- People will choose to hear what they want to hear

- Three technical signals I’m watching on the S&P 500

- Earnings season so far has been subpar (at best)

Are you bullish or bearish?

The correct answer to that question is always ‘what’s your timeframe?’

1 month? 6 months? 3 years?

My default position is always long-term bullish.

However, I also accept that the path is never in a straight line.

There are always going to be zig-zags along the way – often in the range of 20% or more.

That’s fine… embrace them.

In bear markets – like we have today – the rips are especially sharp.

During the recessions of 2000 and 2008 we saw several 20%+ rips higher – only to reverse course.

And pending how you are positioned – those rips can be painful.

For example, if you’re excessively bearish (i.e., short or overweight cash)… it’s probably been painful watching this market surge.

You have been caught on the wrong side of the trade.

I am neither short the market or bearish.

And whilst I think there’s every chance we go lower – my portfolio remains ~65% long in quality names.

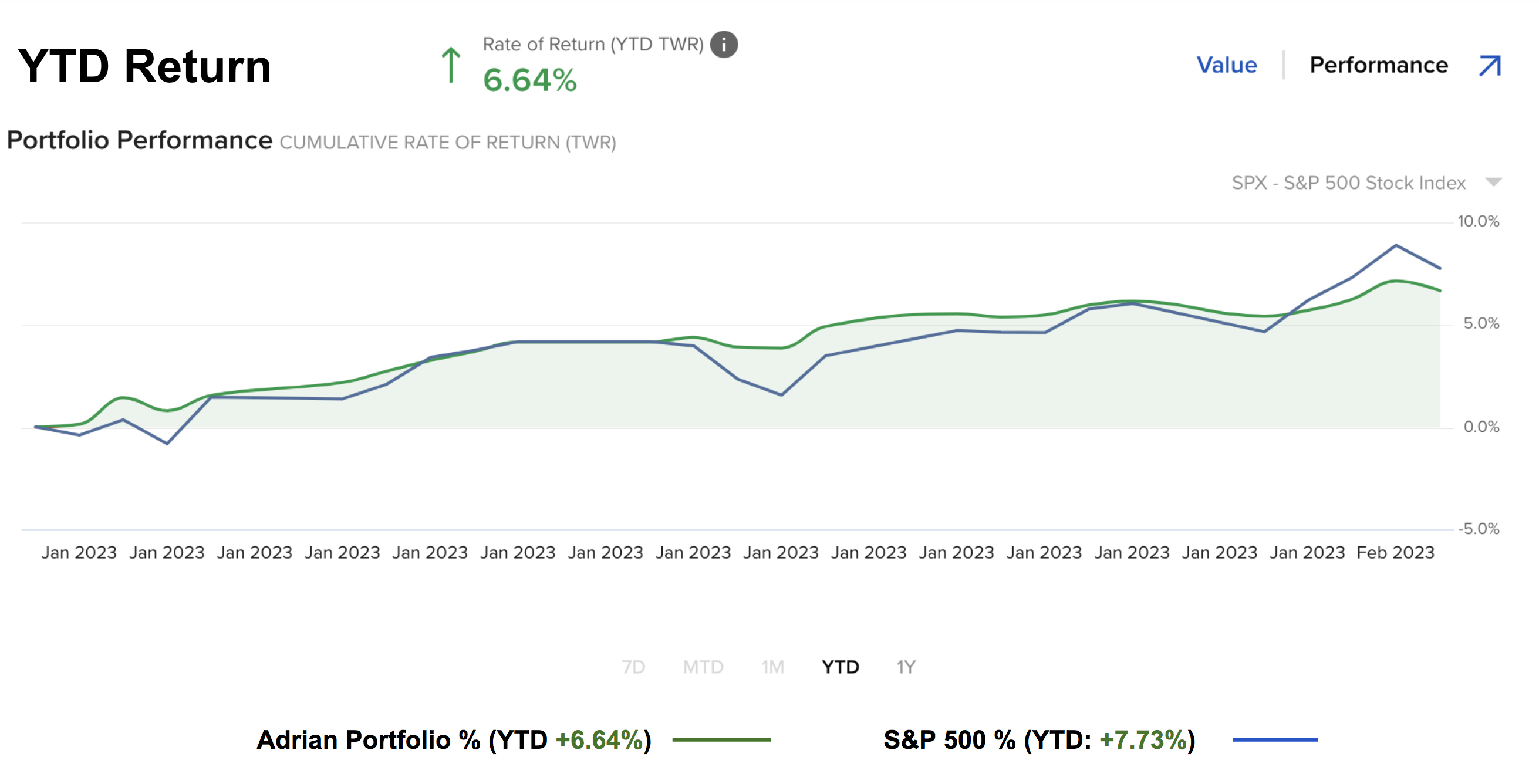

This decision has led to a slight underperformance year-to-date (following 19% outperformance FY2022) – however I will happily take being positive almost 7% in one month.

Feb 4 2023

- The downside to being 65% long is it will often lead to underperformance if the market rips higher; however

- The upside is I’m also partially ‘hedged’ against the market pulling back sharply.

And that’s the needle I am trying to thread.

For example, I don’t think investors have a ‘green light‘ to pin their ears back and buy.

It still feels like there is a yellow flag on the course.

The time to increase my exposure will come… but I don’t think it’s now.

I will talk to that more in a moment.

That said, there are valid arguments to have some market exposure. As I said recently – if you have no exposure at all – that is also a mistake.

Things are not falling off a cliff… far from it.

And over time – things improve.

Recessions and markets bottoming are a process… and we are still working through it.

For now, I’m satisfied with my exposure and not tempted to increase it.

