- What the market may not be pricing in

- Tech multiples are sky-high – will their earnings outlook justify the premiums?

- What has the bulls buying… are they misguided?

Q1 earnings kicks into full year next week as we hear from more than 222 companies.

Widely held names like Microsoft, Google, Amazon and Apple will all report.

As will all the “blue chip” names (e.g. Coke, Pepsi and McDonalds).

Names like this will shed some light on how healthy consumer spending is.

Remember:

70% of US GDP is driven by consumers spending.

So far they have racked up a cool $1 trillion on their credit cards – paying an average rate of 26%.

Amazing what some people will do.

Last week the question was how healthy are the systemically important banks (extremely healthy as it turns out) – next week it will turn to the consumer.

But let’s come back to big cap tech…

Collectively these names carry 25% of the total market.

The sector has soared to start 2023 – with the ETF QQQ up ~20% YTD.

Will the momentum continue?

Netflix wasn’t a bad number – but the subscriber number looked weak.

However, Tesla was horrible – its shares down 11% this week – as total gross profit margins fell a massive 10%.

Turns out they need to aggressively slash prices to move product?

And here I thought people were falling over themselves to get a Tesla? Apparently not.

Will other tech names disappoint against a low bar?

More on that in a moment… but first let’s look at the set up.

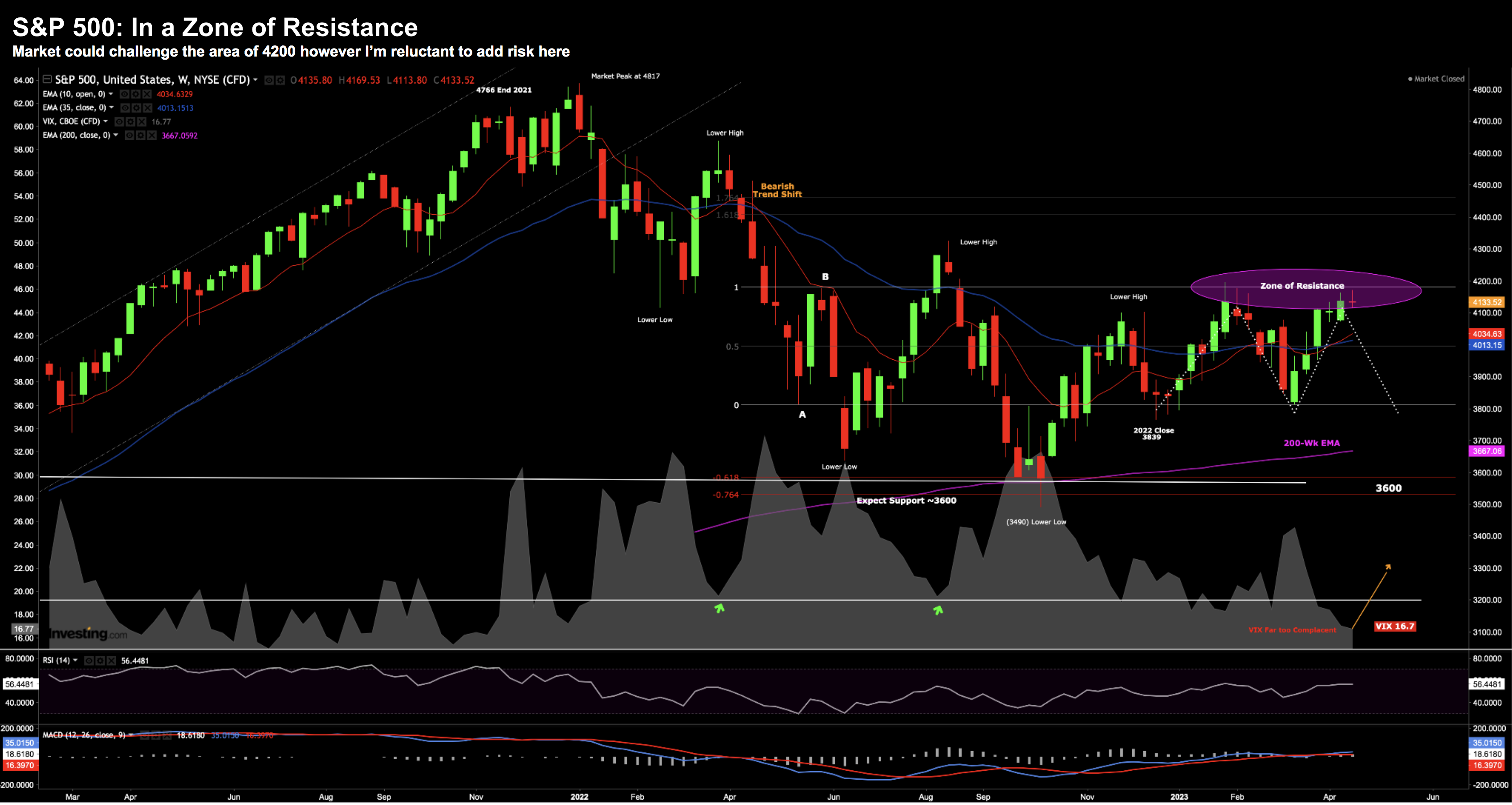

S&P 500 Hits the Wall (Again)

Last week I said the S&P 500 looks like facing another litmus test around 4200.

