- Did the 2/10 year yield curve just signal recession?

- Don’t be too quick to ‘cheer’ plunging bond yields

- Equities appear to be mis-pricing risk

- The failure of two US banks and threat of more to follow;

- Bond yields cratering by more than 100 bps;

- The Fed raising rates despite financial instability; and

- Systemic European banks on the brink.

You would think the volatility index (VIX) would be sky high.

Nope.

Despite all the above – the VIX has actually declined.

What’s more, the S&P 500 sits at almost the same level as it did February 20.

All that commotion to basically go nowhere.

I will examine the weekly chart for the S&P 500 shortly…

But first, what gives?

It’s hard to say…

Either the market is correct that there’s nothing to worry about; or it’s completely mis-pricing risk.

I don’t pretend to know…

However, for now it appears that equities are optimistic we are about to get out of jail for free (collecting $200 as we past ‘go’)

But it’s not a view that’s shared by the bond market.

The “smart money” is screaming recession dead ahead.

Let’s start with a look at the historic move in US 2-year bond yields… followed by an ominous signal from the yield curve.

2-Year Yields Crater

Rarely have we seen such volatility in the bond market (perhaps not since the early 1980s)

Consider the daily chart for US 2-year treasury over the past three weeks:

March 24 2023

These yields were above 5% not long ago – today they are well under 4.0%

This is the bond market suggesting the Fed will be cutting rates before too long.

And aggressively…

Now some investors (not me) will be cheering lower yields…

But I will argue this is not a healthy sign.

For example, if we see the US 2-year fall towards levels of 3.0%… something is horribly wrong.

Again, if the Fed are forced to cut, it will be because of some kind of crisis.

For example:

- An extraneous credit event; and/or

- A recession

However, it won’t be because they think they have won the fight against unwanted inflation.

To that end, I would be willing to bet if the 2-year trades near 3.0% – equities will be 10%+ lower than where they are today.

And perhaps the answer rests with the yield curve.

