- What message does ‘no rate hike’ send?

- A crisis of confidence (vs systemic risk)

- Fed has done what it needed to do – ensure liquidity.

Here’s a question:

Do you believe the current banking ‘crisis’ is idiosyncratic or systemic?

The short answer is it’s still too early to know.

Hopefully it’s more of the former and less the latter.

Because if it’s the latter, that’s a problem. Last week’s issues will become multiplicative (vs additive)

Now 2008 was a global systemic banking crisis.

Toxic mortgage backed securities become multiplicative at warp speed.

Turns out asset values were not what they thought they were.

But for me – and I’m not a banking analyst – this feels nothing like 2008.

However, there are cracks in the system.

Something did break.

That something was confidence in the banking sector.

Banking doesn’t work without people feeling confident their money is safe.

Right?

That’s why the FDIC and Fed were willing to take the unprecedented measure of insuring all deposits – irrespective of the amount.

A staggering $9 Trillion of assets were insured.

People should now feel safe.

From mine, their swift actions feel representative of idiosyncratic issues vs those which are inherently systemic.

Let’s explore…

Banks are in Strong Shape

Personally, I am not worried about the US banking system.

Maybe I should be?

But I’m not.

Now some (panicked) readers wrote to me using language like “the entire house is burning down”

It never felt like that to me… but it gave me a sense of how some people felt.

And I can understand how it might feel like that (especially if you banked with a regional bank)

“We need regional banks” they shouted at me.

Of course we do!

I never said we didn’t?

1000%.

They are extremely important to the ecosystem and every community across the country.

And they should be supported.

We just don’t need them behaving badly.

That said, should we be drawing parallels to 2008 – where the house was literally on fire?

I don’t think so.

For example, if you listen to most banking CEO’s, they will tell you the industry remains in excellent shape.

By way of example, the US’ largest banks (not the Fed) poured in $30B of funds to help our First Republic (a mid-sized Californian Bank) today.

Would they do that if they needed the $30B to preserve their own balance sheets?

Unlikely.

Here’s Politico:

Federal regulators said it demonstrates “the resilience of the banking system,” according to a joint statement from Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell, FDIC Chair Martin Gruenberg and Acting Comptroller of the Currency Michael Hsu.

The infusion of money is intended to sweep away fears by depositors and investors that First Republic and other midsize banks could fall victim to perilous runs. The private sector action could also help the Biden administration avoid the politically damaging charge that it is bailing out banks.

JPMorgan Chase, Bank of America, Citigroup and Wells Fargo will each kick in $5 billion, with other institutions providing smaller amounts, according to a statement by the lenders.

First Republic is the country’s 14th-largest bank by assets.

Not large but not insignificant either.

Now my guess is the $30B infused was simply money that fled First Republic and being returned.

However, instead of First Republic only paying depositors maybe 0.2% on their savings (which is probably close) – they’re now paying ~5% to get that same money back from their competitors.

Ouch.

But I also think the Big Banks know how important it is to see a bank like First Republic stay upright. If they were to fail – it could hurt them just as much.

Confidence would evaporate.

So this was a great move.

I digress…

But what it also demonstrates (to me) that the US’ banking system has lots of capital and sufficient liquidity.

And if I am wrong on this – we will know in just under one month’s time.

The banks will report their Q1 2023 profits and talk to the strength of their balance sheets (BAC reports April 18 – a stock I added to last week during the crisis – along with WFC)

(My rule: try and buy quality banks at a book value at 1x. Sell them at 2x)

Further to what I wrote earlier this week (and I hope I’m not wrong) – what we’ve seen is two (arguably) unique regional US banks (SVB and Signature) who failed to adequately risk manage their business.

Note: Credit Suisse is another problem entirely (its troubles are well documented) and was given a $50B lifeline by the Swiss National Bank)

For example, with respect to regional US banks (or any bank?!) – I suspect very few would deliberately choose to have as much as 80%+ of their funding base from one industry (especially one as risky as tech startups – where 90% are expected to fail)?

Now could any of the other 51 regional banks in the Bay Area lent money to these tech startups?

Absolutely!

But guess what – my bet is most elected not to (or at least certainly not at the same scale as SVB) due to the concentrated risk.

Makes sense to me.

Think about it this way…

You don’t need to be a banker to know that anything more than “20%” of your book exposed to a sector where 90% of businesses fail is risky.

Heck, 10% is risky.

