- Core CPI 5.6% first YoY increase in 5 months

- Fed more than likely to raise by 25 bps May 2nd

- Consumers feeling the squeeze…

Before markets opened today – we learned headline inflation eased slightly for the month of March.

Good news.

Futures were higher immediately following the print.

Now markets expected softer prices – however the question was would it be enough for the Fed to pause?

In short, no.

Below is a quick summary:

- Headline CPI rose 0.1% for the month; and 5.0% YoY

- Excluding food and energy, the Core CPI rose 0.4% and 5.6% YoY

- 0.6% increase in shelter costs — up 8.2% YoY

What matters is Core CPI – its first increase in 5 months.

Further to this post – Fed’s 2% Inflation Goal: A Long Slow Fight – the fight to get inflation down from 5% to 2% could take years.

Why?

Ongoing pressures in both housing and the labor sectors.

Going from 9% to 5% was always low hanging fruit.

That’s mostly done.

From Fed Governor – Phillip Jefferson:

“High inflation may come down only slowly. Bringing services inflation under control depends on a better balance in the labor supply and demand“

From the latest March report:

While food costs declined at the supermarket by 0.3%, food at dining establishments continued rising at a brisk 0.6% pace, which is emblematic of the challenges associated with reining in services inflation. Leisure and hospitality remains the hottest labor sector of them all.

As an aside, eggs were up 36%; dairy up 12%, bakery up 14%; fruit and vegetable up 3% YoY.

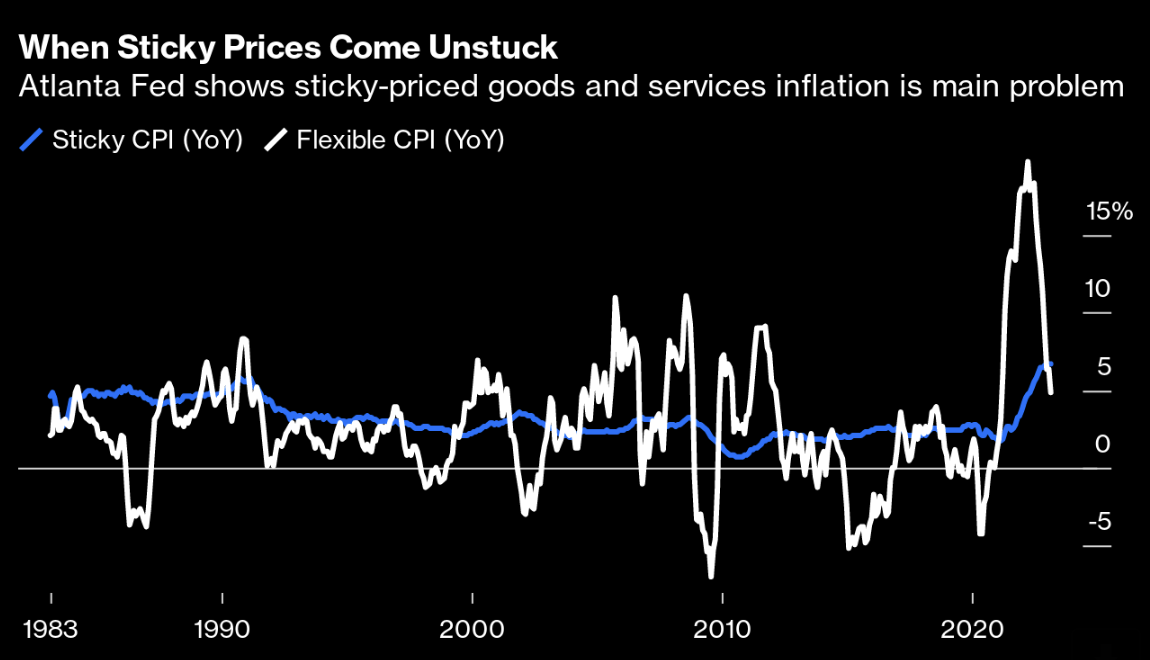

This chart from Bloomberg shows the trend with sticky inflation (blue) vs flexible items (white)

