- Powell’s real fight will be with labor and wages

- Markets to pivot their gaze from CPI to employment; and

- Does the “Fed Put” still exist?

If there was one thing which preoccupied investor’s minds in 2022… it was inflation.

How high? How fast? How long?

Inflation has not been this high in over 40 years… a first for many under the age of ~55 (which includes myself)

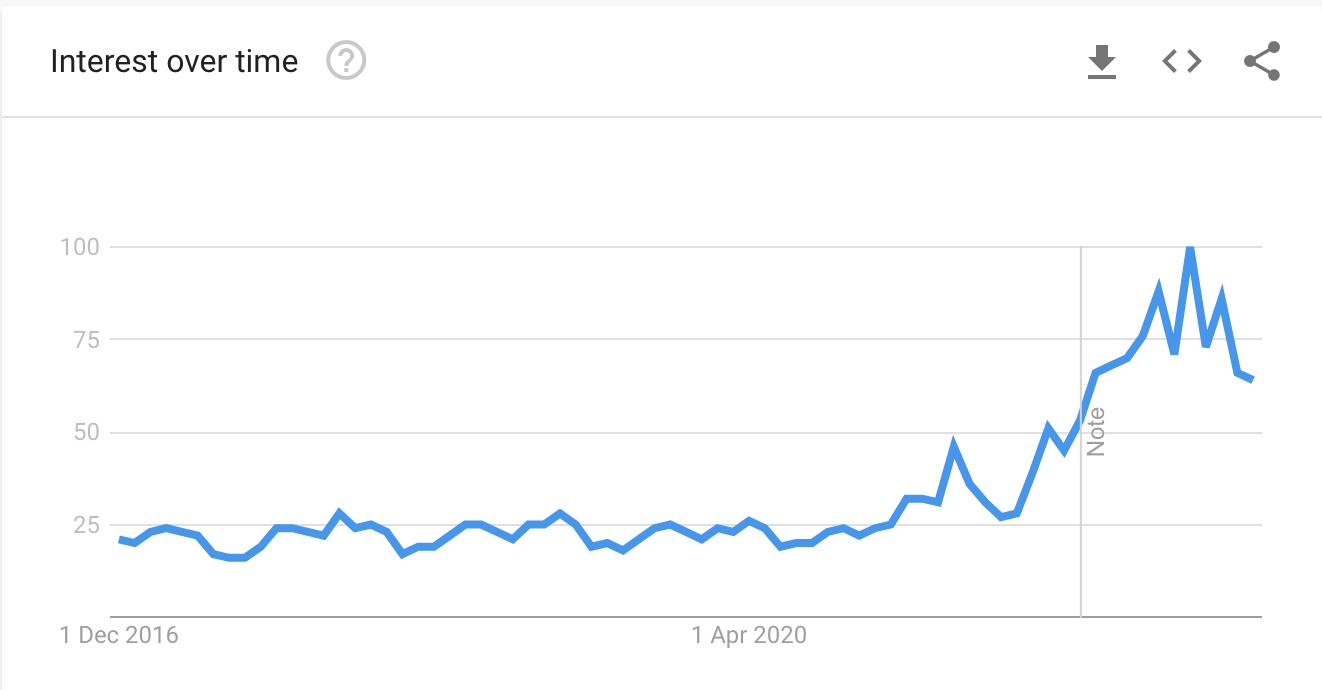

Below we find the 6-year Google trend for the term from 2016….

Google Search Trend for Inflation from 2016

Every month, financial markets were braced for the monthly CPI.

Funny isn’t it… this (typically boring) figure came and went for 40 years with barely any attention… now it was all that mattered.

In June, headline CPI peaked at 9.1%.

Now it is some 200 basis points lower… as the prices of most goods (excluding food) and energy plunge.

But not all forms of inflation are equal….

For example, prices for things such as “TVs, t-shirts, baseballs and shoes” is very different from “seeing your Doctor” or “getting a haircut”

One is a manufactured good… the other is a service.

