- Powell open to moderating rate hikes – cements 50 bps for December

- Non committal on how long rates stay high – points to sticky wages

- Is slowing enterprise spend a canary in the ‘recession’ coal mine?

From Saturday, the Fed enter what is a ‘black out’ period ahead of their next policy decision (Dec 14th).

This means we won’t hear any further language from Fed Presidents.

That’s a good thing!

From mine, the less the Fed speaks the better.

Personally, I find it disturbing that the market sweats every syllable from a Fed official.

It just shows how (credit) addicted the patient is.

But here we are…

If you get lemons – make lemonade.

Today, in a closely watched speech at the Brookings Institution, the Fed Chief said rising costs for services — from health care to haircuts — might be “the most important category for understanding the future evolution” of prices, and that wages are the largest cost within that category.

Spot on. Wages and rents.

And it’s the ongoing labor shortage which is only adding to the Fed’s battle with ‘stickier’ inflation.

Here’s Powell:

“To be clear, strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation. That will require reducing demand for labor by slowing the economy”

Here’s the translation – the Fed are probably targeting an unemployment rate closer to 5.0% (not 3.5%)

Powell added:

“It will take substantially more evidence to give comfort that inflation is actually declining”.

“Policies to support labor supply are not the domain of the Fed: our tools work principally on demand.

Without advocating any particular policy, however, I will say that policies to support labor force participation could, over time, bring benefits to the workers who join the labor force and support overall economic growth.

Such policies would take time to implement and have their effects, however.”

Although he would never phrase it this way – their mission is to crush demand.

Because that’s how they will reduce inflation.

Lock-in 50 Basis Points for December

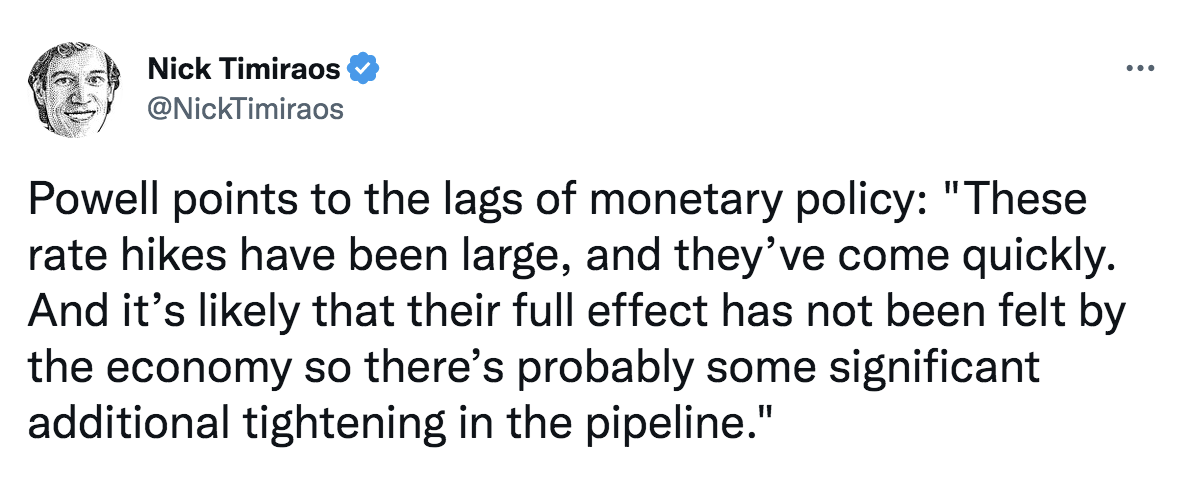

October 21st I issued a post titled ‘Fed Whisperer Spurs Market’

Repeating what I wrote at the time:

Nick Timiraos writes for the Wall Street Journal… and is a well-known Fed Whisperer.

It’s a poorly kept secret that the Fed uses the press (specifically the WSJ) as a leak channel ahead of decisions.

And their favoured reporter is Timiraos.

Case in point:

July 17, 2022, Timiraos had a column titled “Fed Officials Preparing to Lift Interest Rates by Another 0.75 Percentage Point.”

Sure enough… we got 75 bps.

