- Market’s quick to cheer April consumer price inflation

- Fed likely to go on pause in June…

- However, that doesn’t mean we will see rate cuts this year

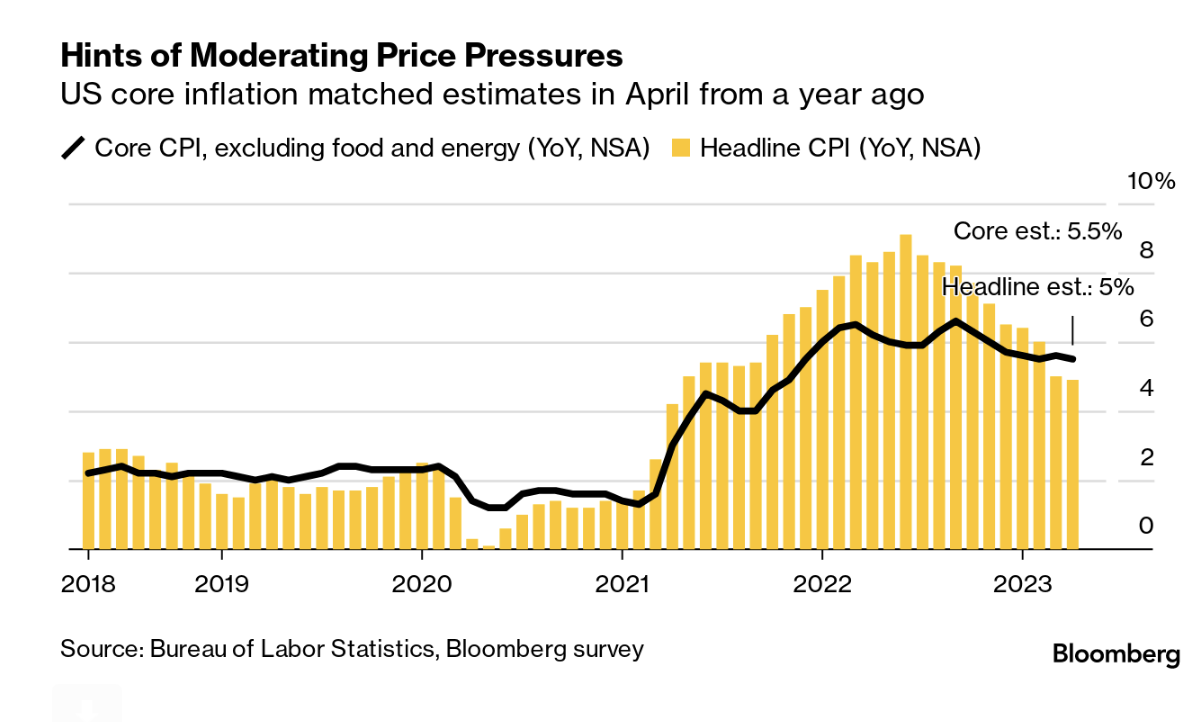

This week we received the last monthly figures for Consumer Price Inflation (CPI).

Below is a summary:

- CPI MoM 0.4% vs 0.4% expected (prior MoM reading was 0.1%)

- CPI YoY 4.9% vs 5.0% expected (lowest since February 2021)

- MoM 0.4% versus 0.4% expected

- Core YoY 5.5% versus 5.5% expected

- Shelter 0.4% versus 0.6% last month

Markets were quick to cheer the news…

But should they?

As regular readers know – the market is focused on Core. Core is a measure of inflation that excludes certain volatile items, and that’s almost always food and energy prices.

The idea behind using core CPI is that these items can have large fluctuations in prices due to factors such as weather, natural disasters and geopolitical tensions, which do not necessarily reflect underlying inflationary trends.

Now this is important – as a large component of the decrease in the headline was due to lower energy.

And as we can see – Core CPI remains at a very high 5.5%

Yet – markets interpreted as good news…

Here’s my question:

Will headline CPI get down to a 3-handle by year’s end?

I don’t think so.

For example, Fed President Barkin said with the April print: “inflation remains stubbornly high and is not making enough progress towards the Fed’s target”

Therefore, can we take a June hike (or any hike over the next 6 months) completely off the table?