All year I have felt this will act as stiff resistance.

So far so good.

The index traded as high as 4169 – before finishing the week in the red – it’s first losing week in seven.

Technically not much has changed (not enough for me to change last week’s chart title!)

April 21 2023

- The upside reward does not outweigh the (many) downside risks; and

- The VIX is far too complacent (at 16) given the unknowns.

From mine, I expect a meaningful move to the downside over the next 3-6 months.

I am not adding to risk here – remaining 65% long.

What Has the Bulls Buying?

The market has finally come to terms with the fact the Fed is more likely to raise 25 bps in two weeks.

It took them a while to catch on – but they got there.

From mine, a strong inflation report gave the Fed a green light. I talked about that here.

However, the mistake the market could be making is they assume that’s it.

That’s a bold assumption.

For example, if you are thinking it will be “one more and done” — you’re also thinking I don’t want to miss the “Fed pause trade”

But here’s the thing:

It’s rare the best time to be buying was when the Fed chose to pause rates.

In fact, the best time to buy stocks is typically when the Fed is finished cutting rates.

Again, when the Fed eventually moves to cut rates (which I think is early 2024), it will because of either:

(a) economy is recession (where inflation is no longer a risk); and/or

(b) there is a major credit event

Who knows – we might get both!

Neither are great climates to own risk assets.

