- Learning from four key mistakes this year

- There were not many places to hide; and

- How I’m thinking about sector allocation in 2023

One trading day remains for 2022…

And good riddance you might say… as the Index looks set to lock in its worst performance since 2008.

How did you go?

If you had the power of hindsight – what would you have done differently?

And what lessons will you take into 2023?

I made plenty of mistakes this year… and I will share some of these below.

But the silver lining was these mistakes didn’t result in any fatal errors.

Charlie Munger perhaps said it best:

It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent. There must be some wisdom in the folk saying: ‘It’s the strong swimmers who drown.

If I can just eliminate stupid decisions… generally that will hold me in reasonable stead.

However 2022 certainly gave investors ‘plenty of rope’ to make some questionable decisions.

Here’s the thing:

We are all going to make mistakes.

What’s more, even good decisions may not turn out the way we expected.

Things go wrong and that’s okay.

The two questions that I like to ask myself when I make a mistake is:

- how quickly the error was identified; and

- what steps were taken to remedy it?

It’s not the mistakes we make in life – it’s how quickly we recover that counts.

However, compounding your mistakes by digging a deeper hole (e.g. Cathie Wood) is problematic.

If your portfolio is down “~80%” for the year – you probably compounded your error(s).

That can have a material impact on your performance.

When it comes to this game… we measure ourselves against one benchmark: the S&P 500

Your goal is to consistently beat the Index.

If that’s not your goal – then simply invest in a low-cost Index fund (e.g., Vanguard) and just going along for the (passive) ride.

Over the long-term you will do very well (and beat ~90% of all fund managers without the excessive 1% to 2% in fees)

