- It’s not earnings and rates driving the market the higher

- A narrow market also means fragility

- Why debt ceiling negotitations are like kidney stones…

It’s risk on.

That’s the market’s sentiment.

Question is whether that risk is worth it?

Not from my lens.

The S&P 500 finished the week at 4191 – which represents a gain of 9.18% YTD (or ~24% annualized)

May 20 2023

That’s a cracking pace!

And it’s not too far short of the long-term (100-year) average annual return for the market (which is around 10%)

Technically the setup has not changed all year; i.e., pushing the zone of 4200 only to find resistance.

We saw that again this week.

But what we need to do is look under the hood…

As I said here – there are only a handful of stocks carrying the market higher.

This lack of breadth also means the market is fragile.

For example, should names like Amazon, Google, Apple, Microsoft, Meta and Tesla pull back from nose-bleed valuations – the whole house comes down with it.

We can also frame things this way…

If these stocks correct ~10-15% (highly possible) and sectors like finance and energy rally – the market would still trade lower.

This is due to the sheer weight of tech on the market.

Now I’m not complaining – as I own each of Amazon, Google, Apple and Microsoft.

I consider them core holdings.

But I am not adding to them here.

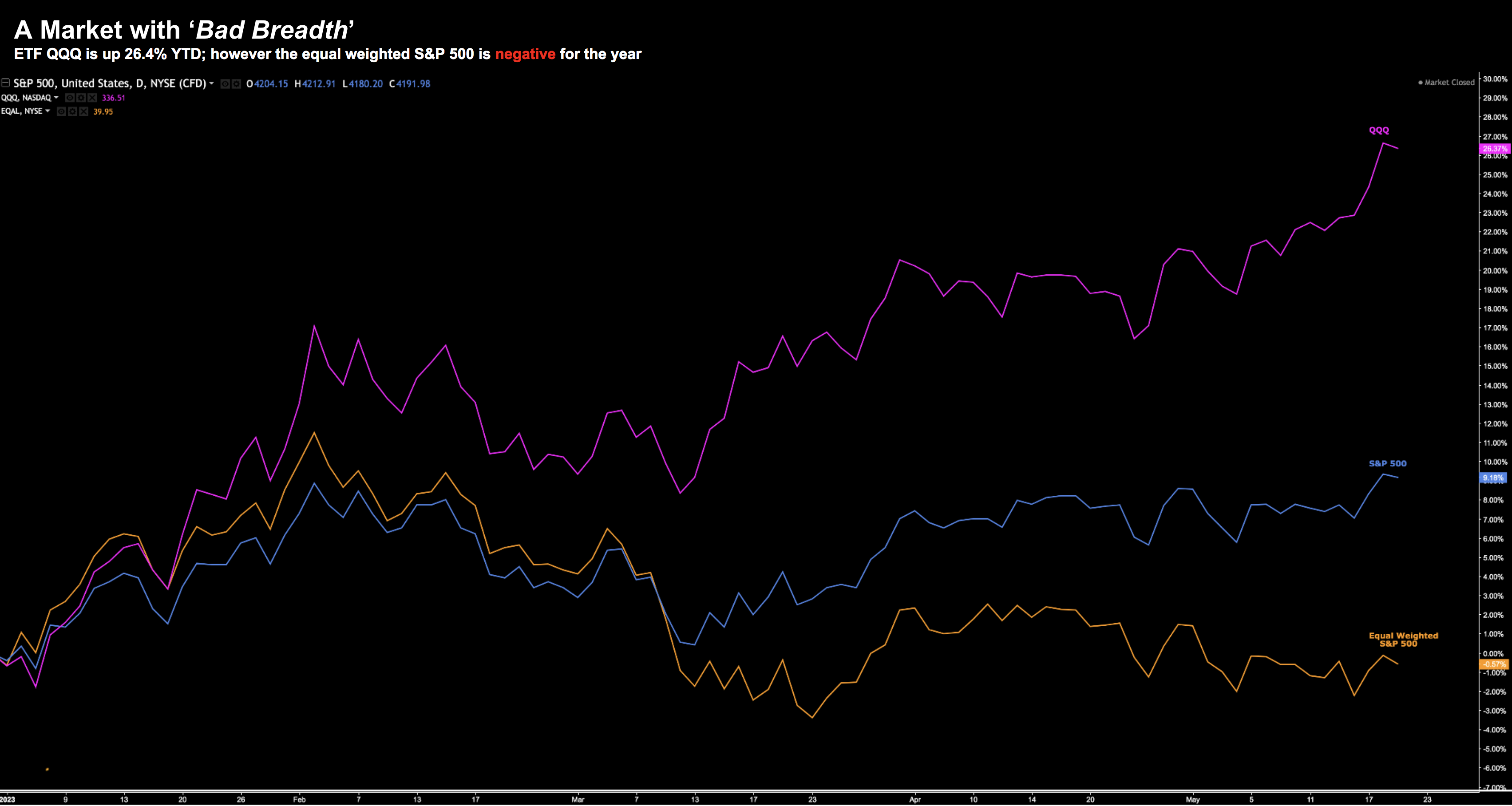

To help demonstrate the fragility of the market – consider the chart below:

May 20 2023

In purple we have tech-heavy ETF QQQ (+26%); the S&P 500 in blue (+9.18%); and the equal weighted S&P 500 (-0.57%)

This should trouble any investor.

If this was a healthy market really – all sectors would be participating (not just a few stocks).

For example, are there only “10” stocks across the entire market which are capable of growing?

What does that suggest?

So what’s going on? And what’s driving prices higher?

Is it earnings? Interest Rates?

Or something else?

How Did We Get Here?

Typically when you see stocks rallying – it’s due to analysts raising their forecasts due to stronger than expect earnings (and/or guidance).

But this isn’t the case.

Alternatively, you might see stocks get re-rated on the back of much lower interest rates.

For example, when rates were anchored at zero, a market multiple of 20x forward could be justified.

However, that has not been the case either.

But let’s start with earnings…

With Q1 now behind us, at best we could say is earnings were better than feared (with the bar set very low).

That said, market leaders like Apple and Google saw their revenues decline for the second straight quarter.

Other market leaders such as Meta, Amazon and Microsoft were only able to post single digit growth.

And last week, earnings from the likes of Target and Walmart posed a bleak picture of the consumer (where revenue growth was only positive due to the effects of inflation). How will this look in subsequent quarters?

Margins were crushed as they worked on clearing excess inventory.

Put simply, this was not a strong earnings season.

What’s more, most companies only see modest improvement looking ahead (mostly on the back of weaker YoY comps) – although the outlook remains extremely uncertain.

As this earnings trend from Bloomy shows – we are still well below where we were in Q2 of last year.

How about interest rates?

Typically stocks will rally when bond yields (rates) are falling

However this has not been the case.

Take a look at the US 10-year yield – it hasn’t moved the past few months:

May 20 2023

From mine, bond yields are trading slightly higher as debt markets start to believe the Fed.

That is, rates will be higher for longer (assuming there is no default).

Just on this, we heard from numerous Fed officials this week.

Not one said they are considering cuts.

In fact, a few said it would be remiss to rule out further hikes.

For example, Dallas Fed President Lorie Logan said the case for pausing interest rate increases in the June meeting isn’t yet clear.

Fed Governor Philip Jefferson suggested he’s willing to be patient to see how an aggressive rise in interest rates over the past year filters through the economy.

Now the Fed has not deviated from this script for months.

And yet the equity market is convinced that the Fed will cut rates as many as three times this year.

Why?

A major credit event? A recession?

What would give the Fed reason to slash rates by 75 bps or more?

From mine, earnings and rates are not driving the market higher.

However, there is something…. and it should not come as a surprise

Liquidity Spigots

Every stock market rally in history has one thing in common: increased liquidity.

Consider what we have seen the past couple of months:

- The Bank Term Funding Program (BTFP); with a combination of

- A lower cost of capital

Those two things in parallel are a gift for risk assets.

With respect to the BTFP – the Fed offered to lend to banks additional liquidity on the basis the bonds in their portfolios were still worth their face value.