Goods are coming down… services are not.

The reason?

Services are largely a function of the labor cost.

And that is what the Fed are almost exclusively focused on reducing.

The Key to Fed Hikes

At the time of writing, markets mostly see headline CPI as rear-view mirror.

To be clear, we still trade with a low 7-handle however the trend is lower.

For example, the market expects CPI to trade in the realm of 4-5% by mid-2023.

That’s the good news.

However, what remains far less clear (and more challenging) is how fast stickier forms of inflation will fall (e.g., wages and rent)

Just on this, last week Powell said (the Fed) “have not made much progress with inflation”.

Some participants questioned this comment – given what we have seen with CPI and the prices of most commodities falling.

But Powell wasn’t just talking about the price of goods falling.

He was talking to services.

For example, anything from “child care” to the “cost of haircut”.

Services such as these are a function of domestic labor costs (not a globally manufactured good)

On this, the Fed reminded us their job is to see inflation moving “toward 2% in a sustained way.”

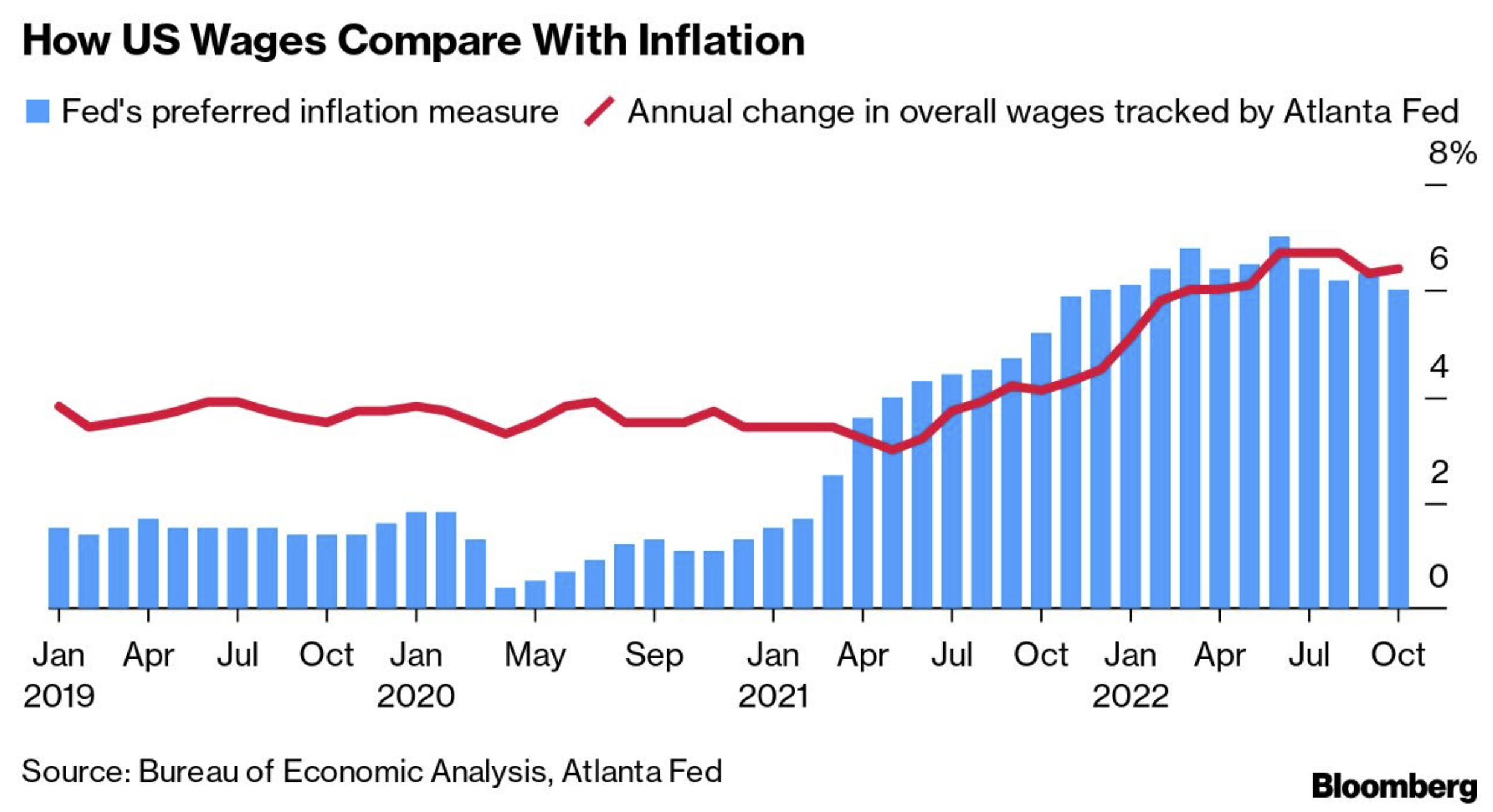

That implies that wages need to come down…

5% wage growth simply isn’t sustainable.

What’s more… it’s dangerous..

For example, this chart shows where we are with wage inflation (red line) today:

Will this be a ‘one-time bump’ (similar to goods inflation)?

Or do the Fed face the risk of “5%” wage inflation becoming entrenched?

The latter is what strikes fear in the heart of central bankers.

If that happens – it can lend to an inflation spiral.

Here’s how it could work:

- US companies are working hard to adjust to large shortage in labor – in turn paying more for scarce resources; whilst

- Existing workers demand parity with inflation levels — so they don’t fall behind with purchasing power.

The end result is a vicious cycle.

From Powell’s perspective, the circuit breaker is overshooting on hikes if necessary… even if that cost is a recession.

Normalcy Bias?

Recently I posited that investing strategies which worked the past decade are unlikely to work looking ahead.

Investors need to re-think asset allocation… where risk now has a price.

And I think that’s good news…

