- Grantham warns of possible 50% crash (again)

- Why the bears could be wrong this year

- If we see a ~20% pullback – buy with your “ears pinned back”

My most recent post talked to some of the arguments for the bulls and bears.

Which way do you lean?

Today there is a reasonable case for either argument.

As I pen this missive – the bulls are having a better time of it – pushing the S&P 500 to just over 4,000.

Personally I think we will see some resistance around the zone of 4100 – but more than happy to be wrong.

It’s a stark contrast to how we started last year – with stocks very much in the green.

And hopefully… you have some market exposure.

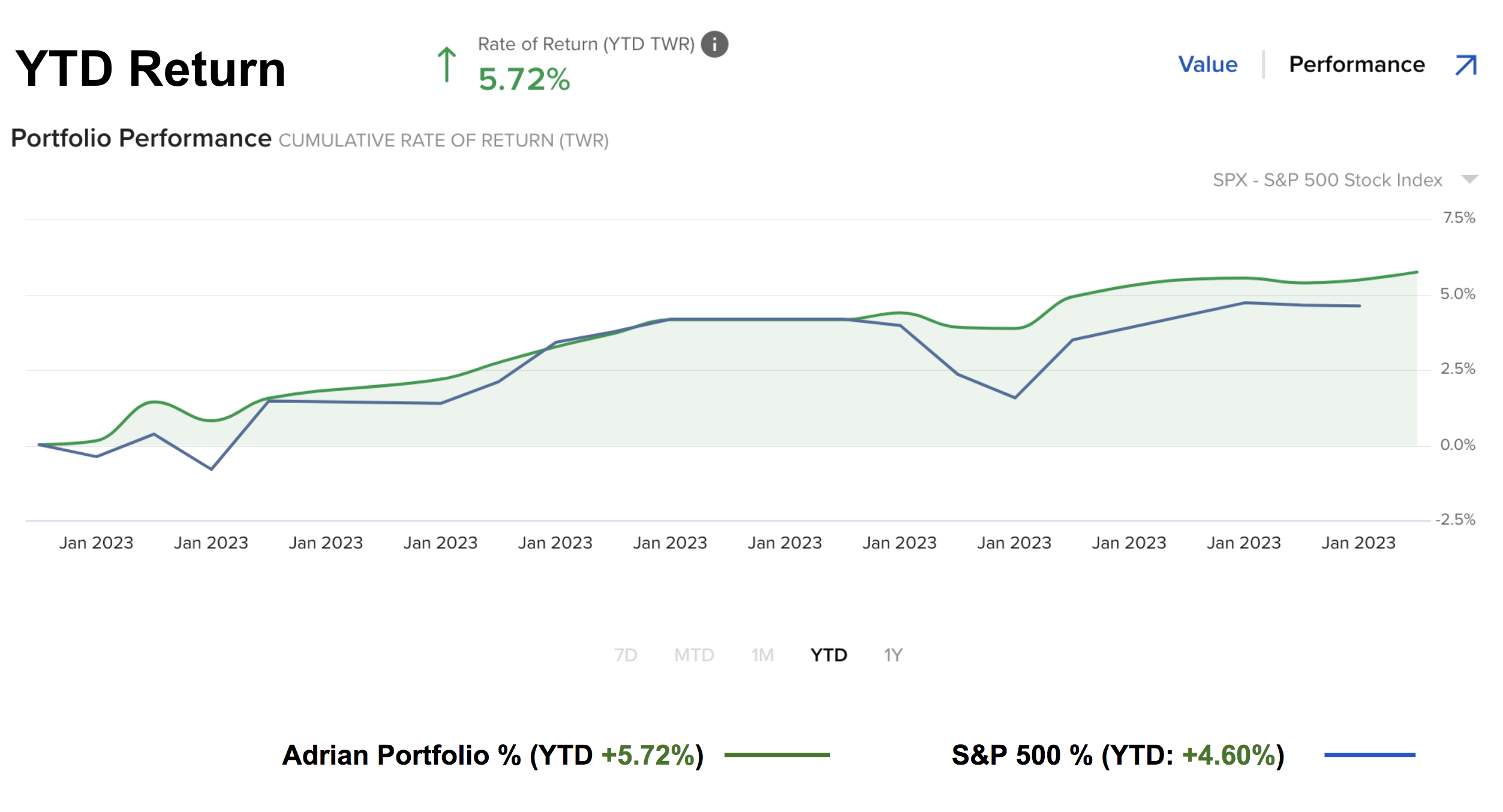

For now, I remain ~65% long.