These risks become obvious to everyone when the close-knit tech community decided they wanted out (n.b., SVB can thank billionaire VC Peter Thiel for that)

Now when depositors are screaming for their money back – do you think they are looking at “what assets they hold” or “duration risk”?

I doubt it.

They simply lacked confidence their money was safe.

And that’s the crisis the Fed and FDIC are contending with.

Confidence.

It Doesn’t Feel like 2008

Banking is a game of confidence.

Confidence your money is there when you need it at any time.

No quibble.

Unfortunately the issues which brought down SVB and Signature rocked the entire banking sector.

Now if everyone thought like my reader who felt “the whole building is on fire” – yes – then maybe it would catch fire.

But that’s not the case (at least from my lens)

That said I don’t want to sound dismissive or ‘pollyannaish’.

Something broke.

But I don’t necessarily subscribe to the theory this is repeat of 2008.

More important, I don’t think either the Fed or the government feel this is a repeat.

We will hear more from the Fed in 6 days (March 22).

And it’s my view they will still raise rates 25 bps (much to the anger of many I am sure)

I will share my thoughts on what message this potential sends shortly…

However, the primary reason I think they will have confidence to raise rates is they don’t see widespread systemic issues.

But they are aware of potential liquidity issues.

Why We Have a Central Bank

- price stability (i.e. taming unwanted inflation); and

- full employment.

However, it’s also to ensure the banking system has adequate liquidity.

The spigots cannot seize.

Now if the Fed or FDIC were worried about banks like “SVB” making bad loans – then they can step in and shut them down (and I expect we will see greater oversight as a result).

They did that with Signature – a lender to the (ultra speculative) crypto sector.

But I don’t think they are worried about the banking sector’s strength – including the ~4500 regional US banks

Yes, so far 2 of these 4500 had problems.

And there will be more…

But consider this:

SVB and Signature combined comprised ~1% (or $300B) of the total US banking system’s assets.

As a whole, the US system has $30 Trillion of assets… where just under $5 Trillion (~17%) sits with Regionals.

And whilst the collapse of these two banks is a problem…. the Fed acted quickly.

You might say the patient caught a case of the flu… not cancer.

The ‘Doctor’ stepped in to make sure banks had the money available to serve their customers.

What’s more, they insured some $9 Trillion of people’s money.

Everyone exhale.

That was designed to restore confidence.

Not systemic risk.

From mine, this is the function of the central bank.

When financial markets “catch a nasty virus” — the Fed is there to provide necessary liquidity.

As an aside, because of the actions taken by the Fed, another $2 Trillion has now come into the system as a result.

In short, liquidity is flooding in.

And you are likely to see even more next week.

What Message Does the Fed Want to Send?

So let’s switch gears…

Wednesday’s post posited the Fed faces a very difficult choice.

But according to some readers – there is no choice.

This is the sentiment I received via email:

‘You can’t raise rates! The house is burning down’ – or language to that effect.

And I’m sure that reader is not alone.

I’ve heard many commentators begging the Fed not to raise rates next week (with similar sentiment)

Now before I explain why I think they will raise – yesterday I read Larry Fink’s annual shareholder letter

It’s always a good read but this year it was unusually long (whereas Buffett’s letter was his shortest ever)

Fink described the current financial situation as the “price of easy money” and that he expects more Fed rate increases.

Now whether more increases is the right thing to do is another discussion entirely… but I agree with Fink’s assessment there will be more.

Fink added that post the regional banking “crisis” – the financial industry could see what he termed “liquidity mismatches.”

Agree with that too!

That is because the low rates have driven some asset owners to raise their exposure to higher-yielding investments that are not easy to sell.

I would call that a function of chasing yield (at any cost!)

He adds:

“Bond markets were down 15% last year, but it still seemed, as they say in those old Western movies, ‘quiet, too quiet”

Something else had to give as the fastest pace of rate hikes since the 1980s exposed cracks in the financial system.”

But as I described earlier – immediate policy action helped avoid a wider crisis of confidence.

On the subject of inflation – Fink believes it will “more likely to stay closer to 3.5% or 4% in the next few years.”

Agree with that.

Now in support of Fink’s (higher-than-expected) long-term inflation forecast – the latest monthly data supports his thesis.

Let me offer three charts (all from Bloomy) – and then I will tie this back to what message the Fed may want to send.