Not yet.

Market has ‘Happy Ears’

You will often hear me say that “people tend to hear what they want to hear”

What’s more, they will lean into existing biases.

Politics is a good example of that.

For example, ask someone if they prefer to watch Fox News or CNN… and I can guess their bias.

The problem is taking a bias will lead to blindspots.

However, what you want to do is argue the other side better than they can.

You need to know all their arguments and why they think the way they do.

I always try to challenge my underlying assumptions… gaining as many perspectives as possible.

I do this because I know I can’t see every angle.

And what’s more, never assume your thesis is correct.

This means not being too attached to it.

And in my case, I am not overly attached to the market pulling back to test the October lows.

I hope it does… but there’s every chance it doesn’t.

Let’s apply that to what I see on the market and start with what we learned.

Not only did the Federal Reserve hike rates an expected 25 bps (warning of at least two more similar hikes) – we also saw the European Central Bank (ECB) and Bank of England (BoE) follow suit.

Each central bank went to lengths to talk to slower (projected) economic growth – while affirming it’s premature to declare victory against unwanted inflation.

However, what did markets hear?

“Central banks… you are wrong. The battle over inflation is won… it’s rear view mirror. And you will be cutting rates before long”

Here’s the thing:

Markets had a strong bullish bias going into each of the central bank meetings.

I say that because they were up 18.5% off their recent (October) lows.

That’s bullish.

It didn’t matter what central banks had to say or any warnings… they choose to ignore their blindspots.

My interpretation was they celebrated the Fed’s mention of disinflation (the first time we’ve heard Powell reference this) and paid no attention to any suggestion of likely future tightening.

Why?

I can only guess they believe they know better.

That is, they feel that policy makers will be forced to pivot to rate cuts sooner than they realise.

Think about this if you are a central banker….

Your primary job is price stability.