They used him to sound out the market’s reaction.

Today, via the WSJ, he gave equities signs of hope with this article.

At the time, Timiraos suggested:

- The Fed will definitely raise 75 bps in November (the market knows that); however

- The Fed may not be committed to 75 basis points for December.

Bingo. We got the 75 last month and it looks certain we will “only” get 50 bps for December.

And mark my words – look for another WSJ article from Timiraos soon sounding out a 25 bps rate rise for January (which the market already has priced in)

But here’s my argument:

The discussion on “how high” is almost arbitrary.

We’re going to a rate somewhere in the realm of 4.75% to 5.00% by Q1 next year.

But beyond 5.0% may be more difficult.

Again, that’s priced in (as we find with the US 2-year treasury)

What’s not priced in – and what Powell could not talk to – was how long we stay at that elevated level?

And listening to Powell – he was quick to remind the audience that their work is far from done.

From mine, the Fed is likely to maintain rates north of 4.50% deep into 2023.

And I say that because the preferred PCE Core Deflator will not be anywhere near their nominated 2% target.

If that’s true – equities will re-price.

Santa Rally followed by Q1 Dip

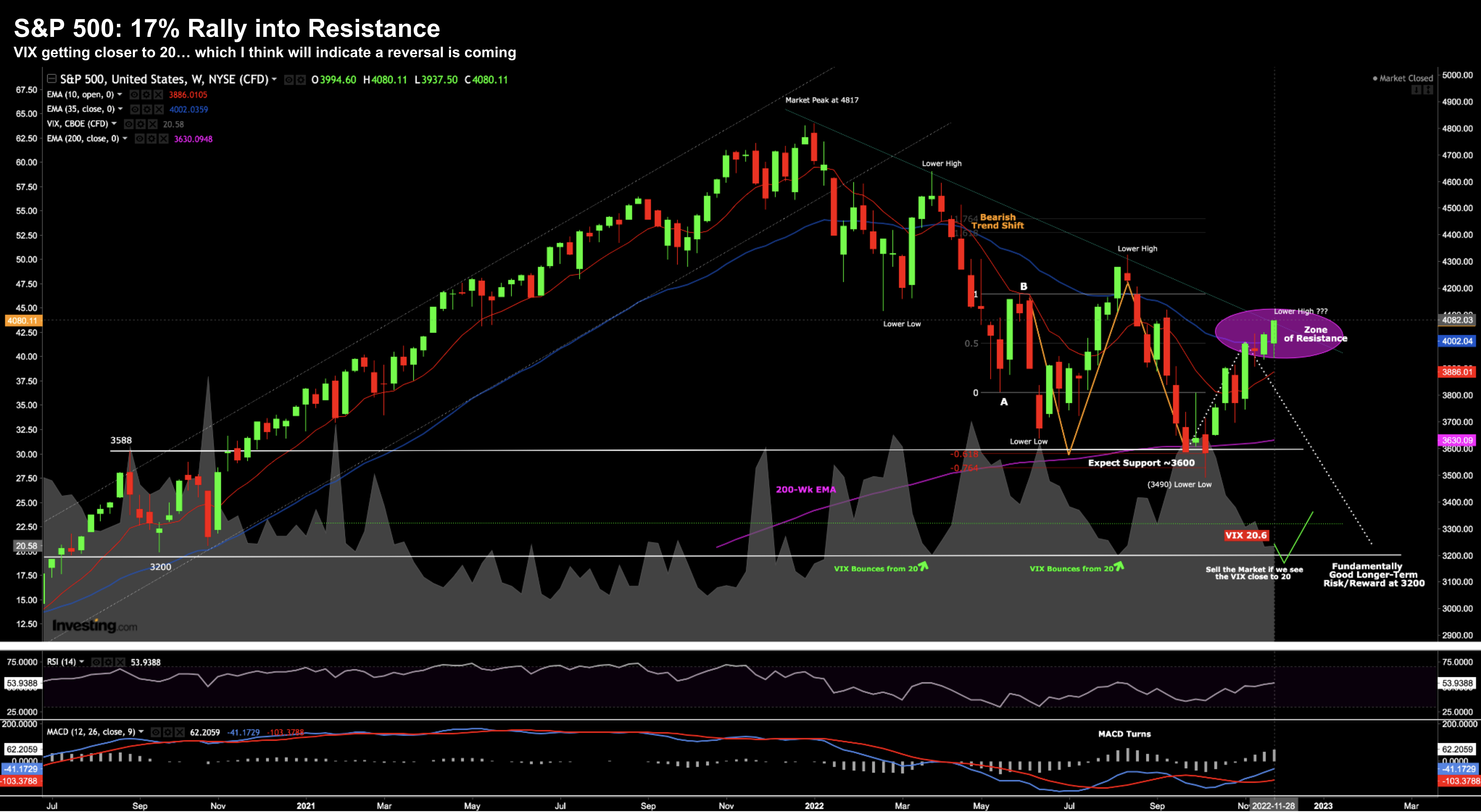

Barring any nasty surprises on CPI Dec 13th – it’s likely the seasonal market rally could make its way up to ~4200.

