- Odds increase for July rate hike

- Bonds now see rates higher for longer (no cuts in 2023)

- ‘Good news’ will soon become ‘bad news’

Two months ago – the bond market was at odds with the Fed.

Fixed income markets felt the Fed were going to be forced to cut rates as many as three times this year.

For example, the gap between the 2-year yield and the Fed funds rate was in excess of 100 basis points.

That’s not something you see too often…

At the time I questioned who would be right?

Bonds? Or the Fed?

My money (as always) was on the Fed.

Fast forward to today and the gap has closed considerably

2-year yields have raced higher – up ~110 basis points from their lows on the basis that rates will be higher for longer.

June 5th 2023

Looking further ahead, January 2024 Fed Fund Futures has the rate at 4.97%.

But what’s curious (for me) is that equities have managed to rally in the face of higher yields and a higher dollar.

Why?

Typically these factors are headwinds for stocks (i.e. implying a far higher cost of capital) – but that’s not what we have seen?

But if you look a bit closer – those gains are restricted to a handful of stocks.

For example, the equal weighted S&P 500 is negative year-to-date.

Therefore, at what point will excessive valuations for a few stocks start to matter?

And what’s ahead for the Fed?

65% Chance of July Hike

For months I’ve argued it was going to be very difficult for the Fed to cut rates this year.

In short, the data simply didn’t support it.

Core PCE, Core CPI, employment and wage inflation were all far too high.

That’s still the cast today.

There were only two reasons which could give rise to the Fed slashing rates:

(a) a recession; and/or

(b) a major credit event

Neither appear likely in the very near-term – as ~$2.6 Trillion of excess liquidity provides a ‘cushion’ for the economy.

Now given the soft-ish data in the May monthly jobs report – this can justify the Fed pausing.

Sure, the headline number appeared strong.

But if you scratch below the surface, there’s enough weakness for the Fed to tap the breaks.

As I highlighted – most of the jobs were in lower paid sectors.

But let’s also consider the consumer…

Are they capitulating?

Are they desperate for work and unable to pay their bills?

And are they defaulting on their debt?

Not yet.

But that will come.

For now, they are showing resilience whilst they have a job – choosing to spend (despite not having the money).

And whilst they are spending less on material goods – they continue to spend on experiences and services (making up for lost time)

Just go to any airport in the country – it’s packed.

Inflation is still present.

Now prior to the recent (idiosyncratic) events in the banking sector (which appear largely behind us) – the Fed was on track to raise the benchmark rate to ~5.50% (or higher).

But given the recent (short-term) stresses in the system, this has given the Fed reason to pause.

Things now appear to be stabilizing with regional banks… good news.

Deposit outflows have eased.

And should things continue to stabilize – I think we could see the Fed resume their previous path given where we are with inflation.

At a guess, a benchmark rate in the realm of 5.00% to 6.00% (at the very high end) will probably be sufficiently restrictive (especially given what we see with reduced bank lending)

For example, there are pockets where the Fed’s 500 bps of rate rises are working.

Again… that’s good news.

But what it also highlights is it takes time for the Fed’s measures to filter though.

How Long?

November last year – I offered readers this three-point framework when thinking about the Fed.

This still holds true.

The conversation today is a balance between how long and maybe how high.

I say that because I think we are within 50-75 bps of the peak rate.

That’s only a guess!

But what no-one can answer is how long (as it’s entirely a function of the data)

What we’re seeing play-out today is bond markets (not so much equities) recalibrate on the length of time rates will stay above 5%

For example, consider what we see with Fed futures.

I talked about the Jan 24 futures at 4.96% (i.e. no rate cuts this year)