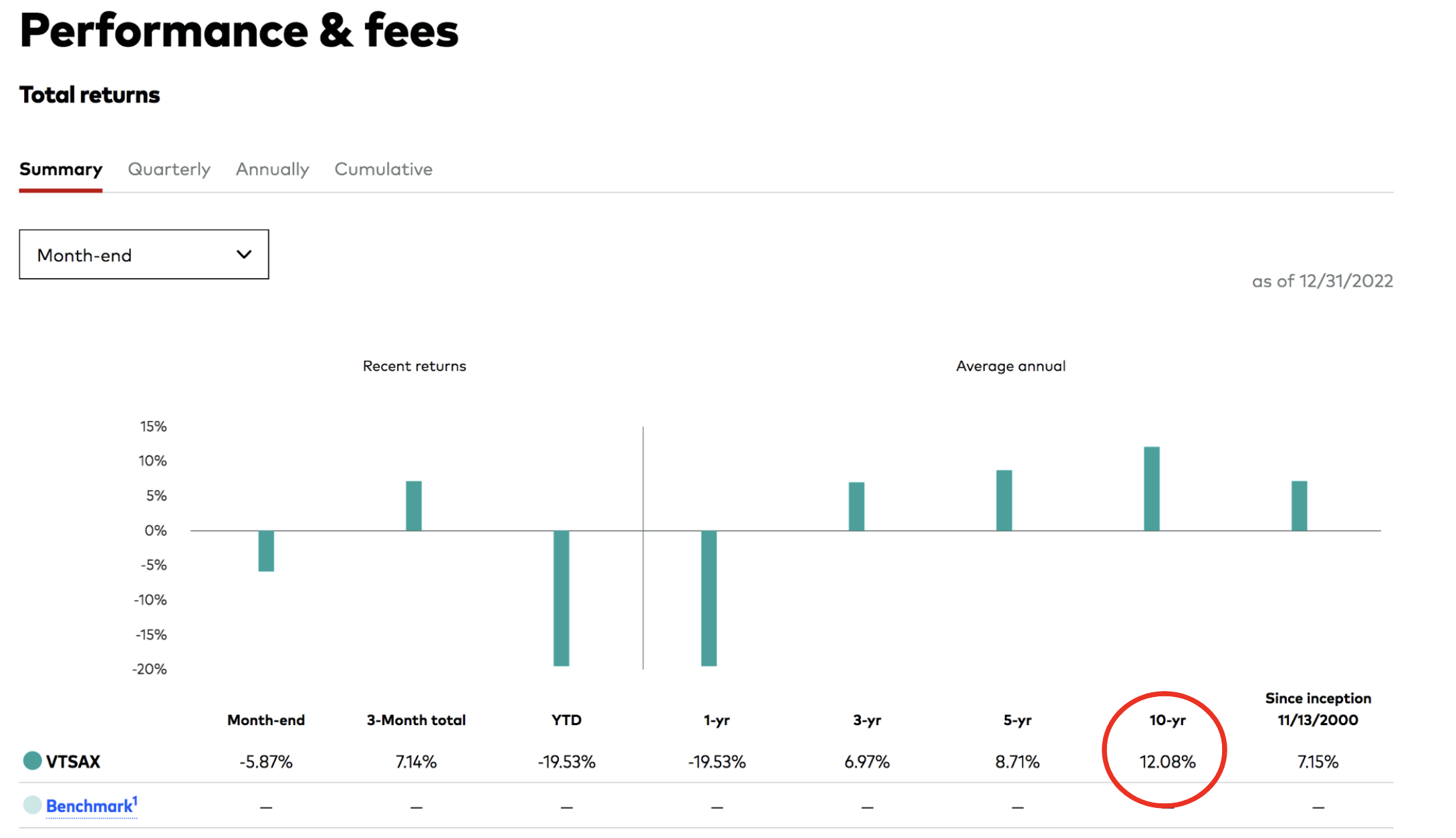

As as aside, if you don’t think a 2% management fee per annum isn’t much…. you would be mistaken. For e.g., if your fund is worth $100,000… compounded over just 10 years… that is $21,900 in fees you have given away. Why do it when you have the option of a very low cost index fund (e.g., VTSAX). It will match the S&P 500 with an expense ratio of just 0.04% (that’s the best I’ve seen in the market). Sit back. Relax. And know you are beating ~90% of all fund managers

Source: Vanguard

At the time of writing, the S&P 500 is down ~19.5% for 2022 (i.e., consistent with what we see with VTSAX above)

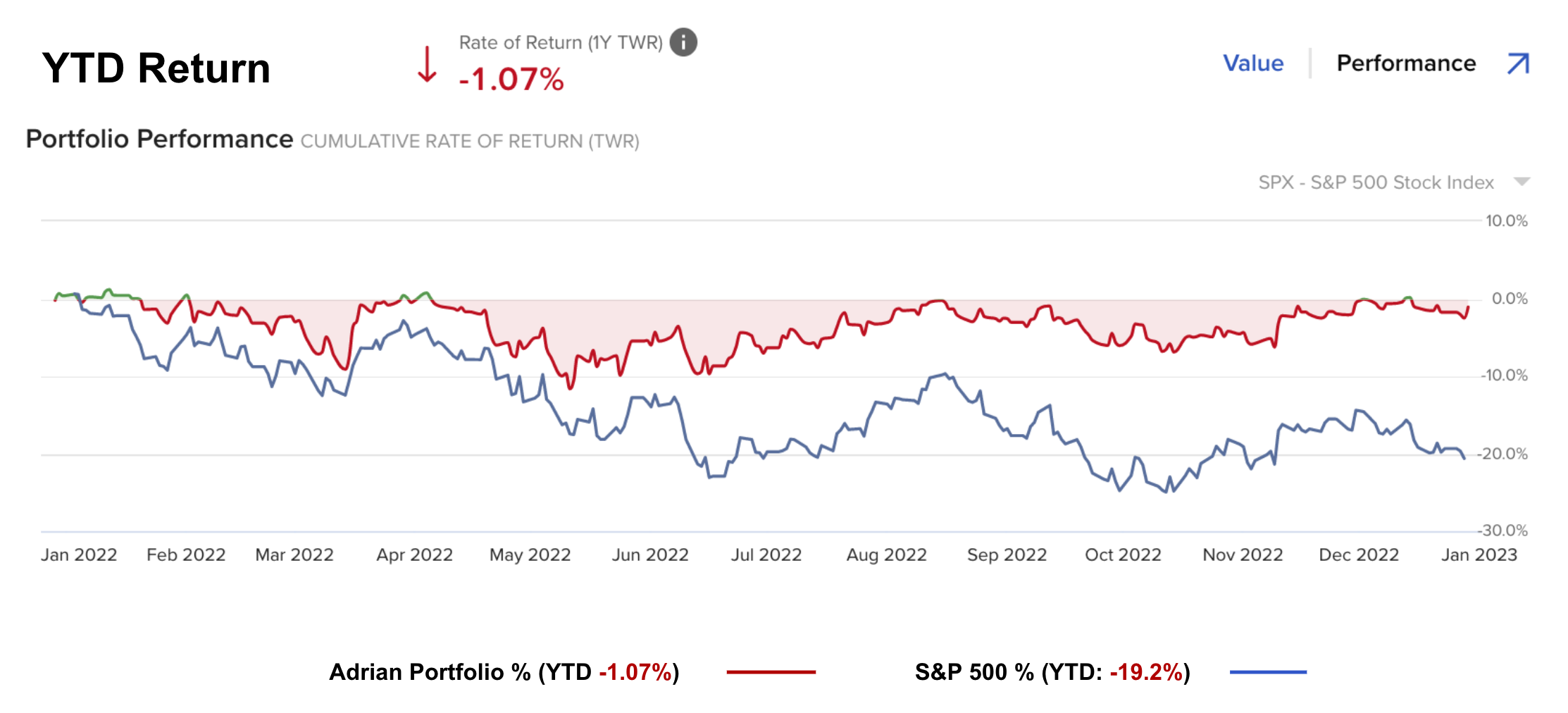

Pending tomorrow’s trade – I will most likely finish the year ~18% better than the Index.