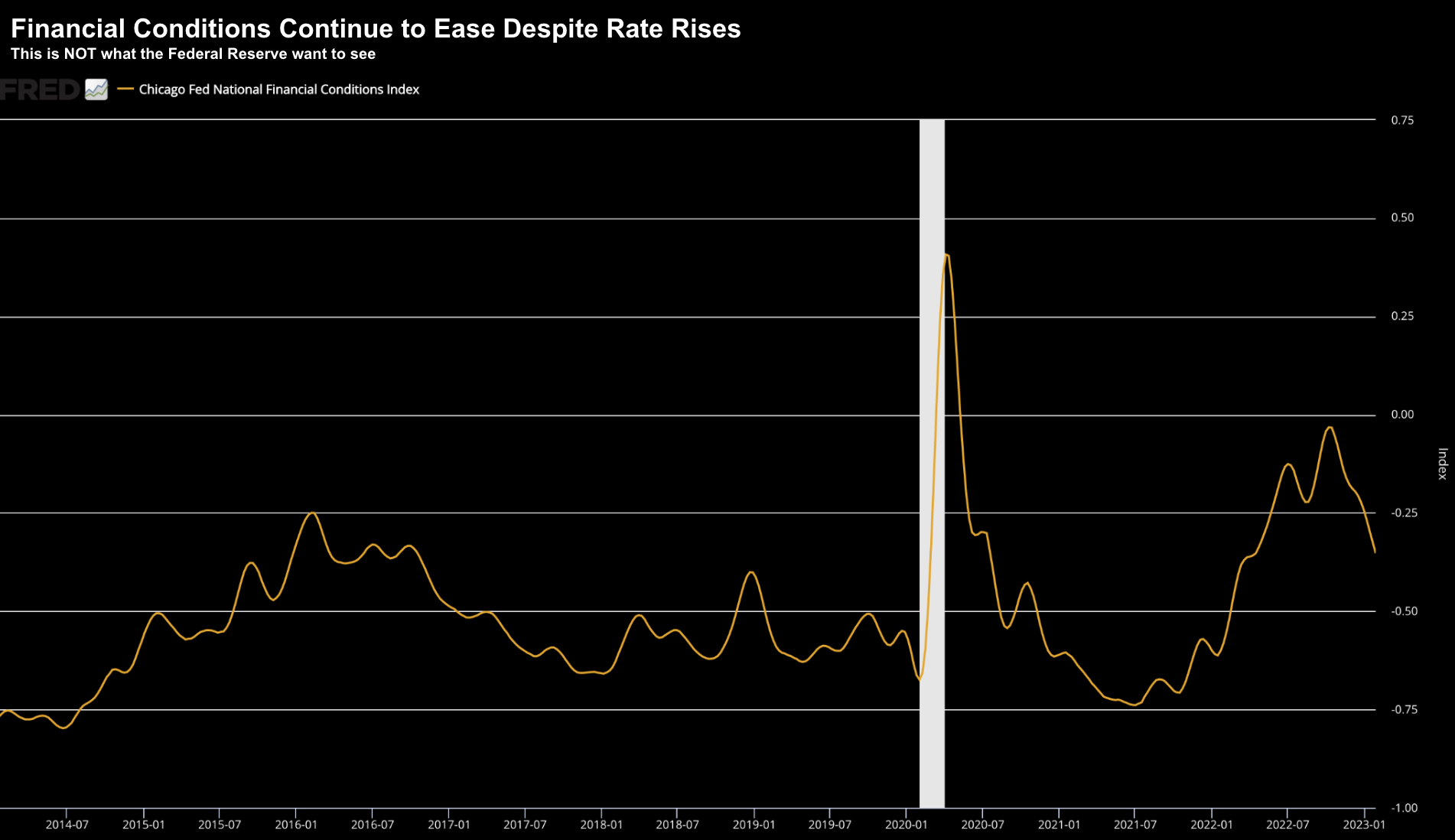

One pathway to achieving price stability (whilst experiencing strong core inflation) is to tighten financial conditions.

But the opposite is happening:

Feb 03 2023

Financial conditions continue to ease despite the Fed’s tightening.

My take on this is it’s effectively going to make central banker’s that much more difficult.

Remember:

Inflation is excess money chasing too few goods.

The Fed is using their tools to influence the former (excess money)… as they can’t influence the latter (supply of goods).

As a complete aside – I’ve always argued a better way to combat inflation is from the supply-side (i.e. produce more). But that comes with business-friendly regulatory and financial incentives (which are not there).

Now given markets are bullish on the basis that financial conditions are now easier than 12 months ago – there’s every possibility it could force more aggressive central bank action.

Bond markets continued to fall after central banks spoke last week – which is the opposite of what central banks want to see.

What’s more, overnight-priced swaps (where investors swap fixed rate contracts with variable rates) – also see a wave of rate cuts coming.

Who will be right?

The market is choosing to “fight the Fed”

They see central banks talking a tough game – but are pricing in rate cuts once economies fall into recession (and perhaps irrespective of inflation levels)

But will that be a winning bet?

Minneapolis Fed chief Neel Kashkari, a former investment banker, said recently with confidence that investors will lose on bets that the Fed will give in on the inflation battle.

Ray Dalio of Bridgewater Associates says it’s “one of the easiest, safest bets” that the Fed won’t give in.