And this is consistent with what I’ve been saying the past few weeks…

Nov 30 2022

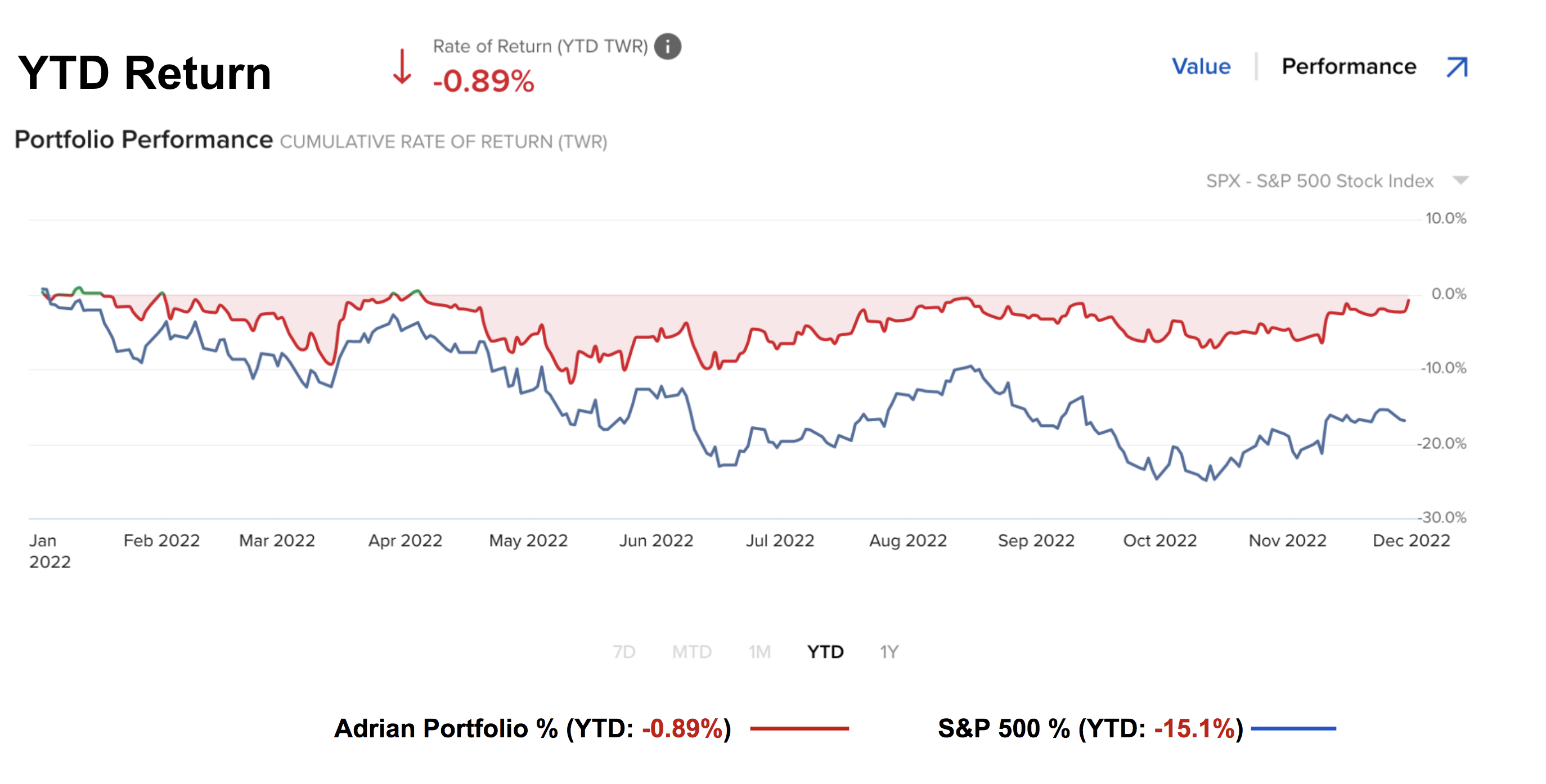

After today’s ‘Powell Pop’ we are now around 17% off the October low.

And look, I’m very appreciative of the bounce, taking my own portfolio to down just 0.8% for the year.

But I still don’t like this setup… not technically or fundamentally.

A couple of things:

- Powell has not altered his stance on fighting inflation; and

- The market looks overly complacent as the VIX approaches 20

There could be a 3-4% left in this market before Dec 31… but where we go in the first half of next year is another story.

My best guess is this remains a market where you fade strength.

We are still yet to see meaningful earnings revisions – with the market pricing in 4% 2023 EPS growth – which means the market is now looking very expensive.

And when (not if) we start to see these earnings revisions — I think we will find both the “E” and the “PE” multiple come down.

For me, 19.5x forward is not attractive (i.e., where “E” is estimated at $210 – a decline of 5% on 2022)

Enterprise Spend is Slowing

So why do I think earnings will decline next year (and not expand)?

Simple:

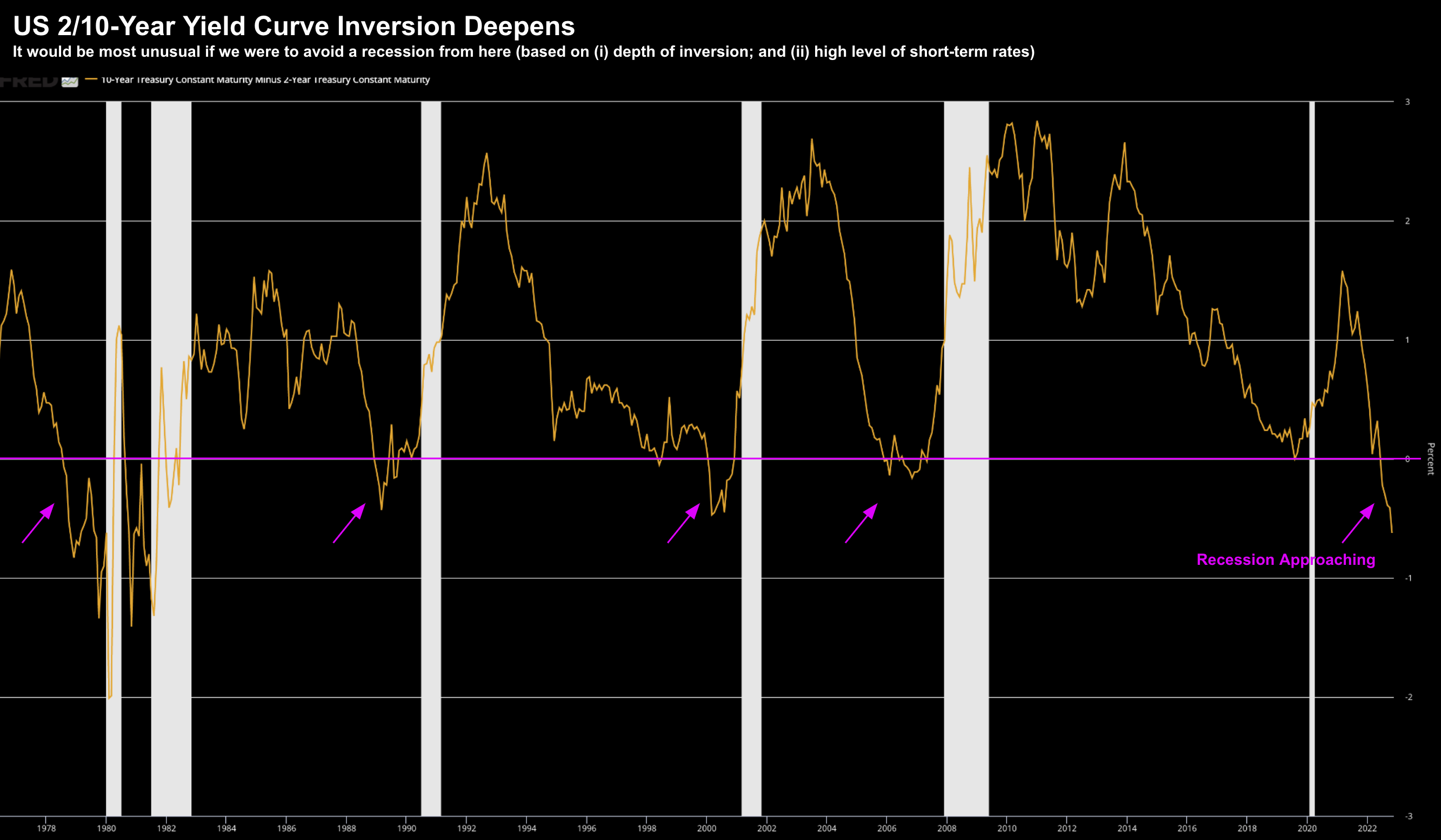

We’re increasingly likely to see a recession next year.

For example, almost all leading financial indicators suggest this is the case (e.g., deeply inverted 2/10 yield curve).

Nov 30 2022

This is the bond market screaming recession ahead…

And it’s why I took a trade on TLT Oct 25th — where I’m likely to lock-in a 23% annualized return.

But in terms of a recession – I outlined my 4-point hypothesis here.

Nothing Powell said today changed that.

If anything, recent corporate earnings reports have only reinforced my view.

For example, earnings calls from leading enterprise based companies such as:

… suggest corporate America is slowing (and fast).

For example, all of these (cloud service) companies reported elongated sales cycles.

And whilst demand remains strong – it’s getting harder for these companies to close a deal. They cite deals having to pass the desks of the C-Suite to close.

This suggests that belts are tightening.

To be clear, the services these companies offer are typically mission critical.

They include cloud compute, storage and cyber security — the very backbone of any enterprise.

They keep the lights on.

But now these services are being scrutinized.

Now it’s easy to slash an advertising budget… that’s typically the first thing to go. It’s discretionary.

Ad budgets swell during boom times and vanish in downturns.

But (business) critical services (like security) should not be compromised (unless of course you have downsized your workforce!)

