- Microsoft and Meta the big winners

- Amazon delivers a solid result – however guidance is soft

- Investors want to see greater efficiency gains from Google

Coming into this week – large cap tech traded at the following forward multiples:

- Apple 26.5x

- Microsoft 28.5x

- Alphabet 20.5x

- Meta 20.5x

- NVIDIA 59.5x

- Tesla 46x

- Amazon 74x

In short, these stocks are not cheap.

Investors are being asked to ‘pay up’ for their earning quality, growth prospects, respective moats, balance sheets and profit margins.

But therein lies the rub:

If revenue growth isn’t there or margins are seen to be declining – look out below.

Whilst we are still waiting on earnings from Apple and NVIDIA – we’ve seen some revealing trends from those who have reported.

In short, Meta and Microsoft were big winners.

Why?

Revenue growth; efficiency gains and positive outlooks.

However, Alphabet, Amazon and Tesla all disappointed (for very different reasons)

Tonight, my quick take on these 4 names and charts (I’m not looking at Tesla).

Full disclosure – I own each of Apple, Google, Amazon and Microsoft (all considered core holdings). I no longer own Meta or Tesla.

#1. Alphabet

Given I work at Alphabet (aka Google) – I can only talk to what is publicly available.

From mine, the biggest takeaway was the second straight quarter of revenue declines as expenses grew.

At a guess, investors might have been looking for more progress on the expense side – especially given what we’ve seen from the likes of Meta and Amazon (which I’ll address below).

Ruth Porat – CFO – said on the earning call that “the company is committed to growing its revenue faster than its costs”

Now if a stock is trading at a premium multiple of 20x forward – revenue decline is difficult to swallow (unless there is a clear pathway to strong growth)

But if there is a trend of revenue declines – it needs to be supported by strong efficiency gains.

I think that’s going to be the focus of subsequent earnings reports.

If there was ‘good news’ with Alphabet – it would be:

- Earnings were slightly better than feared; and

- A $70B buyback

The latter is great news for shareholders.

But for Alphabet’s stock to get back to above $150 per share – it may need to come from efficiency gains vs a return to double-digit revenue growth (in the near-term)

I’m very confident revenue growth will resume when the economy regains its footing in 2024 (i.e. businesses have the ability to spend more on ads).

I say that because ad budgets are typically the first thing to be cut during downturns.

What’s more, the relative ‘YoY comps’ for Google will get better in subsequent quarters. The current quarter was a difficult comparison.

But for now, it feels like there could be some more ‘wood to chop’ on the expense side.

Let’s look at the chart:

April 27 2023

To be fair, the stock has rallied a long way into the earnings print. For example, a move from the low of $83 (October 2022) to ~$108 at the time of writing is 30.1%

Therefore, a lot of the good news was priced in.

Technically the stock looks like it could rally a bit further – with the weekly trend turning bullish.

We have not seen that since it turned bearish April 2022 (when it closed $127)

I think we could see it test a price of around $125 – the high of August last year.

However, at forward PE above 21x at today’s price – that extends the forward PE closer to 23x.

That’s fine if we are to see solid revenue growth and margin improvements.

From mine, the stock will trade in the range between $100 and $125 until we see a catalyst for it to break out.

If you don’t own Google – it should be a part of your long-term core holding.

But I would not be chasing it here.

For example, it represents a great long-term risk reward closer to 18x forward (ie $100).

