- Wage inflation softer at 4.6% YoY – with 223K jobs added in December

- Unemployment rate falls to 3.5% from 3.6%

- My investment thesis remains the same – exercise patience

Earlier this week I shared what I think are the most important factors to shape the narrative for 2023.

At the top of my list was employment and specifically wage inflation.

Today, we got our first print for 2023 (what we saw in December):

- Non-farm payrolls increase 223,000 in December

- Unemployment rate falls to 3.5% from 3.6%

- Household employment surges; labor force rises

- Average hourly earnings gain 0.3%; up 4.6% year-on-year

How you decide interpret this data will be function of your lens.

And yours will probably differ to mine.

For example, one possible lens is “it’s very bullish… wage inflation is down… giving the Fed ‘cover’ in terms of slowing rates”

However, another argument could be “it’s one data point and a long way from the Fed’s target of 2.0%. What’s more, the labor market remains strong suggesting wage inflation will remain persistent”

Which is correct?

Obviously we don’t know… as it’s how you choose to interpret the data.

Turn on CNBC or Bloomberg – and they will treat you to ‘a thousand’ interpretations.

This is my advice:

Whatever your interpretation – my advice is don’t be too attached to it.

I say that because you cannot prove (beyond doubt) you are right.

You might be right… but odds are you will be proven wrong.

The market clearly took for the former narrative (which I will expand on shortly) – thinking this gives the Fed less scope to be overly aggressive.

And that might be correct.

But I’m a little more sanguine… as 4.6% is still a long way from 2.0%.

What do I often say: “one hot night doesn’t make a summer”

My interpretation is the Fed has little reason to take its foot off the pedal with just one green shoot.

For example, let’s say we receive another 4+ months (or more) where wage inflation drops from “4.6% -> 4.2% -> 3.6% -> 3.2% etc” … then we have a trend.

And ideally, that’s what we need to see.

For now, the first monthly decline in wage inflation is encouraging.

Here’s Sal Guatieri, a senior economist at BMO Capital Markets:

“The labor market remains resilient but is losing pep and worker shortages remain intense. While wage growth has moderated, it’s still far from consistent with price stability.

Don’t look for the Fed to ratchet down its hawkish talk or slow the pace of rate hikes on February 1.”

I agree.

The labor print potentially means the Fed’s medicine is starting to take effect where it’s most intended.

However, as Guatieri notes, job additions remain strong and the unemployment rate fell to 3.5%

Labor market resilience is what will underpin the economy by sustaining consumer spending (which is ~70% of GDP in the US’ case)

That could mean ‘sticky’ wage pressure down the pike.

Markets are Optimistic

- Softer-than-expected wage inflation and downward revisions to November;

- Institute for Supply Management (ISM) services data sharply slowing; and

- Further weakness in the US dollar.

Points 1 and 2 can be interpreted as giving the Fed a lot more “cover” in terms of their rate hikes. A less aggressive Fed potentially means higher stock prices.

For example, it was the first time we have seen ISM contract since May 2020.

U.S. services industry activity contracted for the first time in more than 2-1/2 years in December amid weakening demand, while the pace of increase in prices paid by businesses slowed considerably, offering more evidence that inflation was abating.

The Institute for Supply Management (ISM) said on Friday its non-manufacturing PMI dropped to 49.6 last month from 56.5 in November. It was the first time since May 2020 that the services PMI fell below the 50 threshold, which indicates contraction in the sector that accounts for more than two-thirds of U.S. economic activity.

“Bad news” is effectively “good news” for the market – as it’s another signal a good portion is in contraction (i.e. deflationary).

But perhaps the least discussed thing today was the drop in the US dollar (also in my Top 5 2023 charts).

As an aside, last year I was bullish on the USD index – given what I felt the Fed needed to do with rates.

That trade worked.

However, this year I think there could be headwinds for the dollar as the Fed rate hike cycle matures and rate differentials close.

Jan 6 2023

For example, I think this is currency markets betting that the Federal Reserve could be the first major central bank to pause on rate hikes.

And as I’ve outlined in the past – a weaker USD will be tailwind for stocks (and also gold – another one of my Top 5 charts)

Given the move in the dollar, bonds caught a bid which sent yields lower (and that makes sense)

Yields will likely fall if the market believes we are headed into recession.

Nothing Changes

From my perspective, my thesis into 2023 has not changed after today’s jobs print.

That’s not to say I am not deeply attached to it (I’m not) – but I didn’t see anything here which I think changes the course of events from the Fed.

That’s what I am primarily focused on…

My interpretation is they have a (bright) green light to raise rates either 25 bps or even 50 bps on Feb 1st.

I don’t really care whether it’s “25 or 50 or even 75” – the point is they are likely to keep tightening.

That’s all I am interested in.

And whilst they continue to see wage inflation well above 2.0%; robust job additions with full unemployment – why would they stop?

Again, the price of undershooting here is far riskier than overshooting.

For example, Powell told us last month that he feels the unemployment rate will need to be closer to ~4.6% if they are to achieve their 2% wage inflation objective.

Today we learned the unemployment rate went the opposite direction.

200K+ jobs were added.

For perspective, if we are to 4.6% unemployment by the end of the year, that would roughly equal 1M jobs lost (perhaps 100K p/mth on average)

Here’s something else:

Every time last year the market interpreted what it felt was an encouraging print (e.g. lower CPI) – thinking it would mean a more dovish Fed – what happened?

At first the market rallied… trying to ‘front run’ the Fed.

However, Powell consistently poured cold water on any “pause or pivot” scenario.

In fact, he went to extreme lengths to explain just how much work still lies ahead.

The market took a day or two to process Powell’s sentiment… and subsequently sold off.

