- What happened to the Santa Rally?

- There’s good news… and bad news

- And why I think a solid “flush” still awaits

Dec 15 2022

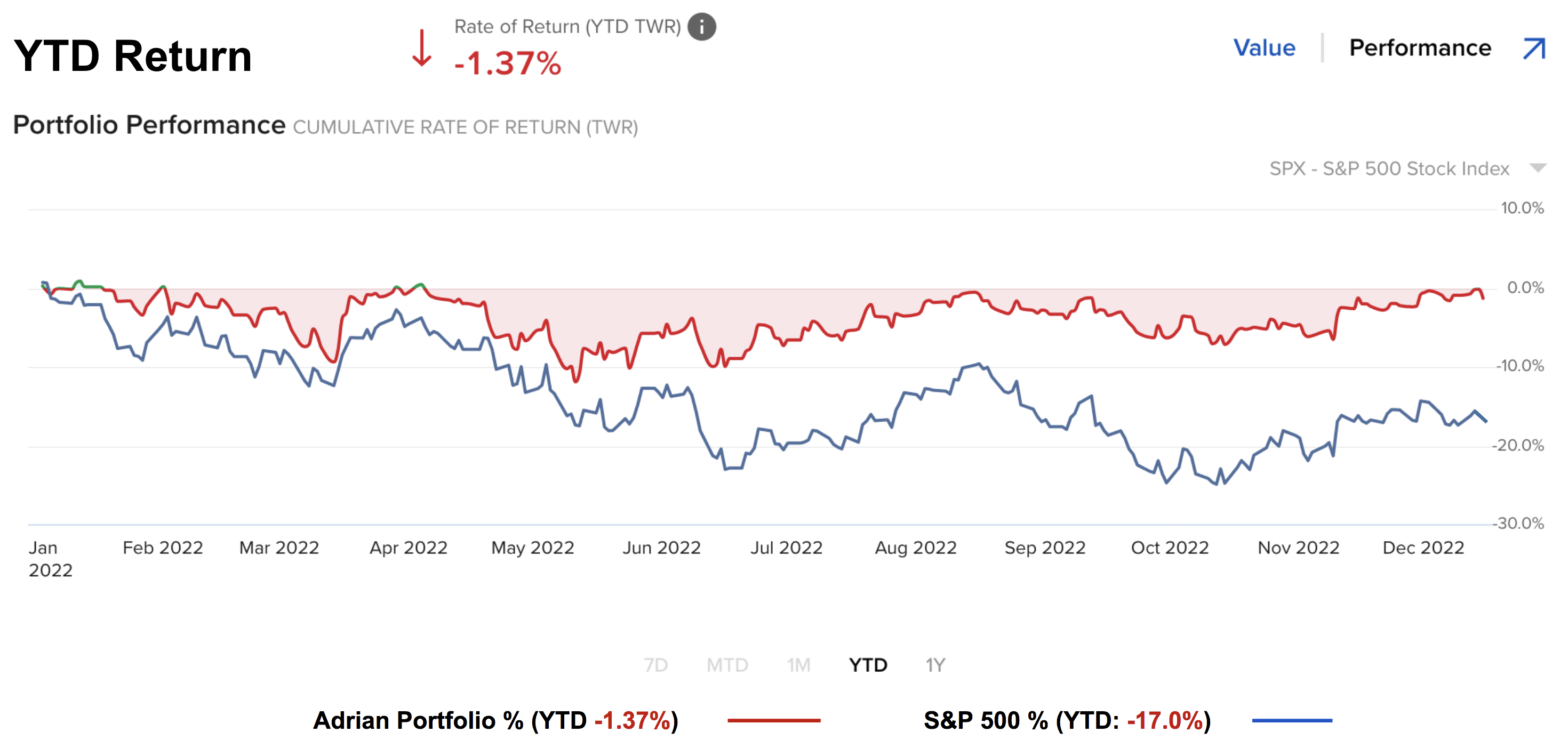

For regular readers – the annotations on this chart are very familiar.

First up, I was looking for the market to find stiff resistance in the purple shaded ellipse – or just above the 35-week EMA.

So far, the market is about 5% off the 4100 high achieved the week of Nov 28.