Dec 29 2022

Regular readers will recall my #1 goal this year was not losing too much money.

The logic was simple enough:

When monetary policy is tightening – risks assets typically underperform. David Tepper reminded us of that just the other week…

From there, if then we then factor additional risks such as:

- Escalating geo-political tensions in both Europe and China;

- Exceptionally high stock valuations heading into the year; and

- The growing likelihood of 2023/24 recession…

… you have to ask whether the upside reward meaningfully outweighed the downside risks?

I didn’t think so.

2022: Nowhere to Hide

There were not many places to hide in 2022.

For example, the heralded (defensive) “60/40” portfolio lost 17% this year… its worst showing in four decades.

For those less familiar, this refers to putting 60% of a portfolio in stocks and 40% in bonds.

This is considered a safer approach – designed to hedge against both assets dropping simultaneously.

That is not what happened this year.

40-year high inflation combined with sharply higher interest rates – saw both asset classes decimated.

Fixed income investments saw its worst year in decades (where lower bond prices equals higher yields)

Almost everything went down… equities, bonds, precious metals and even cash (where inflation erodes its purchasing power).

Anyone who generated double-digit returns this year either:

- shorted the market (profiting from stocks falling); and/or

- overweight long in a specific sectors (e.g. healthcare and energy)

From mine, there were four key macro events which shaped the narrative:

- Vladimir Putin invading Ukraine;

- China’s economy suffering from its zero-COVID policy;

- Inflation proving far less transitory (and meaningfully higher than many anticipated); and

- Equities being overpriced due to grossly mis-priced risk (i.e., artificially low rates)

I saw a high probability of #3 and #4; however a lower chance of #1 and #2.

Now if you managed your portfolio around #3 and #4 – you would have probably fared better than the Index.

However, if you were able to get all 4 correct (which certainly wasn’t me) – you probably had a double-digit return year.

Below are some (not all) of the mistakes I made this year… each of them a lesson into 2023.

Mistake 1: Underestimating Putin

Last year I read numerous reports about Putin amassing a huge army at the Ukrainian border.

At the time I felt he was threatening – but was unlikely to wage a new ‘world war’.

I felt his downside risk(s) far outweighed what could be gained.

I was wrong.

Few (including myself) underestimated the atrocities Putin would commit… something we have not seen since WWII.

When his actions and intent were clear, defense and energy stocks rallied.

The mistake I made was missing this trade.

