- Don’t get too far in front of the Fed

- Lessons learned from trading through two recessions

- What Powell’s intended “pain” means for stocks

I’ve been at the investing game since ~1995.

And over the course of those 27 years, 2022 will be remembered as one of the more challenging.

However, having the benefit of trading through the recessions of 2000/01 and 2008/09 – this has enabled me to become a better investor.

The dot.com bust was the first time I experienced meaningful losses.

At the time, I chased momentum on high-flying tech stocks, happy to pay ‘any price’.

It worked well… until it didn’t.

Turns out trees don’t grow to the sky.

That was a lesson. Write it down.

But I was also very lucky…

At the ‘bulletproof’ age of 30 – where you have licence to take more risk – I learned my first valuable (life-long) lesson.

In years to come, I would fondly call it my $200K tuition fee (about what it cost me at the time) – far more valuable than my post-grad studies at the Australian Securities Institute.

There is nothing quite like losing real money… and learning how you react.

Emotions are powerful things.

A financial degree doesn’t give you that (neither does paper trading).

My second lesson came courtesy of 2008/09.

Needless to say I lost more money – but this time far less than $200K

It still hurt nonetheless… as these recession ‘things’ were proving to be costly affairs.

However I was improving… still young at just 38.

Fast forward to today – the upcoming recession will be my third.

Over ~25 years you start to learn what works and equally what doesn’t.

You make better decisions… but you are still learning.

Learning is a game that never ends.

I think it takes at least 15 years to start to become ‘reasonably’ good at this game… and even then it will bite you when you least expect it.

Without question, thanks to the severe recessions of 2000 and 2008, this made me better.

