- FOMO has driven the market higher;

- PPI inflation, retail sales and credit card spend all surge

- Equity market’s contradiction with bonds and the US dollar index

After three decades navigating markets – the past 12 months has been right up there as the most challenging.

Yes, last year was difficult.

It’s not often markets shed 20% in any single calendar year.

And I was happy to break even (with my portfolio only down 0.86% for calendar 2022).

That said, the start of 2023 has not been a lot easier!

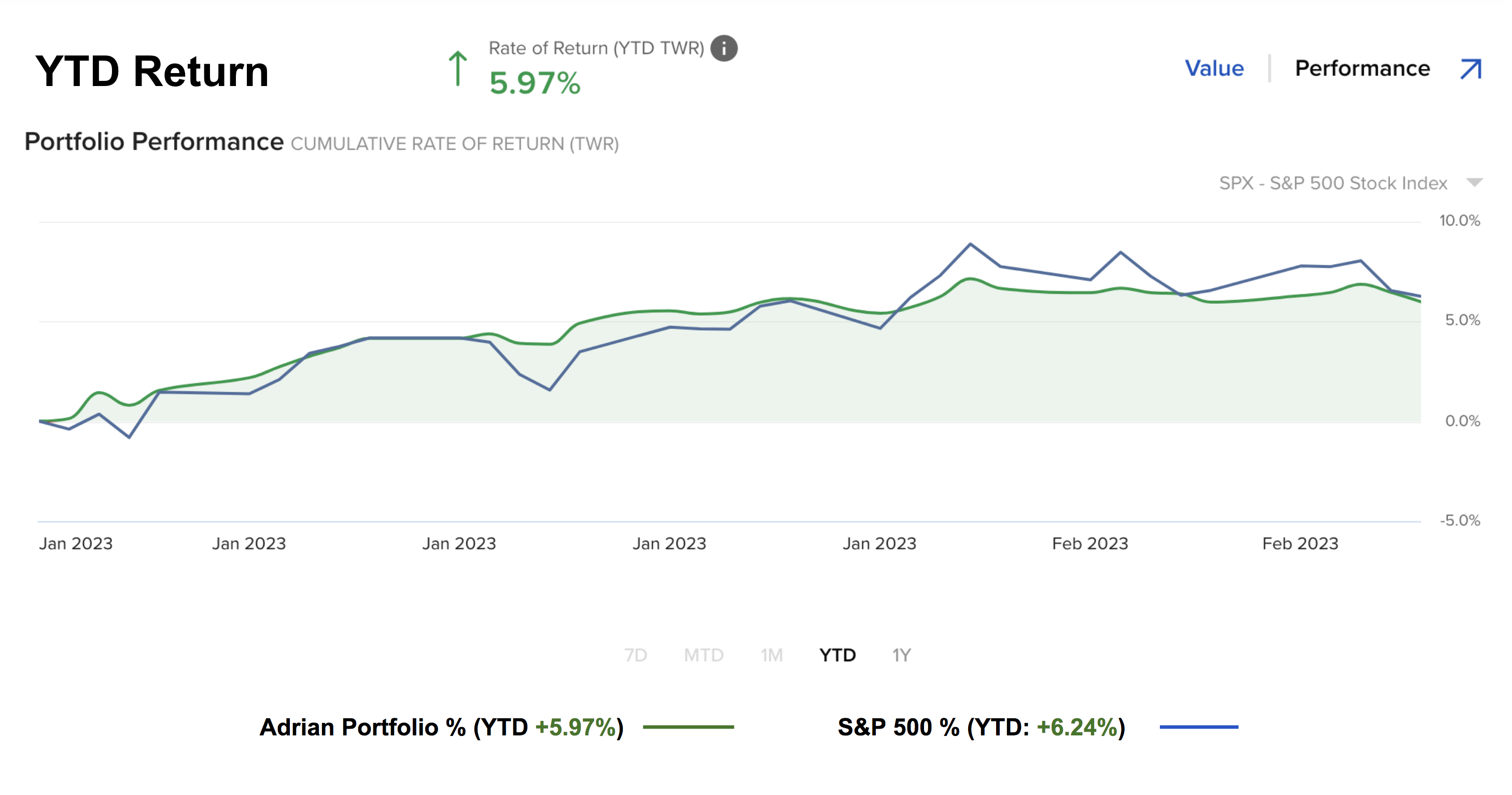

The ‘good news’ is my portfolio is up ~ 6.0% year to date.

I will take it… it was unexpected.

But nothing ‘feels good’ about it.

In fact, this rally feels against the grain (for reasons I will explain shortly)

I will say that after almost thirty years analyzing (and trading) markets – it helps you understand a few things.

For example, three which come to mind include (not limited to):

(a) understanding my psychology and emotions;

(b) carefully managing my risk profile; and

(c) having a strong understanding of the range of strategies at my disposal.