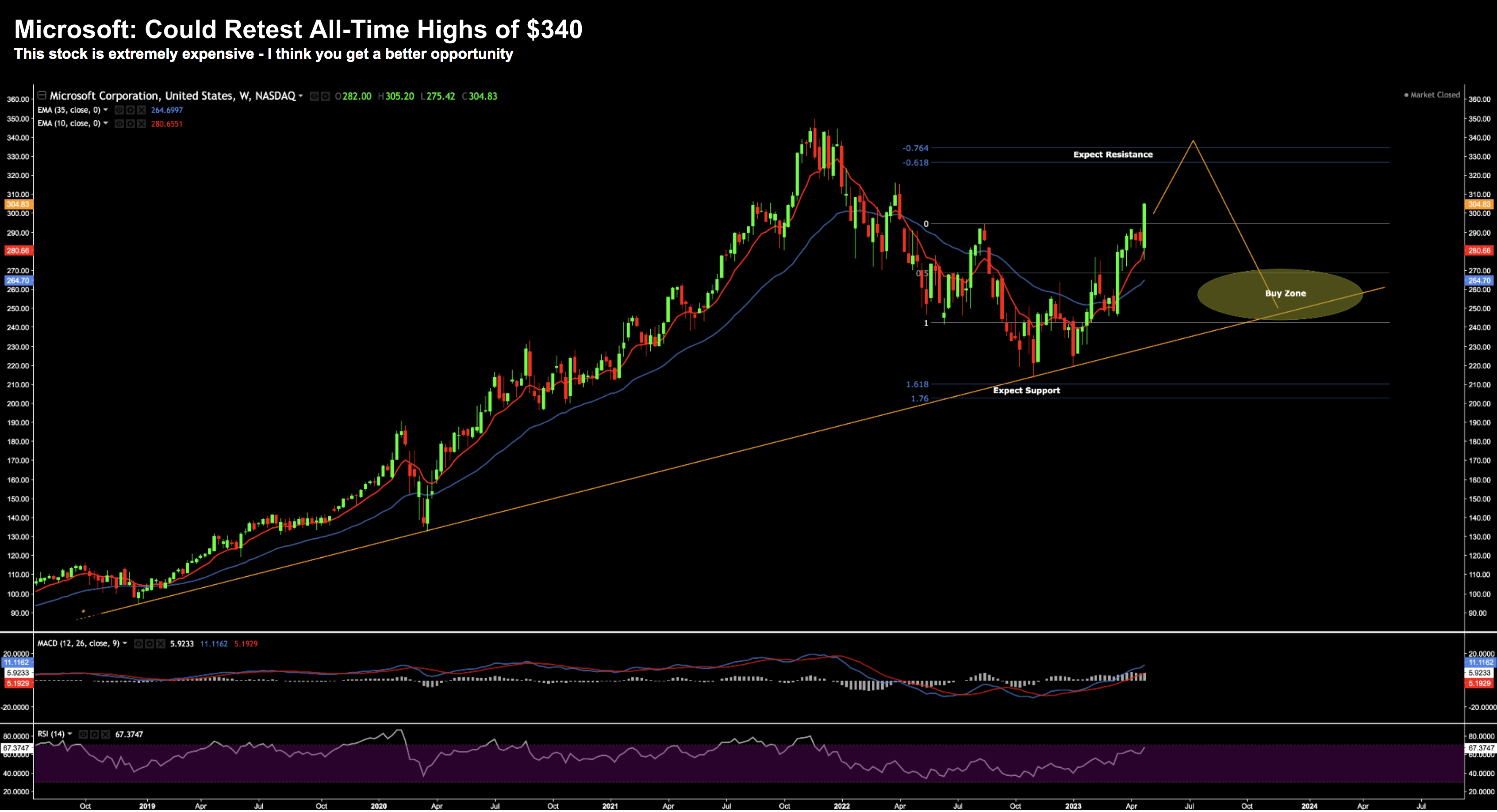

#2. Microsoft

Along with Meta – this was the clear stand out winner of the tech earnings (so far)

We will see what Apple has to say soon…

Microsoft delivered strong beats on the top and bottom lines – showing how resilient their cloud business continues to be.

Revenue overall was up 7% and net income up 9%

But what’s important, it was growth was up in the segments that matter.

For example, their “intelligent cloud” offering was up a whopping 16% year over year (from a large base)

Now Azure – the broader cloud business – grew 27%.

Bear in mind – this time a year ago it was growing closer to 50%.

Again, I warned of this the other week when I said the companies are aggressively trimming their IT budgets – as they too look for their own operating efficiencies.

There were a couple of weak points – but in areas the market is far less focused on.

For example, personal computing fell 9% YoY; and Windows O/S licence revenue was down 28% (due to weak PC shipments)

Now Satya Nadella – their CEO – did his best to try and sprinkle some “AI pixie dust” on the numbers – calling Microsoft the “platform of choice for AI innovation”

I could only chuckle – Microsoft’s AI innovation comes mostly from the company OpenAI.

Regardless, how many companies today like to sprinkle their earnings reports with words like “AI” and “efficiency” these days?

Overall, there is a lot to like with Microsoft’s Q1 result.

The only negative I have is nothing to do with management or their company’s performance – they are hitting on all 12 cylinders – it’s how far investors have driven up the price.

It’s overvalued – which is not MSFT’s fault.

April 27 2023

The tape suggests we could see MSFT re-test its all-time highs of around $340.

The weekly trend is bullish and the path of least resistance is higher.

But I won’t be adding to my position here…

For example, the forward PE for MSFT is now close to 30x.

They are already being rewarded for the growth they said would be coming next year – opposite things like (and I hate to say it) “AI”

Remain patient here if you don’t own it.

Again, this should always be a stock in your core holdings.

I don’t try and “trade around the stock“… I am happy owning it… adding to it when it goes on sale (which is rare).

It will go “on sale” again at some point… but it could be a while.

The “AI pixie dust” is still having its halo effect on the stock.

#3. Meta

Well, it turns out our old mate Zuckerberg finally got the memo.

Whilst he has slow on the uptake – he was told by the market to get his company “fit” and he did just that!

Well done.

Meta grew revenue by 3% this quarter vs the 1% decline the market was expecting.

More importantly, he delivered its first quarter of YoY growth after three consecutive quarters of revenue declines.

Again, the market’s demands are simple if carrying a high multiple: revenue growth and cost efficiencies.

And if you hit on both counts – well guess what – it does terrific things for the bottom line!

There’s the rub:

Meta lowered the top end of their 2023 expense guidance range.