Second, I also warned of the VIX trading at 19.1 – as we awaited news of the monthly CPI and the Fed’s statement on monetary policy.

I said “the market assumes nothing can go wrong” – and was overly complacent. Since then the VIX has jumped ~17% coinciding with the market top (as we have seen on two other occasions this year)

Third, with the weekly trend bearish, probabilities suggest that strength is typically sold.

Now at 4100, the S&P 500 was ~17% off its October low in just 7 weeks. That is a very sharp rally – the kind you expect in bear markets.

What looks like happening is we are about to form another “lower high”

If you put that together, for me things are trading very much “per the script”.

In fact, they have traded per the script almost all year from the time I called for a market correction at the start of the year – where traders were advised to de-risk.

And that the time of writing – I feel very much the same today as I did in December 2021 – despite stocks being about ~17% lower

December 15 2022

From here, I maintain we go lower.

Not only that, I think we will make a new low in 2023.

But that will be a great opportunity for savvy buyers for the years ahead.

And that will be a time to get excited… not anxious or depressed.

There’s Good News & Bad News

Now to be clear…

I am not calling a ‘victory’ just yet on my call for the market to reverse course around 4100.

Yes we are below that level by around 5%… and it could rally again from here.

I think that’s a lower probability… but we will see.

But let me start with what I think is the silver lining today:

- The rate hike cycle is maturing;

- Inflation has peaked and is falling; and

- China looks like it has a chance of re-opening

This means a lot of the ‘hard work‘ is now behind us.

For example, on the first point I think the Fed will be lucky if they can raise rates a further 75 bps (as the latest Dec dot plot suggests).

For what it’s worth, I hope they do but I think the economy (not the market) will drop to its knees before they get to 5.0% (as I said months ago).

What’s more, the bond market agrees.

Second, inflation is falling and falling fast.

My best guess is headline inflation will see a 4 or 5 handle by mid-year. And that’s what the market has priced in.

However, getting from say 5% to 2% will take a lot longer than just a few months. Falling prices of goods simply wont get us there alone – we need wages and rents to fall substantially.

Third, China coming back online is a great sign for global growth.

So what’s the bad news?

Four things here:

- First, we need to adjust our thinking in terms of investing (and living) with a Fed funds rate in the realm of 4.50% to perhaps 5.00% for some time to come. That could be 6+ months or more. For example, repeating what I said in my previous post (echoing Howard Marks) – the new normal over the next decade will be a Fed funds rate somewhere between 2.0% and 4.0% (vs say 0% and 2% of the past 15 years)

2. The Fed is no longer expanding its balance sheet, it is allowing assets to “roll off” (vs selling assets). This is known as Quantitative Tightening which acts like a rate increase. $95B per month is coming off their balance sheet… which is a negative for equities (i.e., the opposite of QE)

3. Corporate earnings are likely to contract in 2023, they are unlikely to expand. This is what happens in every recession (bar none). That means earnings revisions have to come down substantially from where they are today. I think we start to see that from February (we have not seen it yet); and finally

4. The broader economy is going to slow substantially. Millions of jobs will be lost – where the unemployment rate will likely push 5% (the Fed’s unspoken objective to crush demand).

As I say, there is good news and bad news

Net-net however I think it’s bad news for equities heading into 2023 (which is what bonds are suggesting).

But let’s say stocks continue to hold around “3800 to 4100” zone for the next few months… what then?

From mine, that only gives the Fed more ammunition to keep going.

The Fed does not want to see higher stock prices… just like they don’t want to see the unemployment rate at just 3.7%.

They are not a stock cheerleader here… they are the opposite.

The idea is to crush the wealth effect… not add to it.

Sell-off in H1 2023

My high level thinking here is we get a market sell-off potentially in the first quarter of next year.

But let me add a caveat…

Predicting the timing of these things within a few months is near impossible.

It may be Q1 or Q2… I don’t know… but I think we are going lower to start next year.

Here are some useless stats:

- Over the past 22 years – 13 of those years have seen a negative January

- However, when the market was bearish – January was down 100% of the time

- 2000, 2001, 2002, 2003, 2008, 2009 and 2022 – Jan and Feb all lost ground

Now given we remain in a bear market… I don’t see any reason why I would be calling for a strong January.

Markets are now bracing themselves for a recession in 2023.