But developing this mindset (and knowledge) required me making plenty of mistakes.

Mistakes are the only way we learn.

And each one contributes towards to what I call your investing “tuition fees”.

Now there is one lesson I’ve been drawing on lately…

It’s patience.

If you’re to be successful at this game – there are two ‘mistakes’ you need to master:

- the fear of missing out;

- paralysis through fear

I would chase trades that I felt were getting away (i.e., my emotions got the better of me).

That never ended well.

And on the flip-side – there were times I would sit on the sidelines paralyzed with fear (generally burned by a losing trade)

I’m sure some of you can relate… and perhaps that’s you today?

Fortunately, I learned to overcome this shortcomings.

But it took me decades to master.

I have developed a strict set of rules and only putting capital at risk when probabilities favor me.

What’s more, I take all the emotion of it.

That’s the key.

Sure, not all trades work out.

That’s more than fine. I don’t expect them to. And taking that mindset goes a long way towards a healthy psychology.

But on balance… most trades do work out.

Regular readers will know I call this a game. And it’s a game where you have the ability to stack the odds in your favour.

Warren Buffett uses a similar (baseball) analogy.

For him, it means you don’t have to swing at every pitch.

No.

I don’t like the pitch being thrown.

So far my deployment of ~65% capital has yielded +6.0% year-to-date returns…. consistent with the S&P 500.

That’s fine.

But it’s the same equity exposure I was comfortable with last quarter; and I see no reason to increase it.

Let explore…

Higher for Longer

Over the past eight weeks this was a contrarian view.

For example, the US 2-year yield had plunged to just 4.1% – equities were ripping higher.

Markets were convinced rate cuts were coming…

For example, acclaimed Wharton Professor Jermey Siegal was saying the Fed will cut rates by mid year.

I wasn’t buying it. Not with the data that I was seeing.

Consider what we received this week:

- Producer Price Index (PPI) inflation ripping higher by 0.7% MoM

- Retail sales surging 3.0% YoY (as consumers use money they don’t have)

- Credit card debt hits a new record – some US$986 Billion

- Weekly jobless claims were only down 1,000 – i..e, a very tight labor market

- Two Fed Presidents (Bullard and Mester) not ruling out a 50 bps hike

You tell me…

What is stopping the Fed from continuing their path of rate hikes given the above?

Not much from my lens.

Then again, we have people like Professor Siegal who see it completely the opposite?

Now the market is giving the ‘middle finger salute‘ to the Fed’s hikes.

This isn’t fighting the Fed… it’s taunting the Fed (as one JP Morgan analyst commented)

For example, think about the ‘rubbish’ that has rallied.

Most are stocks that were down some ‘70% to 90%’ last year (e.g., “ARKK” names)

They have ripped higher… mostly due to short covering.

Have their earnings improved?

Nope. If anything they barely met already very low expectations.

Is guidance better?

Nope. It’s uncertain.

Yet traders are suffering from a serious case of “FOMO”… chasing momentum higher.

Two Notable Data Points

The first is the price action we see with bonds – overlapping with my post yesterday.

Consider the US 10-year…

The last time the 10-year yield traded at 3.81% (i.e., the level today) – the S&P 500 was 3800.

Feb 17 2023

Second, consider King Dollar.

We all know that when the US dollar rallies – this is a strong headwind for stocks and profits.

Almost every major company cited FX headwinds as part of their latest release.

Take a look at the price action in the world’s reserve currency the past few weeks… it was rallied meaningfully (crushing gold in the process)

And yet, stocks are up?

Feb 17 2023

So when trying to justify the ~7% increase in valuations – I offer two questions:

- Have earnings notably improved? or

- Has forward guidance improved?

Earnings continue to be sub-par (see latest from Factset); and guidance continues to be cautious (at best).

Therefore, what we have seen is multiple expansion.

This means risk has only increased.

To use Buffett’s analogy – that just makes the “pitch” that much more unattractive.

The market is throwing balls “well outside the plate”… so let them go through to the catcher.

We don’t have to swing.