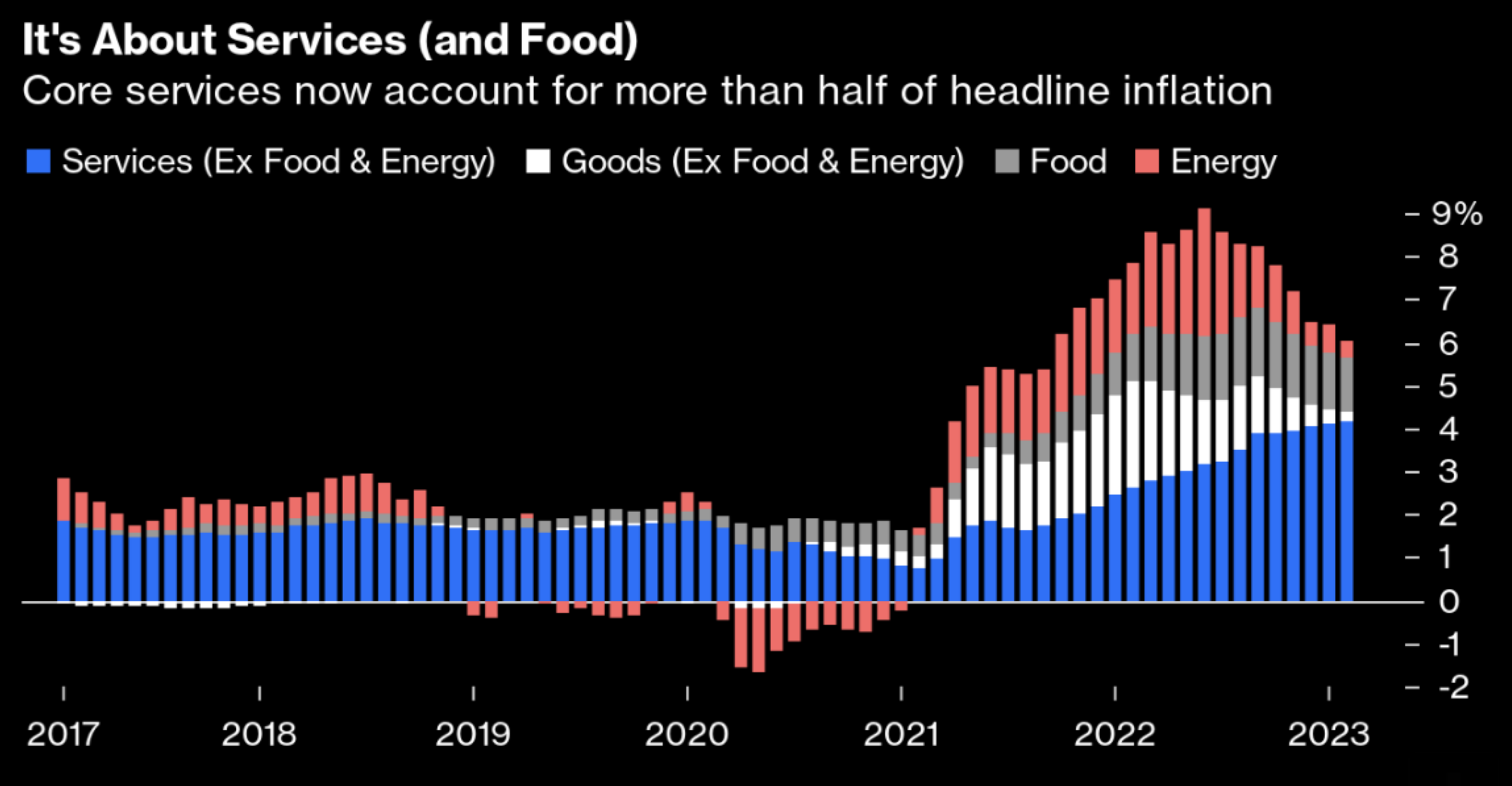

The first chart shows exactly where the inflation problem is:

In short, it’s all in services.

As we can see, Headline CPI fell thanks to sharp declines in the price rises of energy and of core goods — two sectors that drove the spike initially.

However, persistent food inflation (which the Fed can do nothing about) keeps the headline high, but the greatest driver is services.

For example, services like restaurants, flights, concerts etc etc… all of which are a function of higher labor costs.