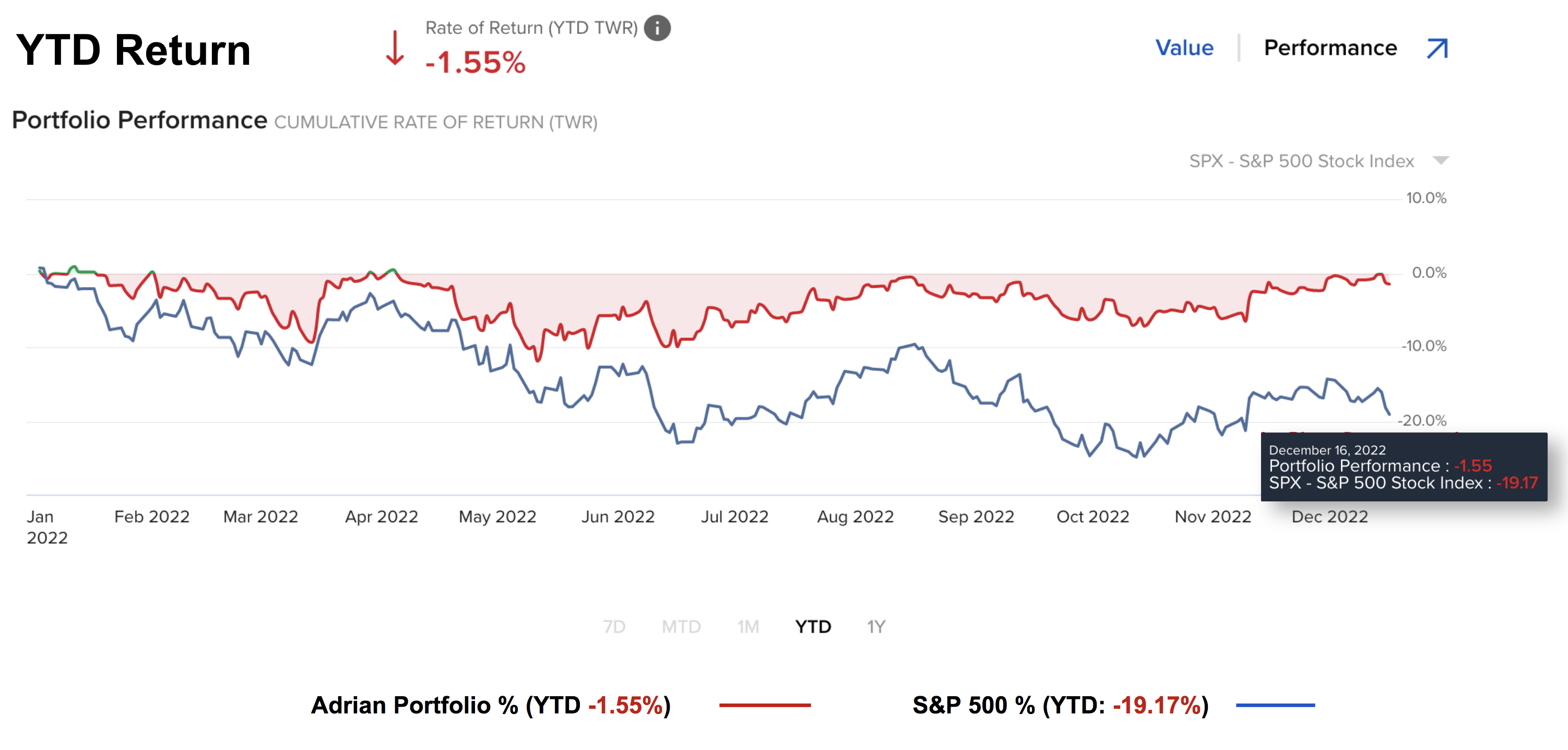

And to that end, I think this is the only reason I’m 18% better than the S&P 500 so far this year.

Dec 17 2022

But if I didn’t have the benefit of those two recessions… my guess is I’d be down at least 20%… wondering what I did wrong buying something like say “Peloton”, “Robinhood”, “Roku”, “Docusign”, “Coinbase” or “Twilio” at their highs (this list is very very long)

~25 years years ago I would have bought all those names… thinking I was a genius (for maybe 5 mins) as I watched them “double” in price.

Not today.

What we do is learn from mistakes.

We (hopefully) make better decisions.

And if this 11-year blog has served its purpose – you will have benefited from some of those lessons via my missives.

Sure, I’ve made a few mistakes this year and I certainly didn’t get everything right.

That’s part of the deal.

But I was happy with my decision making process… which is the main thing.

I know that sometimes good decisions don’t work out. Equally, sometimes bad decisions work out well.

For example, you buy some stock trading at “20x sales” revenue and it goes to “40x”.

Good for you… luck was probably on your side.

But don’t confuse the two!

For me, a few trades were cut for a loss... and I’m glad I cut them.

That’s a good decision.

Another thing I learned along the way was I don’t have to make the money back on the stocks which lost me money.

That’s a lesson. Write it down.

What’s more (and thanks to 2001) choosing to avoid exceptionally high price-to-sales or high-PE stocks with rates likely to rise was a good decision.

Write it down.

But the mistakes I made this year will be recorded – just like they were in 2000 and 2008.

For the most part, my goal this year was simply not to lose too much money.

This was never going to be a year to “make money”

If I did… well and good.

But it was not the primary objective.

We will get plenty more of those years… as they are far more frequent than ultra-defensive years.

Remember:

Over the past 100+ years – stocks tend to rise almost 70% of the time.

You just need to tread carefully when it’s not one of those years.

That brings me to lessons learned…

Always Avoid Large Losses

Here’s something to pin somewhere on your desk:

The most effective way to compound gains is to avoid large losses.

Sounds easy right?

But maybe harder to do in practice… as I will share via one professional investment manager shortly.

For me (and this will vary by person) – it’s far more important not to lose large sums of money than it is to take big risks.

For example, let’s say the market returns “30%+” in any one year.

Typically I will not match return that as it means I will have probably taken a lot of concentrated risk.

Now I might get lucky with one or two positions and have a 30%+ year – but it’s unusual.

Typically a 30%+ year means either:

(a) most of my positions have done exceptionally well; or

(b) I’ve been close to 100% (fully) vested.

But let’s say the index loses say 15% or 20% in any year (like this year).

In those years, I generally do a lot better due to how I play defense.

For example, this means lowering my exposure; writing calls against long positions (i.e. enhancing my returns); and being very selective.

It’s more a game of sitting and waiting (vs doing).

This year my maximum exposure has been around 65%. It was as low as 50%

But the question I ask myself every day is “how much can I lose here… versus what can I gain”

That’s my mindset.

With respect to playing great defense vs offense... consider Cathie Wood’s ARK Innovation ETF (ARKK).

At the end of 2021 – she was hailed as the next “Warren Buffett” – posting staggering returns. She graced the cover of every financial magazine… and anytime you turned on say CNBC or Bloomberg… there she was… telling you about the next big thing in tech.

People saw her as a guru… quickly gaining cult-like status.

Here’s her 5-year performance:

Dec 17 2022

Cathie played exceptionally strong offense during a time which called for more risk (i.e., zero percent rates with trillions in QE).