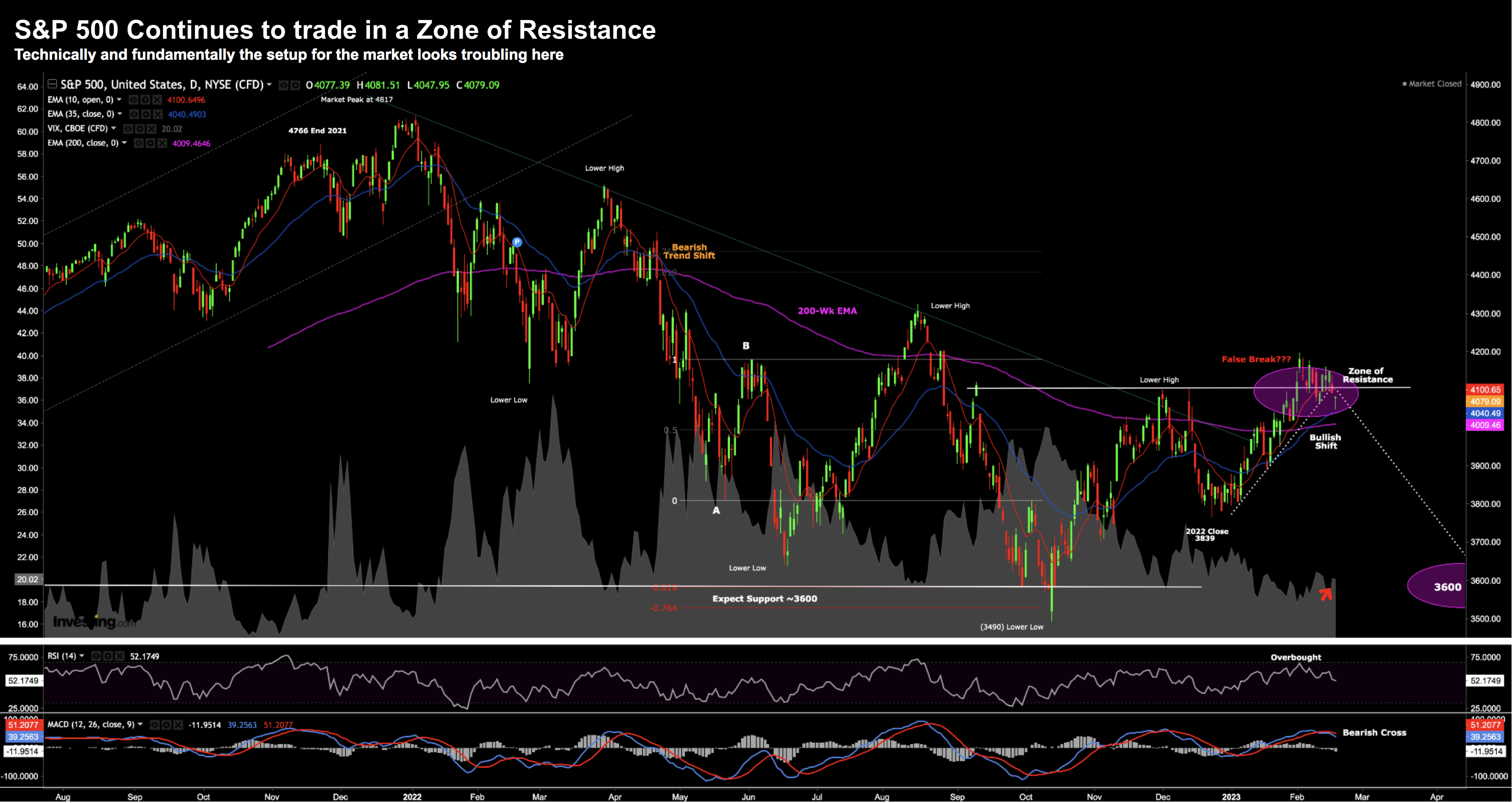

S&P 500 Poised for a Pullback

Feb 17 2023

- The market surge above 4200 and hold there for several weeks (fail)

- The VIX to remain well below 20 and hold there (fail); and

- The MACD to show positive momentum (fail)

- interest rates are likely to be 5.0%+ for longer;

- quantitative tightening continues; and as

- recession odds increase (which implies a likely earnings contraction)

Putting it All Together

“But it’s different this time… the bottom is in” – say some of the talking heads.

“This is the start of the next bull market” say others…

Is it? Why?

I ask because the Fed is still tightening. They are yet to even start the ‘pause’ phase.

The data we received this week only reinforced (to me) they are likely to remain higher for balance of the year.

What’s more, bond markets now (finally) agree.

But here’s something else to ponder….

Equities have never bottomed before a recession commences.

Why will this be different?

If I’m to guess – what’s giving the bulls hope is we’re yet to see the slowdown they think should have happened by now.

Two thoughts on this:

First, there are long and variable lags with tightening policy. And they are still to be felt.

For example, consumers had ~$2 Trillion in savings (and COVID handouts) which provided a buffer. However, those savings have been eroded – evidenced by the record credit card spend.

Second, jobs are always the very last piece in the recession puzzle.

Look at the recessions of both 2008 and 2001.

Unemployment was very strong (i.e., around 4%) approx 6-9 months before the recession started. At the time, things felt “strong” then too.

But when jobs started to fall… they were swift.

In closing, I don’t know if we will retest the lows of last year however it would be remiss to rule it out.

That said, the market is not attractively priced at ~4100.

In the near-term, the downside risks outweigh any (small) potential upside.

Don’t be sucked in by the fear of missing out.