Finally, three International Monetary Fund officials warned in a blog post this week that central banks needed to push back on markets and “remain resolute” without loosening prematurely — or risk a sharp resurgence in inflation as activity rebounds.

For my money, I choose not to fight the Fed.

But that’s just me…

S&P 500 – False Break Higher?

Below is the 18.5% rally we’ve seen on the S&P 500 since October… and more than 7% just this year:

Feb 04 2023

The past few weeks I said to expect a rally to the zone of 4100 to 4200.

This week we closed 4136

This is where I think the S&P 500 faces its first real litmus test; i.e. the retest of the December 2022 highs.

Three technical observations:

- False Break: we need to see the market rally above this level and hold it there for a few weeks. In other words, what I don’t want to see is the market briefly trade above the December highs of 4100 and drop back below. If we saw this, I would consider it a “false break” of the previous high… often a reliable reversal signal

- VIX at 18.5: Last week I asked whether the VIX could remain levels of 15-16 for a few weeks? If so, this would be a healthy bullish indicator. This week the fear index traded as low as 17.0 however closed sharply higher. If this surges back above 20… it’s a sign of a reversal.

- Weekly RSI: The third technical indicator I wanted to call out is the Relative Strength Index (RSI). When the market traded 4195 we saw the weekly RSI trade above 70 – which is overbought. Now if you look at the previous instance of the RSI trading above 70 on the weekly timeframe – it has been prone to reversals.

My thinking is we will give back some of the recent gains over the next few weeks.

It feels like this is ‘too much too fast’ – particularly when we consider the ‘highly speculative’ ARKK ETF names.

The most unloved stocks of 2022 have arguably rallied the most to start 2023.

Now has nothing to do with fundamentals (as most of these companies are not profitable) — it’s all to do with positioning.

That is not to say positioning should not be ignored… it shouldn’t… but fundamentally the picture has not improved.

This is all momentum trading.

If anything – the fundamental picture looks less favorable at 4200.

For example, if we assume expected earnings of $210 (contraction of only ~5% YoY on last year) for the S&P 500 (which now feels optimistic after miserable earnings reports this week) — that’s a forward PE of 20x

Personally, I don’t think a forward PE of 20x is a bargain.

What’s more, I also think that earnings of $210 feels optimistic given what I heard from Apple, Amazon, Google and Meta this week.

They were subpar at best and failed to offer positive guidance.

Putting it All Together

I understand why markets feel optimistic – but I’m not buying it.

Not yet. There’s more wood to chop.

But above all else, the upside reward from 4200 does not handily outweigh the downside risks.

What’s more, I’m more convinced the market feels expensive given the weak earnings reports (and lack of guidance) received.

Here’s Factset (Feb 3rd):

At the midpoint of the Q4 earnings season, the performance of S&P 500 companies continues to be subpar.

While the percentage of S&P 500 companies reporting positive earnings surprises remained flat over the past week, the magnitude of these earnings surprises decreased during this time, mainly due to negative EPS surprises reported by a number of large technology companies.

Both metrics are below their 5-year and 10-year averages. As a result, the earnings decline for the fourth quarter is larger today compared to the end of last week and compared to the end of the quarter.

If the index reports an actual decline in earnings for Q4 2022, it will mark the first year-over-year decline in earnings reported by the index since Q3 2020

Subject for another post – we now find the following 2024 earnings multiples for these market leaders (taking the average of FY24 estimates):

- Apple at 23x forward

- Google at 22x forward

- Meta at 17x forward

- Microsoft at 24x forward

- Amazon at 35x forward

If you plug in 2023 earnings estimates – they are even more expensive on a multiple basis.

At the time of writing, each of these companies is reporting single digit revenue growth.

They are also warning of further margin (profit) compression.

As an aside, every one of these companies called out two primary themes with their earnings calls:

- The focus and investments being made into AI; and

- Striving to deliver greater cost efficiencies.

Now whilst these tech leaders have come down from their lofty 2022 valuations… we could easily see ‘3 turns‘ lower on a multiple basis.

What’s more, who is to say the “E” in “PE” doesn’t come down should we experience a recession?

Typically that’s what happens.

My approach is to stay patient – happy to wait for a better opportunity to put more cash to work.