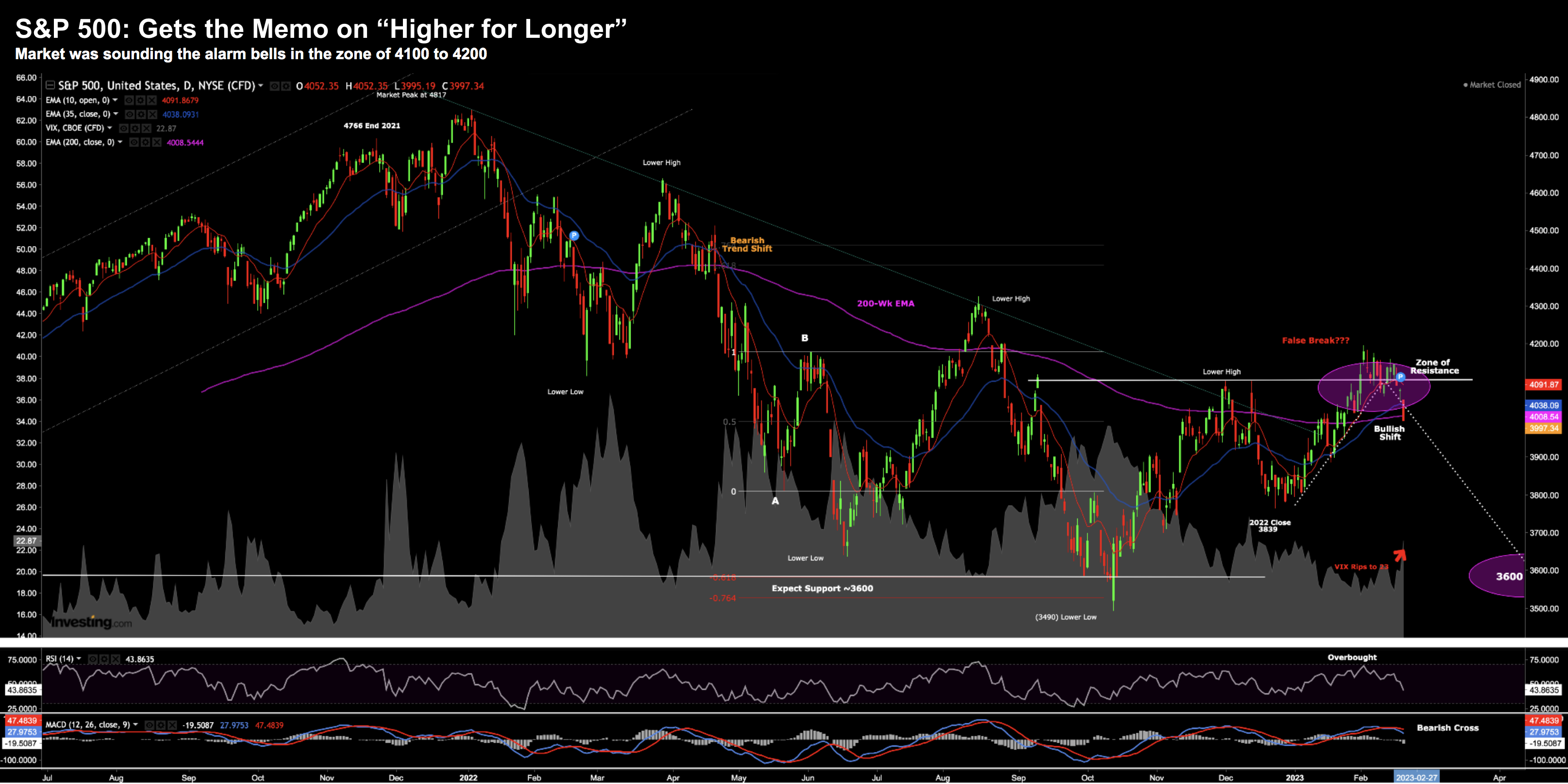

- Markets suffer worst day of 2023

- ‘False break’ of 4100 high playing out

- Don’t be in any hurry to put new capital to work

Last week my sentiment was the market was “poised for a pull back”

In fact, for the past few weeks I’ve cautioned readers adding (new) exposure with the S&P 500 trading in the zone of 4100 to 4200.

In short, both fundamentally and technically this rally failed the ‘sniff test’

Something was off.