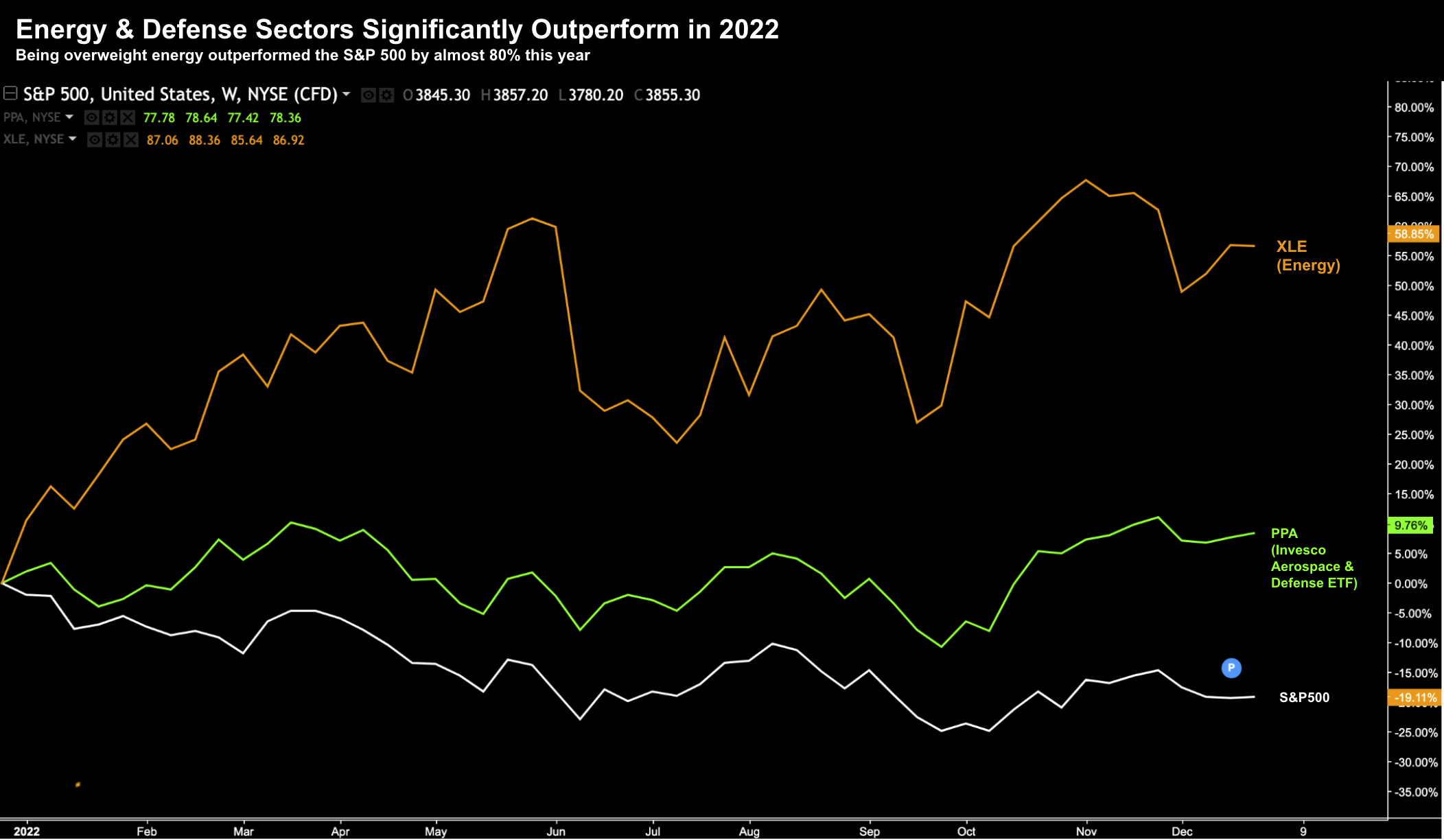

For example, below are 2022 YTD comparisons between:

- XLE (Energy ETF – orange)

- PPA (Invesco Aerospace & Defense ETF – green); and

- S&P 500 – white

Dec 29 2022

The XLE ETF (energy) returned investors ~60% this year — catapulting after Putin’s invasion in February.

Now coupled with the political climate against (sufficient) investment in fossil fuels – this compounded supply constraints with oil (which have not gone away)

Unlike Warren Buffett (who took a massive position in energy company OXY) – my mistake this year was not being overweight energy earlier.

I’ve taken (some) steps the past few months to amend the error – but I missed the bulk of the gains.