Whilst it’s still early… things are travelling well.

Jan 26 2023

Today I want to warn investors about being too bearish.

Yes, I think the near-term downside risks outweigh the upside.

And I say that because of how far (and how fast) we’ve rallied in a short space of time.

That said, I think the next dip between 3200 and 3600 will offer a generational buying opportunity.

Call me a long-term optimist.

And as I showed in my previous post… that will typically have you on the right side of the ledger.

Broken Clocks

In 1771, English writers Joseph Addison and Richard Steele were said to have penned the phrase “even a broken clock is right twice a day”.

Well said.

And it’s an accurate way to describe Permabears.

Put another way…. eventually they get it one call right.

But let me warn you – take these guys with a large grain of salt.

Not only are their investor returns (and market forecasts) exceptionally poor… their game is to sell fear.

But more on that later…

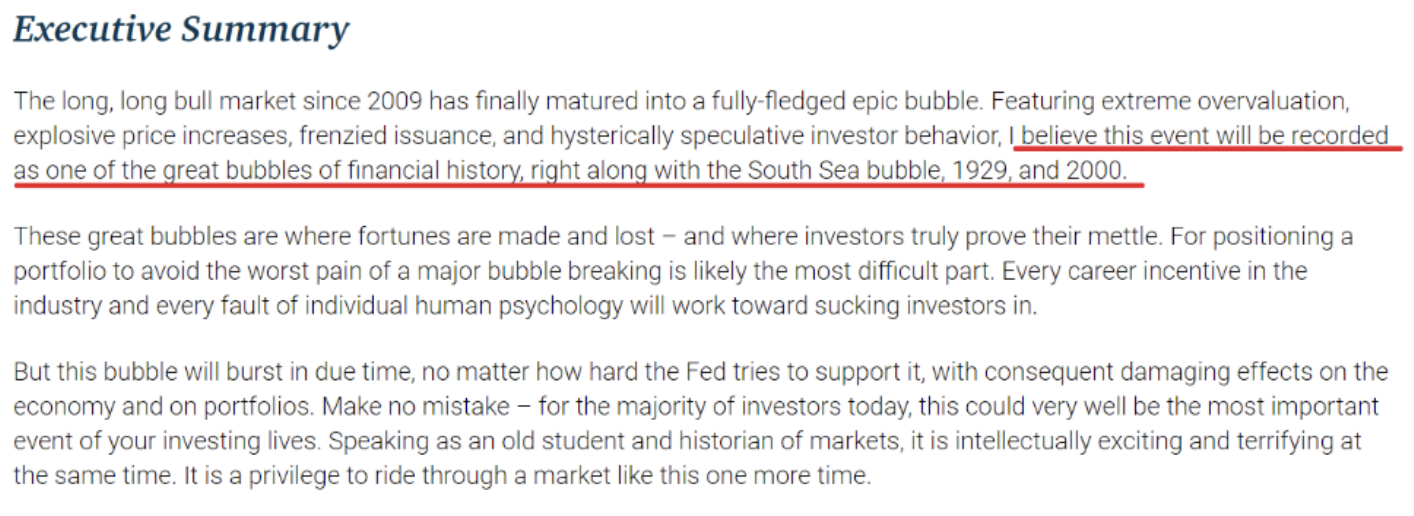

Let’s take well known Permabear Jeremy Grantham.

He is the founder and CEO of asset management firm GMO.

This week he was voicing his concerns – warning of potential 50% crash this year.