As there is now a viable alternative to risk assets (e.g. fixed income yielding over 5% in some cases)

In short, we should expect higher rates for longer — where the “new normal” for the next decade is likely to be in the realm of 2-4% (vs 0-2%).

But here’s something else…

What should we expect from the Fed when (not if) the ‘shit hits the fan’?

For example, ever since I’ve been investing (since ~1995) – without fail – the Fed (along with other central banks) lack the fortitude to tighten if that meant hurting risk assets (i.e. stocks and houses)

And with any hint of distress… the Fed would rush in with liquidity and lower rates.

Investors knew this… and were trained to expect that response.

QE = Buy

The Fed would ring the bell… the dogs would come running.

So here’s my question:

With the potential threat of entrenched (unwanted) inflation present (e.g., wages exceeding 2% growth) – will that still be the case?

Or do investors suffer from a form of normalcy bias?

Normalcy bias is a cognitive bias which leads people to disbelieve or minimize threat warnings. Consequently, individuals underestimate the likelihood of a disaster, when it might affect them, and its potential adverse effects.

The normalcy bias causes many people to not adequately prepare for natural disasters, market crashes, and calamities caused by human error. About 70% of people reportedly display normalcy bias during a disaster.

What will the Fed do faced with possible (structural) 5%+ wage inflation for an extended period?

For example, do they relent to investor tantrums (e.g. equities or house prices lower by 30%?)

Up until this year, central banks had the option to crank their liquidity spigots without limits – knowing there was little risk of stoking unwanted inflation.

Not now.

That option has been taken away.

Therefore, is it different this time?

I think it might be.

Putting it All Together

The rules of the game have changed.

From mine, 2022 will mark a “40-year” (tectonic) shift.

Howard Marks described it best with his latest memo.

The question I have is whether the market is potentially caught offside in terms of the Fed’s lengthy (structural) fight ahead?

Falling goods prices isn’t the concern… it’s labor markets.

And more specifically – it’s the stubborness around wage growth.

For now, that’s my thinking…

Stay patient… exercising discipline and diligence.