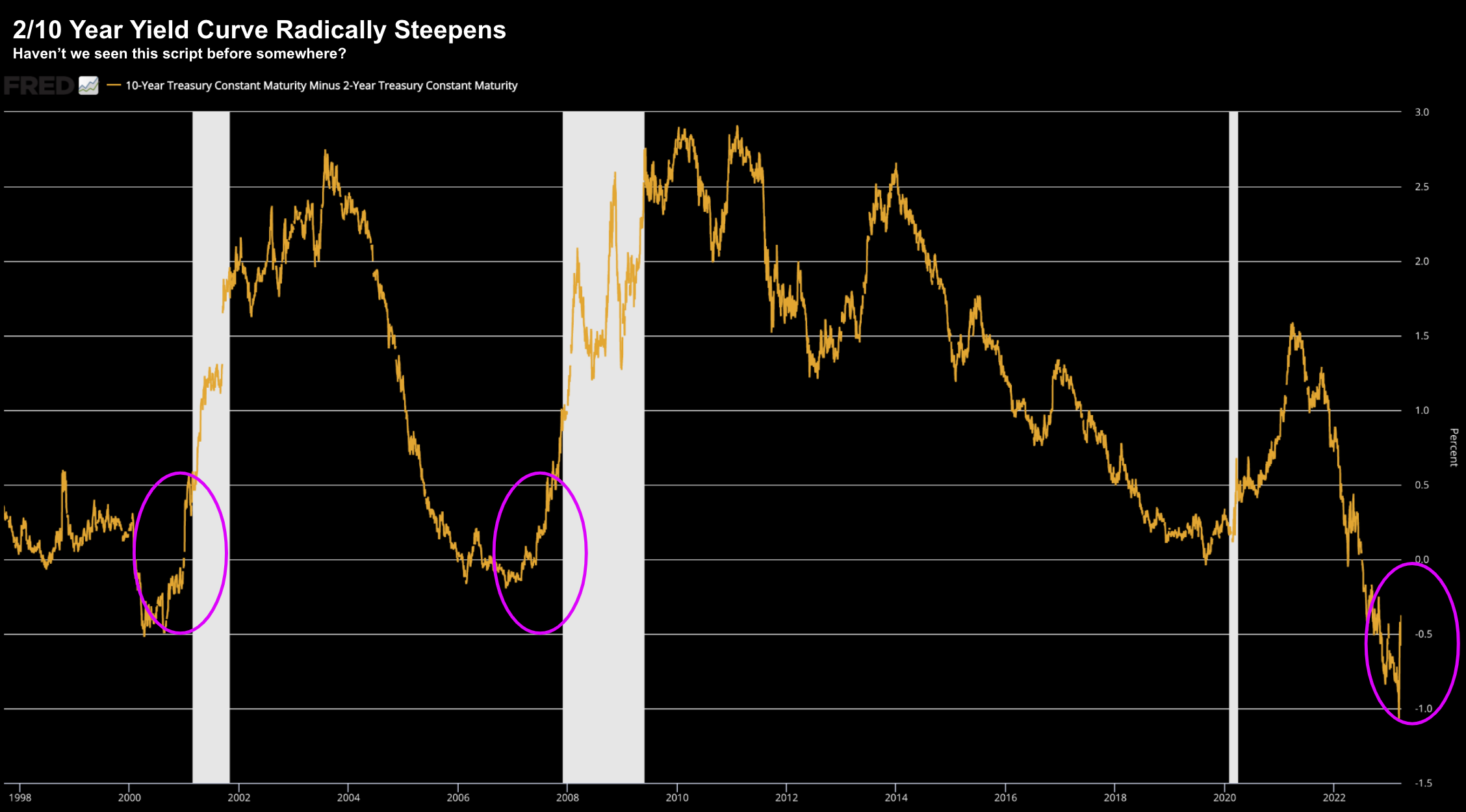

Yield Curve Dramatically Steepens

Crashing 2-year yields isn’t a great sign.

For example, it’s decline has now triggered the 2/10-year yield curve to flash red.

Take a look at how much we have seen this yield curve steepen given the fall in the 2-year:

March 24 2023

Circled are the other times we have seen the yield curve steepen like this after being in negative territory.

It was in 2000 and again in 2007.

Guess what… we know how the movie ends.

Over the past 6+ months I’ve been saying we should expect a recession late 2023 or early 2024.

That hasn’t changed.

However, the plunge in the 2-year (and resulting change in the yield curve) has simply strengthened my conviction.