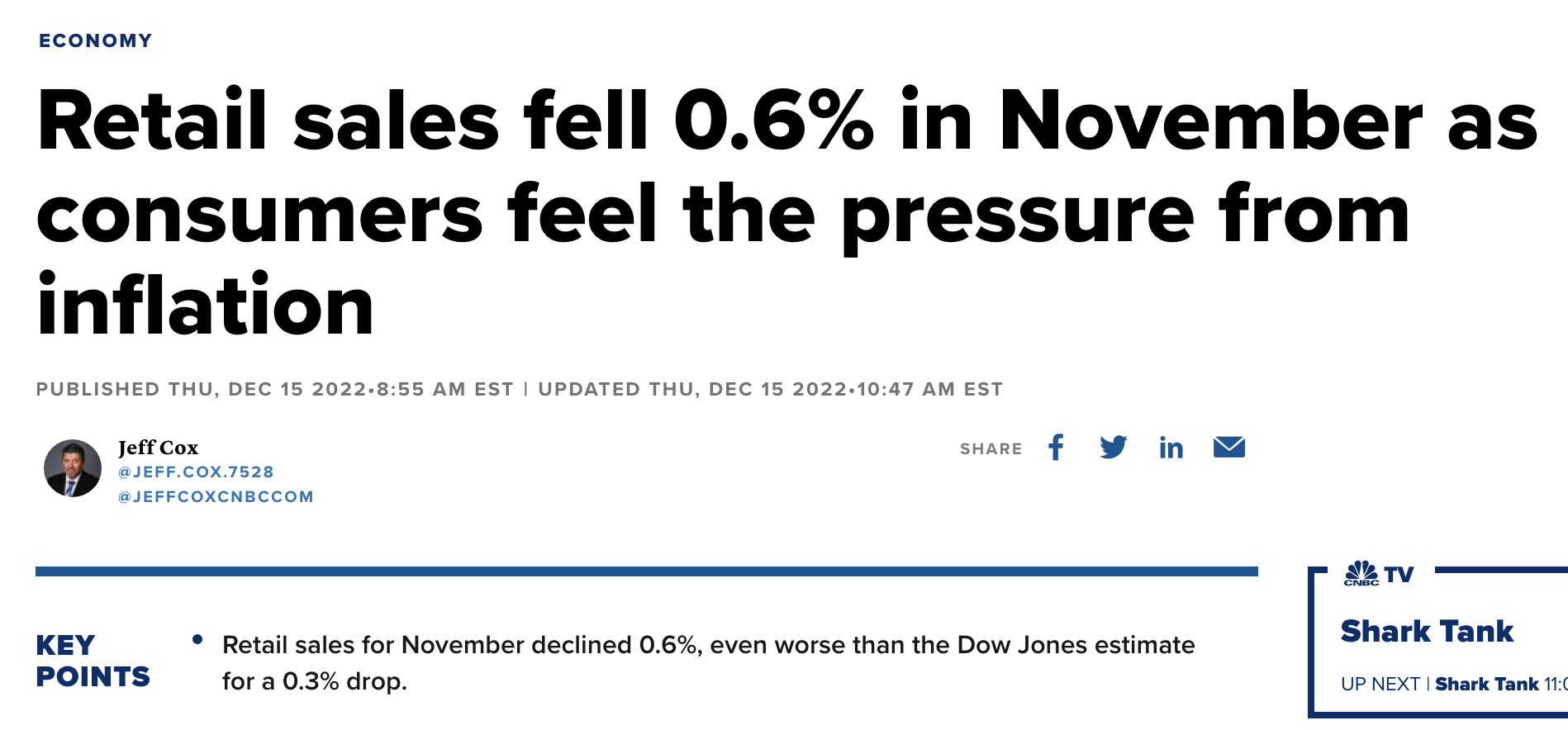

There are some who still think we will avoid it (I don’t see how) – however it’s becoming more likely when you consider leading economic indicators (n.b., we received miserable retail data today)

But let’s say there is no recession in 2023….

Does that mean it’s all clear? Pin your ears back and buy stocks?

No.

I think what you will find is the market will then start pricing in a recession for 2024.

From there, the market will then apply a recession type multiple (15x to 16x forward) on those (weaker) 2023 earnings.

The recession is coming.