She was all-in and probably levered to the upside.

However, she failed to play great defence when the investment climate changed.

Her approach required tweaking you might say.

Look, the stocks she advocates may end up changing the world in 5 years… I have no idea.

I hope they do… some appear to be truly disruptive (if they can make money)

But it doesn’t mean you simply give back ~80% of the gains made.

That’s irresponsible (from my lens).

Her fund has now “round tripped” all the way back to 2017 (when the S&P 500 traded for 2400)

Put another way, the Index is up 60% plus dividends over the past 5 years and Cathie’s fund is basically flat.

There was no need for her to give back those hard-earned returns (in my view).

Patience is a Virtue

Earlier this week I told readers that I’m starting to get excited… however it’s still early.

In short, I think we could see the S&P 500 trading closer to 3400 next year (possibly 3200) – which would represent a once-in-a-decade opportunity for traders to start increasing their exposure for the longer-term (3+ years).

That said, the Index may not fall any lower than it is today.

For example, who says we can’t rally “20%” from this week’s low over the next few months… in turn making me look like a right fool (and it would not be the first time!)

That’s possible.

But I think that is a lower probability outcome (for reasons I will explain).

Given no-one can pretend to know what the future holds (although some do) – all we have are probabilities based on what we know.

My thesis – as I’ve outlined here and here – is that the Fed’s tightening cycle will not be helpful for the economy and/or financial assets.

That’s intentional.

The Fed is on a mission to crush demand.

That’s one way to kill inflation (n.b., the other is to improve supply – where more business friendly fiscal policy helps)

The central bank made an error leaving rates too low for too long (with QE) – and now they’re likely to compound that error by over tightening.

That’s how the cycles go… boom then bust.

Crushing the speculation in financial markets (housing and stocks) is part of that deal.

As Powell put it… “there will be pain”.

How Does “Pain” Translate To Stocks?

From Powell’s perspective – not only does he want to kill unwanted levels of inflation (i.e. anything above 2%) – he has his credibility at stake.

For example, I doubt Powell wants to be remembered as another “Arthur Burns” – the Fed Chair of the 1970’s who saw the inflation rate average 9%

And if that means interest rates overshooting – pushing the economy into recession – so be it.

Today some market participants (not all) believe the Powell will fold like a wet tram ticket.

In other words, his bark is far worse than his bite.

Part of me gets that… as that’s how markets have been trained for the better part of 14+ years (arguably longer)

It’s Pavlov’s Dog…

Every time the market (or economy) shows the slightest hint of stumbling… the Fed rushed to the rescue with lower rates.

Rates go to zero (negative in real terms) and they ramp up the printing press… and away we go.

Asset prices soar.

Call it the “Fed Put”… as they have always been willing to step in and “buy” at a certain pain point.

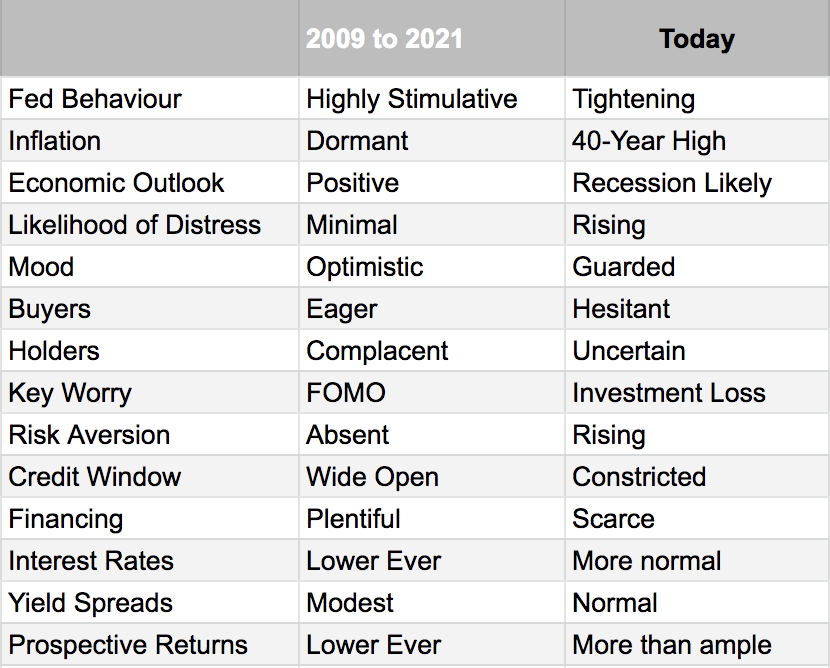

But this is a very different situation…

Drawing parallels to economic pullbacks post 2008 cannot be made given what we find with 40-year high inflation.