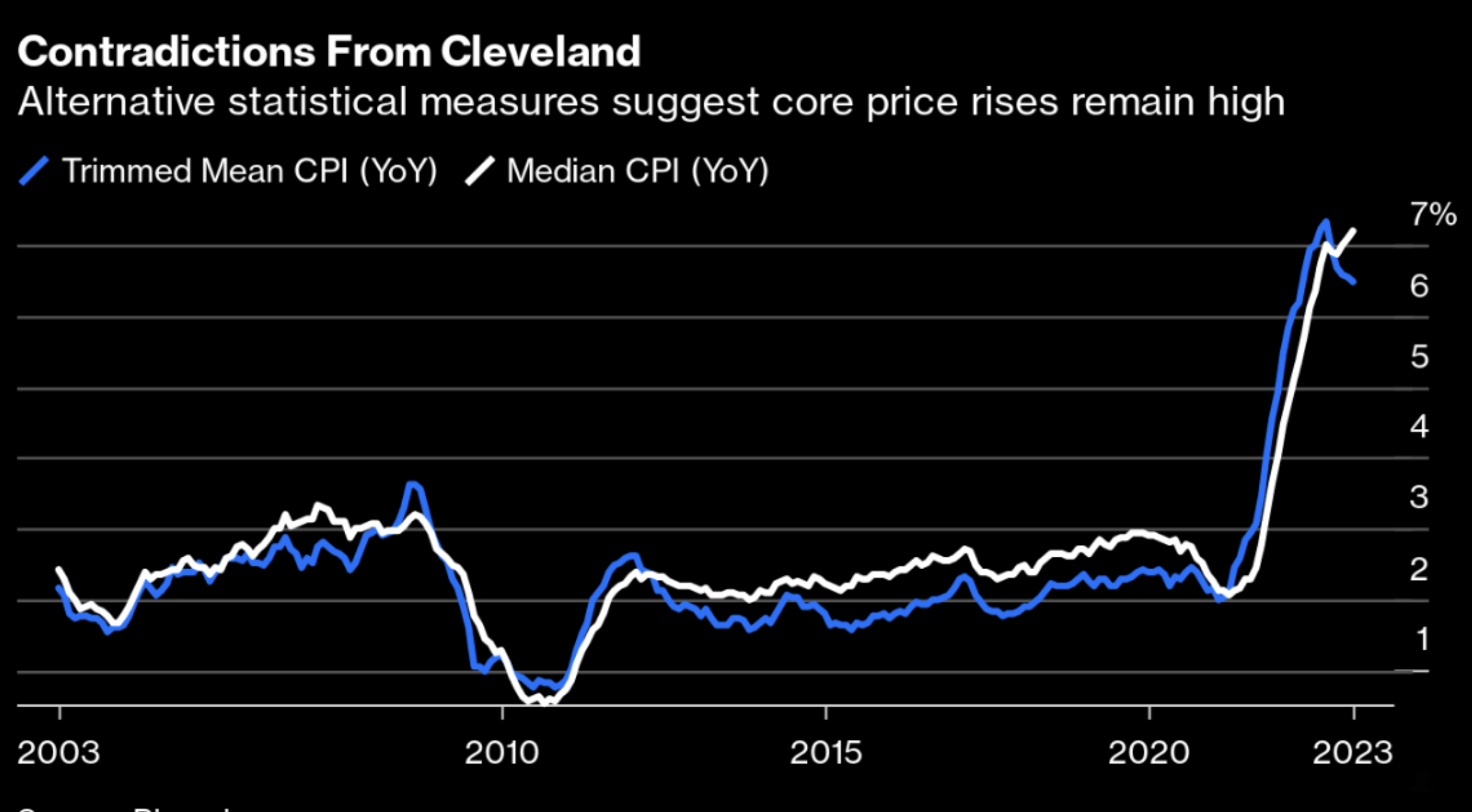

The second chart comes from Cleveland Fed’s measure of the trimmed mean (where outlier components are discarded and an average taken of the rest)

This is barely below its January level, and still above 6%.

Now its measure of the median has topped 7% for the first time.

So far the Fed are “0 for 2”