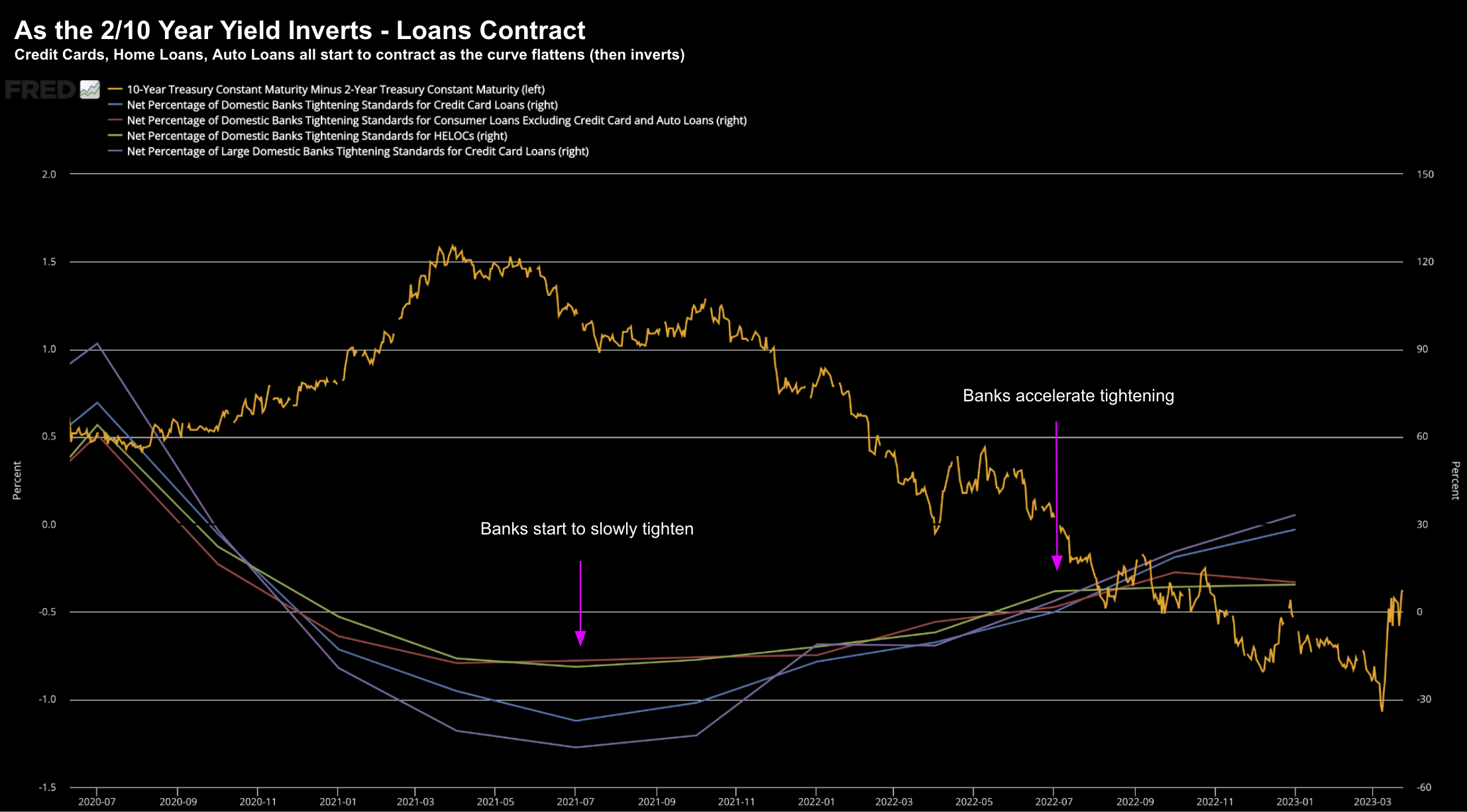

But let me explain why yield curve(s) matter…

It’s all do with the banking system and credit.

What these do is help catalyze a slowdown by creating further bank stress.

Banking is not a hard business (if you can manage your risk).

Banks make money from borrowing short and lending long.

Now when the short rate (e.g. 2-year) exceeds the long rate (e.g. 10-year) – you get what’s called inversion.

That makes it difficult for banks.

When the curve inverts – banks will typically tighten lending standards or increase price terms across every major loan category.

The chart below demonstrates this:

March 24 2023

As we can see above, ever since the events of SVB, banks have really tightened the screws.

It’s not surprising…

Banks are now trying to save themselves by shoring up deposits.

Let’s now bring it back to the yield curve.

We often hear people issue caution when the curve initially inverts.

And that’s reasonable – it typically flags banks will likely restrict lending (as the charts above)

However, when it pivots sharply in the opposite direction – that’s time to ring the bell.

Why?

Because banking crises are historically deflationary events (as this FDIC research paper discusses)

Deflation does two things:

- Increases the real value of debt; while

- Decreasing the value of collateral for loans

And if your entire economy is structured on the foundation of expanding (cheap) credit — that’s an issue.

Banks will slow (or stop) extending loans which causes credit to contract.

From there, asset prices come down.

This becomes a feedback loop between slower growth, falling asset prices, and larger (real) debts.

In summary, this is what bonds (and gold) are signalling.