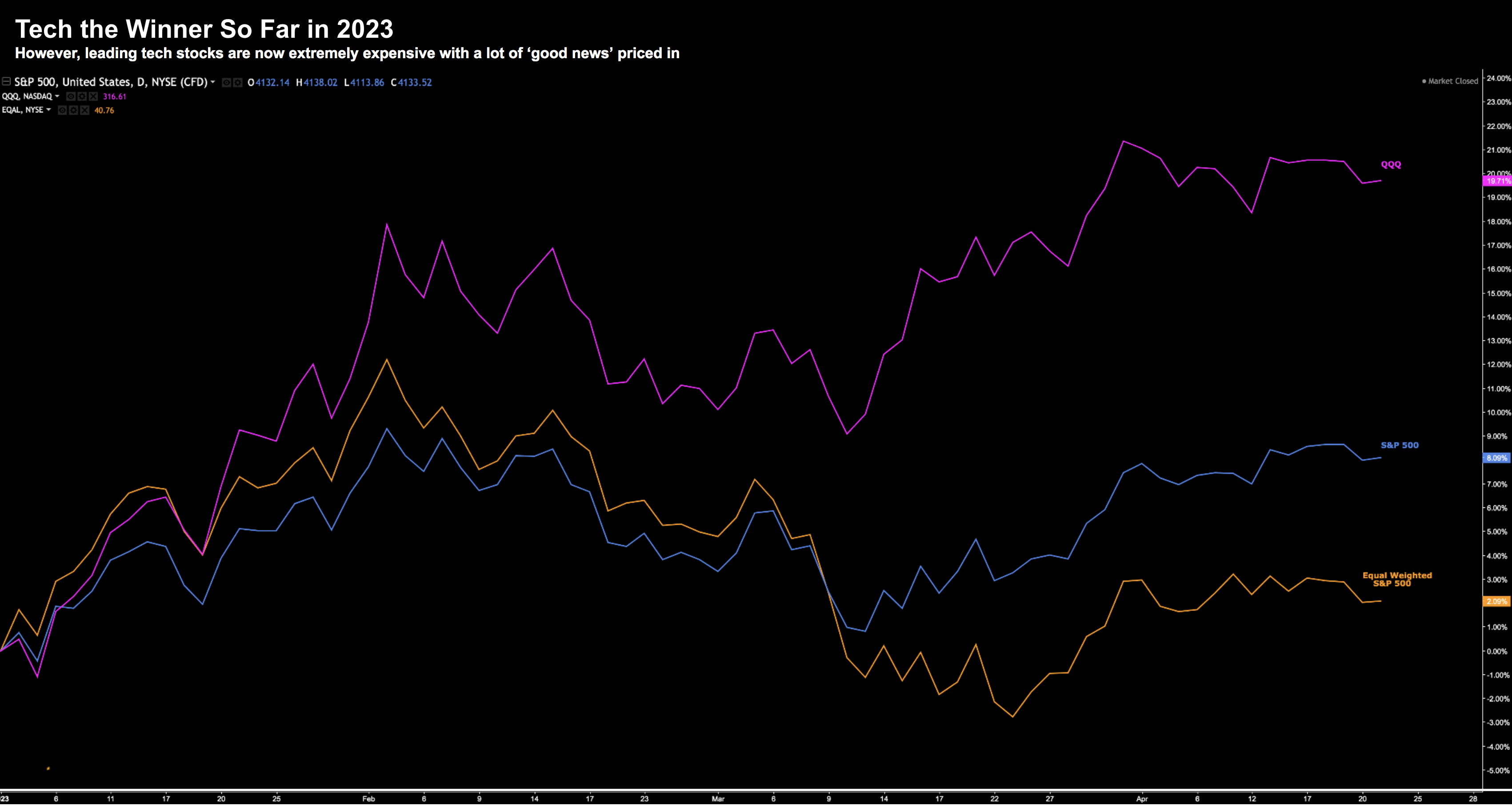

Now I mentioned earlier the bulls have been pouring money into tech so far in 2023.

Below is what we see in terms of its 2023 performance vs the S&P 500 (and equal weighted index):

April 21 2023

The takeaway from this chart is the lack of breadth.

Names like NVIDIA, Tesla and Meta have all driven the market higher.

However, this also sees these names trading at stupid multiples.

Sure, I was a buyer of Tesla and Meta around $120 each… but more recently I offloaded these names.

From mine, tech looks vulnerable.

Careful on Tech Into the Print(s)

Not only are tech valuations extremely high… investors should think about how tech makes money.

In short, it does well if the economy is doing well.

The opposite holds true.

How does Google make its money?

By millions of large and small businesses spending money on advertising.

How does Microsoft and Amazon make money?

By millions of large and small businesses spending money on greater cloud and IT services.

How does Apple make money?

People buying more iPhones and consuming more Apple services (music, movies, storage etc).

But in terms of IT and advertising spending – businesses have been pulling back.

How do you think that will impact the revenues of these companies?

And their margins?

Consider what we heard from CDW this week…

Whilst the market focused its gaze on companies like Tesla, American Express, P&G and Netflix… one of the most important stories was from this “less known” enterprise IT spend business.

From Motley Fool:

Heading into the quarter — where official results are due out before market open on May 3 — analysts had been forecasting nearly $5.4 billion in sales for CDW (according to Yahoo! Finance figures), and flat earnings of $2.20 per share.

But this morning, CDW warned that sales will actually be closer to $5.1 billion for the quarter, and that profits for the full year will be “modestly below” 2022 numbers.

They added they expect IT spend this year to be down high single digits.

Look for this to show up in both Microsoft and Amazon’s report (and to some degree Google Cloud)

My guess is all of these companies will show slowing growth (warning of slowing growth ahead)

Lagging Effects

From mine, the impact of the Fed’s 500 bps of rate hikes the past 12 months is only just starting to work its way into the system.

How much we don’t know.

What’s clear (to me) is things are clearly slowing.

And in some small pockets – they are slowing sharply. I offered these examples last week:

Now if you throw in at least another 25 basis points from the Fed – on top of sharp bank credit tightening – what’s that going to do?

If you ask me – it spells a slow-down.

But my point is the rate hikes and the recent flow-on effects from the mini-banking crisis – all take time to filter through the economy.

My question is to what extent are markets pricing this in?

I’m not sure…

However, I think the downdrafts of credit tightening are yet to be felt.

Banks are just starting to really pull things in.

That won’t fully show up in the Q1 numbers.

And if I am correct – that means equity valuations will need to come down.

PCE Next Week

Whilst all eyes will be on earnings (and they should be) – we also get PCE inflation for March.

This is just as important.

Whilst a 25 bps rate increase is now priced in for May – a hotter-than-expected PCE number could also put a rate rise for June in play.

Markets are definitely not pricing that in.

Again, the recent rally in stocks this week is the attitude of “one and done” from the Fed.

What’s more, there is an expectation of 100 basis of cuts later in 2023.

I think the latter is extremely presumptuous.

Markets are expecting March PCE to show further moderation – down to levels of 4.4%

This will be important – as it’s the last major economic data release ahead of the Fed decision May 2nd.

For comparison, the February PCE, released March 31, showed 5% annual inflation.

Question is whether anything around 4.4% be enough for the Fed to pause?

Difficult to know.

Putting it All Together

- Apple 26.5x

- Microsoft 28.5x

- Alphabet 20.5x

- Meta 20.5x

- NVIDIA 59.5x

- Tesla 46x

- Amazon 74x

Good luck if you’re happy to pay these multiples and expect to do well over the next few years.

These companies will need to grow at “silly” rates (i.e. 30% plus) to justify these multiples.

Too rich for my blood!

The only two which are close to be reasonably priced (but are still expensive) are Alphabet and Meta ~20.5x

If it were me – I would much prefer to see the tech sector down 20% coming into Q1 earnings – not up 20%

My focus won’t be on top-line revenue… it will be on margins and specifically expenses.

Tesla already showed its hand – reporting a total gross profit margin of 19.3% – down 10% from the prior period.

Promises to a fun week… lots of information to digest.

Trade with a healthy sense of caution.

And try not to over pay.