For example, consider what we’ve seen the past few weeks (not limited to):

- Q4 earnings coming in sub-par;

- Forward guidance uncertain at best (see Walmart report);

- Inflation data coming in hotter than expected;

- Fed continuing their hawkish rhetoric; and

- Ongoing strength in the (services) job market (pressuring wage inflation )

For example, consider some ‘thumbnail’ math with earnings:

- Assume 2023 S&P 500 earnings expand 4% year-on-year to $230 per share

- At 4100, this represents a forward PE of ~18x

A forward multiple of this magnitude is not cheap with interest rates trading at or around 5%.

And that’s the most important thing… rates.

That’s the discount factor we need to apply.

Put another way, if I saw the 10-year yield trading closer to say 2.5%, I could justify something north of 4100.

But not where yields are trading today.

Now, let’s also assume we are to experience a recession later this year (or first half of 2024) — earnings are likely to contract.

The market is not pricing that in.

Again, let’s run some back-of-the-envelope math:

- A recession will see earnings contract ~10% to 15% – putting EPS around $200 to $210.

- Applying a forward PE multiple of 18x to $200 per share… and we get 3600.

And therein lies the rub…

- What is the “E” in “PE” (e.g. will we see earnings expand or contract this year)? and

- What multiple is an attractive risk/reward with rates pressing 5% (e.g., is it closer to 16x rather than 18x)?

How you think about both the “E” and “PE” will be a function of your lens.

For example, if you feel we are headed for a recession within the next 12 months, then it’s most unlikely we will see earnings expansion (as it’s never happened)

And typically, when interest rates trade around 5%, market multiples are generally closer to 15x (i.e, ‘three multiple turns’ lower than today)

That’s how I am framing our 3+ year risk/reward equation; i.e., earnings contracting this year with a multiple closer to 16x.

And at that point, I will be happier adding more risk (not before).

Let’s now see if the technicals align…

S&P 500 Breaking Down

The price action today was somewhat expected…

For example, Feb 10th I warned about a potential “false break” of the previous (4100) high.

If we saw that – my sense was the market was ‘ripe’ for a quick retreat.

That’s what we saw today… the market’s worst day year-to-date.

Feb 21 2023: Daily Chart

The S&P 500 is now trading back at levels we saw Jan 13th… and the Dow Jones is negative for the year.

Here’s the thing:

It can only take one session to eliminate all the gains of the year. We could see similar losses again this week (or next).

My best guess is we continue to see the market under pressure.

And the reason I say this is the lack of any real catalyst to push it higher.

And specifically I am talking about the Fed.

My (basic) thesis is we will need to see a dovish Fed to get excited.

For clarity, a dovish Fed is not one hiking rates by 25 bps over the next two meetings..

No…

What we need to see is two things:

- The Fed to initially decide on pausing rates; and second

- Advising they are getting closer to easing policy

From mine, we will not see the latter until some point in H1 2024 (i.e. as the risks of a recession or a credit event grow)

For my money, that’s when you can become bullish with authority.

Risk assets (stocks and houses) do well when central banks are easing policy and adding liquidity to the system

At the time of writing (and the foreseeable future) – they are doing the opposite.

So let me ask you this:

Why ‘front run’ the Fed by thinking you know when this will change?

What’s the upside?

Doesn’t make a lot of sense to me.

Home Depot Confirm a Cautious Consumer

Before I close, just a quick word on Home Depot’s earnings today (or lack of)

This is a good company to watch – as it has a solid “pulse” on the American consumer.

They provided a muted outlook for the next year because of a tough consumer backdrop.

From mine, you didn’t have to look far to see that coming.

Consumer savings are mostly depleted as Americans now leverage their credit cards.

As I like to say: “never underestimate American’s desire to spend“… however whether they can afford it is another question.

Here’s what Home Depot posted:

- Earnings per share: $3.30 vs. $3.28 expected

- Revenue: $35.83 billion vs. $35.97 billion expected

What was telling is it was the first time they missed Wall Street’s revenue expectations since November 2019

Shares of the company closed down more than 7% on forward guidance.

Putting it All Together

My hope is you were not sucked into the latest bear market rally.

As I’ve shared in the past – rallies of 15% to 20% are quite normal during bear markets.

They are sharp and they often give you the impression the lows are in.

How many ‘talking heads’ have you heard say something like “this is the next bull market”?

I’ve heard plenty.

We saw more than one 20% bear market rally during the corrections of both 2001 and 2008.

So treat them with scepticism.

In this case, stocks were rallying on nothing more than hopes of the Fed cutting rates twice this year – with the expectation that (core services) inflation problems are behind us.

I felt this was premature.

For example, what data were they looking at?

The market now appears to be connecting the dots that bond markets made two weeks ago; i.e. rates will be higher for longer.

Stay patient before adding any new capital.

Things are trading per the script and I sense we will see better risk/reward opportunities ahead.