Equities however remain unmoved (for now)…

And I think that is potentially a mistake.

Equities – Mispricing Risk

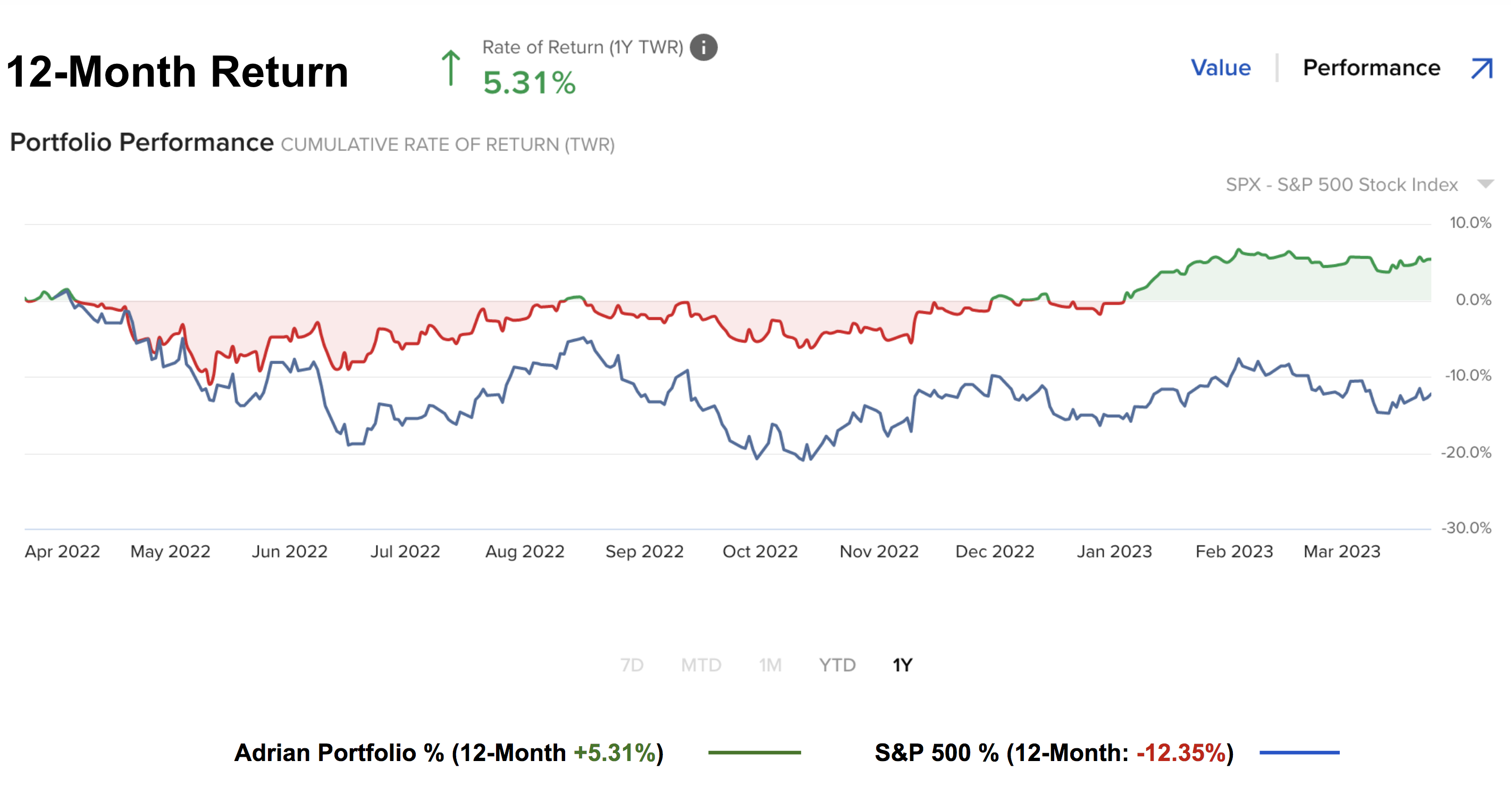

At the end of 2021 – I had a sense that equities were mispricing risks.