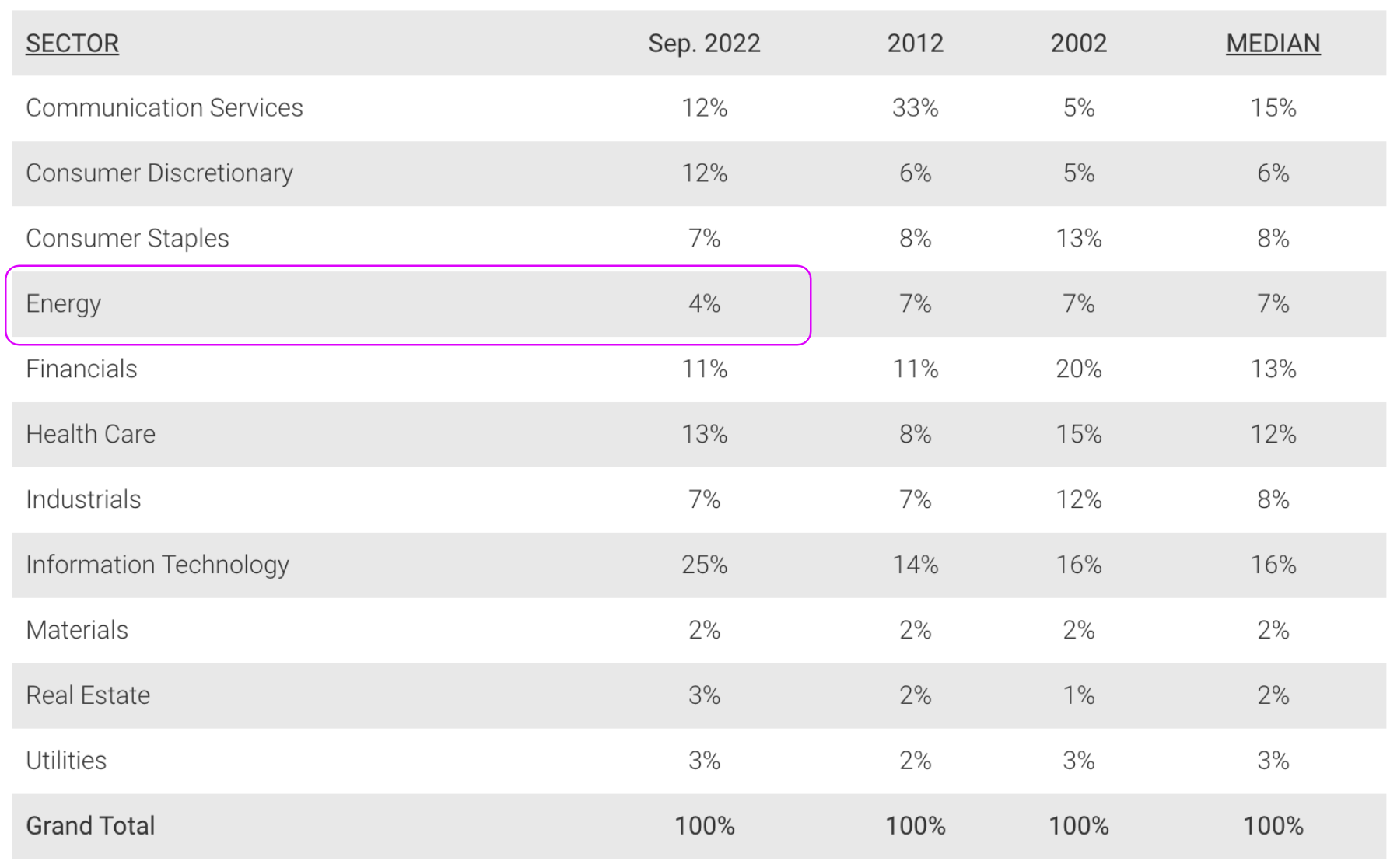

For example, my portfolio weighting opposite energy for 2022 was only ~4% (i.e., Index weight).

S&P 500 Sector Weights – Sept 2022

That weighting should have been in the realm of 10-15%

A thesis I have for 2023 is oil is going to trade meaningfully above $70/b.

That may prove to be an error however that’s how I will be positioned.

For example, not only has the supply equation for fossil fuels deteriorated — quality energy companies (like OXY) are producing phenomenal amounts of free cash flow (as much as 10% FCF Yield) which will be returned to shareholders.

Econ 101 tells us that if you produce less of something (especially if it’s something we need to survive) – it will cost more.

On the assumption oil will remain above $60/b in 2023 – well managed energy companies are positioned to continue printing cash without excessive capital investment.

Mistake 2: Failing to Short Bonds

I was frustrated at myself for not identifying this trade.

Not only was I of the view the Fed were forced to aggressively raise rates – I felt their job would continue deep into 2023

Given that, the trade was to simply short bonds.

For those less familiar, bond prices fall when rates rise.

Below is the 2022 YTD performance of the ETF TBF (Short 20-Year Treasury) vs the S&P 500 (white)

Dec 29 2022

The ETF TBF was up 40% this year… ~60% better than the S&P 500

Not unlike the trade on energy – in hindsight – this was an ‘easy’ trade to make.

I missed this trade.

Now at the start of the year, I felt the long-term treasuries would struggle to meaningfully rise above 3.0% – despite the Fed raising rates.

That was wrong.

Looking forward however – I would not aggressively short bonds.

Yes, rates have further to rise in the near-term. However, I also feel that the rate cycle is maturing.

To be clear, that does not mean rate cuts.

It means we’re likely getting closer to peak rates (e.g. 5.00% to 5.25% at a guess… it could be higher pending wage inflation and employment levels next year)

Now should the economy fall into recession in the second half of next year (or perhaps early 2024) – I believe long-term bond yields will fall.

On that basis, my intent is to add duration via something like the TLT (a trade I suggested earlier in December)

For example, if the US 10-year yield was to pull back to ~3.0% in the second half of next year – TLT will move higher.

However, I would be patient buying this.

For example, it would not surprise me to see the 10-year rally back above 4.0% early in 2023 as the Fed raises rates over February and March (e.g. 50 bps in aggregate)

If this happens, the TLT could trade back towards the mid 90’s (where I’m a buyer).

Mistake 3: Overweight Tech for Too Long

Recently I referenced Howard Marks latest memo “Sea Change”.

In short, Marks suggested the 40-year period of artificially lower rates is over.

As a result, what worked as an investment the past decade (e.g. high valuation tech) will unlikely work the next decade.

As part of that post – I shared the multi-decade trend in 10-year bond yields:

Marks feels that rates are more likely to trade in a 2.0% to 4.0% range the next decade (vs 0.0% to 2.0% the past decade).

This means investors need to question two things:

- what sectors / assets are best positioned; vs

- those which are not

The latter is arguably far more important (i.e., avoiding a “stupid” mistake).

My third mistake this year was too much exposure to quality tech for too long.

Yes, I managed to avoid exposure to sky-high “Cathie Wood” stocks.

Those valuations never made sense to me.

However, my core positions (which I’ve owned for over a decade) in Apple, Amazon, Google and Microsoft dragged down my performance.

And whilst I don’t intend to get rid of these names – I’ve reduced my holdings to below market weight (i.e., below 25%)

In particular, Apple and Microsoft feel expensive at current valuations – as I shared here.

However, I think Google and Amazon (with Amazon on a price-to-sales (not earnings) basis) look like better value from a long-term perspective.