Fed Likely to Pause

Given the tightening of credit conditions and the broader slowing in the economy – there’s a strong argument the Fed is more likely to pause in June than raise rates again.

And this is what the market has priced in.

Given what we found with April’s report – this tends to support this outcome.

However, on the other side, there’s no reason to see why the Fed should start cutting rates any time soon.

But that is not what the market is pricing in.

The market expects to see the Fed cutting rates three times this year.

I don’t see that happening with Core CPI still travelling around 5.5% (and not falling at great speed)

Nonetheless, stocks rallied on the news and bond yields fell.

We will see how they go with that.

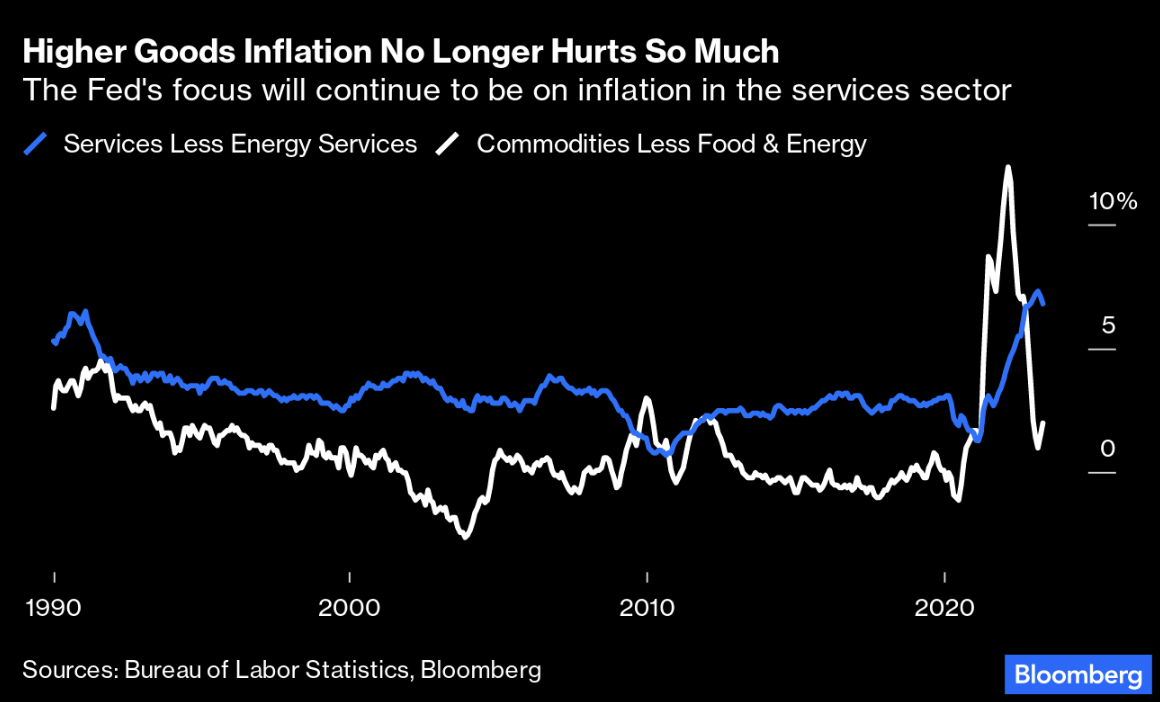

But let’s talk to services based inflation – as that’s all that matters from the Fed’s lens.

As we know, services inflation (unlike goods) are driven by wages.

This is why the Fed are very much focused on the labor market.

From Bloomy:

The “good news” was there was the smallest tick lower in services inflation (blue line).

But enough to price in three rate cuts?

I doubt it.