My take is if the Fed puts the economy into recession as a result of over tightening (which I think will be the case) – that’s the price that must be paid.

And as Powell has said repeatedly – that’s a far smaller price than having 4%+ inflation entrenched for years to come.

Again, if the thesis of a recession within the next 12 months is correct (and it may not be) – that will equal a bear market.

And the severity of the recession will largely be a function of where we are coming from.

As we know, we were coming from some dizzying heights… where stock price-to-earnings multiples almost ~22x forward.

What’s more, house prices were at insane levels.

In terms of stocks – two things will likely happen next year:

- Earnings will contract (vs expand); and

- The multiple investors are willing to pay will also come down (due to more normal (not high) risk-free rates)

Here’s how it works:

- We’re coming from: $220 earnings per share at 22x forward = 4800

- We’re going to: $200 earnings per share at 16x to 17x forward = 3200 to 3400

Now earnings may vary as much as +/- 8% from this number – I don’t know.

We will get more insight to that in February – where I expect the “knives” to come out.

What’s more, we can also expect the multiple to move up and down pending investor confidence / sentiment.

For example, recently at 4100 it was as high as 19x.

I said that’s “quite rich” given the risks and where rates are going.

But if where we are “going to” is in the ballpark (and it may not be) — that would represent a decline of ~30%… not inconsistent with previous recessions.

My expectation is the S&P 500 will likely lose something in the realm of 25% to 30%

I don’t think it will be as acute as either 2001 or 2008… where the Index lost ~50%.

That’s the opportunity…. for those who have patience.

Lower We Go

To be clear, there is likely going to be a lot of volatility between now and then.

Stocks will not simply go ‘straight down’ to 3600 or 3400.

For example, we might even see a little Santa Claus rally over the next 2 weeks or so.

That would not be surprising… ’tis the season after all.

However, as we start to watch the “long and variable” lags of the Fed’s policy on things such as consumer spend, unemployment, earnings etc – the pressure will be to the downside.

And I think that’s your story for 2023…

We will ‘zig zag’ our way to a zone of between 3200 to 3600 (at a guess) – which starts to offer a more compelling 3+ year risk reward:

Dec 17 2022

Looking at the weekly chart above – I don’t have anything incremental to add to my previous post.

Nothing has changed except stocks moved a tiny bit lower.

Things appear to be trading per the script, failing in the zone I flagged some 10 weeks ago.

The market could be putting in a “lower high” here but it’s still premature to call (i.e., just 5% lower than the recent 4100 high)

But let me offer some lessons in terms of buying ahead of a recession…

One thing I have observed is the stock market does not typically bottom ahead of a recession.

And we are certainly not there yet...

Buying Ahead of a Recession

Let me share two recent examples… as it helps to offer us an important lesson in patience.