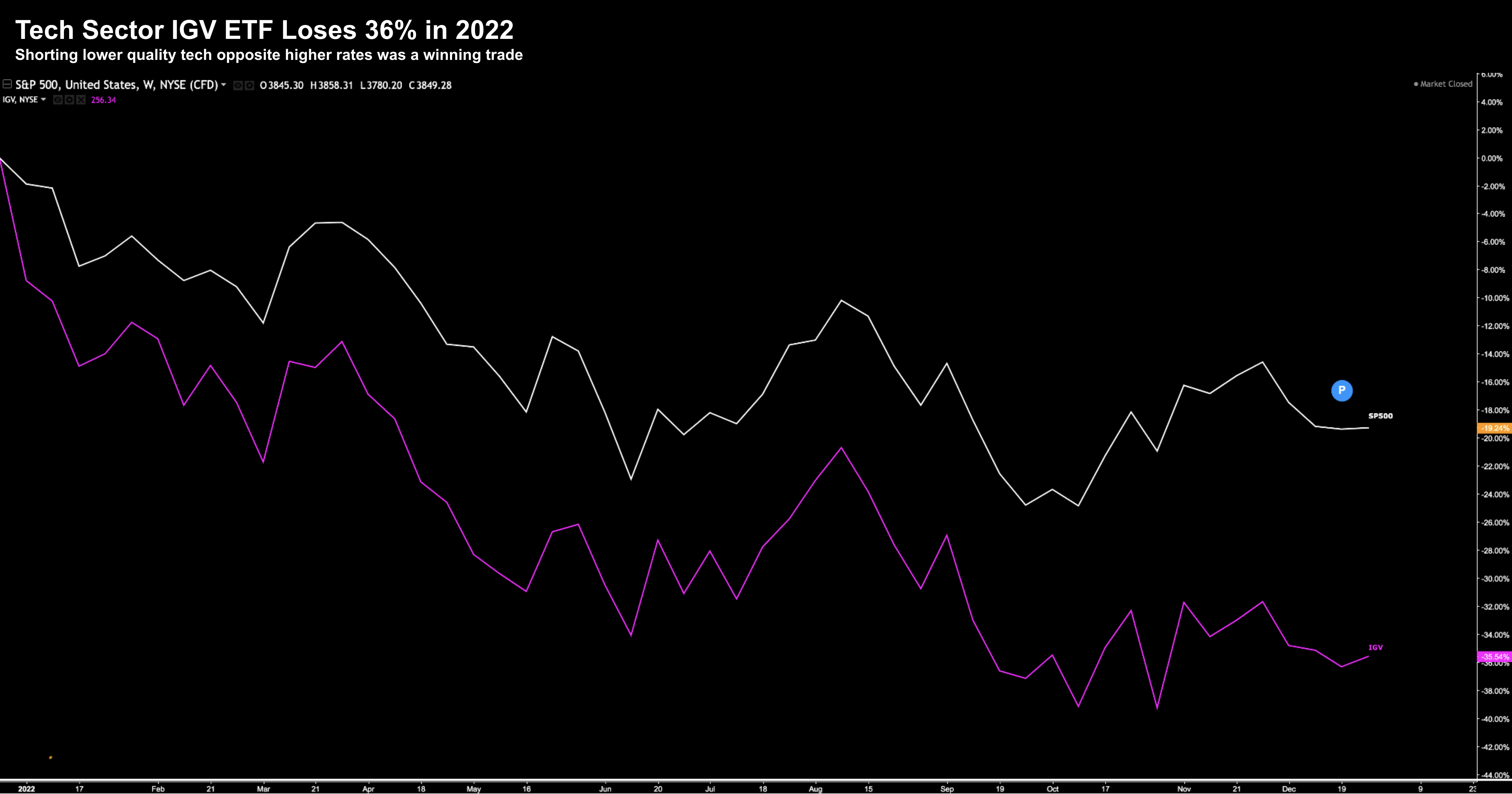

The other mistake I made in this sector was failing to short the tech sector ETF IGV

Dec 29 2022

For example, a quick look at IGV highlights its over-exposure to high valuation names

And whilst I think IGV will likely trade lower in 2023 – the bulk of the downside has now been made.

To be clear, that does not mean I think we will see some kind of v-shaped recovery in this ETF!

No.

But I don’t see this sector leading market returns in 2023 (especially not in the same way it did the past decade with a zero cost of capital).

I got this trade very wrong in 2022 – where my move to correct it was late.

Mistake #4: Underweight Value

Recently I shared a missive exploring the sectors which I think will lead in 2023.

In short, I think it’s likely to be a return to defensive / value names.

Think (very) boring businesses that we consume (or need) every day.

These businesses are not producing revenue growth of “20% plus” per year… and nor are they boasting multiples of 30x plus earnings.