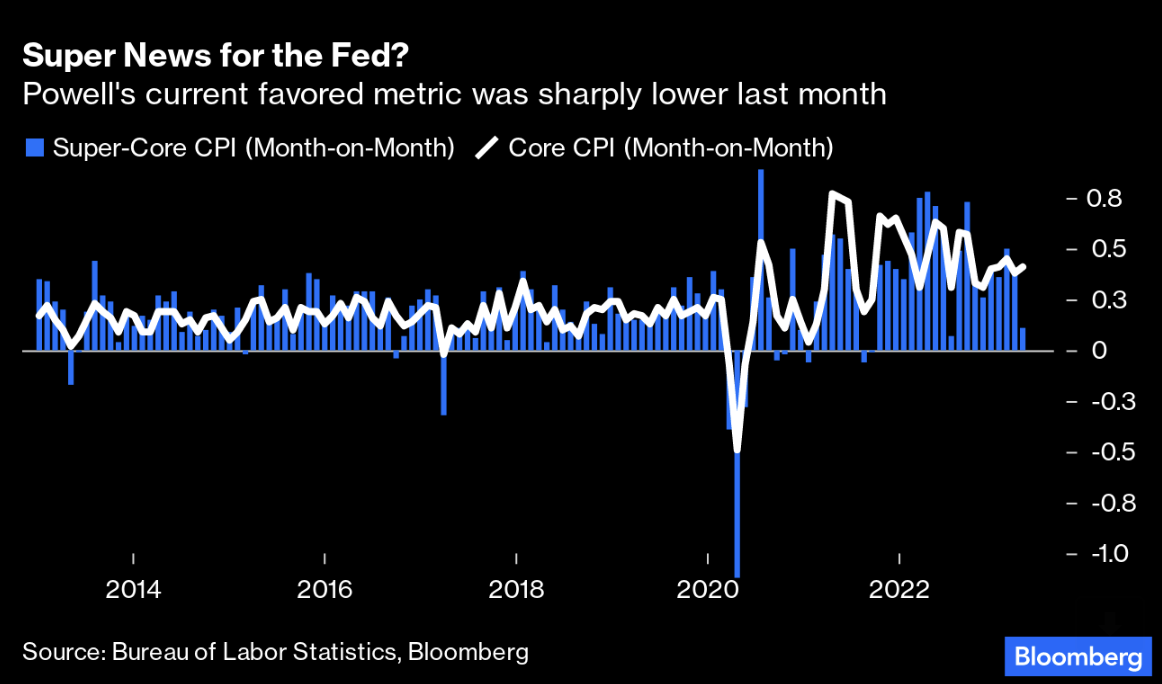

The other bit of good news was what Powell refers to as “super core” inflation.

This measure looks at services prices excluding costs related to shelter.

Shelter came in at 0.4% versus 0.6% last month – it’s lowest in eight months.

Again, from Bloomy:

But Is It Reason to Cheer?

They say one hot night does not make a summer.

Yes, there were some encouraging signs things could be turning in the Fed’s favour.

And I think ultimately they will.

However, the Fed still has a lot of work to do.

This will take longer than what the market thinks.

From mine, the Fed will still need to see meaningful declines before they even contemplate rate cuts.

As we know, sticky inflation will take a lot longer to decline.