Sounds all too familiar:

In Grantham’s view, the pandemic stock gains were a bubble, and that bubble hasn’t fully popped yet. Putting some numbers to this view, Grantham believes that a further drop of 20% is possible this year – and in his worst-case scenario, he says that the S&P 500 could collapse as much as 50% from current levels.

Backing his view, Grantham says of that worst case, “Even the direst case of a 50% decline from here would leave us at just under 2,000 on the S&P, or about 37% cheap.

To put this in perspective, it would still be a far smaller percent deviation from trendline value than the overpricing we had at the end of 2021 of over 70%. So you shouldn’t be tempted to think it absolutely cannot happen.

But this kind of call isn’t new for those familiar with his work.

For example, in January of 2021, he was warning us of a crash akin to 1929 or 2000:

His fund – which you can track here – returned investors around 7% in 2021 (vs 26.9% for the S&P 500 exclusive of dividends).

But we should never cherry pick dates when evaluating performance (irrespective of the fund or asset)

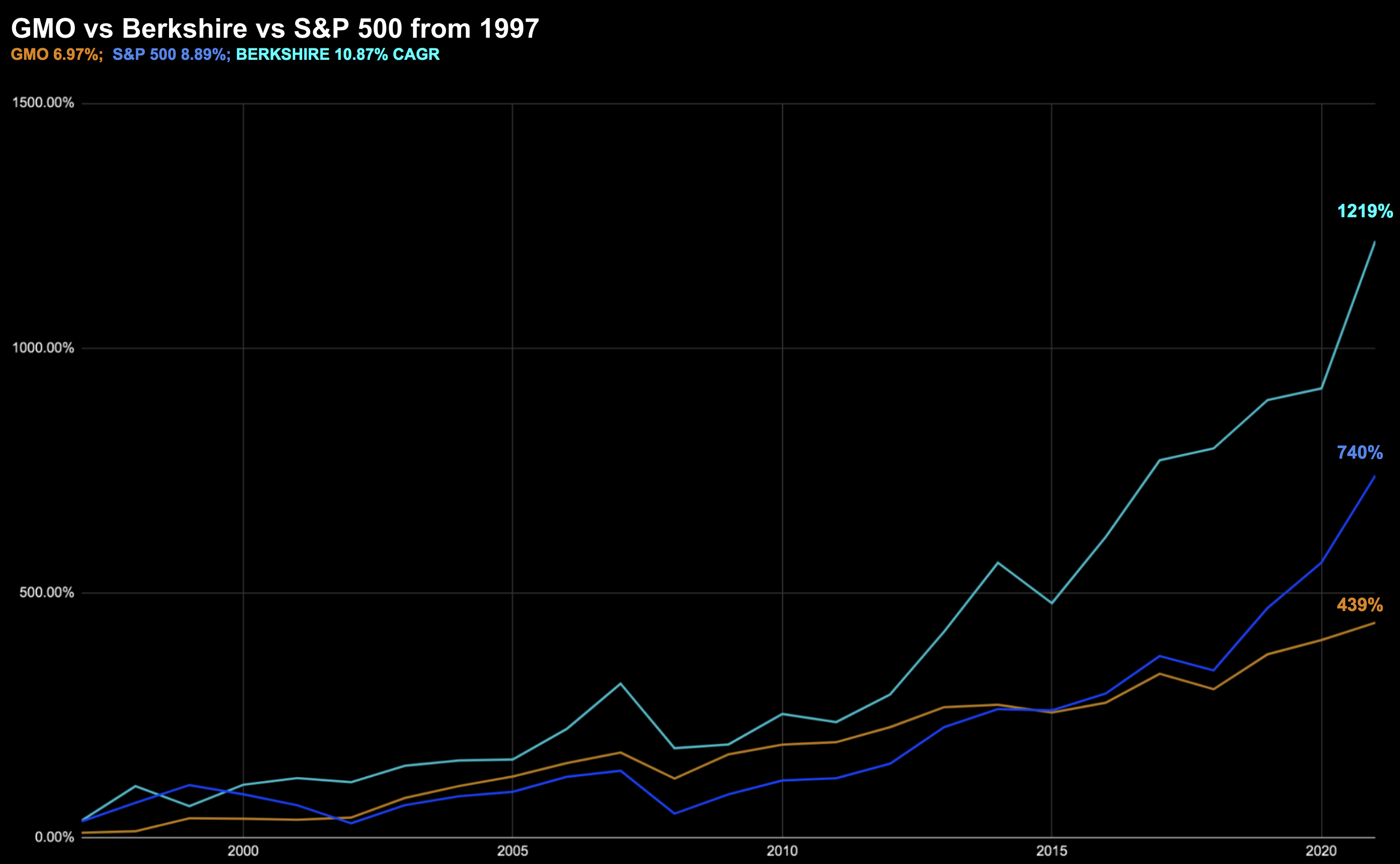

Below is GMO’s performance against the S&P 500 over the past 25 years

Jan 26 2023

The S&P 500 has returned investors more than 740% the past 25 years vs GMO’s 439%.

(I’ve included the annual return data on the right hand side)

In terms of the Compounded Annual Growth Rates (CAGR) – GMO at 6.97% vs S&P 500 at 8.89%

(FWIW – Berkshire Hathaway CAGR is 10.87% over the same period – a cumulative gain of 1,218%)

As a conservative investor – Grantham will generally outperform when the S&P 500 posts a poor year.

For example, in 2002, the S&P 500 lost 22.1% however Grantham’s fund added 3.15%

And in 2008 where the S&P 500 lost 37.0% – GMO lost only 19.38%

However over the long term – he has failed to outperform the Index by a wide margin.

Grantham’s latest letter – “Back to the Meat Grinder” – says the bubble has only just started to burst.

And look he might be right…

He adds we will see “a continued market decline of at least substantial proportions, while not the near certainty it was a year ago, is much more likely than not.”

And he is not alone.

But what could prove him wrong?