Costs are now coming down (after the slashed more than 20,000 staff)

Again, well done Mark.

What’s more, the “Metacurse” (as I call it) is now only expected to lose somewhere in the realm of $4B this year (still a lot) — but that’s significantly better than the $10B cash furnace it was last year.

If it were me, I would cut Metacurse investment to ~$1B and see where it goes (especially given the complete lack of product market fit).

I think the share price would be 10-20% higher if they did that.

Anyone notice that Zuckerberg barely mentioned it?

And yet, he could not mention the term “AI” enough.

Go figure.

As an aside, I see Metacurse as a bit like crypto. That is, there might be something here in 5 years time – and it warrants having a very small bet to see what happens – but expect to lose the money.

You could treat it like an option trade.

A couple of other Meta metrics which impressed me:

- Average revenue per user (ARPU) increased to $9.62

- Daily average users (DAUs) also increased 2.3%

This is a big deal as their DAUs in the realm of 2 Billion users.

What’s more, its four consecutive quarters of DAU growth.

And this is what holds the Meta story all together – the sticky DAUs on platforms like “Instagram”

I appreciate I’m in the minority and don’t use any of their social platforms (I’m not a fan of social media) – but there are ~2 Billion people who clearly are!

April 27 2023

Technically the chart has come a long way (170%) and fast.

What’s more, it has done that on the back of essentially zero revenue growth over that time.

For example, I was happy going long the stock around $120 – where I paid ~12x forward earnings.

To me that felt like a reasonable risk reward.

The stock looked cheap – especially when evaluating the stock on its incredible free cash flow (my favoured metric)

I am now out of the name.

It’s now trading close to 24x forward after today.

I think it will find some resistance in this zone – maybe up to $260 – before it pulls back.

I don’t think we will see $120 again for a while – but we could easily see $200

In closing, Meta had two big problems last year – top and bottom line.

They have now addressed both.

#4. Amazon

Whilst Meta and Microsoft were the standouts – from mine – Amazon was somewhat neutral.

And look, it wasn’t hard to see given the pressure on IT spend and weaker consumer.

Initially the stock popped on the headline news – but during the call – warnings of a slow down on cloud spend took some of the shine off the Q1 number.

I’ll start with the good news…

Amazon delivered an impressive 9% top line revenue growth number – which is very good in this difficult climate.

Their cloud business – AWS – continues to decelerate but it was much better than feared.

What’s more – they still command more than 33% of the total market share.

Sales at AWS rose about 16% in the first quarter to $21.35 billion.

Still, that marks a deceleration from the previous quarter, when AWS grew 20%.

This echoes the trend we heard from Azure (MSFT).

From today’s earnings call:

“As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. We are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.”

500 basis points equates to something in the realm of just 11% growth next quarter

Ouch!

My guess – we are seeing some market share shift here – not simply a slow down in spend.

The retail business was not too bad – with a small improvement in margins on massive volumes.

And based on what their new CEO said – they’re starting to realize some of those efficiency gains.

Finally, they delivered another impressive advertising result in a soft market. That business continues to outpace their competitors and take share:

- Amazon Web Services: $21.3 billion vs. $21.22 billion expected

- Advertising: $9.5 billion vs. $9.1 billion expected

Here is CEO Andy Jassy:

“Our advertising business continues to deliver robust growth, largely due to our ongoing machine learning investments that help customers see relevant information when they engage with us, which in turn delivers unusually strong results for brands”

The only criticism I have on this result is the multiple the market is asking for the stock.

It’s trading above 84x forward earnings… which is too high for the growth and margins they are delivering.

April 27 2023

Technically the stock has found strong support around $80.

I think it continues to remain in a range bound given the excessive multiple being asked and uncertain macro outlook (a risk underscored by Jassy on the call).

Amazon feels more prone to recession risks than other large cap tech (given the likely weakness with the consumer).

That said, this is a stock you must own (at a reasonable price)

If you could pick this up between $80 and $90 – I think it represents a solid long-term risk / reward.

Putting it All Together

Amazon, Google and Microsoft are part of my ‘core’ long-term holdings.

Meta is not.

That’s not to say Meta is not a good business – it’s just not a stock I want to own for the long-term.

In closing, these four stocks feel expensive post their earnings.

Results on the whole were better than feared versus ‘stellar’.

Microsoft and Meta grew revenue by single digits and lowered their costs.

What’s more, they offered solid guidance.

That’s a recipe the market is looking for.

Amazon did a good job on both the bottom and top lines for Q1 – but the outlook for AWS was soft. Again, with AWS expected to only show 11% growth for Q2 – that’s a long way from the near 40% a year ago.

Is this just a slowing in IT spend? Or are they now starting to lose market share?

I suspect it could be some of the latter. If so, that’s a shift.

With respect to Google – I think investors need to see more with efficiency gains given the second consecutive quarter of revenue decline and lack of forward guidance.

Apple announces its earnings on May 3rd.

Looking forward to that one!

I will be back on Saturday when I review how the broader market finished the week.