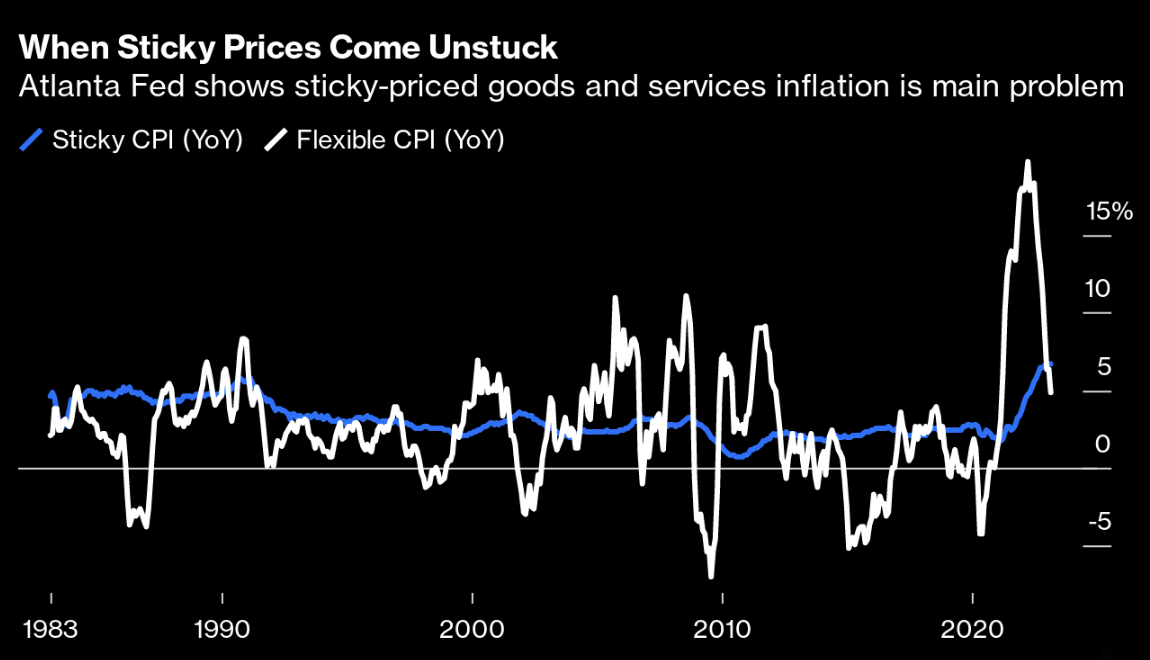

The third inflation chart is the one I lean into…

The Atlanta Fed’s measures it by dividing CPI into components whose prices are flexible (e.g. goods) and those that are sticky (e.g. rents and wages)

In 2021 and early 2022, the resurgence of inflation was almost entirely about flexible (goods) pricing (see this post early January)

Not now.

Sticky price inflation is higher than flexible and remains extremely elevated.

And that’s what the Fed are solely focused on:

This is the concern…

For example, if this trend continues to trend higher, inflationary psychology will become ingrained.

The more it becomes ingrained – the longer it will persist.

Here’s the thing:

You might (falsely) assume that inflation like this can just “wait for another day”

For example, the Fed should simply ‘back off the rate hikes for a while’.

Easier said than done.

But let’s assume that’s the mindset of the Fed…

Take the foot off the gas and pause (especially given the events of SVB and dramatic tightening of credit conditions)

What message will that send?

For example, with median inflation above 7%, could it be interpreted as a sign of panic opposite the financial risks?

Maybe.

Will that potentially send the wrong signal and cause more panic?

Hard to know?

But if they decide to pause (and there is a lot of pressure on them to do exactly that) – will it be because of what we see with the banking sector?

I say that because it won’t be because of growing (serious) inflation risks (as those three charts highlight).

Food for thought.

Putting it All Together

The Fed faces a tough choice.

It feels like it’s ‘heads you lose; tails you lose’

If they pause – it could send a message they are deeply concerned about financial risks.

What will that do to confidence?

However, whilst a rate rise might instill (some) confidence – financial conditions have tightened dramatically the past week.

Will that make things worse?

Maybe.

But the more important question (as I always say) is what’s the end game?

25 bps next week won’t make a big difference.

But how long will rates say at 4.75% or higher?

That’s likely to have a bigger impact.

Irrespective of the Fed’s decision, we’re going to see banks tighten lending and focus on their balance sheets.

That’s not great for credit growth – which the US heavily depends on.

If nothing else, this only increases the probability for a recession (potentially bringing it forward).

If that’s true – a recession will equal lower stock prices / valuations.

Before I close…

My contrarian call (made when the S&P 500 hit ~4200) was to not rule out a retest of 3600 – doesn’t sound too crazy now?

Now I didn’t not see a ‘banking crisis’ in January (who did?) – but I was pretty sure a recession was unavoidable.

And if that thesis held true – valuations were excessive at almost 19x forward.

What’s more, I saw inflation as extremely sticky and the Fed were more than likely to over-tighten.

Let’s see how I go – we are not at 3600 yet.