up 2.24% for the year.

However, it potentially gets worse.

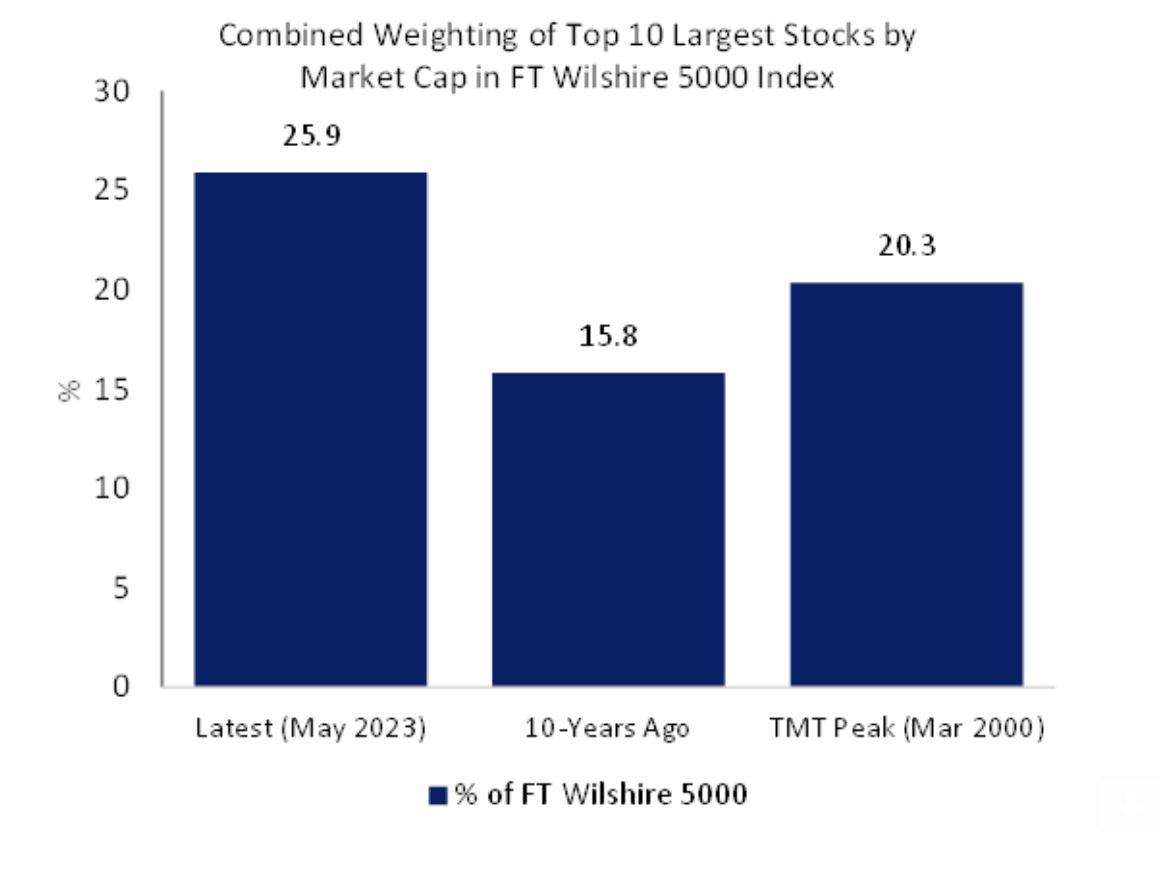

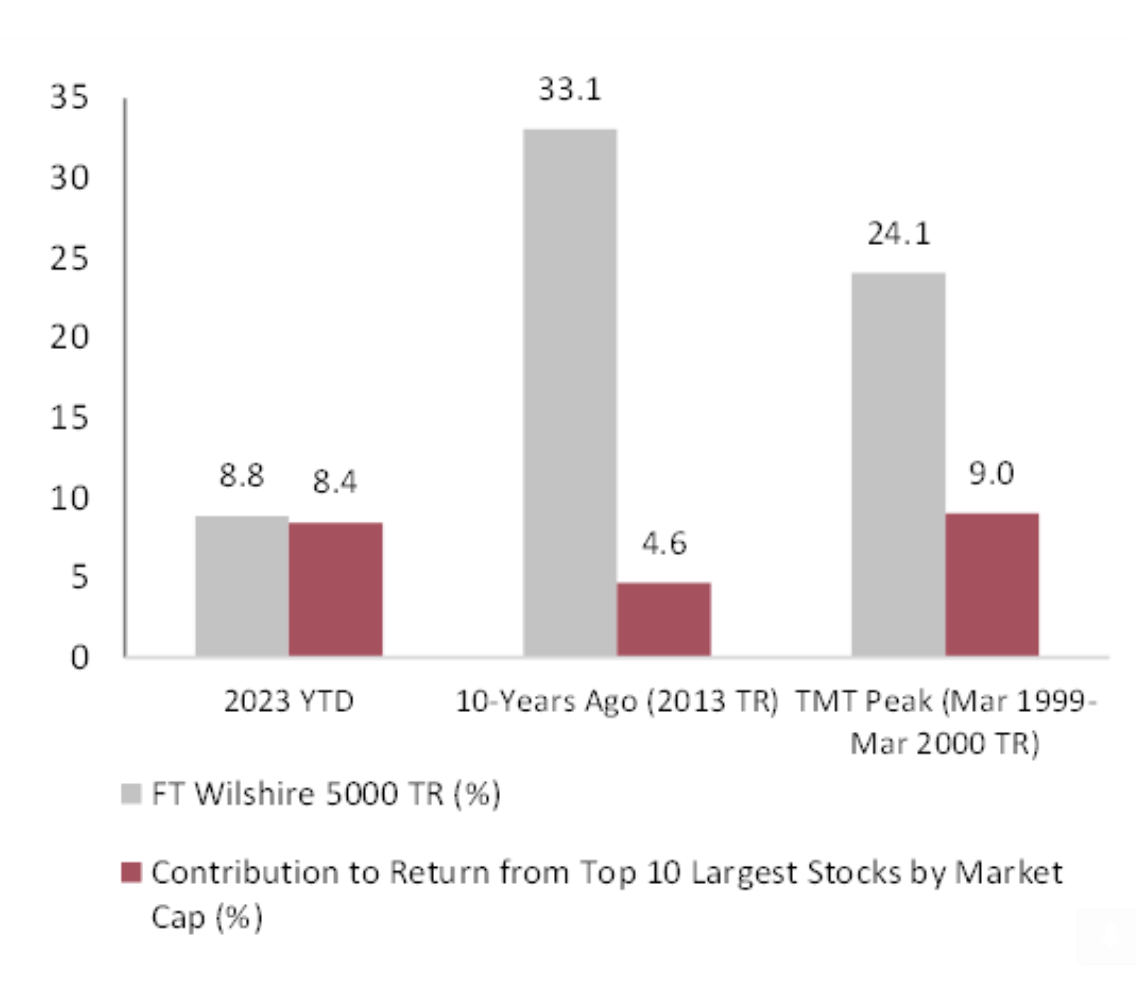

Wiltshire offers a chart which compares the present combined weighting of the top 10 largest stocks by market cap in the FT Wilshire 5000 Index – with the same figures for 10 years ago, and 23 years ago during the dot-com bubble.

Even in 2000, the weighting of the top 10 at 20.3% was much lighter than today, when they account for almost 26%.

“Not only are we seeing a greater concentration, but we are also seeing more dependence on the return contribution“

John Authers of Bloomberg – citing the research – frames Wiltshire’s two charts this way:

“There has seldom or never been less reward for taking the risk of investing in stocks outside the biggest mega-caps”

Yep.

And this helps explain the narrowness of the market today (and its fragility)

3. Unavoidable Recession

Soft landing? Hard landing? No landing?

I am sure we will create some other term soon.

The bear case is it will be near impossible to avoid a recession.

The bull case is if we do have a recession – it’s likely to be very mild (i.e. a soft landing).

You will hear arguments from both sides every day of the week.

Their other argument is the 20% sell-off we saw last year was the market pricing in the recession in earnings.

I think it was part of it… but not all of it.

My view is a recession is unavoidable.

The only question is when?