However, they produce reliable (strong) free cash flows – where they enjoy pricing power and defensible moats.

Sectors here include energy, healthcare and industrials.

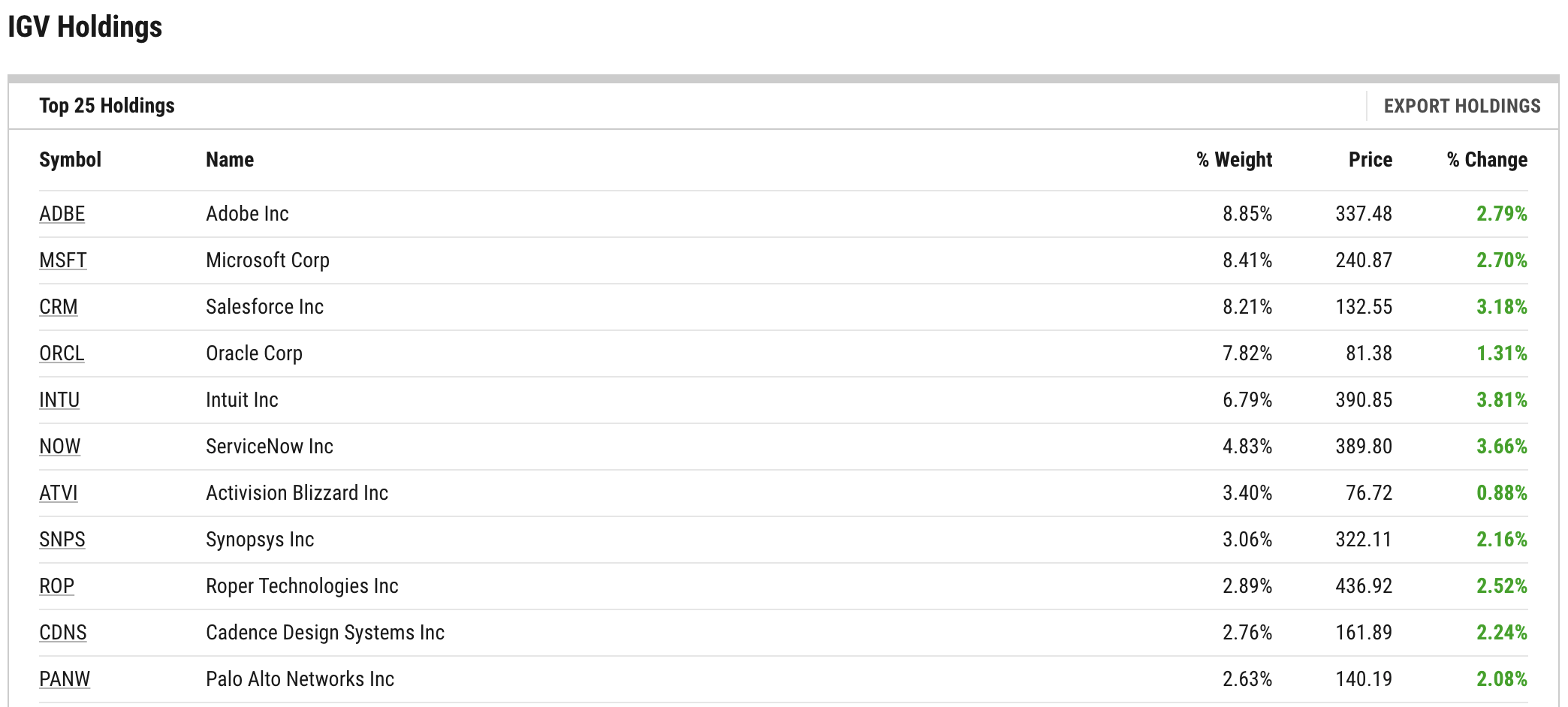

For example, at the time of writing, equal market weight for healthcare is 13%.

Here I like names like LLY, UNH, DHR and CI.

Below is how these 4 stocks performed against the S&P 500 in 2022:

Dec 29 2022

Fortunately I had exposure to both LLY and UNH this year (before they become expensive).

LLY posted a gain of 44% and UNH 32% (helping to offset some of the downside I experienced with tech)

If you don’t own these – wait for more reasonable prices.

However, the mistake I made was similar to energy; i.e. I should have been overweight the sector.

Looking ahead I plan to increase my weighting to healthcare.

During times of recession – this sector will likely outperform the broader market (despite the strong gains over 2022).