I can think of a few things…

Why the Bears Could be Wrong?

Before I offer 4 reasons why Grantham (and others like him) might get it wrong — just a few words on the market.

To start, I entirely agree it’s possible we could experience a market pullback in the realm of ~20%.

That would put the S&P 500 around 3200… a zone I called out earlier in the year.

However, I also feel that if we were fortunate enough to prices this low – it would be a generational buying opportunity.

Yes, it’s important we hedge when investing conditions are not favourable.

And that still applies.

We don’t yet have the ‘all clear’.

I did this last year – with my fund outperforming the Index by ~19%.

However, what’s also important is we capitalize when things are more favourable.

When assessing GMO’s 25-year performance – that’s where he falls short.

For example, whilst a CAGR of 6.97% isn’t horrible… over a 25-year period it’s a long way behind simply investing in a low-cost Index fund.

However, a top-performing investor is able to play both great defence and offence.

But let me offer 4 reasons why Grantham’s dire scenario for “50%+ declines” could be wrong:

- No Recession;

- Fed Rate Cut(s);

- Earnings Expansion; and

- Political Cycle

#1. No Recession

Readers will know I am calling for a recession either later in 2023 or early 2024.

You only need to look at (a) the deeply inverted yield curve; and (b) the contraction in money supply to tell you it’s coming.

As an aside, this is the steepest decline in money supply since the depression.

What we are waiting for (which will come) are deteriorating jobs.

Jobs are always the last to fall… but it’s starting.

As I wrote recently – employment was also very strong in 2007 and 2000 before we went into recession.

This isn’t any different.

Now you will hear talking heads say “oh but it’s different this time”

But is it? Really?

Why>?

It’s generally always the same.

However, if there isn’t a recession (which I think is lower probability), Grantham’s call for a possible 50% decline will not eventuate.

#2. Fed Rate Cut(s)

Much of the rally this year is largely due to markets pricing in the Fed cutting rates at least twice later this year.

Again, that’s certainly possible but unlikely.