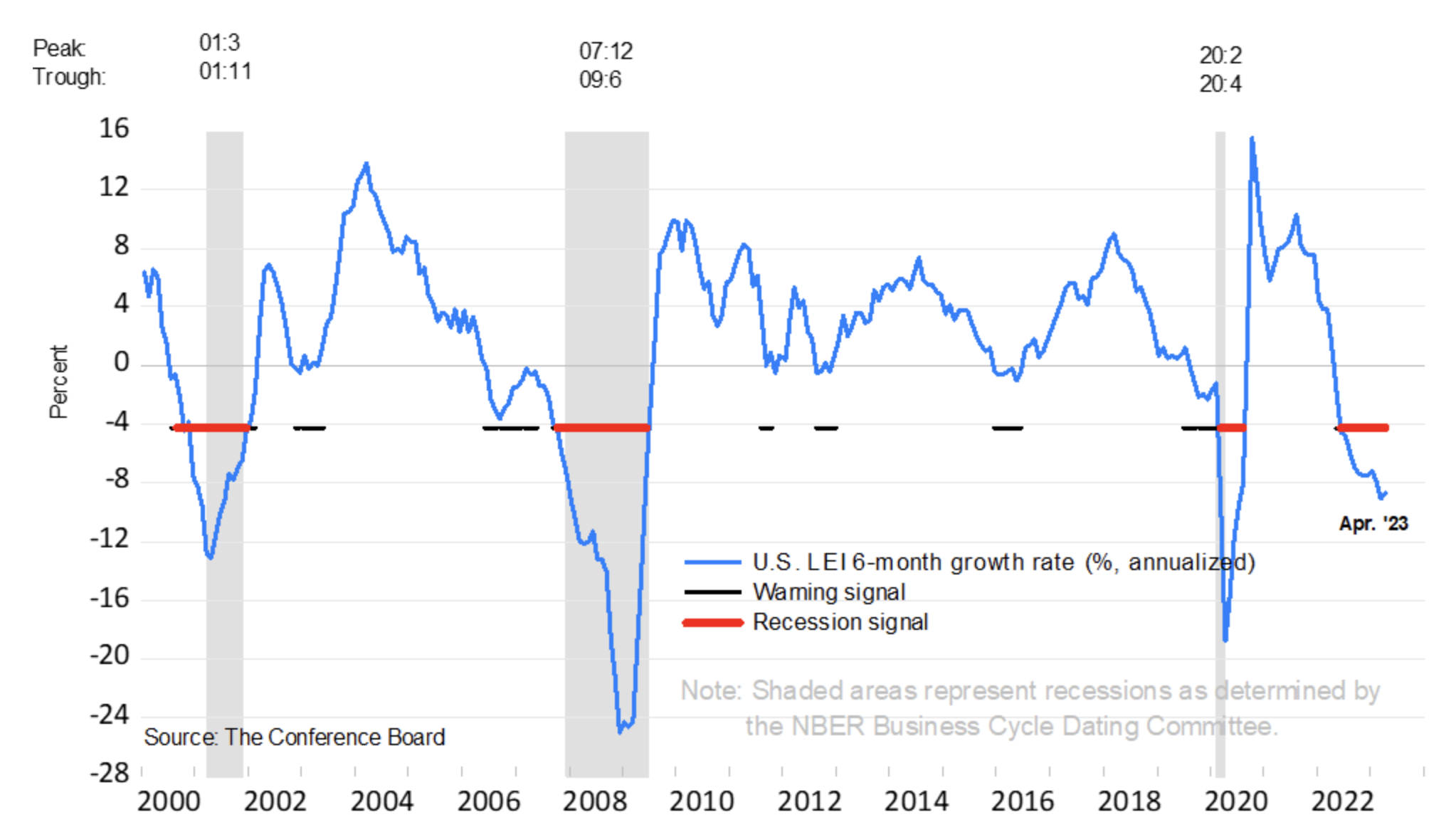

Specifically, I lean into two reliable (leading) financial indicators:

1. The depth of the yield curve inversion (at any duration);

2. Leading Economic Indicators (from the Conference Board) – see below

Whilst not a terrific timing tool – this suggests a recession is roughly 9-12 months away.

Now with respect to the inversion of the yield curve… the reason it’s very good at predicting recessions is because it causes them.

As I’ve explained in previous posts – banks make they money by buying (or borrowing) short and lend (investing) long.

This works well if the short end is lower than the long end.

However, when the curve is deeply inverted, it gums up the money and credit creation process because there is little financial incentive to make loans or invest in securities.

Consequently, the inverted curve signals tightening in credit conditions and looming financial market stress.

It’s a driver of a recession v’s a predictor.

Now if you believe we are likely to enter recession either later this year (or in the first half of next year) – it’s most unlikely we have seen the lows for the market.

Put another way, if this was the start of a new bull market, it would be unusual for it to begin just prior to a recession.

A new bull market will typically start when the Fed moves into its easing cycle.

And as we all know – rates will be higher for longer.

Putting it All Together

One other point in favour of the bears is the market feels stretched in the very near-term.

However, it’s a minor argument, as a pullback of say 5-10% is hardly bearish.

For example, if that were to happen, it would not reverse the weekly bullish trend.

And if that pullback is bought (which I expect) – that’s another win for the bulls (not the bears)

But if you are tactical (very short-term) trader – there’s a case to be made we see profit taking around the 4200 zone.

In fact, if we fall back through 4200, there’s a strong chance we give back 5-10%

We saw a tiny bit of selling in tech stocks today.

Again, a tiny bit.

On the contrary – value based names like banks and energy were bought.

This could be the start of a fund rotation (which would not surprise me).

Summing up – I am neither bullish or bearish.

Do I think we could retest the lows before the end of this year?

Yes.

Do I think we could trade another 5-10% higher from here?

Yes.

Am I adding to stocks at current levels?

No.

Do I think the market is overvalued?

Yes (specifically tech)

Am I taking ‘downside protection’ with puts?

No.

I’ve always maintained traders need to have some exposure to this market.

Simply sitting things out entirely is not wise.

You are losing money (especially adjusted for inflation).

However, you need to be selective.

Your focus needs to be on quality.

- Bullet proof balance sheets.

- Free predictable cash flows.

- Low debt levels.

- Strong margins.

- Defensible moats etc.

A rising tide simply won’t lift all boats.

That only happens when money is ultra-cheap (where rates are close to zero)… those days are long gone.

As I said the other week: ‘invest with optimism – but keep your eyes open’