But if we look out to say May 2024 – that rate comes down to 4.33%

And if we go all the way to end of 2024 – we are down to 3.45%

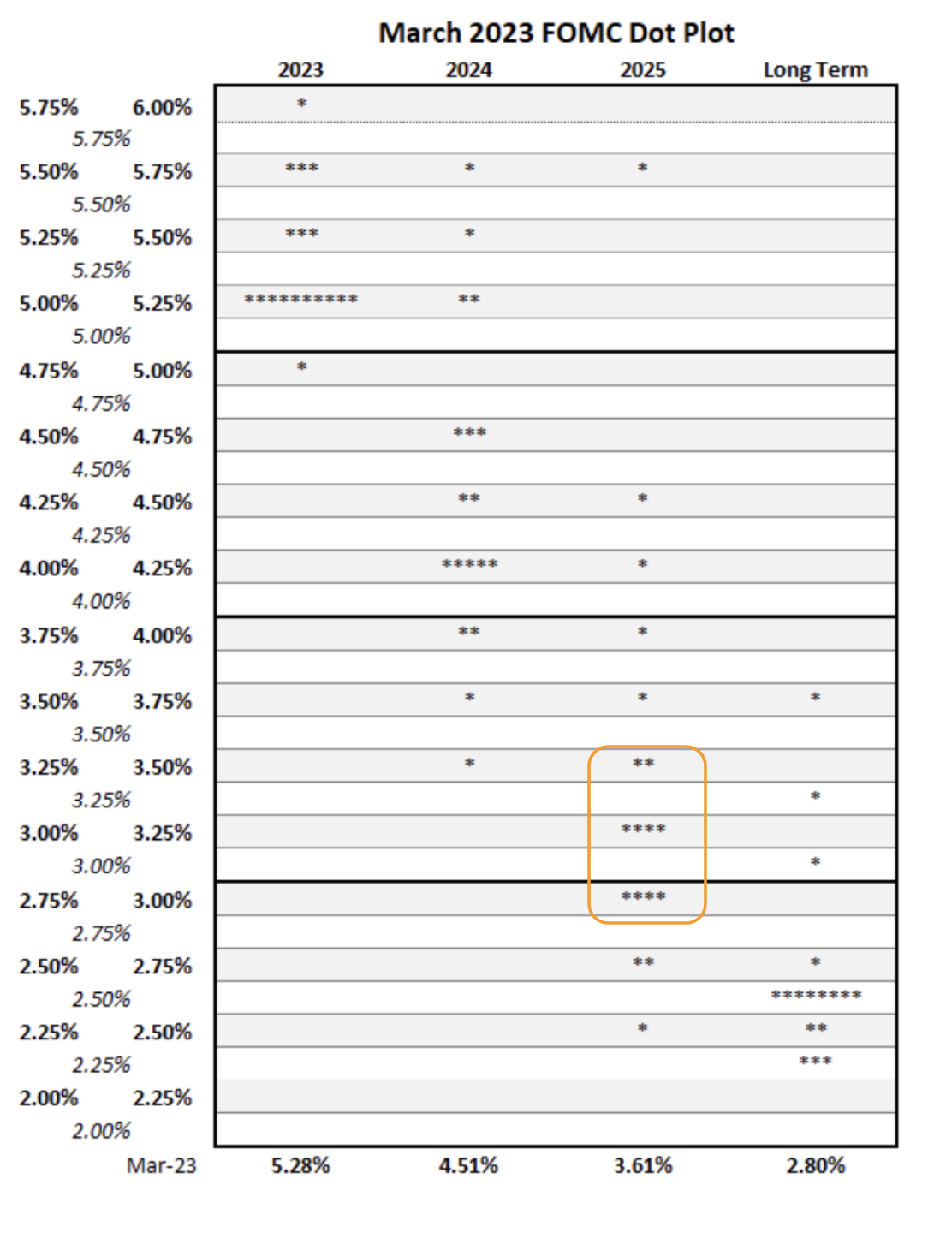

This is not too dissimilar to the Fed’s own so-called ‘dot plot’ which sees the Fed funds rate back to low 3’s in 2025.

I will add that these “dot plot” will change.

As more data comes in with Core PCE, wage growth, employment levels etc – these will be adjusted.

It’s a moving target.

The current view is inflation will come down; economic growth will slow; unemployment will rise; and the Fed will have scope to ease.

And I think that feels right…

But that easing is a long way off.

Will Good News Become Bad News?

Here’s a question…

Given the bond market now realizes the Fed doesn’t have the scope to cut this year… at what point does ‘good news’ become ‘bad news’?

My personal take is we are now close to that point.

For example, I think the ‘better than expected’ May jobs report is an example.

Once that ‘good news’ hit the tape – markets were quick to reduce expectations of rate cuts (the ‘bad news’)

And should we see things like (not limited to):

- Profit margins holding up (as they pass on the costs of higher input costs)

- Unemployment below 4.0%

- Wage growth above 4.0%

- Core PCE inflation above 4.0%; and

- The regional banking system stabilizing

… this only gives the Fed a green light.

‘Good news’ becomes ‘bad news’

Consider corporate profits…

We have just finished earnings season and for the most part – they were better than feared.

Good news.

But this is also one of the reasons we are seeing inflation remain elevated.

Companies are not quick to give up their margin – especially if consumers are willing to pay!

Therefore prices are not coming down as fast as (the Fed) would like.

Now is that a driver or inflation?

Or is it simply reacting to a ‘strong’ consumer?

The answer is perhaps some of each – however it’s still there in the system.