So don’t be too surprised to see something similar….

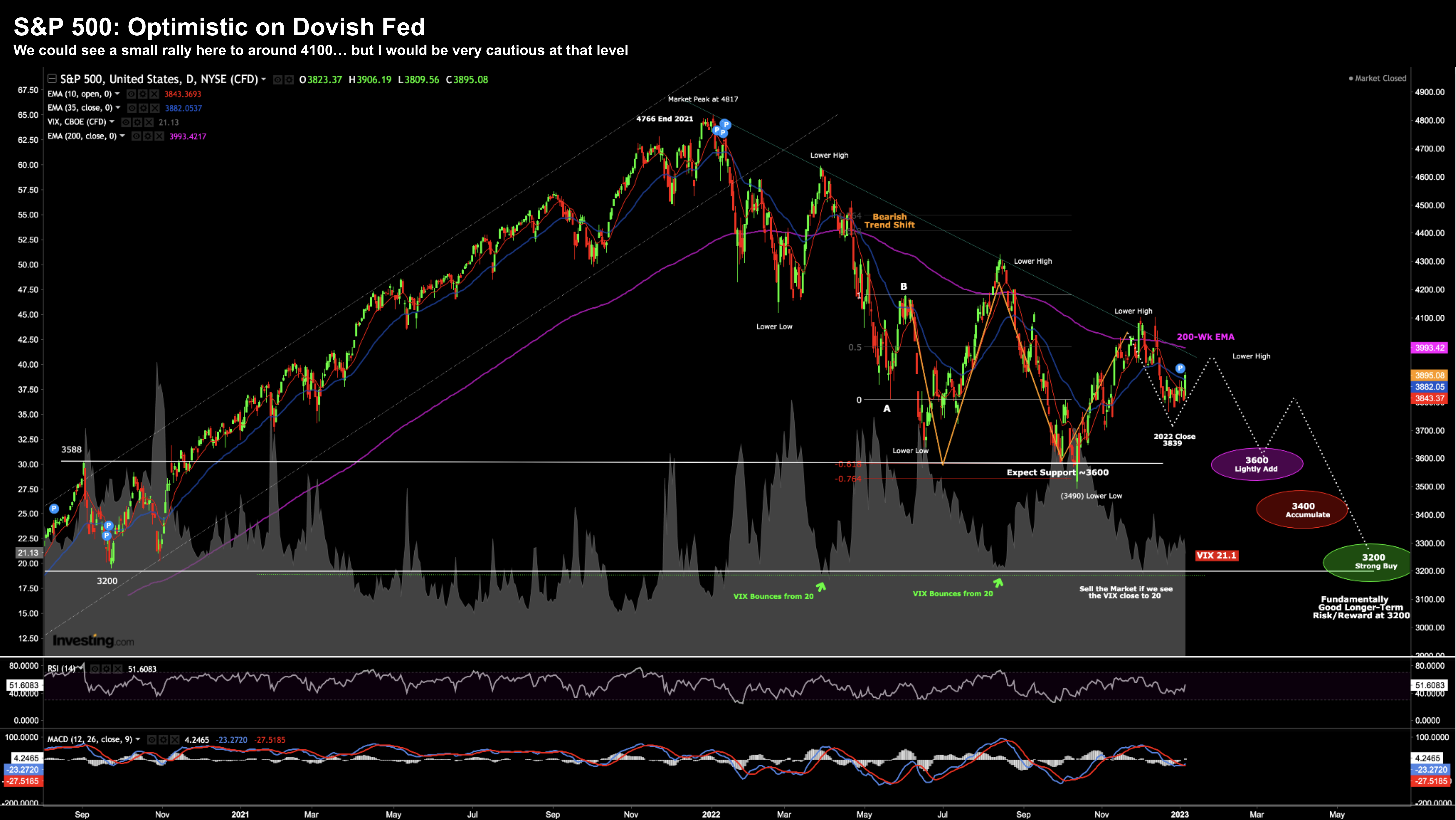

For example, the market could rally a little into Feb 1 (e.g. maybe to 4100 – see chart below).

At which time, Powell will most likely issue another “25bps or 50bps” hike coupled with very hawkish sentiment.

What then?

As I’ve explained over the past few months… once we get into ‘4100 territory’ on the S&P 500 – with earnings likely to be in the realm of $210 per share (best case) – that makes for forward PE of 19.5x

I would remain very cautious at anything around this level.

Jan 6 2023

To me, this feels like the “higher end” of the range (especially given the climate)

Sure, the market could extend beyond this by perhaps ~5% or so… but it doesn’t outweigh the downside risks given the climate.

But let me throw this out there:

Let’s say the Fed does pivot (as a long shot) – do you think that will be some kind of panacea for stocks?

Hardly.

Putting it All Together

Over the weekend I will share some data from Factset on earnings expectations.

They have come down (good news) but consensus feels far too high for 2023 – something in the realm of $230 per share.

In closing, we are still in a bear market.

Bear markets favour lower prices.

We can see the economy is weakening (e.g. housing starts, home loans, the ISM services contracting) and will likely weaken further over the next nine months (at a rough guess).

The ISM print today is just the beginning of it – not the end.

How much further will it contract?

It’s my view we enter a recession at some point later this year (e.g., second half)

If that’s correct, it means earnings will most likely contract (not expand)… and that means lower prices.

But I’m genuinely excited for 2023… as it will not be like 2022.

We will be given opportunities – but for now exercise patience and discipline.

That’s how you win at this game.

Days like today are likely to get the dopamine firing inside your brain – acting like a trigger.

Turn that off.

There will be a time to be more aggressive with stocks… now isn’t that time.