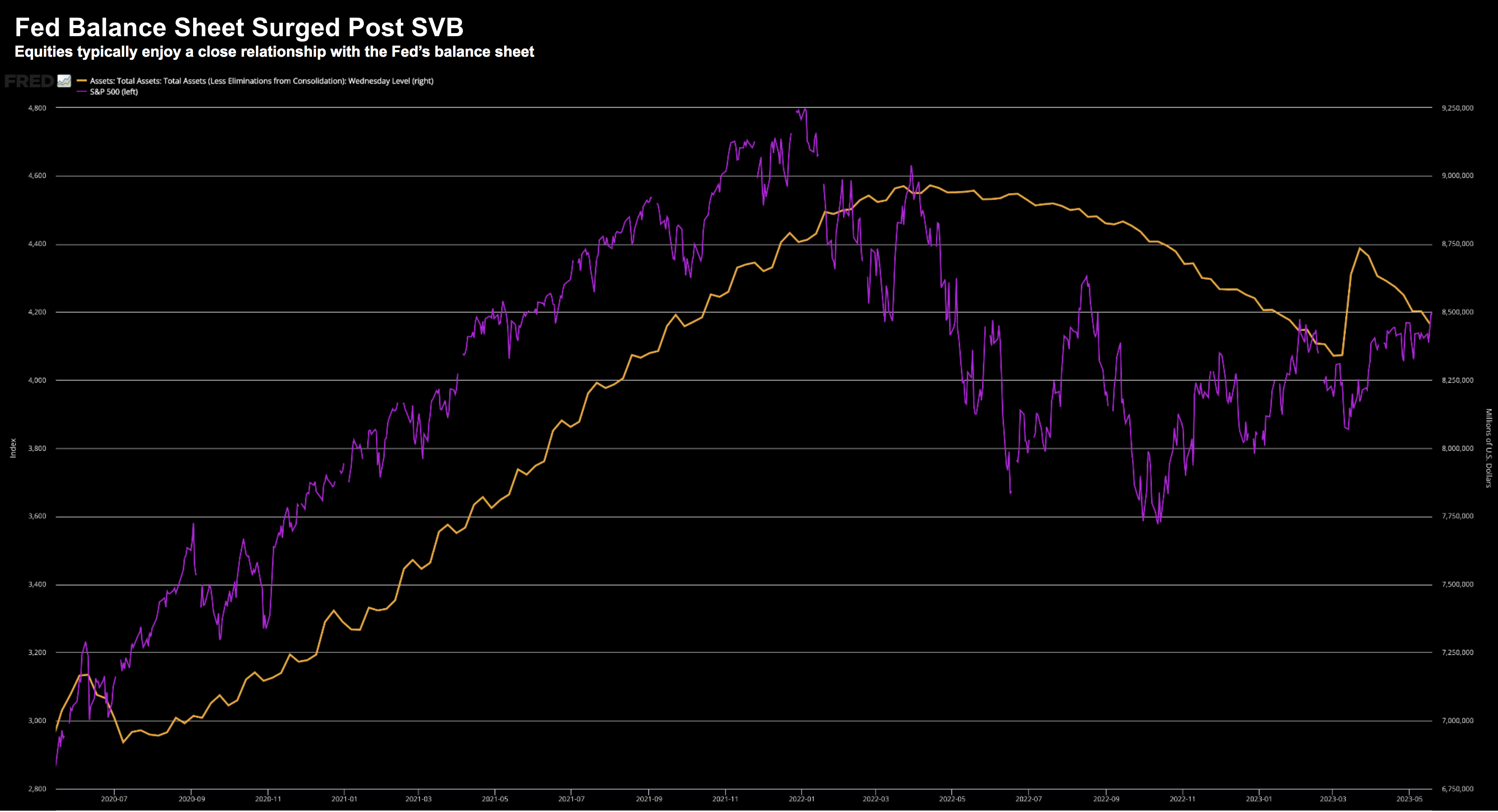

This – in combination with the expansion of the Fed’s balance sheet – saw a surge in liquidity.

May 20 2023

The rally in the market this year coincided with the creation and growth of the BTFP as well as QE.

For example, the central bank’s balance sheet grew roughly $400 billion to $8.73 trillion between March 1 and March 22.

It currently stands at around $8.50 trillion.