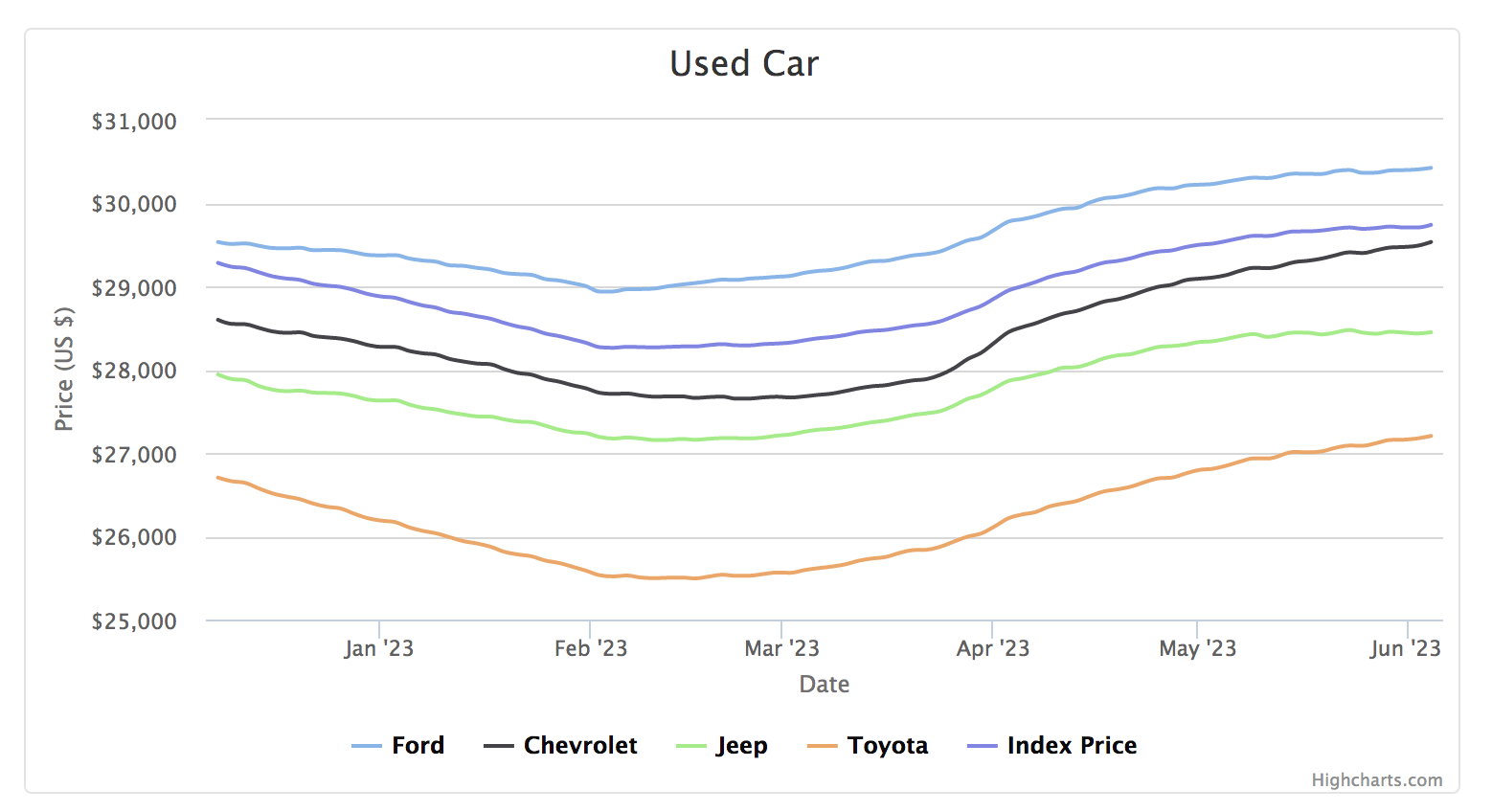

Large durable items like new and used cars, household appliances etc are holding up better than what most expected (and rising in some cases).

Here we see used car prices (which are a large component of CPI) are now higher than they were in January by a good margin.

From a company perspective – if they feel the price elasticity is there – they will take it.

But that doesn’t help with inflation.

This is why we are shifting towards a ‘good news is bad news’ narrative.

At some point, when we hear of strong employment, wage gains, higher used car prices etc – it will mean a higher benchmark rate from the Fed.

So how does that fit with a market trading at around 19x forward earnings?

You tell me.

Putting it All Together

Depending on who you talk to – they will have a different lens on what lies ahead or where we are.

That’s a good thing – it is what makes a market.

My guess is most investors (not all) are now starting to think it’s going to be “higher for longer”

They might have taken a few months to get there – but they are mostly there now.

However, there is portion of traders who firmly believe:

- the economy is already in recession (or close to)

- bank stresses have not yet peaked; and

- rate cuts are imminent.

That’s not me… but I understand why they might think that.

My view is that the lagging effects of the Fed’s 500 bps increase – in addition to further bank tightening – is going to bite later this year.

This is why I’ve earmarked the recession for late 2023 / first half 2024.

Again, credit tightening takes time to work through (and perhaps extended by the excess liquidity still in the system).

For now the narrative feels like a soft landing is possible.

And I get it…. it will always feel like a soft landing until it doesn’t.

Remember…

In 2007 we had unemployment around 4% and three consecutive quarters of 2.5% GDP growth.

How many were calling for a hard landing then?

Virtually no-one.

The good news – things are likely to muddle along for a bit yet.