Keep an eye on these sales cycles…

From mine it’s a sure sign corporate America is watching its expenses.

And the reason is revenue (and margins) are in decline.

When this happens – eventually that spills into the real economy.

To be clear, it has not happened yet and we are still in the very early innings. This will start to show up in both Q4 2022 and Q1 2023 earnings.

To borrow the Fed’s language, the lags of monetary policy are “long and variable” (whatever that is supposed to mean)

Putting it All Together

Don’t be surprised to see the market add 3-4% before we close the year.

But for me, that’s not worth chasing.

If you have not enjoyed this 17% rally – it’s too late to try and catch it.

The time to add risk was when the S&P 500 traded ~3600 (what I did) — not around 4100+

As I shared at the time, adding to quality names (and the index) at 16x forward felt like a better long-term risk reward.

Now I didn’t pretend to know that ~3600 was going to a near-term bottom.

I was more than happy if the market proceeded to trade at 3200!

In fact, I was hoping it did.

However, I also felt that it was a good time to nibble at quality positions.

And I still feel that is the case.

That said, my strong sense is if you missed this rally, you will get another shot in the first half of 2023 (possibly Q1)

Again, the language we are hearing from enterprise based businesses suggests corporate America is weakening.

And that could be your “canary in the coal mine” ahead of any 2023 recession.