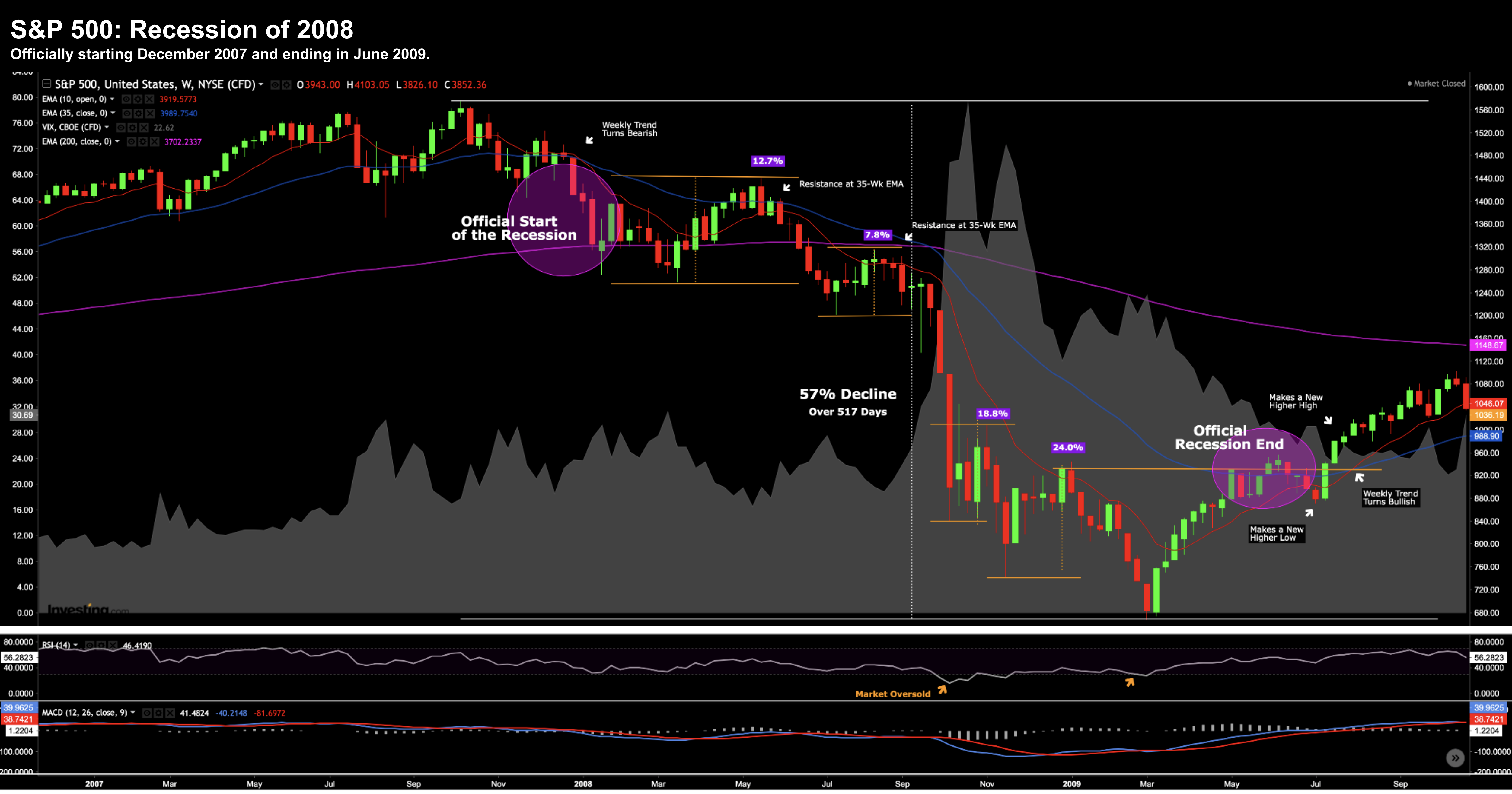

First, below we see when the recession of 2008 began… December 2007.

However, observe what we saw with the price action subsequent…. it was straight down.

Recession of 2008/09

If you added to positions ahead of the recession (Q4 2007) – it would have been a very painful journey.

As a complete aside, also observe the bear market rallies along the way down.

Labelled are 4 rallies of at least ~8% – however our weekly (bearish) trend did not deviate.

Now the recession of 2008 ended June 2009 – however the market bottomed in March of that year.

The rally between March and June was a staggering was 44%.

Buying the market perhaps ~6 months before the end of the recession meant you would have worn a little more downside (that’s fine) – but you would have caught the upside.