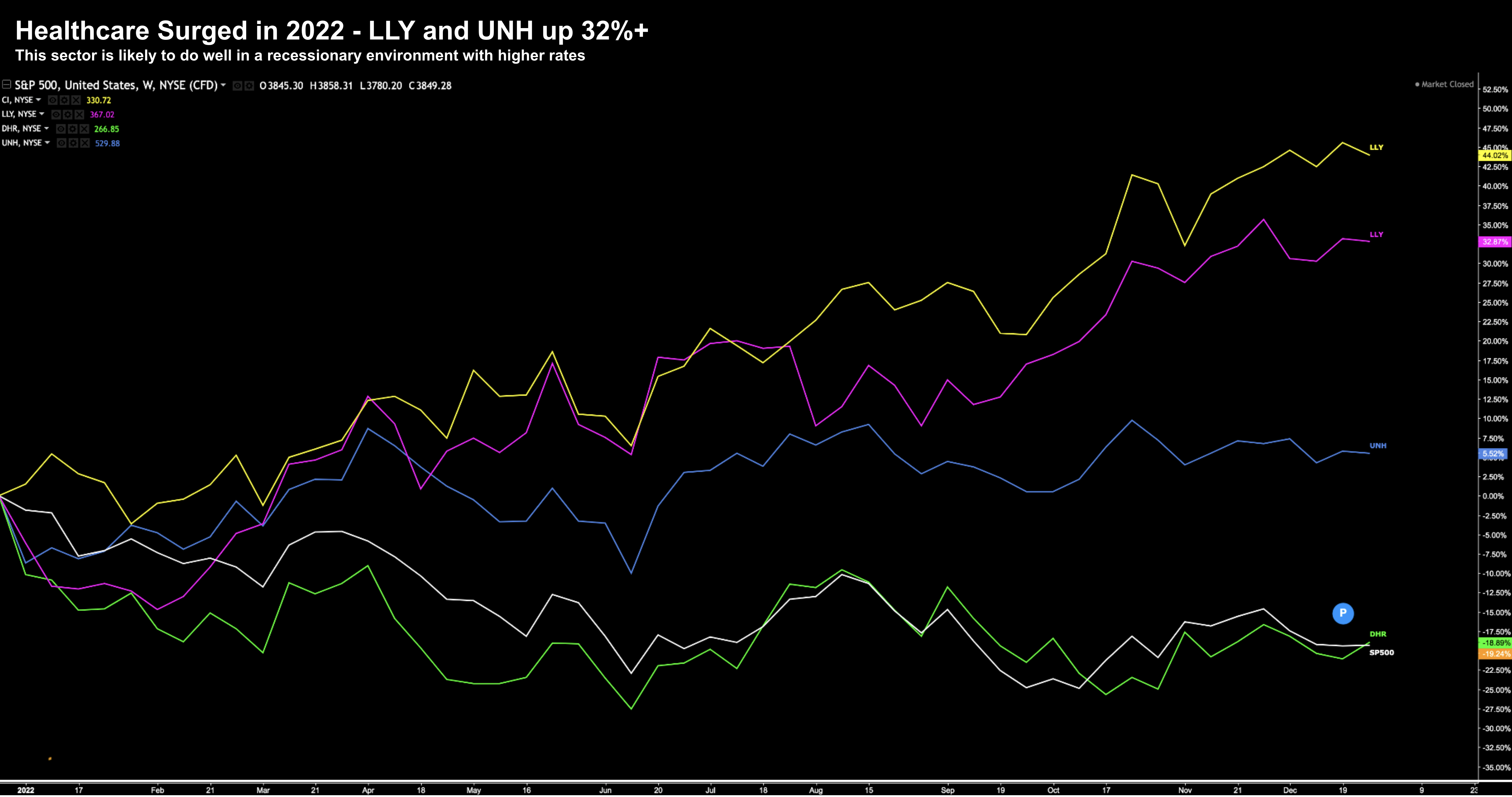

In addition, I also like (defensive) names such as:

- McDonalds (MCD)

- Visa (V)

- American Express (AXP)

- Procter & Gamble (PG)

- Pepsi (PEP); and

- Johnson & Johnson (JNJ)

Each are largely recession-proof businesses…. evidenced by how they’ve weathered higher rates (and inflation) so far:

Dec 29 2022

Next year I plan to add exposure to these names on any weakness (when it presents)

Putting it All Together

If I was to give myself a score this year – it’s 7 out of 10.

I give myself points for:

- Outperforming the market by ~18%;

- Avoiding excessively high valuations coming into 2022; and

- Not losing too much money (down ~1% with one trading day remaining)

My primary objective this year was the latter. This was not a year where it was ‘easy’ to post double-digit returns. However, I lose “three points” for:

- Not producing a positive return;

- Leaving it too long to reduce my market weight position in big-cap tech;

- Failing to increase my exposure to energy and healthcare (despite the macro climate and prevailing trend); and

- Underestimating the impact of the rising geo-political risks

Every year we are given opportunities to learn from mistakes…

What’s more important is that we identify the mistake (early) and take action to correct it.

Making the mistake isn’t the problem (that’s going to happen)… it’s how quickly we recover that counts.

I highly recommend taking an honest look at your own performance… writing down what didn’t work and why.

And from there, the corrective actions you will take into next year.