Period.

What’s impossible to forecast is the timing… and why I don’t get too caught up on it.

For example, it’s not too dissimilar to trying to “forecast the peak Fed funds rate” (as so many do); or what the monthly inflation print will be…. why bother?

All that’s important is you need to know where we are; i.e.

- Rates are rising (they are not falling)

- Liquidity is contracting (it’s not expanding)

- Earnings are falling (they are not rising)

- Growth is slowing (it’s not expanding)

That’s how to start thinking… understand where things are in the grand cycle.

Don’t waste time stressing about whether the terminal rate is “4.50%, 4.75% or 5.0%”.

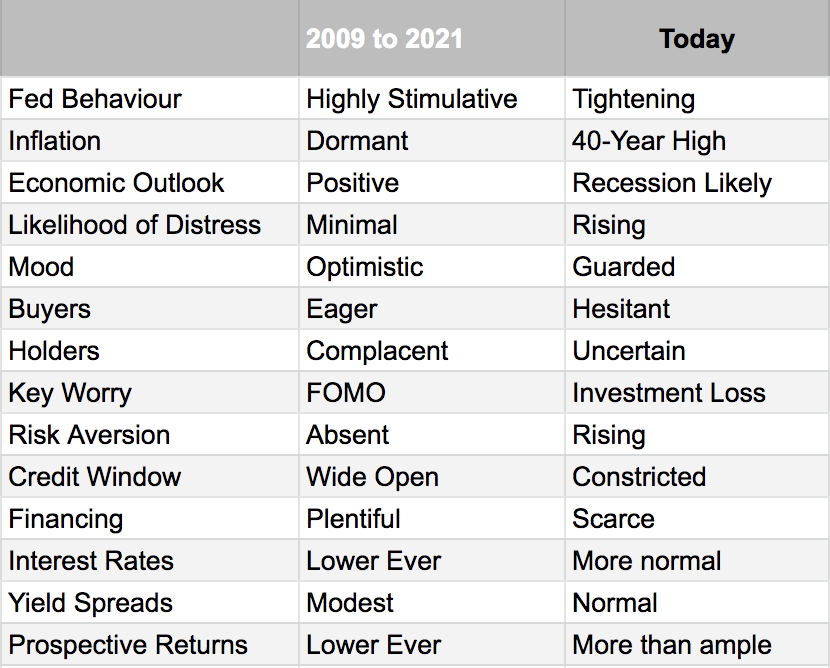

Howard Marks did an excellent job this week about telling us where we are with this table:

There’s your “investing map” right there… all you need to know.

There’s ample information to tell you now is not the time to be increasing your risk profile.

None of this is complex (and don’t let a fund manager tell you it is!)

If I listened to a typical fund manager (acknowledging there are some good ones) – my performance would be down ~17% in 2023 (ouch!!) versus only being down ~1%

Putting it All Together

I will admit I had a chuckle when I saw the market give back a few points today.

It felt like a delayed reaction to Powell’s (same) language yesterday

“Ohhh… that’s what he meant”

Seriously.

But what really made me laugh was Powell said nothing different to his past few statements.

He just recycled the same language and their relentless commitment to squash inflation.

In closing, if you’re adding to positions above 3700 on the S&P 500, you are paying a hefty premium for risk.

It’s not a strong risk / reward (as I’ve been saying for almost 6 months)

For example, at today’s close (Dec 15) of 3895 – the market looks very expensive – especially when I know earnings are going to plunge.

However, once we drop to 3600 (which I think is high probability) then things start to look a little more interesting.

For example, if we assume earnings of $200 next year (e.g. a ~10% decline on 2022) – that is a forward PE of 18x

It’s not cheap…. but it’s ok if your mindset is at least 3 years.

Now, if w are to dip to 3400 (and I think there’s a good chance) – things get better again – our forward PE drops to around 17x.

Feel free to start having a good nibble around 3400 (quality names only – e.g., strong free cash flow, profitable, very low debt)

However, at ~3200 you are being given a great (multi-year) opportunity.

For example, you might have a shot at 10% average CAGRs for a few years (decades) if buying at this level.

At that point, I would “pin your ears” back and load up with at least a 3-year view.

That’s why I’m starting to get excited again.

You see, it’s not all bad news!