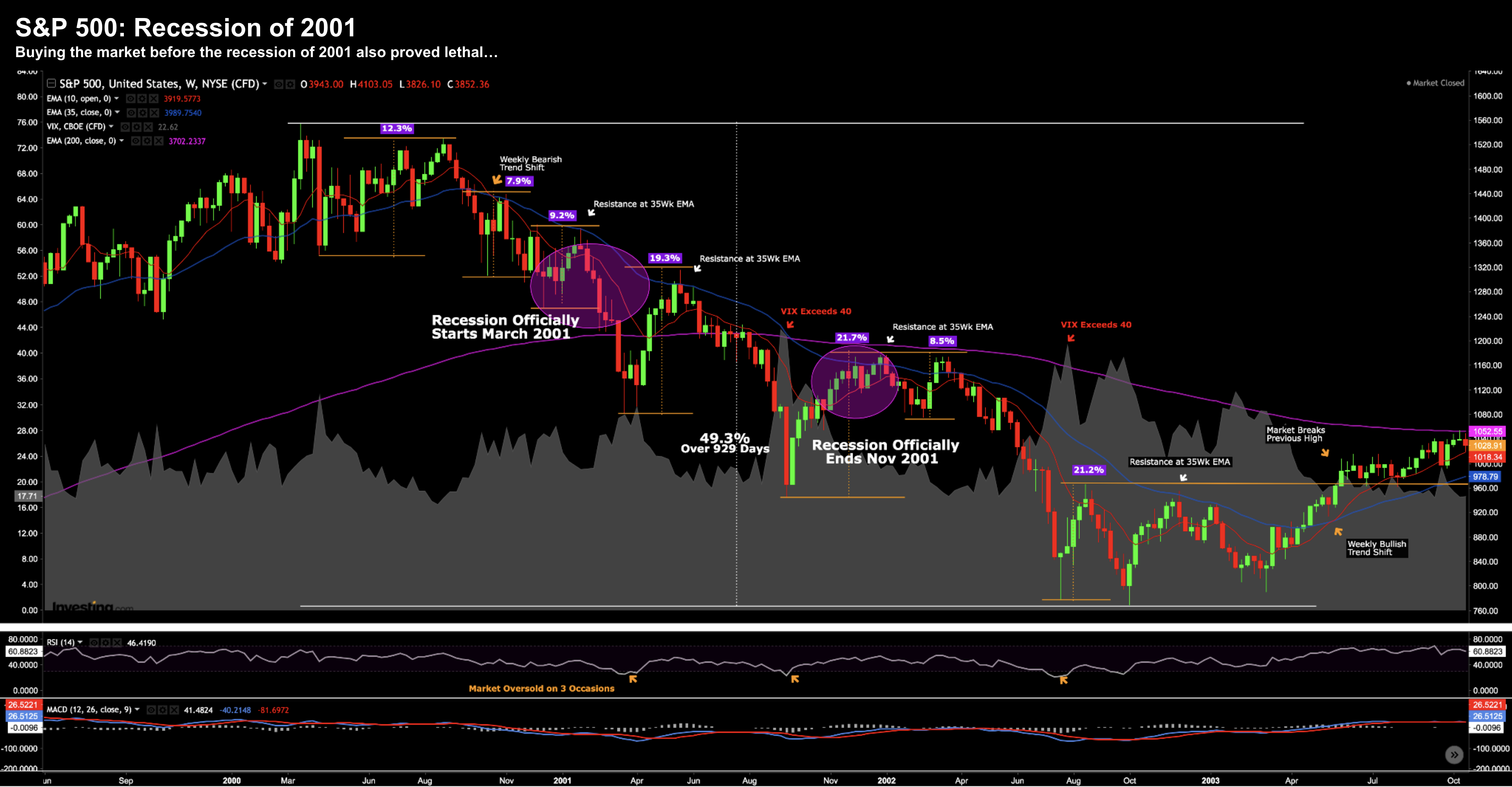

The end of the recession of 2001 was a little different… but the lessons in the lead up are the same:

Recession of 2001

The market continued to sell off after we entered a recession in March 2001.

However, what was different here was the market failed to recover once the recession was over.

The weekly trend continued to remain bearish despite 6 powerful bear market rallies…. some greater than 20%

Once the weekly trend turned bullish (i.e. the 10-week EMA was above the 35-week)… we were away.

Using these as a rough guide… I think we’re at least 6 to 12 months away from bottoming.

It might be longer… but that’s what I’m thinking at the time of writing.

In between now and then – we will experience several 10-20% type rallies (we’ve already experienced two) – as the market tries to feel its way (mostly second guess the Fed’s next move)

From my perspective, I need to see three things from the Fed:

- First – stop raising rates (we are several months from that);

- Second – to remain on pause for an extended period (that feels like H2 2023); and finally

- Three – start cutting rates

Stocks have a far higher probability of success in easing cycles… not when they are restrictive.

Again, re-read Howard Marks’ investment map I shared during the week:

The far-right hand column is not conducive to meaningfully higher prices in the near-term.

That’s where we are today…

Putting it All Together

Bull markets always follow bear markets (and vice versa).

We’ve just finished one of the greatest bull markets of all time.

Thanks for the free lunch!

But this is all part of the cycle… and it’s important you know where we are in the cycle.

You don’t need to time it perfectly.

And money should not be burning a hole in your pocket (trust me, I know it is for some people)

You have plenty of time to remain patient.

Allow the price to come to you.

Continue to practice discipline and diligence.

And pending what we see with monetary policy, labor conditions, earnings growth etc in the second half of 2023… we may get a great opportunity.

Or that may push out to 2024… it’s impossible to know.

But getting too aggressive ahead of the Fed’s easing cycle (and prior to the recession) is arguably a lower probability bet.