I say it’s possible because inflation (mostly commodities and goods) are falling.

However, services (core) inflation is more stubborn (still more than double the Fed’s objective)

That’s what the Fed are mostly targeting (not commodity prices)

Speculators would love nothing more than to see the Fed funds rate drop back below say 3%.

A dovish Fed – wanting to expand the money supply – is almost always a positive for risk assets.

But here’s the thing:

What economic conditions would we need to see if the Fed cut rates (with core inflation likely well above 2%)?

You got it – a sharp recession.

Rate cuts happen when the economy is in need of assistance.

What’s more, when the Fed first cuts rates, it’s typically well after stocks have sold off.

For example, if we look back at 2000 and 2007, the market had already given back 41% and 55% respectively before the Fed moved to cut rates.

At the time of writing, the market is barely 16% off its highs!

What’s more, unemployment levels are just 3.5% and GDP expanded 2.9% last quarter.

But the more important point is what we see with core inflation…

The Fed will not be keen to repeat the mistakes of the 1970s with a stop-start routine.

During the 1970s – when they felt inflation was well under control (falling sharply) – they cut prematurely only to see it reignite.

Powell won’t make that mistake.

Of course, the data will shift as we progress, and we have many more employment and inflation reports to process between now and then.

That said, if the Fed happens to cut rates… that will bode well for stocks… and will kill GMO’s most dire scenario.

#3. Earnings Expand

We are in the thick of earnings…

And so far, earnings for Q4 are not as bad as feared.

But to be clear – they are not great either.

Most are barely beating already very low expectations.

That said, the forward guidance we are hearing from company’s is poor.

Anyone from Microsoft to Intel are painting a weak view of the consumer… revising down expectations.

We are still very early into the earnings season – with only ~25% of the S&P 500 having reported.

My worry is not so much Q4… it’s what lies ahead.