As a result, during Q4 of 2021, I reduced my equity exposure.

The move paid off… enabling me to outperform the index by ~19% over 2022.

And so far, things have started well for the first quarter of this year.

Below is my rolling 12-month performance vs the S&P 500 (which still remains in negative territory at -12.4%)

You can track my 2023 YTD performance here (updated at the end of each week).

Now I’m not sure if markets are set to decline 20% from here… however I feel the next move is lower.

And this is what the bond market is telling me….

Let’s see how the S&P 500 closed the week:

March 24 2023

The other week my best guess was for equities to catch a bid around the 3800 zone.

That’s what we have seen.

However, the small move higher doesn’t make me too excited.

I don’t see this as the start of the next “big bull run”

Three reasons:

- The bulk of the move is largely defensive – with money seeking “shelter” in large cap tech stocks (Apple, Google, Microsoft) given the strength of their balance sheets and cash flow. These names comprise almost 26% of the total S&P 500 market weight. If you remove those gains – the S&P 500 would basically be flat;

2. Banks are not in great shape technically. And whilst I think names like BAC, WFC and JPM represent great value (long-term) – technically they could all move a lot lower. Now without banks participating in the market – I think we struggle from here; and finally

3. Bond yields are exceptionally volatile. If the equity market is to establish a sustainable rally – we need bonds to stabilize. Further, if the 2-year continues to fall, I think that does not bode well for equities. If anything – we need bond yields to rally (which is a sign the market is confident the economy is in good shape)

In summary, I think you need to act with a healthy sense of caution here.

For me personally, I remain about 65% long.

My portfolio has performed reasonably well so far this year (up 5.84%) – however would be at least 1.0% higher if it weren’t for poor performance from my bank and energy holdings.

That said, if we see quality banks (and energy) continue to sell down further, I will be looking to capitalize.

I am not looking to add further exposure to large cap tech (where I remain slightly below market weight)

Putting it All Together

Investing in this market continues to be fascinating.

This is what draws me to this game (and it is a game) – the never ending challenge of trying to connect the dots / calibrate the risks / see what’s unseen.

Today for example, it’s hard to remember a time where we are fighting both:

(a) financial stability (where liquidity needs to be added); along with

(b) unwanted inflation

The two are essentially at odds.

For example, when former Fed Chair Ben Bernanke fought a banking crisis in 2008, he didn’t have to worry about inflation above 6%.

And when Paul Volcker’s ramped interest rates to ~18% to bring down double-digit inflation – he wasn’t worried about a banking crisis.

Jay Powell has the ‘pleasure’ of both.

The irony of course is this almost entirely due to the Fed’s own doing (the government also played a big hand).

For example, printing an incremental $4 Trillion to enable the government to “fight” COVID (if that’s the right word) is now roaring back to bite.

In terms of inflation – that is simply excess money chasing too few goods.

However, it predates COVID.

I would argue that leaving interest rates anchored close to zero for over a decade (in addition to trillions in QE) was also the wrong thing to do.

This simply results in a massive misallocation of capital.

This is what we have seen in tech.

Now the actions of policy makers the past three years simply exaggerated a bubble which was already forming.

All actions have consequences.

You would be foolish to think there was not going to be a cost.

In closing, it’s hard to see how Powell can thread the needle successfully.

Things appear to be coming unglued…

Policy prescriptions for taming prices and bolstering banks point in opposite directions.

For example, to get inflation down, central banks hiked rates and withdraw liquidity from the banking system (i.e. reduce excess money).

However, to short-circuit crises, they shove money out to stricken lenders and cut the cost of credit.

What a mess.

But you know what they say… you lie in the bed you make.

Remain cautious.