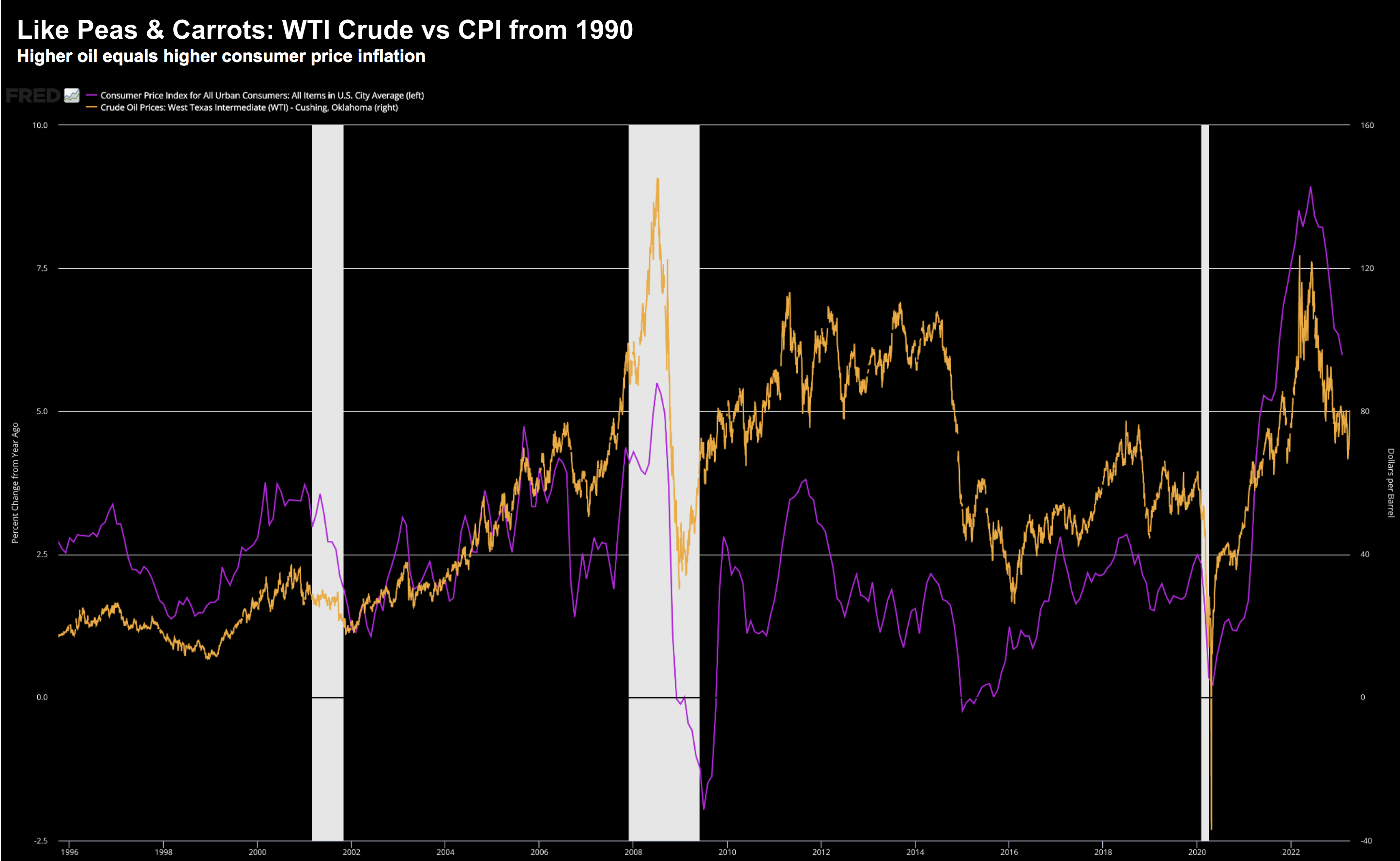

Higher Energy Could Cause Problems

A large part of the fall in headline inflation was lower energy prices.

For example, over March, oil prices declined sharply – as recession fears weighed on the (energy) demand concerns.

Gasoline prices declined 4.6% and services (electricity and heating) dropped 2.3%.

Naturally, CPI fell:

April 10 2023

My question is what happens if we see oil prices back above $100/b over the next few months?

How does that help the Fed?

The production cuts from OPEC+ (which equate to just under 4% of global supply or 3.6M barrels per day) may have put a ‘floor’ under the price.

If that’s true, higher energy prices will likely create inflation throughout the economy — pressuring consumers.

Spending more money at the pump and/or powering their homes – means less on discretionary spend on other things.

Crude oil prices are up ~10% from the March – recently trading above $82/b

April 12 2023

Will that be a problem?

Earnings Start Friday

With CPI behind us, our attention now turns to Q1 earnings.

The banks lead things off Friday.

The market expects Q1 earnings to fall around 7% in the first quarter.

If true, this will mark the second consecutive quarter of declines.

Two quick thoughts:

- A 7% EPS decline feels like the best case; and

- Expecting a sharp rebound in earnings over subsequent orders is unlikely if we see a recession.

I say this because earnings have never bottomed before a recession.

My thesis (over the past 9+ months) has been to expect a recession in the second half of 2023 or early 2024.

My conviction has increased the past few weeks – given data points such as (not limited to):

All of that feels recessionary.

Further to the Dallas Fed’s report – consumers are going to have to battle through tighter credit conditions for the balance of this year (if not longer).

Banks are going to be far more stringent with loans… as they look to shore up their own balance sheets.

And as Warren Buffett told CNBC this morning – we have not seen the end of the banking failures.

Translation: tighter credit.

(Buffett sold all his bank stocks except one: Bank of America)

So let’s connect a few of the dots:

- Higher prices at the pump will impact discretionary spend (i.e., resulting in lower company sales / profits)

- Consumers relying more on credit to get by – where credit card debt will push $1 trillion in June.

- The average interest rate for credit cards in April hit 24% (vs ~16% 12 months ago).

- Banks are likely to continue tightening conditions – making it harder for consumers to extend their credit; and finally

- Job losses are only going to increase

Does that spell earnings expansion to you?

My guess is revenue (and profits) are going to be squeezed.

But we will get an answer to that over the coming 4 weeks… happy to be wrong on all of the above.

Putting it All Together

Tomorrow we get Producer Price Index (PPI) inflation.

This is useful to know – because if producers are paying higher prices – they are likely to be passed on.

But based on what we saw with March Core CPI – I think the Fed gets a “green light”.

Markets seemed to figure that out by the close of trade – but initially they cheered the news.

Continue to remain patient…

Anything above 4000 on the S&P 500 is expensive – where earnings expectations feel too high.

Best case, the forward multiple is 18.5x (not cheap)

However, if earnings are revised lower, that multiple blows out (e.g. 20+)

Let’s see what the banks have to say on Friday… they could set the tone for what’s ahead.