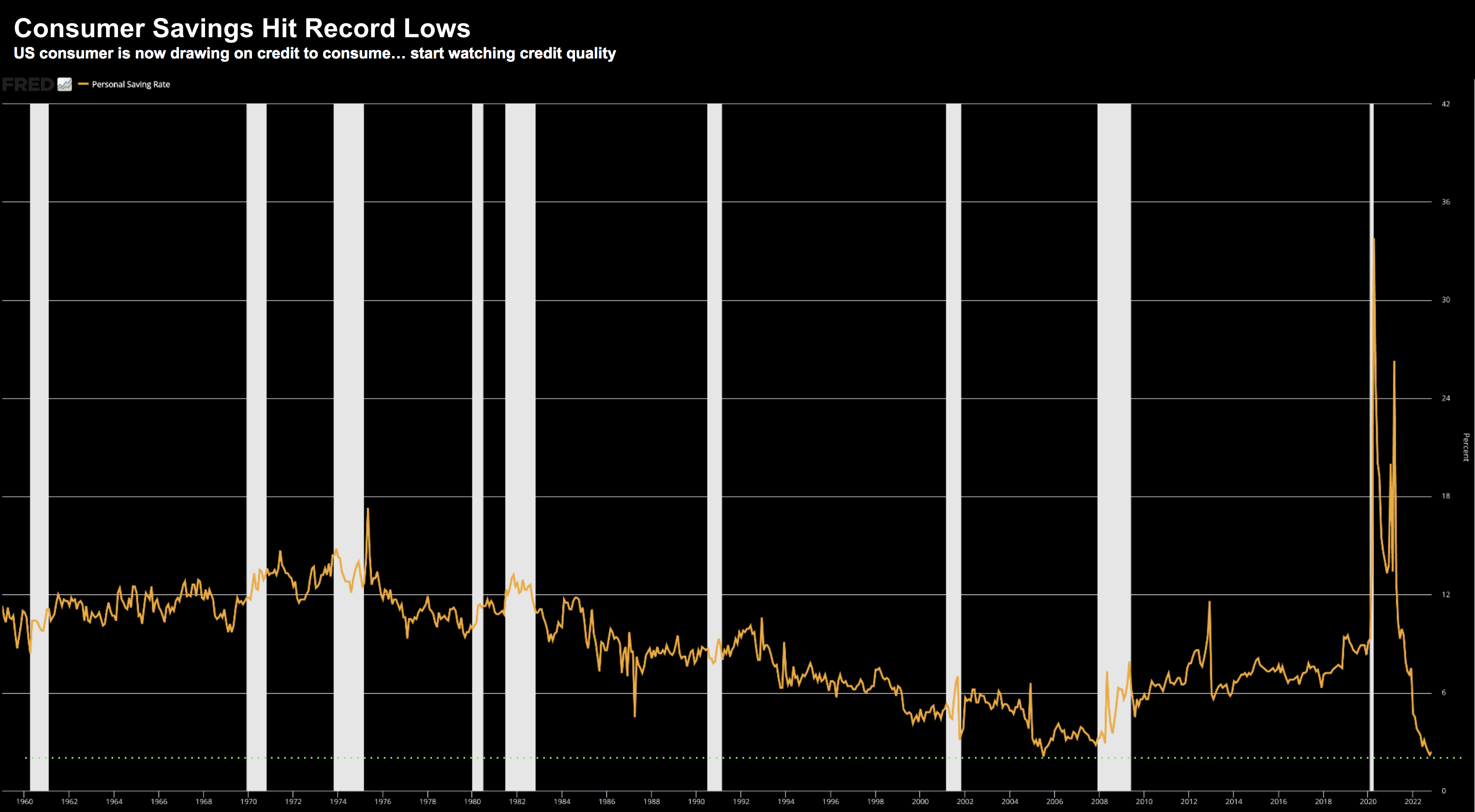

For example, Q4 saw consumers draw down the last of their $2 Trillion in savings (and government handouts) and just start to tap credit (at much higher interest rates).

That allowed GDP to hold up reasonably well (along with a very healthy dose of government spend!)

However, I think we will see Q1 look materially worse as the softness starts to bite.

And specifically, I am looking at profit margins.

Revenues are generally declining (Microsoft reporting just 2% top-line growth); and costs are increasing (mostly labor)

Net-net — this puts a lot of pressure on margins and earnings.

My expectation is that earnings will decline in the realm of 10% or more.

And the reason I think we will see this is opposite a recession (which always results in earnings contraction).

However, the market expects earnings to expand in 2023 by 4%.

Now if we see earnings expand on last year – it’s most unlikely Grantham’s forecast for levels of around “2000” on the S&P 500 will eventuate.

For example, at $230 earnings – that would result in a PE of just 8.7x

I think the cheapest we will see the S&P 500 is perhaps 12-13x forward (at a guess)

And if we saw that… pin your ears back and buy.