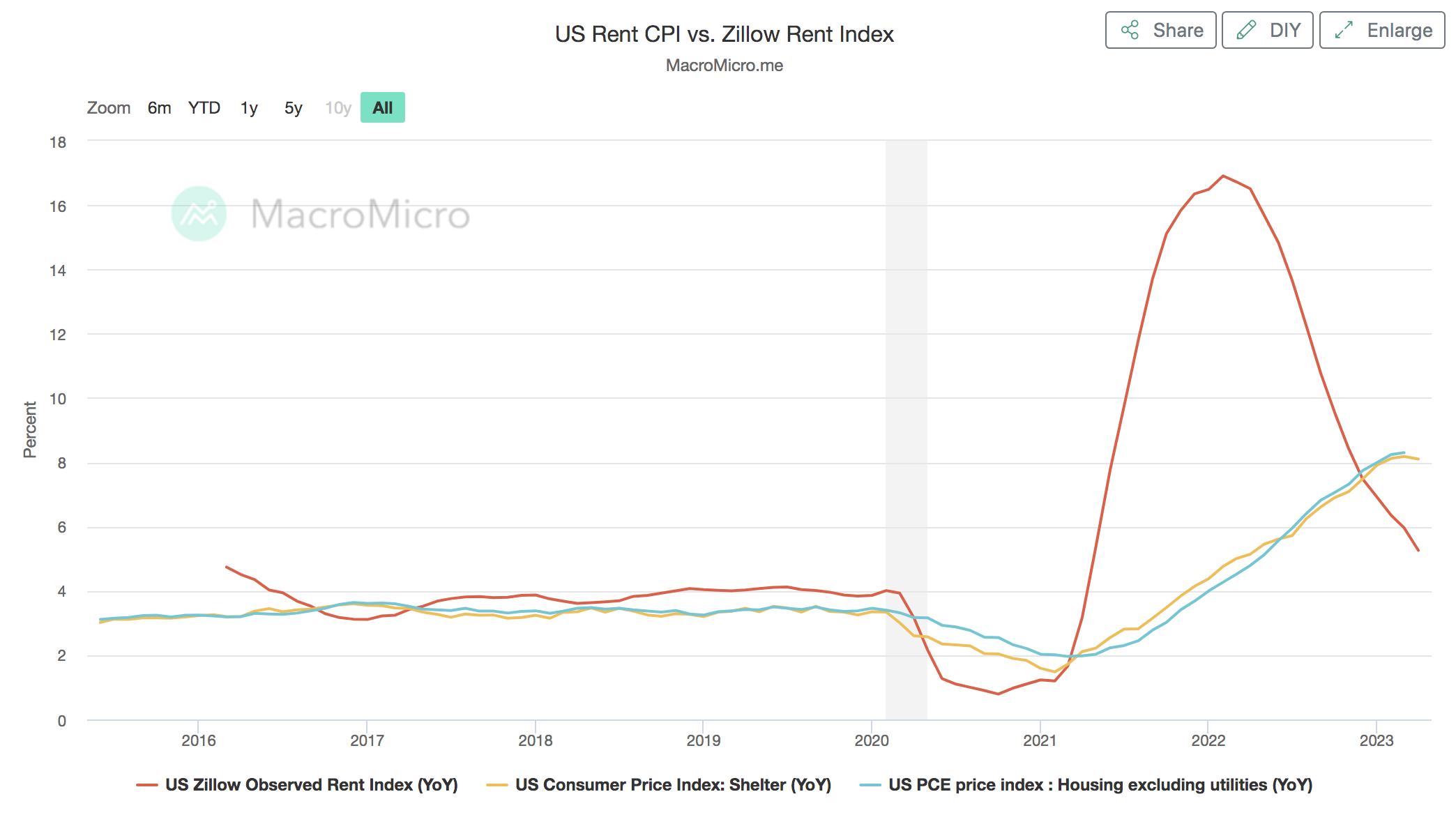

Bloomberg does a great job breaking this down (see below).

They comment that the good news is that stickier inflation is starting to come down. However, the bad news is that this is only true if shelter prices are excluded.

And therein lies the rub:

Shelter accounts for about one-third of the overall CPI index… therefore this is what we will need to see fall.

Bloomberg said there could be reason to be optimistic – as changes in private rents have a lagged impact on CPI.

For example, Zillow’s rent index looks at new leases each month, and has been declining for almost a year.

They add that this has prompted optimism from several analysts.

For example, TD Securities strategist Oscar Munoz said that housing inflation “will continue to bounce around month-on-month, but now within this new range (0.4%-0.5% m/m).”

Rick Rieder, chief investment officer of global fixed income at BlackRock said April’s data offered “additional evidence” that the underlying trend has moved down from its 0.7% run rate over much of the last year.

So maybe there’s good news to come on the inflation front?

Markets certainly think so.

Putting it All Together

From mine, it’s troubling when the market’s “cheer” a 5.5% Core CPI result.

I guess it’s better than 9%?

However, have we become ‘numb’ to higher inflation?

Anything above 3% isn’t great.

I think the Fed will interpret last months print as their work is far from done.

Yes, they are more likely to pause in June.

And I think they can afford to.

For example, the banks are now doing a lot of the Fed’s work. And the forward looking trend we see in declining rents will help bring stickier forms of inflation lower.

But it doesn’t rule out further hikes should inflation spike again.

We’ve seen that happen before.

Continue to keep your eye on services and specifically shelter.

That’s what the Fed will be watching.