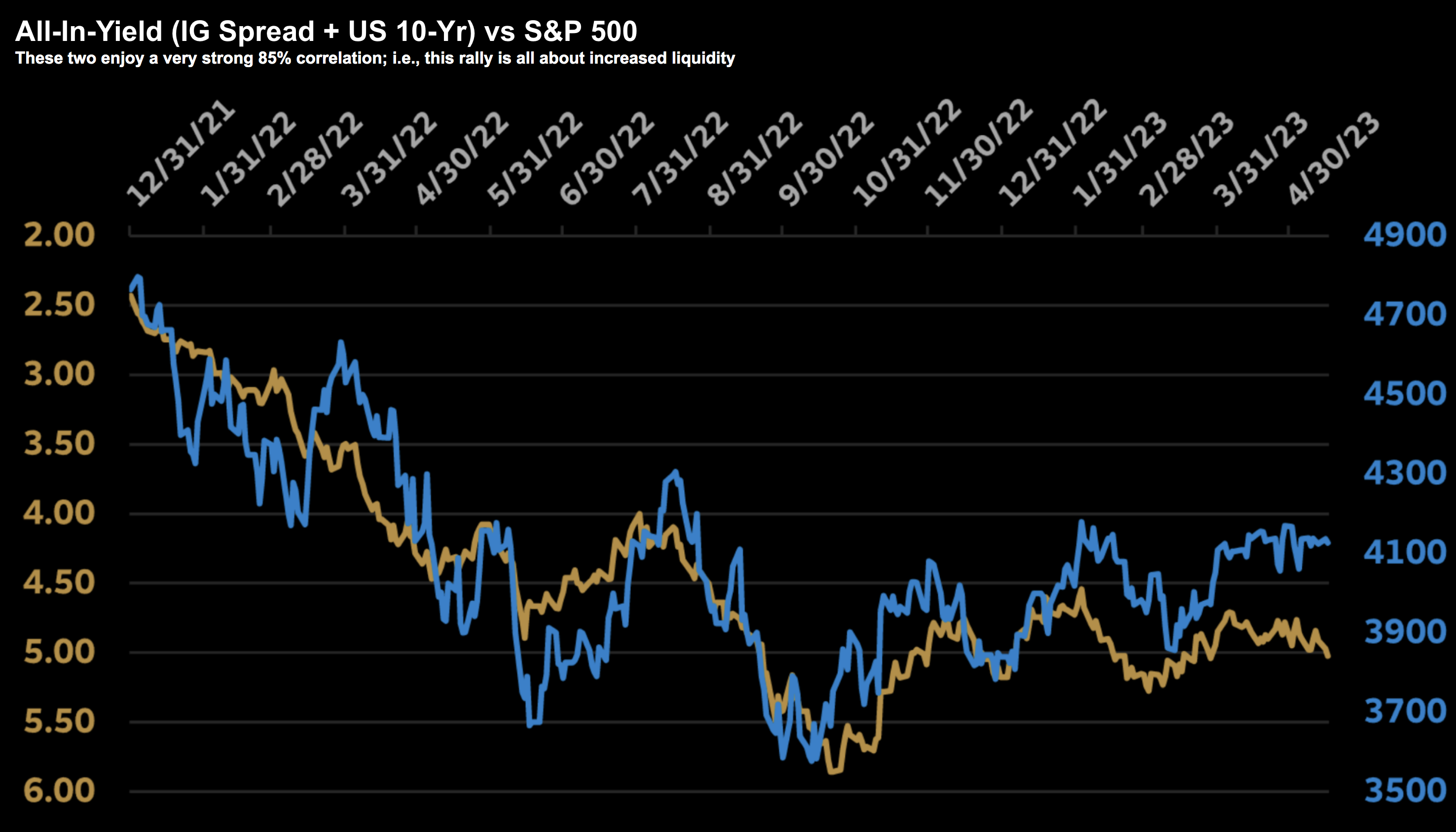

In terms of a lower cost of capital – we saw the expected federal funds rate drop from about 5.5% to ~4.7%.

This saw investment-grade corporate spreads compressing ~30 basis points from this year’s peak of 163 on March 15.

Put together, Wells Fargo call this the “all-in yield” (i.e., 10-year Treasury yield plus the Investment Grade (IG) spread).

However, what’s interesting is when you overlay the ‘all-in-yield’ against the S&P 500.

May 20 2023: All about Funding and Liquidity

Here we find a striking 85% correlation. Here’s Well Fargo:

“Funding and liquidity, not earnings/fundamentals, are the year-to-date drivers of the S&P 500 rally. The “risk of a market reversal appears elevated on the back of wider credit spreads and/or a shrinking Fed balance sheet.”

Precisely!

Therefore, without earnings growth, all we have seen is multiple expansion

Not only that, it has been multiple expansion in a very concentrated group of stocks (i.e. tech)

And from mine, that represents a fragile market (irrespective of the added liquidity risks)

Putting it All Together

So far this year, all we’ve seen is multiple expansion in a concentrated sector.

And whilst some of it is justified (as tech was oversold last year)… valuations are now overdone.

Some of that is investors paying up for safety in these names… and perhaps some is “AI pixie dust”

Either way – valuations are excessive.

For example, I was happy picking up names like Meta at ~12x forward; and Netflix at ~15x forward.

However, now I’m happy offloading them.

Have at it people…

These stocks are now at multiples which suggest the chance of more downside risk than upside reward.

In closing, my own portfolio is up 9.04% YTD – where I’m ~65% long (no short positions)

I choose to keep about 35% in cash (yielding ~4.2%) for a better opportunity.

And who knows, if these debt ceiling negotiations go ‘pear shaped’ (which I fully expect) – there’s every chance we see a sharp move lower.

Don’t get me wrong, the debt ceiling will get it done.

It might take a sequester – but it will get done.

Debt ceiling negotiations are like kidney stones; i.e., eventually they pass… but I’ve heard it’s a painful process.

And that pain could represent opportunity.

However, once a deal is done, we will go straight back to worrying about stubborn inflation risks; rates remaining higher for longer; earnings growth; and the likelihood of recession.