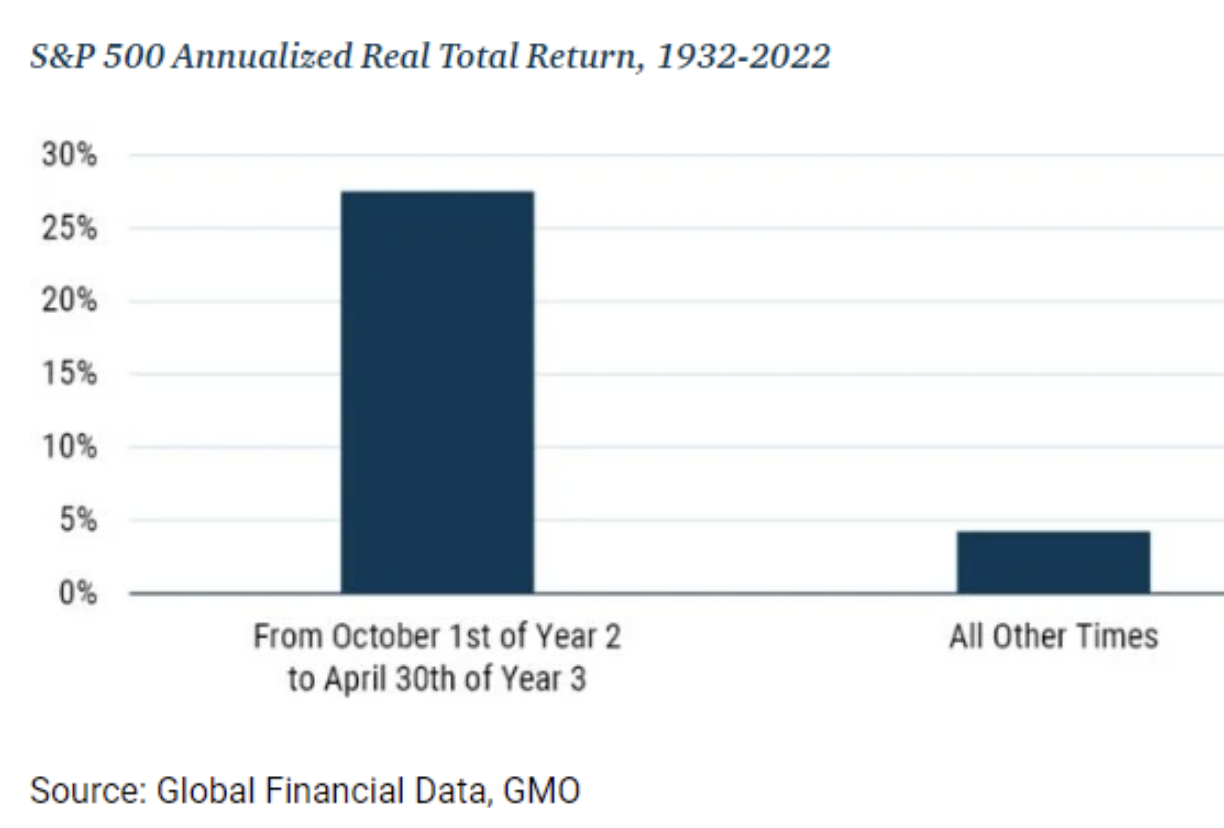

#4. Political Cycle

Interestingly the US political calendar enjoys a strong correlation with the performance of the S&P 500.

For example, GMO reported that since FDR’s first election, Grantham shows that the seven months starting the month before mid-term elections and ending at the end of the following April have been far better than the returns in all the other months of the cycle:

Grantham says that the presidential cycle is “so simple-sounding that no one in the fee-charging business can afford to be associated with it. And that is presumably why it continues to work.”

Based on this, the next few months (i.e. through April 30th) could bode well for the bulls.

Putting it All Together

When it comes to dire warnings from the likes of Grantham – take them with a large grain of salt.

For a start, look at his long-term (25-year) record.

He has failed to outperform the market by a wide margin.

Now if he (or anyone like him) boasted a record close to Warren Buffet, maybe I would listen (see below)

Warren Buffett Handily Beats All

In closing, at times we understand that things get ugly.

Guess what…. that’s okay.

Sure, we will have recessions every 8 years or so.

And there will be bear markets, wars, panics, and pandemics.

But these offer opportunities.

Buffett is known to say “buy when others are fearful and sell when they are greedy”.

It seems to be working for him.

Personally, it pays to be more optimistic than pessimistic. What’s more, the 100-year chart offered from Ben Carlson proves this point.

Optimism should be your default setting.

But perpetual pessimism from the likes of (not limited to) Grantham, Faber, Schiff, Dent, Rickards (it’s a long sorry list) are selling fear.

And fear sells.

For example, Daniel Kahneman won the Nobel Prize for showing that people respond stronger to loss than gain.

It’s an “evolutionary shield” – he writes:

“Organisms that treat threats as more urgent than opportunities have a better chance to survive and reproduce”

And whilst it’s okay to maintain a healthy sense of caution… it’s ill-advised to listen to Permabears.

Unless of course they are consistently beating the S&P 500 over a 25-year period.

Please show me just one who has.